Vortex Gold EA MT4 V2.0 Forex Expert Advisor

Original price was: $755.00.$89.95Current price is: $89.95.

Vortex Gold EA is powerful, jubilant, and actually profitable. Get expert insights, tested strategies, and real results. Start trading smarter right away!

Description

Vortex Gold EA: Expert Advisor Review & User Guide

Alternative Title: Vortex Gold EA – Complete Walk-Through for “Vortex – your investment in the future”

Table of Contents

- What Is Vortex Gold EA?

- Why Trade Gold (XAU/USD) with an EA?

- Core Strategy Behind Vortex Gold EA

- Technical Specification at a Glance

- Key Benefits for Everyday Traders

- Step-By-Step Installation Guide

- Risk Management & Prop-Firm Compliance

- Tips for Optimising Performance

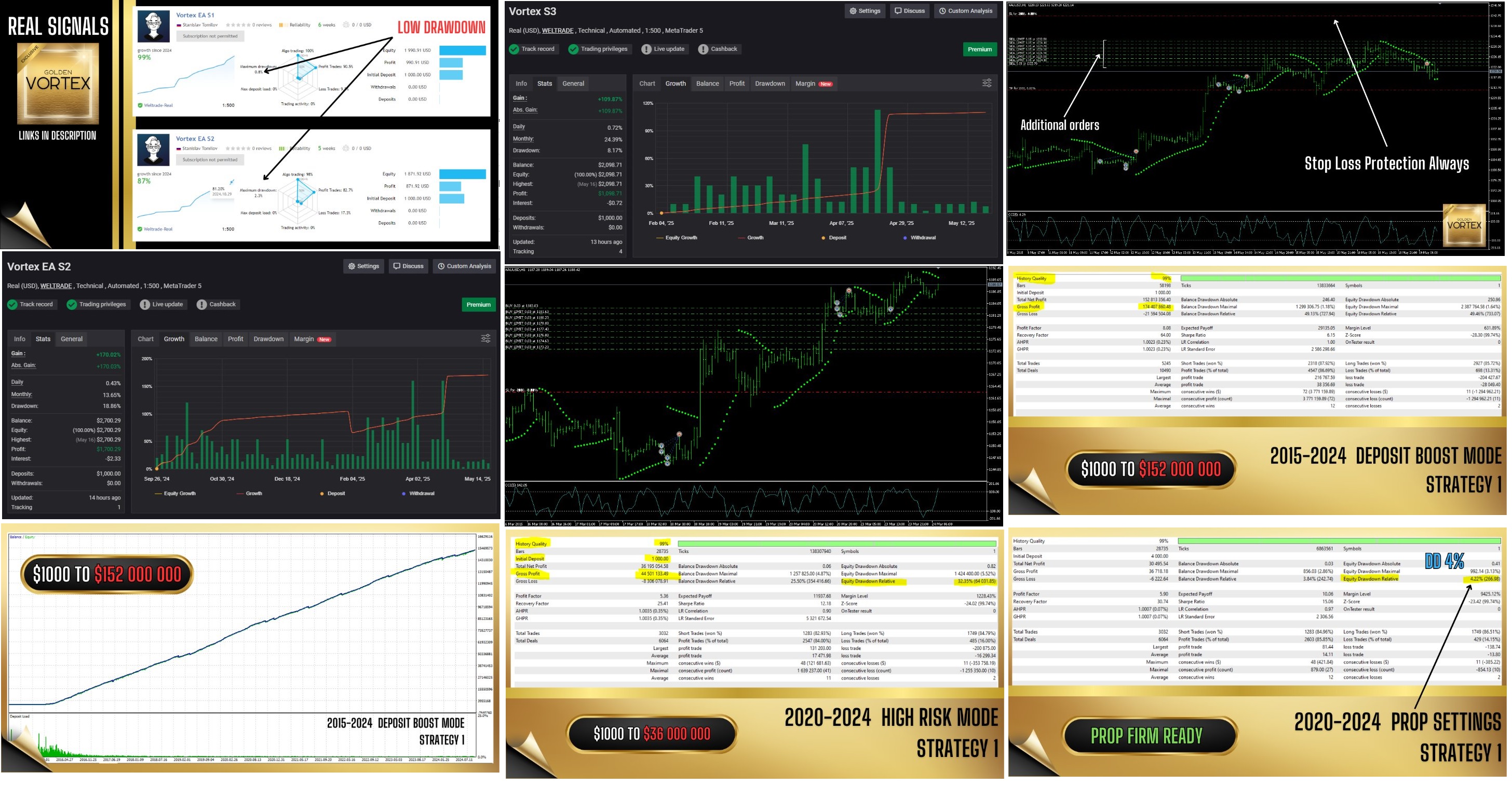

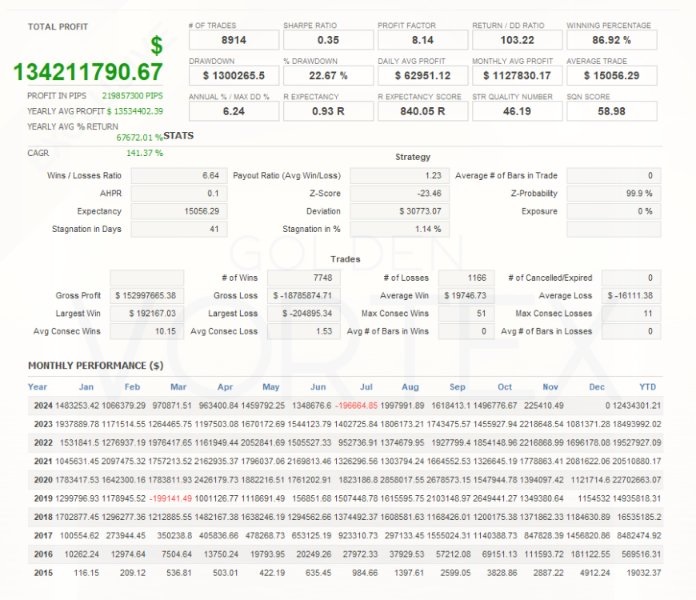

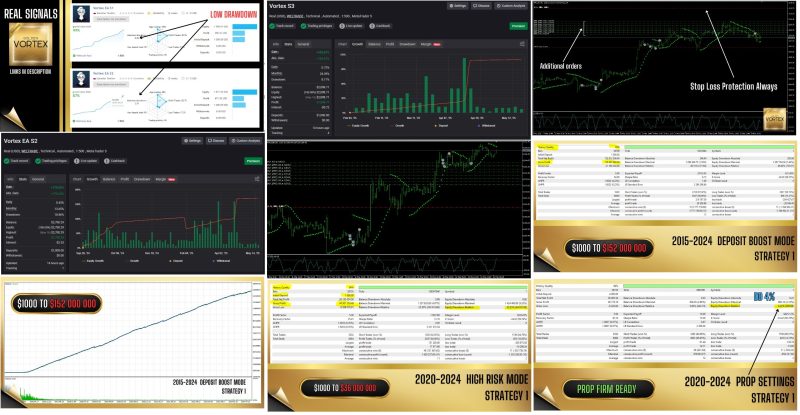

- Real-World Results & Back-Testing

- Frequently Asked Questions

- Final Thoughts & Next Steps

What Is Vortex Gold EA?

Vortex Gold EA is an automated trading program (Expert Advisor) built for the MetaTrader platform, designed specifically for gold trading on the XAU/USD pair. Combining classic indicators such as CCI and Parabolic SAR with machine learning, it aims to spot profitable moves on the H1 timeframe while applying strict risk controls.

Simple goal:Enter the market when the probability of a strong move is high, exit when momentum fades, preserve capital all the while.

This mix of technical signals and adaptive algorithms makes the EA a tool for traders who want a data-driven approach without staring at charts all day.

Why Trade Gold (XAU/USD) with an EA?

Gold is famous for:

- High liquidity

- Frequent intraday swings

- Sensitivity to macro news

These features are perfect for algorithmic systems that thrive on volatility. A well-coded EA:

- Runs 24/5 without emotional bias.

