VMP Pro EA For Prop Firms MT4 For Build 1441+

$9.95

VMP Pro EA: Your secret weapon for Forex mastery. Benefit from years of expert development, proven results, and 24/7 automated trading. Join now!

Description

VMP Pro EA: Maximize Your Prop Firm Trading Success

Alternative Title: VMP Pro EA – Your Automated Solution for Prop Firm Trading

Table of Contents

- Introduction to VMP Pro EA

- Key Features of VMP Pro EA

- How VMP Pro EA Meets Prop Firm Requirements

- Setting Up VMP Pro EA for Optimal Performance

- User Reviews and Performance Insights

- Comparing VMP Pro EA to Other Prop Firm EAs

- Tips for Success with VMP Pro EA

- Conclusion: Is VMP Pro EA Right for You?

Introduction to VMP Pro EA

In the competitive world of prop firm trading, having the right tools can make all the difference. Enter VMP Pro EA, an advanced automated trading solution designed specifically for traders working with proprietary trading firms. This powerful Expert Advisor (EA) combines sophisticated algorithms with strict risk management to help traders navigate the challenges of prop firm rules while aiming for consistent profitability.

VMP Pro EA stands out in the crowded field of trading software by offering a unique blend of features tailored to the needs of prop firm traders. Whether you’re new to prop firm challenges or an experienced trader looking to enhance your performance, VMP Pro EA could be the edge you need in your trading arsenal.

Key Features of VMP Pro EA

VMP Pro EA comes packed with features that cater to the specific needs of prop firm traders:

- Advanced Risk Management:

- Built-in stop-loss and trailing stop mechanisms

- Drawdown control to protect your account

- Position sizing algorithms to manage risk effectively

- Adaptive Trading Algorithms:

- Adjusts strategies based on market conditions

- Multiple trading styles to diversify risk

- Continuous learning and optimization

- 24/5 Automation:

- Trades around the clock without manual intervention

- Captures opportunities in all market sessions

- Reduces emotional decision-making

- Prop Firm Compliance:

- Designed to work within strict prop firm rules

- Helps maintain acceptable drawdown levels

- Adheres to trading time restrictions and other firm-specific requirements

- Customizable Settings:

- Adjust parameters to match your trading style

- Fine-tune risk levels and trade frequency

- Customize for different currency pairs and timeframes

- Backtesting Capabilities:

- Test strategies using historical data

- Optimize settings before live trading

- Evaluate performance across different market conditions

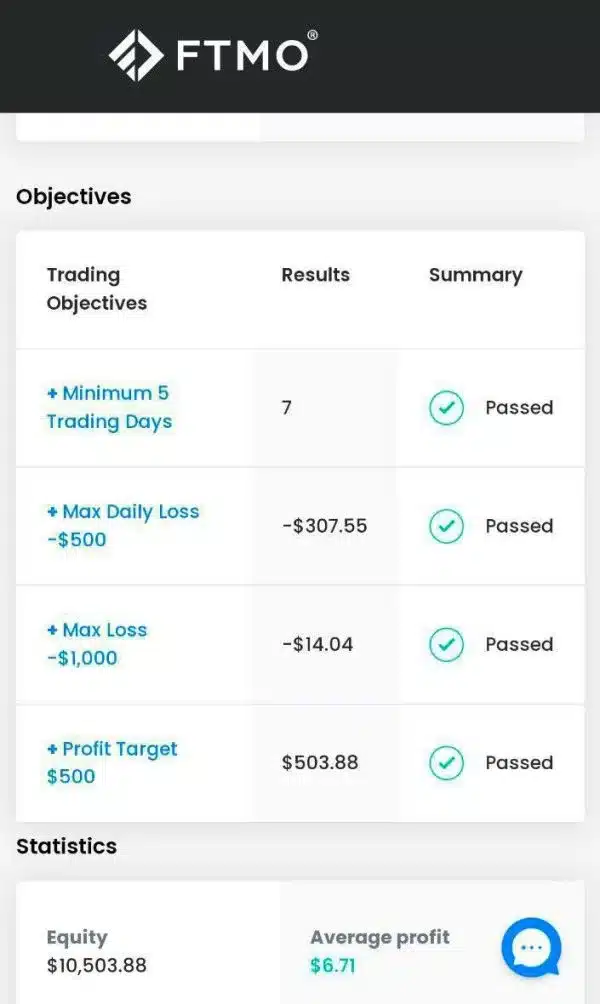

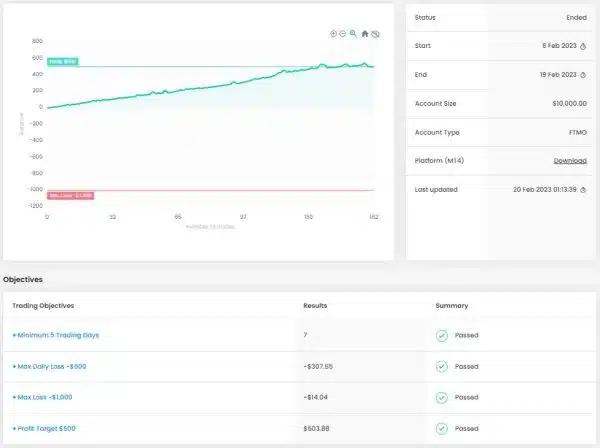

How VMP Pro EA Meets Prop Firm Requirements

Prop firms often have strict rules and requirements that traders must follow. VMP Pro EA is designed with these constraints in mind:

- Drawdown Management:The EA incorporates sophisticated drawdown control mechanisms to help keep your account within the allowed limits set by prop firms.

