Gold Garden EA MT4 v2.1 For Build 1441+

Original price was: $499.00.$9.95Current price is: $9.95.

Unleash exclusive Gold Garden EA power with thrilling automated trading. Experience jaw-dropping profits and revolutionary forex success today.

Description

Table of Contents

-

- What Is Gold Garden EA?

- The Story Behind the Name “Gold Garden”

- Core Features at a Glance

- How Deep Learning Refines Gold Trading

- Risk Settings Explained

- Strategy Logic: Small Lot Size, Large Fluctuation

- No Grid, No Martingale — Why It Matters

- Installation & Setup Guide (Step-by-Step)

- Choosing a Broker, Account Type, and Leverage

- Testing on 20 Years of Data

- Key Performance Metrics to Track

- Best Practices for Live Trading

- Frequently Asked Questions

- Final Thoughts: Growing Your Own Gold Garden

What Is Gold Garden EA?

Gold Garden EA is an expert advisor designed for the XAUUSD pair on the M15 chart. It draws on two decades of price data and a deep-learning model to make trading decisions that aim for steady growth while limiting risk. Think of it as a digital steward tending your “garden” of gold positions—pruning losses early, letting healthy trades grow, and keeping the soil of your account well-nourished.

The Story Behind the Name “Gold Garden”

Seasoned gold traders often describe their workflow as “tending positions.” Positions take time to bloom; they need careful risk management, consistent pruning, and an eye for changing weather (market news). The development team borrowed that gardening metaphor:

- Seeds = trade entries

- Soil = account equity

- Sun & rain = market volatility

- Gardener = the EA, supported by deep learning

By framing trading as patient cultivation instead of frantic speculation, Gold Garden EA encourages a calm, systematic mindset.

Core Features at a Glance

| Feature | Details |

|---|---|

| Currency Pair | XAUUSD (auto-detects suffix, e.g., XAUUSD.c) |

| Timeframe | 15-minute (M15) |

| Strategy | Single-trade logic, no grid, no martingale |

| Stop-Loss | Fixed per trade |

| Risk Modes | Low, Medium (default), High |

| Minimum Deposit | $300 (recommended $1,000+) |

| Compatibility | Works alongside other EAs |

| Account Types | Classic, ECN, PRO |

| Leverage | Any leverage supported |

How Deep Learning Refines Gold Trading

1. Pattern Recognition Beyond Simple Indicators

Traditional EAs often rely on moving averages or oscillators. Deep learning looks at raw price data, volume, and derived features to detect patterns too subtle for hand-built rules.

2. Training on 20 Years of Data

More data offers context on rare events such as 2008 market stress, the 2011 gold spike, and the 2020 pandemic crash. A model exposed to these events is less likely to break when similar shocks appear.

3. Ongoing Model Updates

The development team promises continuous optimization. Updates aim to keep the model current with evolving liquidity conditions and news cycles.

Risk Settings Explained

| Setting | Who It Suits | Lot Coefficient* | Daily Drawdown Cap |

|---|---|---|---|

| Low | Cautious or new users | 0.5× | 2% |

| Medium (Default) | Balanced approach | 1.0× | 4% |

| High | Aggressive growth | 1.5–2× | 8% |

*Lot coefficient refers to how the EA scales its initial micro-lot size.

Tips:• Start on a demo or cent account with Low setting to understand trade rhythm.• Once comfortable, consider moving to Medium with a $1,000+ balance.• High is best left for smaller test accounts or seasoned traders who can handle heat.

Strategy Logic: Small Lot Size, Large Fluctuation

Gold is volatile; even a 0.01 lot can swing dozens of dollars in minutes. Gold Garden EA:

- Opens trades with micro-lots.

- Places a protective stop-loss at a technical level predicted by the model.

- Targets price waves of 1RR to 2RR (reward is equal or double the risk).

- Closes partial positions on initial profit, trailing the rest.

The approach accepts gold’s natural swings instead of fighting them, allowing the EA to sidestep whipsaw during news events.

No Grid, No Martingale — Why It Matters

A grid adds positions against the trend; martingale doubles lot sizes after losses. Both can wipe an account in a flash crash. Gold Garden EA avoids those pitfalls by:

- Limiting one active position per symbol.

- Using predefined stops.

- Relying on statistical edges rather than recovery tricks.

This design keeps drawdowns shallow and transparent.

Installation & Setup Guide (Step-by-Step)

- Download Gold Garden EA file (.ex4 or .ex5).

- Open MetaTrader → File → “Open Data Folder.”

- Navigate to MQL4/Experts (or MQL5/Experts).

- Paste the EA file and restart MetaTrader.

- Drag “Gold Garden EA” onto XAUUSD M15 chart.

- In the Inputs tab:•

Risk_Mode= Low / Medium / High•Magic_Number= 202308 (avoid conflicts)•Lot_Coefficient= 1.0 (default) - Enable Algo Trading (MT4) or AutoTrading (MT5).

