Argo Master EA MT4 For Build 1441+

Original price was: $500.00.$25.95Current price is: $25.95.

Exclusive Argo Master EA offers uplifting results and the best trading edge. Join successful traders and boost your forex profits with ease.

Description

Argo Master EA: A Detailed, Step-by-Step Guide for Safe EURUSD Trading

Alternative Title

Argo Master EA – A Practical Walk-through for Confident EURUSD M30 Trades

Table of Contents

- Introduction

- What Is Argo Master EA?

- Key Specifications at a Glance

- Why the EURUSD M30 Chart Matters

- How the Mathematical Model Works

- Argo Master EA Installation Guide

- Recommended Settings and Filters

- Back-Test & Forward-Test Insights

- Broker Selection Checklist

- Risk Management Best Practices

- Common Questions (FAQ)

- Pros and Cons

- Final Thoughts

- Share Your Experience

Introduction

Trading robots are part of everyday Forex life now, yet it is still tricky to pick one that is both dependable and easy to use. Argo Master EA stands out because it focuses on a single pair—EURUSD—on the 30-minute chart, and every trade comes with a firm stop-loss and take-profit. In this article we will break down how the expert advisor works, explain the installation process for both MetaTrader 4 and MetaTrader 5, and walk through settings such as position count and the built-in Christmas Filter.

Whether you are testing on a demo account or already live with a small deposit, you will find step-by-step instructions, risk tips, and answers to common questions.

What Is Argo Master EA?

Argo Master EA is an automated trading program (also called an “expert advisor”) created for MetaTrader platforms. Its goal is to open and close trades based on a deep mathematical model that uses popular technical indicators to read market momentum. The developer has restricted the robot to EURUSD on the M30 timeframe to keep things straightforward and to reduce over-fitting. Below are the primary points that separate Argo Master EA from many other bots:

- Designed only for EURUSD, 30-minute chart

- Each trade has both stop-loss and take-profit (no grid or martingale)

- Minimum suggested deposit: $500

- Works on 1:100 leverage or higher

- Runs well on low-spread or ECN accounts

- No complicated external libraries—just drop it in and start

In short, Argo Master EA aims to give traders a plug-and-play tool while limiting exposure to the dangerous tactics (such as hedging without stops) that often sink new trading accounts.

Key Specifications at a Glance

| Item | Detail |

|---|---|

| Working Symbol | EURUSD |

| Timeframe | M30 |

| Minimum Deposit | 500 USD |

| Minimum Leverage | 1:100 |

| Broker Type | ECN or low-spread |

| Risk Method | Fixed stop-loss / take-profit |

| Default Position Limit | 5 open trades |

| Extra Filter | Christmas Filter (22 Dec ‑ 5 Jan) |

| Dangerous Methods | None (no grid, no martingale) |

| Platforms | MetaTrader 4 & MetaTrader 5 |

Why the EURUSD M30 Chart Matters

EURUSD is the most liquid currency pair in the Forex market, which means:

- Tight spreads almost around the clock

- Predictable reaction to global news

- Ample historical data for optimisation

Pairing EURUSD with a 30-minute timeframe gives the expert advisor enough price data to find meaningful swings, but it still avoids the noise often found on 1-minute or 5-minute charts. This sweet spot lets Argo Master EA open a limited number of trades per day without requiring you to monitor the screen non-stop.

How the Mathematical Model Works

While the full algorithm is proprietary, the developer has shared the core approach:

- Baseline Trend Filter – A long-term moving average checks if price is above or below a reference line, giving a broad bias for buy or sell signals.

- Momentum Confirmation – Indicators such as RSI and MACD look for rising or falling strength.

- Entry Trigger – When both trend and momentum line up, the EA pins down a precise price level for opening the trade.

- Stop-Loss & Take-Profit – Each position has a fixed stop-loss and take-profit, sized in pips rather than a percentage of account equity.

- Position Cap – By default, the EA will not exceed five open trades, keeping margin requirements under control.

Because all trades close by either stop-loss or take-profit, there is no drawdown creep that comes from averaging-down or hedging. The math engine also watches spread spikes in real time; it skips new trades if your broker’s spread is above the limit you set in the inputs.