- Profit Targets:VMP Pro EA can be configured to aim for specific profit targets, helping you meet the goals set by your prop firm.

- Trading Hours:The EA respects trading hour restrictions, ensuring you don’t violate any time-based rules set by the firm.

- Risk Control:With its advanced risk management features, VMP Pro EA helps maintain a balanced risk profile, which is crucial for passing prop firm challenges and maintaining funded accounts.

- Consistent Performance:The adaptive algorithms aim for steady, consistent returns rather than high-risk, volatile trading, aligning with most prop firms’ preferences.

Setting Up VMP Pro EA for Optimal Performance

To get the most out of VMP Pro EA, follow these steps:

- Install on MetaTrader 4:VMP Pro EA is compatible with MT4. Ensure you have the latest version installed.

- Choose Your Account Size:The EA works well with accounts ranging from $10,000 to $500,000. Adjust settings based on your account size.

- Select Currency Pairs:While VMP Pro EA can trade various pairs, it’s often most effective with major pairs like EURUSD, GBPUSD, AUDUSD, USDCAD, and USDCHF.

- Set Your Timeframes:The EA supports multiple timeframes. M1, M5, M15, and M30 are popular choices.

- Customize Risk Parameters:Adjust stop-loss, take-profit, and maximum drawdown settings to match your risk tolerance and prop firm rules.

- Run Backtests:Before live trading, use the backtesting feature to optimize your settings and understand how the EA performs in different market conditions.

- Start with a Demo Account:It’s always wise to test the EA on a demo account before using it with real funds or in a prop firm challenge.

User Reviews and Performance Insights

Traders who have used VMP Pro EA report a range of experiences:

Positive feedback often highlights:

- Consistent performance within prop firm guidelines

- Effective risk management leading to account growth

- Ease of use and setup

- Ability to trade multiple currency pairs effectively

Areas for improvement mentioned by some users include:

- Need for regular updates to keep up with changing market conditions

- Learning curve for optimizing settings

- Occasional trades that don’t align with manual analysis

It’s important to note that individual results can vary, and past performance doesn’t guarantee future results.

Comparing VMP Pro EA to Other Prop Firm EAs

While there are several EAs marketed for prop firm trading, VMP Pro EA stands out in a few key areas:

- Specialized Design:Unlike generic EAs adapted for prop firms, VMP Pro EA was built from the ground up with prop firm rules in mind.

- Adaptive Algorithms:Many EAs use fixed strategies, but VMP Pro EA adjusts to market conditions, potentially improving long-term performance.

- Comprehensive Risk Management:The multi-layered risk controls in VMP Pro EA are more advanced than those found in many competing products.

- Customization Options:VMP Pro EA offers more flexibility in settings compared to some “one-size-fits-all” solutions.

- Prop Firm Focus:While some EAs try to cater to all traders, VMP Pro EA’s specific focus on prop firm requirements can be an advantage for traders in this niche.

Tips for Success

To maximize your chances of success with this EA:

- Understand Your Prop Firm’s Rules:Make sure you’re familiar with all the requirements and tailor the EA settings accordingly.

- Start Conservative:Begin with conservative risk settings and gradually increase as you become more comfortable with the EA’s performance.

- Monitor and Adjust:Regularly review the EA’s performance and make small adjustments as needed.

- Stay Informed:Keep up with market news and economic events that might impact the currency pairs you’re trading.

- Use in Conjunction with Manual Analysis:While this EA is fully automated, combining its insights with your own market analysis can lead to better decision-making.

- Keep Records:Maintain detailed logs of the EA’s performance to help with future optimizations.

- Continuous Learning:Take advantage of any educational resources or support provided with this EA to deepen your understanding of its functionalities.

Conclusion

This EA offers a powerful solution for traders looking to succeed in the challenging world of prop firm trading. Its combination of advanced algorithms, risk management features, and prop firm-specific design make it a strong contender in the automated trading space.

However, like any trading tool, it’s not a guaranteed path to success. Your results will depend on various factors, including market conditions, your chosen settings, and how well you adapt the EA to your specific prop firm’s requirements.

If you’re serious about prop firm trading and are looking for a reliable, automated solution to help manage your trades, this EA is certainly worth considering. Remember to start with a demo account, thoroughly test the settings, and approach your trading with a balanced, risk-aware mindset.

Ultimately, this EA can be a valuable ally in your trading journey, but it should be part of a broader strategy that includes continuous learning, market analysis, and prudent risk management.

Disclaimer: Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange, you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

| Membership | Yearly Membership |

|---|---|

| Additional Services | Unlock & Decompile |

| Recommended Brokers | Exness Broker, FPMarkets |

| Recommended VPS | FXVM (Low Latency) |

| Youtube Channel | ForexForYou |

| Telegram Channel | Onshoppie Forex EA's & Indicators |

| Telegram Support | Onshoppie Support |

| Installation Guides | Onshoppie Forex Guides |

Brand

ea-mt4

Only logged in customers who have purchased this product may leave a review.

Reviews

There are no reviews yet.