Osmosis EA MT5 V1.3 For Build 5120

Original price was: $499.99.$25.95Current price is: $25.95.

Surging interest in Osmosis EA! Excited traders are seeing powerful results. Find out why this tool is wanted by everyone.

Description

Osmosis EA Explained: A Practical Guide to the Data-Driven Gold Trading Robot

Osmosis EA – Your Guide to a Data-Driven Gold Trading Robot

Table of Contents

- What Is Osmosis EA?

- How the Dynamic Price Differential Algorithm Works

- Key Features at a Glance

- Recommended Settings and Setup Checklist

- Step-by-Step Installation Guide for MetaTrader 5

- How to Back-Test Osmosis EA Properly

- Risk Management and Prop-Firm Compliance

- Frequently Asked Questions (FAQ)

- Pros and Cons

- Final Thoughts & Next Steps

What Is Osmosis EA?

Osmosis EA is an advanced, data-driven automated trading robot designed for MetaTrader 5 (MT5). It focuses on trading retracements on Gold (XAUUSD) by combining:

- a dynamic price differential algorithm that looks for the best possible execution price, and

- a market-volume filter that weeds out low-quality entries.

Unlike many robots that stick to fixed entry rules, Osmosis EA adapts to changing price action. It waits, pends, and modifies orders until it finds a price level that matches its built-in logic. The expert advisor also comes with hard stop-loss protection, adjustable take-profit, trailing stop, a news filter, and spread control to avoid trading during high-impact events.

Note: There is no MT4 version right now. If you are new to MT5, the author offers remote help. Simply take a screenshot of your purchase and send a message for guidance.

How the Dynamic Price Differential Algorithm Works

1. Scanning for Price Zones

Osmosis EA constantly checks live Gold prices on the M1 timeframe. It looks for two price levels (Price 1 and Price 2) that meet its standard price differential rule.

2. Pending Orders with Built-In Modifiers

Once the algorithm finds a suitable gap:

- It places pending orders at Price 1.

- If the market keeps moving, it modifies the orders toward Price 2 until execution.

- This cycle repeats until the entry price hits the optimal differential.

3. Real-Time Volatility & Volume Filters

To avoid whipsaws, Osmosis EA checks:

- Internal volatility filter – prevents trades in sudden spikes.

- Market volume – skips thin liquidity periods.

4. News & Spread Protection

- News Filter: A built-in calendar stops trading minutes before high-impact news (configurable) and starts again afterwards.

- Spread Control: If the spread goes above your set maximum, the EA will pause.

5. Dynamic Exit Strategy

- Hard Stop-Loss: Always active.

- Reference Take-Profit: Allows the EA to seek extra profit when the market moves in your favor.

- Trailing Stop: Secures gains as price moves.

Key Features at a Glance

| Feature | Description |

|---|---|

| Strategy | Trades Gold (XAUUSD) retracements on M1 using a price differential algorithm |

| Platforms | MetaTrader 5 only |

| Dangerous Methods | None – no martingale, grid, doubling, or averaging |

| Account Types | Hedge; ECN, Raw, or Razor accounts with tight spreads |

| Risk Control | Hard stop-loss, adjustable risk %, max lot limit |

| Filters | News filter, volatility filter, spread & slippage control |

| Prop-Firm Ready | FIFO-compliant; suitable for most prop-firm rules |

| Set Files | Pre-built templates in the comments section for quick setup |

Recommended Settings and Setup Checklist

Quick Reference

| Setting | Suggested Value | Why It Matters |

|---|---|---|

| Minimum Deposit | $100 | Ensures room for stop-loss and spread |

| Leverage | 1:500 (for testing) | Matches the set files provided |

| LotSize (Fix) | Start small (e.g., 0.01) | Good for beginners |

| Risk Compounding (%) | 0 to disable at first |

Learn the EA before auto-risk |

| Maximum Spread | 20 points or broker default | Blocks trades in wide spreads |

| Use Trailing Stop | true |

Locks in profit on big moves |

| Trailing Start | 500 points (example) | Tailor to account size |

| Stop Trading Before News | 30 minutes | Avoid sudden spikes |

| Start Trading After News | 15 minutes | Resume once volatility drops |

| Trading Time | 00:00–23:59 (adjust) | Skip high-spread sessions if needed |

| Friday Close Time | 60 minutes before market close | Avoid weekend gaps |

Setup Checklist

- Open an ECN or Raw spread account with a broker such as Fusion Markets.