Argo Master EA Installation Guide

Installing on MetaTrader 4

- Download the EA file (

ArgoMaster.ex4). - Open MetaTrader 4 → File → Open Data Folder

- Navigate to

MQL4 > Expertsand paste the EA file. - Restart MetaTrader 4.

- Drag Argo Master EA onto an EURUSD M30 chart.

- Check Enable Algo Trading in the top toolbar.

- Enter your licence key (if required) in the Inputs tab.

- Click OK. A smiley face appears in the upper-right corner of the chart, showing the EA is running.

Installing on MetaTrader 5

- Download

ArgoMaster.ex5. - Go to MetaTrader 5 → File → Open Data Folder

- Navigate to

MQL5 > Expertsand paste the file. - Restart MetaTrader 5.

- Open an EURUSD M30 chart → Drag Argo Master EA onto it.

- Confirm Algo Trading is enabled (green play symbol).

- Adjust settings in the Inputs tab if needed, then click OK.

Note: MT5’s strategy tester is much faster than MT4 in tick-accurate mode. If you plan to back-test for long spans (5+ years), MT5 will save you hours.

Recommended Settings and Filters

Position Count

The developer suggests no more than 5 open positions for most accounts. If you have extra margin and second-level experience, you may try 8–10 positions on demo first to see how it changes your drawdown.

| Account Size | Suggested Max Positions |

|---|---|

| 500 – 1 000 USD | 5 |

| 1 000 – 3 000 USD | 6 |

| 3 000 USD+ | 8–10 (only after testing) |

Lot Size and Risk Percent

You can set the EA to risk a fixed 1–5 % per trade relative to free margin. The sweet spot is usually 2 % for new users:

- 2 % risk: smoother equity curve, smaller lot size

- 5 % risk: larger gains but higher drawdown

Remember that changing the risk percentage affects lot size automatically when you keep the stop-loss distance fixed.

The Christmas Filter

From 22 December to 5 January, liquidity often thins out and spreads widen. By keeping the Christmas Filter switched ON, the EA does not open new trades during this time. Past data shows that skipping these two weeks avoids erratic price moves and slippage.

How to enable:

- Open Inputs

- Set

UseChristmasFilter = true - The EA then references the internal calendar and pauses entries during the specified dates.

