Range Breakout EA MT4 v1.35 For Build 1441+

Original price was: $197.00.$19.99Current price is: $19.99.

Proven Range Breakout EA secrets exposed! Learn the best trading techniques that successful traders use. Download your guide and start winning now.

Description

Range Breakout EA: A Practical Guide to Consistent Day Trading Results

Range Breakout EA – A Proven Time-Based Breakout Strategy for MT4 & MT5

Alternative Title

Range Breakout EA Review: How This Simple Time-Window Strategy Beats Noise Without Martingale

Table of Contents

- Introduction

- What Makes the Range Breakout EA Different?

- How the Strategy Works – The Logic Behind Time-Based Breakouts

- Key Features at a Glance

- Default Settings and Recommended Markets

- Customising the EA for Your Style

- Time Window Settings

- Position Sizing Choices

- Stop Loss, Take Profit & Risk Controls

- Advanced Functions

- Step-by-Step Installation (MT4 & MT5)

- Live Performance Proof

- Back-Testing vs. Forward-Testing

- Common Mistakes and How to Avoid Them

- Frequently Asked Questions

- Conclusion

- Next Steps

Introduction

If you trade the London or New York open, you know how often price pauses in a tight range before breaking out and running for the rest of the session. The Range Breakout EA is built around this exact behaviour. Unlike many automated systems, it does not rely on martingale, grid, or other risky “double-up” ideas. Instead, it follows a clear time-based plan: define a range, wait for price to break, enter, manage risk, and step aside. This article explains how the EA works, how to set it up, and how to adapt it to your own trading style.

What Makes the Range Breakout EA Different?

| Area | Range Breakout EA | Many Other EAs |

|---|---|---|

| Strategy Type | Genuine day trading breakout | Often scalping, martingale, or grid |

| Risk Control | Fixed SL/TP, no position doubling | May add to losses |

| Time Focus | Uses specific morning window | Trades all day without context |

| Tested Live | Verified on Myfxbook | Frequently demo only |

Because it sticks to one clear idea, the code stays light and predictable. No hidden recovery modes or open-ended drawdowns—an important point for traders looking for consistent, repeatable results.

How the Strategy Works – The Logic Behind Time-Based Breakouts

- Define the pre-market range

- Example (USDJPY default): 08:00 – 09:30 broker time.

- The EA draws a high and low line across this window.

- Set pending orders outside the range

- A buy stop above the high, a sell stop below the low.

- The distance can be filtered with minimum/maximum pips.

- Wait for a break

- First order triggered cancels the opposite side (OCO logic).

- Manage the open position

- Stop Loss placed just outside the range (plus a puffer).

- Take Profit set by factor of the range size or fixed value.

- Optional trail or break-even

- When price moves X pips, SL can move to BE or trail.

- Daily clean-up

- Any leftover orders closed at user-defined times to avoid swaps and overnight risk.

This simple workflow repeats every day, giving you a consistent edge without overcomplication.

Key Features at a Glance

- Works on MT4 and MT5 (identical features)

- Suitable for EURUSD and USDJPY by default; can adapt to other pairs

- Fixed, percentage, or money-based position sizing

- Real-time trailing stop and break-even options

- Daily limit on number of long, short, or total trades

- Range filters: ignore tiny or huge pre-market ranges

- Compatible with hedging and netting accounts

- Lightweight code, low CPU load—great for VPS use

Default Settings and Recommended Markets

| Pair | Time Range | Cancel Orders | Close Positions | Magic Number |

|---|---|---|---|---|

| USDJPY | 08:00 – 09:30 | 20:55 | 21:55 | 5 |

| EURUSD | 09:00 – 10:30 | 20:55 | 21:55 | 1 |

Tip: Always check your broker’s server time. A two-hour offset can turn a good setup into a bad one.

Customising the EA for Your Style

Time Window Settings

Short-term ranges work best around market opens. Here are popular choices:

| Session | Typical Window (Broker Time) |

|---|---|

| London | 07:00 – 09:00 |

| New York | 12:00 – 14:00 |

| Tokyo | 23:00 – 01:00 |

Adjust the window to match volatility and your personal schedule.

