Market Reversal Alerts Indicator MT4 V5.1 For Build 1441+

$9.95

Shocking Secret Indicator Predicts Market Crashes Before They Happen!

Never Lose Money Again! This One Indicator Will Make You a Trading Genius

Understanding Trend Exhaustion with the Compair Price Tool

Description

Profit from Changes in Market Structure as Prices Reverse and Pull Back

The market structure reversal alert indicator pinpoints when a trend or price movement is nearing exhaustion and poised to reverse. It notifies you of changes in market structure, typically signaling an impending reversal or significant pullback.

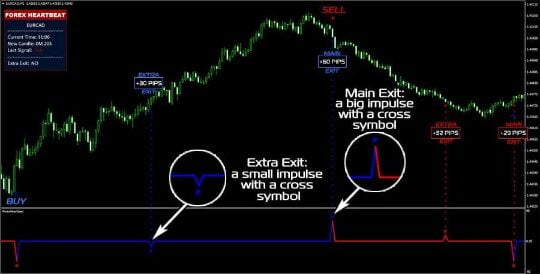

The indicator identifies breakouts and price momentum, marking each instance a new high or low forms near a potential exhaustion point. It then places a rectangle around the last candle of the opposite color, trailing it as the price continues its short-term trend. If the price weakens enough to close above or below this rectangle, it indicates a potential shift in market structure. At this point, the indicator alerts you to a possible change in direction and the start of a reversal or major pullback.

See the indicator in action below to get an idea of how it works!

Optional dashboard add-on to monitor ALL pairs and timeframes here: https://www.mql5.com/en/market/product/62751

Features

- Alerts you to potential market structure changes at key exhaustion points.

- Automatically draws short-term market structures as price nears exhaustion levels.

- Trails alert rectangles behind price to identify the most precise entry points.

- Changes rectangle colors to solid blocks on alerts, indicating potential market structure reversals.

- Compatible with all symbols and timeframes.

- Integrated pop-up, push, and email alerts.

- Notifies you when a reversal alert retest occurs, increasing the likelihood of a valid entry.

- Allows viewing of higher timeframe reversal rectangles on lower trading timeframes, ideal for trend traders and identifying directional bias.

- Select specific directional alerts based on each pair’s current trend direction.

- View higher timeframe directional bias arrows on lower timeframe charts.

Strategy & How to Trade with the Market Structure Reversal Indicator

When a reversal alert is triggered:

- Look left! Check if there is a supply/demand or support/resistance level at the turning point. Market structure shifts (reversals) usually happen when prices retest an old level or after a stop hunt above support or resistance.

- Review higher timeframes to see if there’s a major support/resistance area influencing the lower timeframe changes. Market structure shifts often occur on lower timeframes at significant levels on higher timeframes.

- If these conditions are met, place a trade in the direction of the reversal.

You can complement this indicator with other indicators for additional validation or incorporate it into your existing strategy.

Stop Loss and Take Profit

- Place your stop just above the most recent high or below the most recent low. If the indicator accurately identifies a market structure shift, the price will seldom move past the recent peak. The stop size will vary depending on the intensity of the last move creating the recent high.

- Take profit levels are up to you, but a 1.5:1 or 2:1 risk to reward ratio is easily achievable. Alternatively, entering two trades and having one trail along with the price just above/below new rectangles can result in a 5:1 or higher risk-to-reward ratio.

Brand

Indicator-mt4

Only logged in customers who have purchased this product may leave a review.

Reviews

There are no reviews yet.