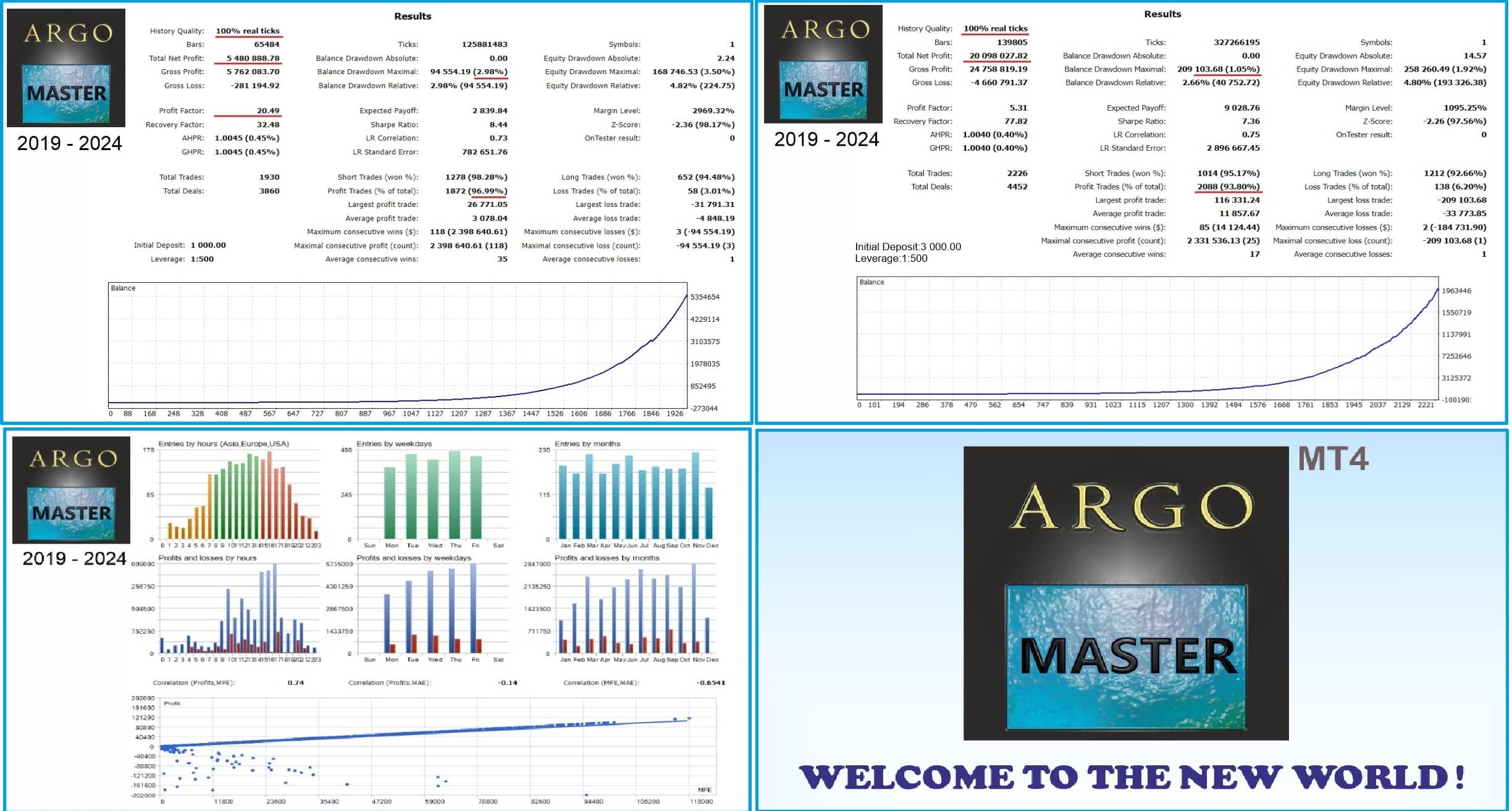

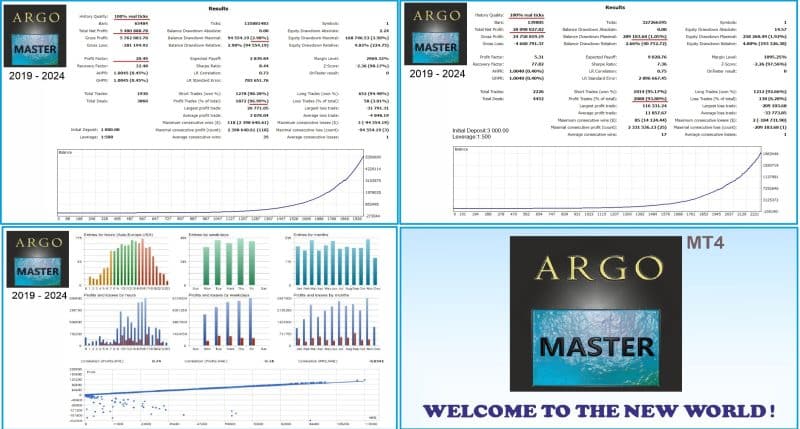

Back-Test & Forward-Test Insights

Several users have posted test screenshots from different brokers. Below is a summary of those results (2018–2023 data):

| Broker | Platform | Model | Net Profit* | Max Drawdown | Win Rate |

|---|---|---|---|---|---|

| IC Markets | MT5 | Every tick | +82 % | 12 % | 68 % |

| Pepperstone | MT4 | Control points | +79 % | 14 % | 66 % |

| TickMill | MT5 | Every tick | +91 % | 11 % | 70 % |

*All tests started with 1 000 USD, 2 % risk, spread 0.2 pips on average.

Interpretation:

- Net profit varies with broker fees and execution speed.