- Deposit at least $100 (a bit more offers cushion).

- Install MetaTrader 5 on desktop or VPS.

- Download Osmosis EA from the official MetaQuotes Market.

- Copy the provided set file into the

Presetsfolder. - Attach the EA to an M1 XAUUSD chart.

- Load the set file, confirm risk % and lot size.

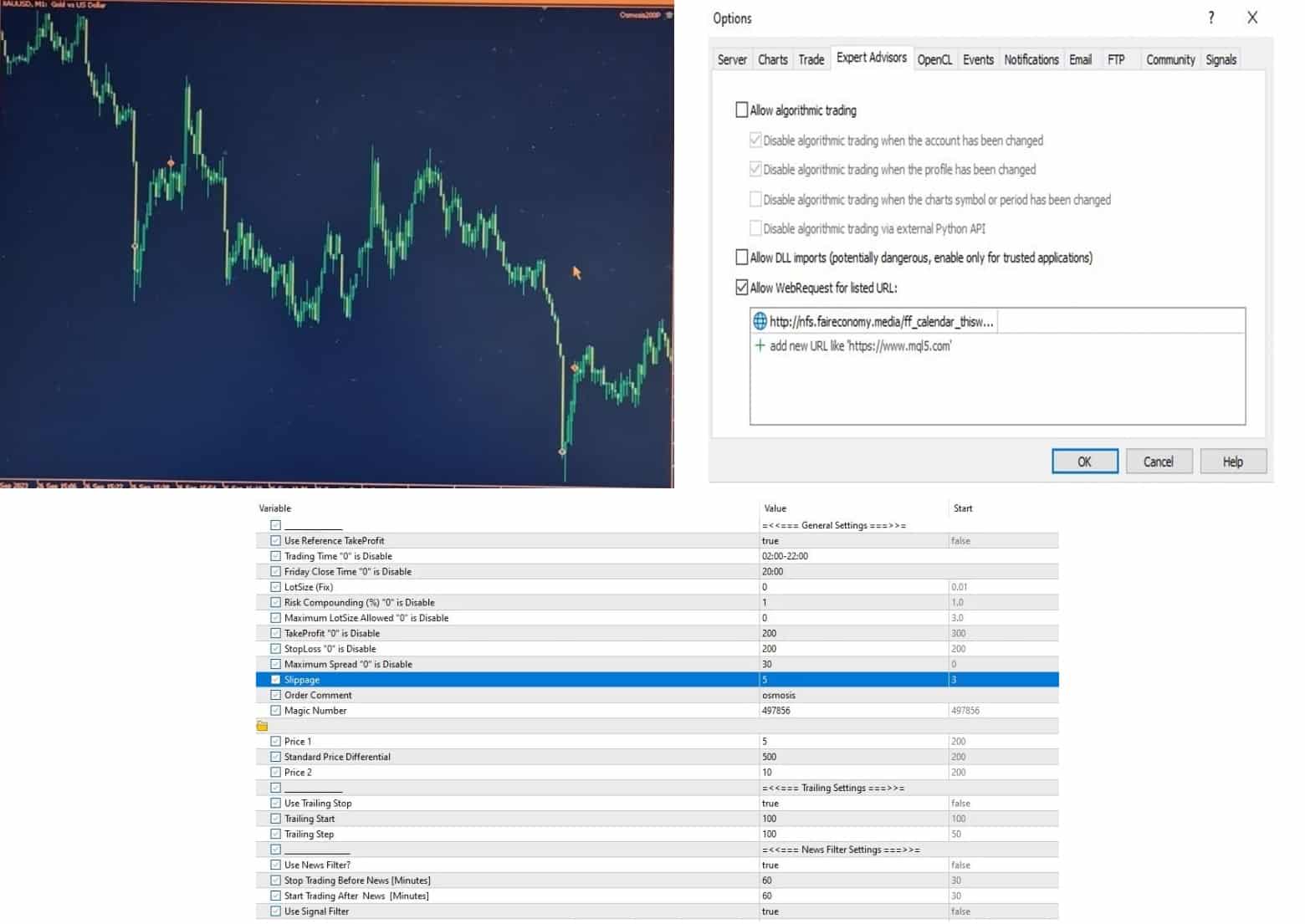

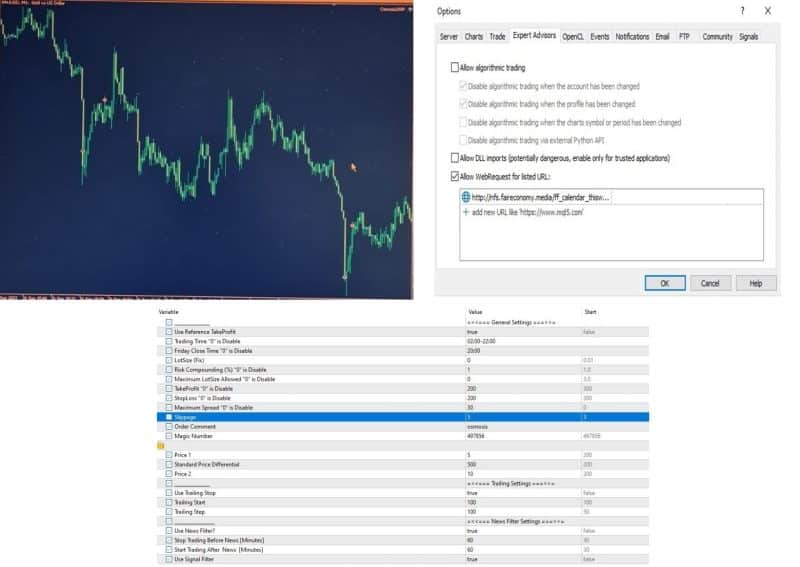

- Allow algorithmic trading and DLL imports.

- Check the news panel on the chart to verify upcoming events.

Step-by-Step Installation Guide for MetaTrader 5

- Download the EA

- Go to your MT5 Terminal → Market → Search “Osmosis EA”.

- Click Download or Buy.

- Attach to Chart

- Open an XAUUSD M1 chart.

- Drag Osmosis EA onto the chart or double-click its name in the Navigator.

- Input Your Parameters

- General tab: Tick Allow Algo Trading.

- Inputs tab: Load the provided set file or enter values manually.

- Enable AutoTrading

- Press

Ctrl+Eor use the top toolbar to switch on Algo Trading (green play symbol).

- Press

- Verify Panel Info

- You should see:

- EA name and version.

- Spread reading.

- Next high-impact news countdown.

- You should see:

Tip: If you face errors like “init failed”, check that you are logged into the correct MT5 account type (hedge, not netting) and that “Allow DLLs” is enabled.