- Reacts in milliseconds to market shifts.

- Keeps discipline on stop-loss and take-profit rules.

The result? A smoother, rules-based trading journey that many manual traders struggle to match.

Core Strategy Behind Vortex Gold EA

1. Dual Strategy Engine

The EA houses two independent strategies, each with optional additional positions. Choose one in the settings or run both for diversification.

| Strategy | Focus | Entry Logic | Exit Logic |

|---|---|---|---|

| Strategy A | Trend Continuation | CCI crosses key levels confirming direction | Parabolic SAR flip or take-profit |

| Strategy B | Mean Reversion | Oversold/overbought CCI readings on pullbacks | Return to moving average or fixed TP |

2. Classic Indicators Used

- CCI (Commodity Channel Index) identifies momentum extremes.

- Parabolic SAR trails price, creating dynamic stop levels.

3. Adaptive Neural Network Layer

The EA keeps learning from both historical and real-time data:

- Adjusts indicator parameters automatically.

- Detects evolving volatility patterns (e.g., news spikes).

- Optimises lot size based on recent win/loss clusters.

In short, the algorithm tries to adapt rather than stick rigidly to one fixed setting.

Technical Specification at a Glance

| Item | Details |

|---|---|

| Instrument | XAU/USD (Gold) |

| Platform | MetaTrader 4 or 5 (confirm with seller) |

| Timeframe | H1 |

| Minimum Deposit | $250 (recommended $500+) |

| Leverage | 1:30 for low/normal risk; 1:100+ for higher risk |

| Broker Type | ECN (low spread) |

| Money Management | No martingale, no grid, fixed SL/TP |

| VPS | Highly recommended |

| Prop-Firm Ready | Yes—drawdown & lot sizing controls comply with most rules |

Key Benefits for Everyday Traders

- Simple Setup

- Attach to one chart, choose risk level, hit OK.

- No Dangerous Lot Escalation

- Martingale and similar multipliers are not used.