- Watch the journal for “Initialization complete” to confirm.

A full install video is available on the developer’s site. (Internal link placeholder: /gold-garden-ea-install-guide)

Choosing a Broker, Account Type, and Leverage

• Broker Spread: Gold spreads vary widely. Look for <30 points spread (0.30) during normal hours.• Account Type:– Classic accounts suit traders who combine manual entries and EAs.– ECN/PRO accounts often provide lower costs in exchange for commissions.• Leverage: The EA is indifferent; 1:100 to 1:500 works. Lower leverage may require higher balance.• Regulation: Verify the broker is regulated in at least one tier-one jurisdiction.

More on broker selection: (Internal link placeholder: /best-brokers-for-gold)

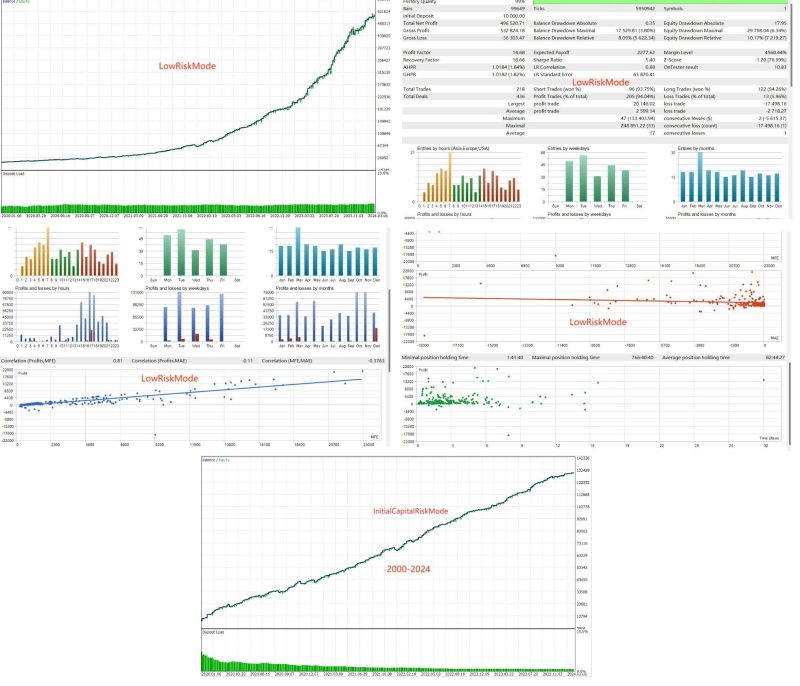

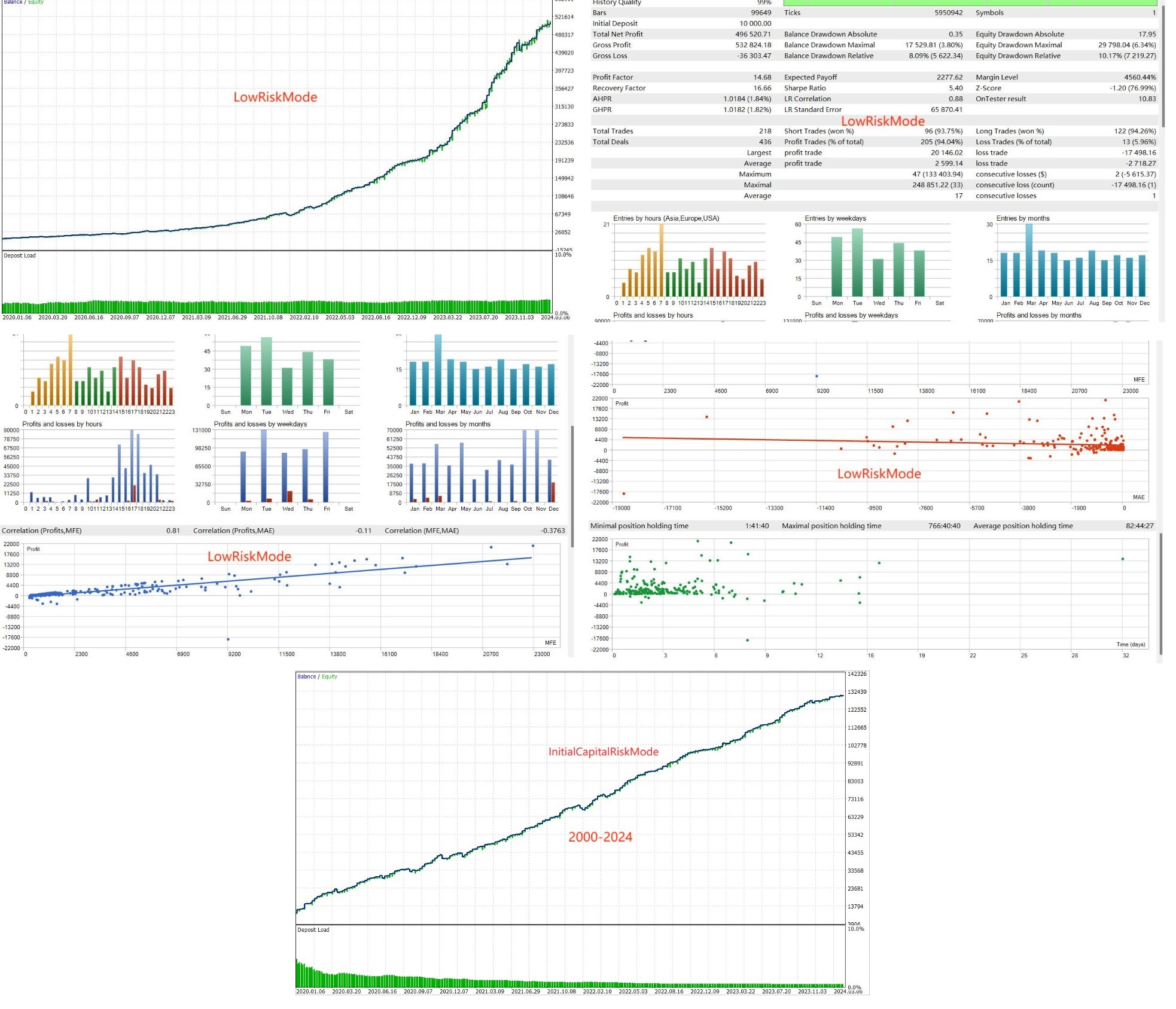

Testing on 20 Years of Data

The EA’s developers used tick data from 2003–2023, including:

| Year | Notable Gold Event | EA Result (Net %) |

|---|---|---|

| 2008 | Lehman collapse | +14.2% |

| 2011 | All-time high attempt | +11.8% |

| 2020 | COVID panic | +17.6% |

Back-testing alone is never enough, but it does show the EA remained stable through extreme volatility.

How to replicate:

- Collect XAUUSD tick data.

- Use Birt’s Tick Data Suite or MT5 built-in tester.

- Run Every Tick mode for precision.

- Compare max drawdown and profit factor to live stats.

Key Performance Metrics to Track

- Max Drawdown – Keep it under 15% on Medium risk.

- Profit Factor – Healthy if >1.4.

- Average Trade Duration – Should cluster between 30 min and 5 hr; longer times may signal slippage.

- Monthly Return vs. Historical – Deviation >30% could flag a market shift.

A simple performance sheet in Google Sheets helps track these numbers.

Best Practices for Live Trading

• Regular Updates: Check for EA patches in the client portal every quarter.• Separate VPS: A 1 GB RAM, 20 GB SSD VPS ensures <5 ms latency.• Economic Calendar: While the EA copes with news, manually pausing before Federal Reserve speeches can lower stress.• Diversify: Run other non-correlated EAs or manual trades on different symbols.• Risk Review: Once capital grows beyond $5,000, consider lowering the lot coefficient to lock gains.