Position Sizing Choices

- Fixed Lot – Simple, transparent. Example: 0.02 lots.

- Risk % of Account – Calculates lot size so SL equals X % of equity.

- Lots per X Money – E.g., 0.01 lots for every 1 000 $ balance.

Stop Loss, Take Profit & Risk Controls

- Puffer Points: Extra pips added to SL beyond the range, giving trades room.

- TP Factor: Multiple of range (e.g., 1.5 ×).

- Maximum Spread: Skip trades when spreads are wide (important during major news).

- Daily Equity Stop: Halt trading when a set percentage is lost or gained.

Advanced Functions

| Setting | Purpose | When to Use |

|---|---|---|

| Trailing Stop | Lock in gains once price moves a set distance. | Trending days. |

| Break-Even | Move SL to entry after X pips. | Choppy days where price may retest. |

| Max Long/Short/Total Trades | Prevent over-trading. | Quiet holiday sessions. |

| Min/Max Range | Avoid ultra-tight or extra-wide ranges. | Any time a session acts unusual. |

All advanced features can be toggled on/off individually.

Step-by-Step Installation (MT4 & MT5)

- Download the EA

- Open your terminal

File → Open Data Folder → MQL4/5 → Experts

- Copy the .ex4 / .ex5 file into the Experts folder.

- Restart MT4/MT5 or click Refresh in the Navigator.

- Attach to a chart

- Use the correct symbol and timeframe (any timeframe; logic is time-based, not bar-based).

- Allow Algo Trading

- Check the smiling face in the top right of the chart.

- Load Preset

- Use included

.setfiles for USDJPY or EURUSD.

- Use included

- Test on Demo

- At least two weeks to confirm broker compatibility.

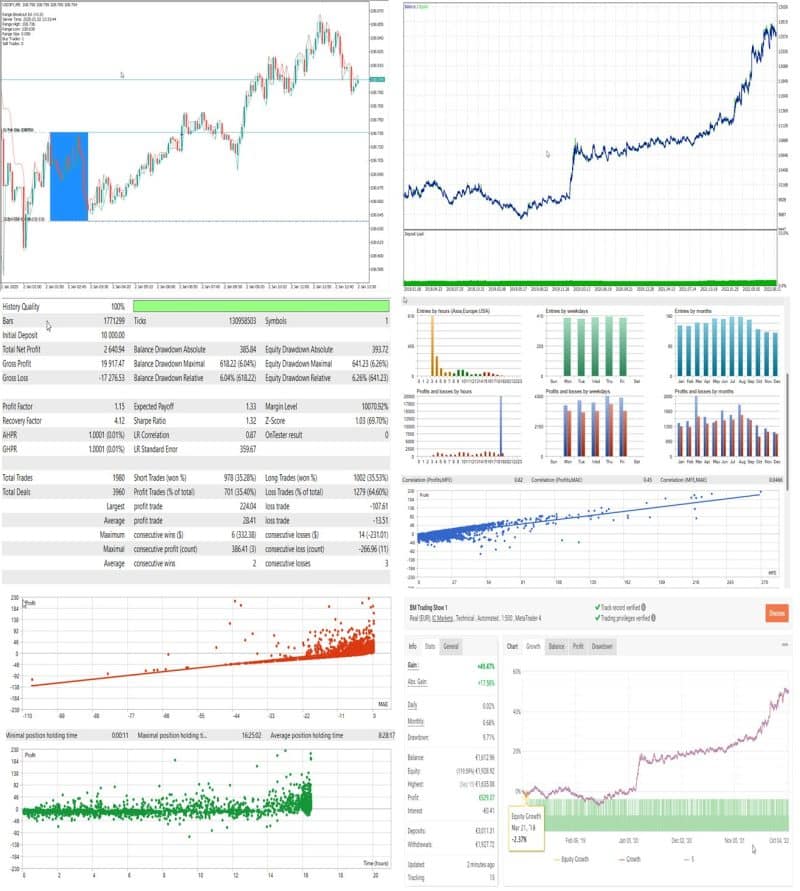

Live Performance Proof

The developer trades this EA on a real account named “BM Trading Show 1”. You can verify results on Myfxbook:

- Go to https://www.myfxbook.com

- Search for “BM Trading Show 1”.