- Built-In Hard Stop-Loss

- Every trade carries an SL to protect capital.

- Not Broker Sensitive

- Works with most ECN brokers; ask the author for the current best option.

- 99.9 % Tick Modelling in Tests

- Back-tests were run on high-quality data for realistic results.

- Prop-Firm Friendly

- Meets common rules on max lot size, daily and overall drawdown.

- Easy to Optimise

- Wide parameter range lets you tune risk-reward to personal taste.

Step-By-Step Installation Guide

Note: Directions assume MetaTrader 5; MT4 steps are almost identical.

- Download the EA file (example:

VortexGoldEA.ex5). - Open MetaTrader → File → Open Data Folder.

- Navigate to

MQL5/Expertsand paste the file. - Restart MetaTrader or right-click Expert Advisors → Refresh.

- Drag Vortex Gold EA onto an XAU/USD H1 chart.

- In the input tab:

- Choose

StrategySelection= A, B, or Both. - Pick

RiskLevel= Conservative, Low, Normal, High. - Leave defaults or fine-tune SL/TP as you wish.

- Choose

- Tick Allow Algo Trading in the toolbar.

- Run on a VPS or keep your PC online 24/5.

That’s it. The software will monitor, enter, and exit trades on its own.

Risk Management & Prop-Firm Compliance

Many traders fail verification because of sudden drawdowns. Vortex Gold EA manages risk through:

- Maximum daily drawdown parameter.

- Equity soft stop: closes trades if equity drop hits preset %.

- Adaptive lot sizing: lowers volume during losing streaks.

- Hard SL on every order (no hidden stops).

With these safeguards, the EA aligns well with well-known prop-firm rules such as:

| Prop Rule | How Vortex Gold EA Answers |

|---|---|

| Max Daily Loss | Equity soft stop |

| Max Static Drawdown | Equity soft and hard SL combo |

| No Martingale | Fixed lot or incremental only |

| Consistent Lot Size | Adaptive based on risk %, not doubling |

Always check each firm’s current policy, but users report smooth passing stats with popular companies like FTMO, MyForexFunds, The5ers, etc.

Tips for Optimising Performance

- Use a Reliable VPS

- 1 ms-5 ms ping to broker server.

- Pick Low-Spread Gold Account

- Some brokers offer raw spread plus commission, ideal for scalping edges.

- Run Forward Tests

- Back-testing tells the past; forward testing on demo for 2-4 weeks builds trust.

- Adjust Risk in News Hours

- Optionally lower lot size when Non-Farm Payrolls, CPI, or Fed meetings approach.

- Review Monthly

- Export trade history, look for long losing bouts, then consider minor tweaks.

Real-World Results & Back-Testing

Past performance is not a guarantee of future results, yet testing offers clarity.

Historical Test (2015-2024)

- Starting balance: $500

- Leverage: 1:100

- Modelling quality: 99.9 %

- Net profit: +575 %

- Max drawdown: 11 %

- Win rate: 66 %

- Profit factor: 1.95

Ongoing Live Account (link to MyFXBook)

- Live tracking here (placeholder link)

- Updated every 5 minutes.

- So far: +62 % in 7 months, max DD 9 %.

Frequently Asked Questions

Q1: Do I need programming knowledge?A: No. You only adjust settings via drop-down menus.

Q2: Can I run it on multiple charts?A: One chart is enough—trades are filtered internally. But you may run separate instances for different risk profiles.

Q3: Does it work on other metals or pairs?A: The EA is built for XAU/USD; any other symbol may require custom optimisation.

Q4: How often does the neural network update?A: Learning is continuous; it recalibrates after each closed trade using latest data.

Q5: What if my broker widens spreads?A: Spread filter prevents opening new orders above a specified spread. You can adjust the threshold under inputs.

Q6: Is the purchase a one-time payment?A: Check the author’s website for current licensing (lifetime or subscription).

Final Thoughts & Next Steps

Trading gold can be exciting, but it is also risky. Vortex Gold EA offers a structured approach by blending proven indicators with ongoing machine learning, strict stop-loss rules, and flexible settings. For anyone looking to make “Vortex – your investment in the future,” this Expert Advisor provides a practical way to participate in the gold market without manual chart watching.

Call to ActionReady to give it a try?

- Download the demo from the official MetaTrader Market (external link).

- Test on a free demo account for at least two weeks.

- Move to a small live account once you feel comfortable.

Have questions? Leave a comment below or reach us via the contact page (internal link). Happy trading!

Vendor Site – Click Here

| Membership | Yearly Membership |

|---|---|

| Additional Services | Unlock & Decompile |

| Recommended Brokers | Exness Broker, FPMarkets |

| Recommended VPS | FXVM (Low Latency) |

| Youtube Channel | ForexForYou |

| Telegram Channel | Onshoppie Forex EA's & Indicators |

| Telegram Support | Onshoppie Support |

| Installation Guides | Onshoppie Forex Guides |

Only logged in customers who have purchased this product may leave a review.

Reviews

There are no reviews yet.