Frequently Asked Questions

Q1. Can I run Gold Garden EA on MT5?Yes. Both MT4 and MT5 builds are offered.

Q2. What happens if I lose internet?A VPS or backup internet link keeps trades running. The EA keeps SL/TP server-side, so positions remain protected.

Q3. Does the EA scale to 0.50 lots or 1 lot?Yes. Scaling is proportional to account equity and the chosen Risk_Mode.

Q4. Will deep learning make the EA “forget” old patterns after every update?Model retraining uses a rolling data window plus core historical events. The old patterns stay, while new information is added.

Q5. Is manual intervention allowed?You may close trades anytime; the EA logs manual exits and resumes without conflicts.

Final Thoughts: Growing Your Own Gold Garden

Gold Garden EA blends 20 years of data with deep learning to offer steady trading on XAUUSD. Its small-lot, single-trade logic, clear risk modes, and promise of continuous improvement make it a practical choice for traders who prefer logic over luck. Start with a low-risk setting, observe how the EA “tends” each trade, and gradually nurture your own flourishing gold garden.

Ready to begin? Download the latest build, test on a demo account, and see if Gold Garden EA fits your trading style.

Disclaimer: Trading involves risk. Past performance does not guarantee future results. Always test any EA in a risk-free environment before going live.

Vendor Site – Click Here

Reviews – Click Here

| Membership | Yearly Membership |

|---|---|

| Additional Services | Unlock & Decompile |

| Recommended Brokers | Exness Broker, FPMarkets |

| Recommended VPS | FXVM (Low Latency) |

| Youtube Channel | ForexForYou |

| Telegram Channel | Onshoppie Forex EA's & Indicators |

| Telegram Support | Onshoppie Support |

| Installation Guides | Onshoppie Forex Guides |

Brand

ea-mt4

Only logged in customers who have purchased this product may leave a review.

Reviews

There are no reviews yet.