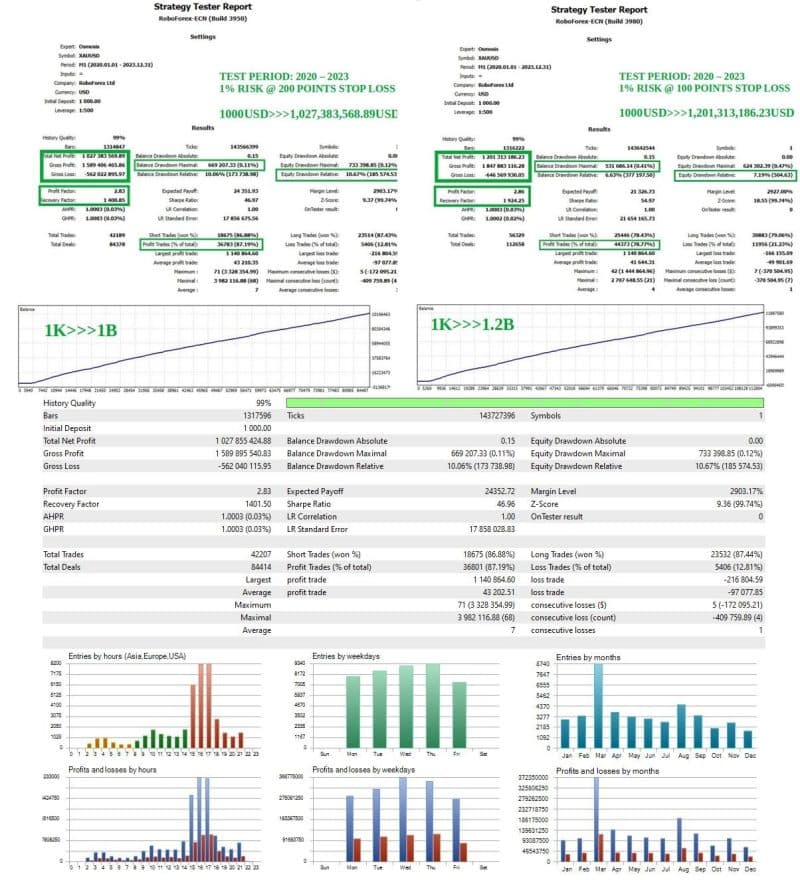

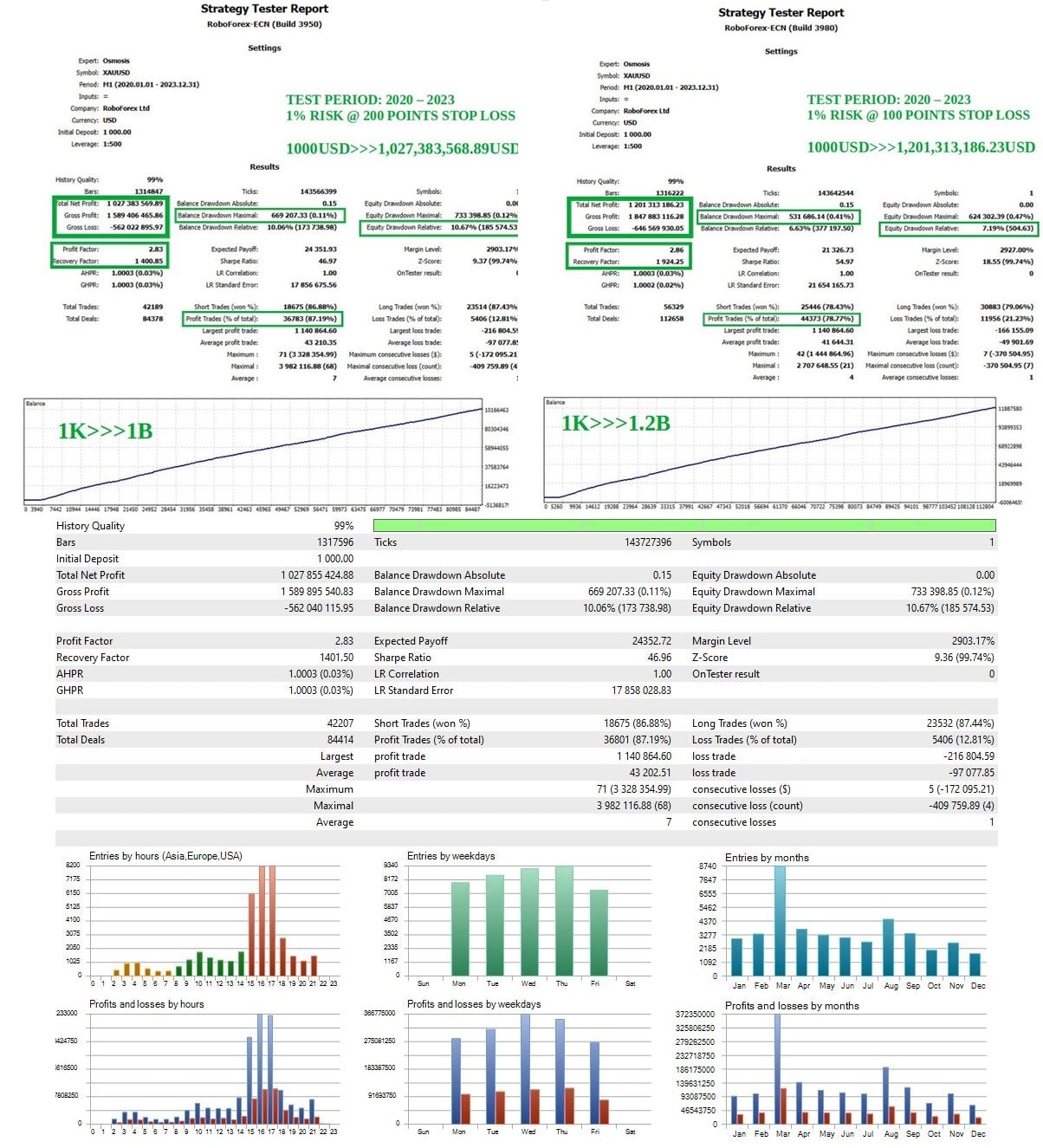

How to Back-Test Osmosis EA Properly

- Open the Strategy Tester (

Ctrl+R). - Symbol:

XAUUSD. - EA:

Osmosis EA. - Model:

Every tick. - Date Range:

2020-01-01to2023-12-30. - Deposit:

$1,000. - Leverage:

1:500. - Use Custom Set File from the comments.