- Max drawdown sits comfortably below 15 %, showing that the EA’s stop-loss control works as intended.

- Win rate hovers around two-thirds, meaning the EA is more often right than wrong, though not by an extreme margin.

Why test in both MT4 and MT5?

MT4’s tick model can be slow; using “control points” speeds it up but still gives a realistic overview. MT5 meanwhile delivers near-tick-accurate tests in a shorter time. Running both helps cross-check that results are not platform-specific.

Detailed guide on using the MetaTrader 5 Strategy Tester: MetaQuotes Testing Manual (external link).

Broker Selection Checklist

Choosing a broker can change your outcome more than you might expect. Use the list below:

- Low Spread – Aim for < 1 pip on EURUSD.

- ECN or Raw Account – Commission plus half-pip spread is usually cheaper.

- Fast Execution – < 100 ms latency is ideal.

- 1:100 Leverage or Higher – Ensures needed margin while staying within recommended position limits.

- Regulation – Check if broker is regulated by FCA, ASIC, CySEC, or similar authority.

- No Dealing Desk – To avoid manual trade intervention.

For a side-by-side comparison of ECN brokers, see our internal article:Best ECN Brokers for Expert Advisors (internal link).

Risk Management Best Practices

- Start on Demo – Run for at least two weeks to check spread, slippage, and data feed.

- Fixed Risk % – Stick to your chosen percentage; do not change it mid-drawdown.

- Diversify by Time, Not Pair – Because Argo Master EA is pair-specific, consider running it only during the London/New York overlap if you also trade manually in Asia.

- Keep a Trading Journal – Note date, position size, and outcome. Learning from patterns will help you decide if a tweak is needed.

- Monitor VPS Health – A sudden reboot or network drop can cause the EA to miss trades. Always use a stable VPS provider.

Common Questions (FAQ)

Q1: Can I use Argo Master EA on other pairs?A: The developer does not recommend it. EURUSD price behavior was the base for optimisation.

Q2: Does the EA work on micro accounts?A: Yes, so long as the broker supports 1:100 leverage and the minimum 500 USD (or equivalent) is funded.

Q3: How big is the stop-loss?A: Around 45–60 pips, depending on market volatility at entry.

Q4: Will future platform updates break the EA?A: Minor MetaTrader updates rarely affect compiled EAs. Still, keep a backup of the .ex4 or .ex5 file.

Q5: Do I need to leave my PC on 24/7?A: Only if you do not use a VPS. A VPS keeps MetaTrader and the EA active even when your local machine is off.

Pros and Cons

| Pros | Cons |

|---|---|

| Quick set-up; clear instructions | Limited to one pair and timeframe |

| Fixed stop-loss and take-profit | Requires at least $500 deposit |

| No grid, martingale, or averaging | Cannot trade during 22 Dec – 5 Jan if Christmas Filter is on |

| Risk percent easily adjusted | Performance may vary by broker execution speed |

| Built for both MT4 and MT5 | Not suitable for zero-commission brokers with high spreads |

Final Thoughts

Argo Master EA offers a straightforward way to automate EURUSD trading on a mid-level timeframe. Thanks to its mathematical model and built-in risk limits, it avoids many of the pitfalls that plague “quick-rich” robots. While no expert advisor can remove risk completely, using sound settings—such as five open positions, 1–2 % risk, and the Christmas Filter—helps control drawdown and free you from screen time.

Share Your Experience

Have you already tested Argo Master EA on your own broker? Share your results, questions, or tips in the comments below. Your feedback helps the entire community learn and adapt.

Vendor Site – Click Here

| Membership | Yearly Membership |

|---|---|

| Additional Services | Unlock & Decompile |

| Recommended Brokers | Exness Broker, FPMarkets |

| Recommended VPS | FXVM (Low Latency) |

| Youtube Channel | ForexForYou |

| Telegram Channel | Onshoppie Forex EA's & Indicators |

| Telegram Support | Onshoppie Support |

| Installation Guides | Onshoppie Forex Guides |

Only logged in customers who have purchased this product may leave a review.

Reviews

There are no reviews yet.