- In Custom Analysis, filter:

- Magic = 1 for EURUSD

- Magic = 5 for USDJPY

Key stats (as of last update):

- Average monthly gain: 3 – 6 %

- Drawdown: under 10 %

- Winning days vs. losing days: roughly 3:1

Remember: past results do not guarantee future returns, but transparent history is still a good sign.

Back-Testing vs. Forward-Testing

| Aspect | Back-Test | Forward-Test |

|---|---|---|

| Data | Historical (tick or minute) | Real-time broker feed |

| Execution | Instant fills | Real slippage & spread |

| Purpose | Proof of concept | Verify forward stability |

Steps to run a reliable back-test:

- Download quality tick data (e.g., from Dukascopy).

- Use “Every Tick” model in MT4 Strategy Tester.

- Test at least five years per symbol.

- Analyse metrics: expectancy, max consecutive losses, profit factor.

Once the back-test looks solid, move to a small live or demo forward-test. Only increase lot size after 2-3 months of stable performance.

Common Mistakes and How to Avoid Them

- Wrong Broker Time Zone

- Solution: Cross-check server time against UTC and adjust EA hours.

- Over-Optimisation

- Resist the urge to chase the best back-test curve. Simple is safer.

- Skipping Spread Filter

- High spreads can wipe gains. Always set a max.

- Ignoring News Events

- Non-farm payrolls can distort ranges. Disable trading on red-flag days.

- Running Multiple EAs with Same Magic

- Use unique magic numbers to keep trades separate.

Frequently Asked Questions

Q1: Can I use Range Breakout EA on other pairs like GBPUSD?A: Yes, but you must find a stable time window and adjust range filters and TP/SL values. Start on demo.

Q2: How many trades per day can I expect?A: Usually one. Some days none if the range filter blocks a setup. The goal is quality, not quantity.

Q3: Will the EA work during high-impact news?A: It places orders before news in most cases. Consider disabling on days with bank rate decisions.

Q4: What VPS specs are required?A: Very light. 1 GB RAM and one CPU core are more than enough because the EA evaluates price once per second.

Q5: Does it support prop-firm rules (e.g., FTMO)?A: Yes, because it limits daily drawdown, doesn’t martingale, and stops trading once the daily target/loss is hit.

Conclusion

The Range Breakout EA offers a clear, logical, and proven way to trade the daily range break in major currency pairs. It avoids risky methods like martingale, keeps risk capped with hard stops, and gives traders the tools they need—time windows, range filters, trailing stops, and fixed daily limits—to tailor the system to their own comfort level. With verified live results and a free demo for both MT4 and MT5, traders can test the strategy without pressure and decide if the approach fits their plan.

Next Steps

- Read our in-depth setup guide.

- Join the discussion in our Telegram group (link inside the EA).

- Share your feedback and trade stats in the comments below to help others learn from real-world use.

Happy trading, and remember: a solid plan plus disciplined risk management beats random entries every time.

Vendor Site – Click Here

| Membership | Yearly Membership |

|---|---|

| Additional Services | Unlock & Decompile |

| Recommended Brokers | Exness Broker, FPMarkets |

| Recommended VPS | FXVM (Low Latency) |

| Youtube Channel | ForexForYou |

| Telegram Channel | Onshoppie Forex EA's & Indicators |

| Telegram Support | Onshoppie Support |

| Installation Guides | Onshoppie Forex Guides |

Brand

ea-mt4

Only logged in customers who have purchased this product may leave a review.

Reviews

There are no reviews yet.