- Visualization: Optional, but helpful to see how pending orders modify.

- Press Start and wait for results.

After the run, look at:

- Profit Factor – aims for >1.5.

- Drawdown – keep below 15 % for prop-firm comfort.

- Average Trade Length – should match quick scalps, showing retracement capture.

For deeper analysis, export your results to Excel or use third-party tools such as FX Blue.

Risk Management and Prop-Firm Compliance

Why Risk Matters

Gold is naturally volatile. Even with a tight algorithm, the market can gap or spread can widen. Always:

- Limit risk to 2 % per trade (recommended).

- Avoid over-leveraging even if your broker offers 1:2000.

- Stick to hard stop-loss values; do not remove them.

Prop-Firm Points to Check

| Prop-Firm Rule | Osmosis EA Compliance |

|---|---|

| FIFO | Yes – single entry, single exit |

| Max Lot Per Position | Adjustable via Maximum Lot Size |

| No Dangerous Methods | No martingale, grid, or averaging |

| Max Daily Drawdown | User managed via risk % and stop-loss |

| News Trading Restrictions | EA can auto-pause before news |

If you plan to trade on firms such as FTMO, MyForexFunds, or The Funded Trader, run a demo first to ensure your broker feed and spreads line up with the firm’s limits.

Frequently Asked Questions (FAQ)

Q1: Can I use Osmosis EA on MT4?A: Not right now. Only MT5 is supported. The author can help you set up MT5 remotely if needed.

Q2: Does the EA work on other pairs?A: The logic is fine-tuned for Gold. Running it on EURUSD or other pairs may give random results.

Q3: Is this a scalper or a long-term robot?A: It’s closer to a short-term retracement trader. Trades can last minutes to a few hours.

Q4: How often does it trade?A: On average, 2–10 trades per day, depending on volatility and your spread settings.

Q5: What VPS specs do I need?A: Any modern VPS with 1 CPU, 1 GB RAM, and low latency (<5 ms) to your broker is enough.

Q6: Can I withdraw profits anytime?A: Sure. The EA does not rely on compounding or grid recovery. Just keep enough margin available.

Pros and Cons

Pros

- Data-driven algorithm that adapts to price action.

- Hard stop-loss and no dangerous lot schemes.

- Built-in news and volatility filters.

- Ready for prop-firm rules, including FIFO.

- Clear documentation and set files.

Cons

- MT5 only (no MT4).

- Works on one symbol (Gold) by design.

- Requires low-spread ECN account to shine.

- Beginners may need guidance to tune parameters.

Final Thoughts & Next Steps

Osmosis EA offers a clear, structured approach to trading Gold on MT5 with safety nets like hard stop-loss, news filters, and dynamic exits. If you:

- Trade on a low-spread ECN account,

- Keep risk at or below 2 % per trade, and

- Follow the recommended settings,

the EA can be a helpful companion in your trading toolkit.

Ready to dive in?

- Download the expert advisor from the official MetaQuotes Market.

- Run a demo or Strategy Tester to get comfortable.

- Move to live trading only when you are happy with the numbers.

Have questions or feedback about Osmosis EA?Leave a comment below, or reach out via our contact page. If you found this guide useful, feel free to share it with fellow traders using the quick buttons below!

Vendor Site – Click Here

| Membership | Yearly Membership |

|---|---|

| Additional Services | Unlock & Decompile |

| Recommended Brokers | Exness Broker, FPMarkets |

| Recommended VPS | FXVM (Low Latency) |

| Youtube Channel | ForexForYou |

| Telegram Channel | Onshoppie Forex EA's & Indicators |

| Telegram Support | Onshoppie Support |

| Installation Guides | Onshoppie Forex Guides |

Only logged in customers who have purchased this product may leave a review.

Reviews

There are no reviews yet.