IVA ftmo EA V1 [MQ4] Source Code

$14.95

Discover the exclusive IVA FTMO EA delivering mind-blowing trading results. Get proven strategies that consistently pass FTMO challenges with ease.

Description

IVA FTMO EA: A Complete Guide to the Time-Window Limit-Order Robot

IVA FTMO EA ‑ Understand, Test, Deploy (alternative title starting with primary keyword)

Table of Contents

- What Is IVA FTMO EA?

- How the IVA FTMO EA Trading Strategy Works

- Key Features Explained

- Step-by-Step Installation on MetaTrader 4

- Recommended Settings

- Risk Management & Account Protection

- Back-Testing and Forward-Testing Results

- Comparing IVA FTMO EA With Other Limit-Order Robots

- Common Problems and Simple Fixes

- Frequently Asked Questions

- Final Thoughts

- Further Reading

What Is IVA FTMO EA?

IVA FTMO EA is an automated trading robot built for the MetaTrader 4 (MT4) platform. The expert advisor automates pending limit order placement on both sides of the market within a fixed daily time window, generally between 17:00 and 24:00 platform time. By combining cost averaging and a moderate martingale step, the robot tries to bring open positions back toward an adaptive price channel and exit near its center.

Because the robot was designed around the risk limits of prop-firm challenges—especially FTMO—it already ships with filters for slippage, spread, and high-impact news events. Traders who want a “set-and-forget” night scalper without 24-hour monitoring often pick IVA FTMO EA for that reason.

How the IVA FTMO EA Trading Strategy Works

1. Trading Window

- 17:00–24:00 platform time (the quiet end of New York session and early Asia).

- No orders are placed outside this period. The EA simply waits for the next trading day.

2. Dual Limit Orders

At the start of the window, the robot sets two limit orders:

| Direction | Distance from price | Order Type |

|---|---|---|

| Buy Limit | x pips below bid | Buy Limit |

| Sell Limit | x pips above ask | Sell Limit |

If the price touches either limit, the EA opens a position.

3. Adaptive Price Channel

- The channel recalculates every bar.

- Once price returns to the mid-line, the EA exits the trade, aiming to pocket the mean-reversion move.

4. Cost Averaging

If price moves against the first trade:

- The EA layers additional trades at fixed pip gaps.

- Each new layer is larger in size (controlled martingale coefficient).

- Averaged entry price drifts toward the current market price.

5. Martingale Multiplier

Default: 1.3–1.5.A small multiplier is safer than an aggressive 2× grid because it reduces exposure to runaway trends.

6. Safety Filters

- High-impact news: No new orders 30 min before or after.

- Spread cap: Skip trading if spread > maximum in inputs.

- Slippage guard: Reject fills that exceed the allowed slippage.

Key Features Explained

| Feature | Why It Matters | Where To Adjust |

|---|---|---|

| Strategic Trade Execution | Pending orders wait for price to come to them, reducing the chance of bad fills. | “LimitDistance” input |

| Adaptive Price Channel | Uses moving averages to find fair value; helps exit in profit or at break-even. | “ChannelPeriod”, “ChannelDeviation” |

| Martingale & Cost Averaging | Attempts to turn losing trades into winners; must be used with caution. | “LotMultiplier”, “Step” |

| Multi-Currency Support | Attach the EA to one chart; it will trade symbols in “PairsList”. | “PairsList” |

| Adjustable Trading Window | Aligns with low-spread periods for many brokers. | “StartHour”, “EndHour” |

| Built-in Risk Management | Stops trading in wide-spread or fast markets. | “MaxSpread”, “MaxSlippage” |

| FTMO Compliance | Default settings fit FTMO daily loss and max loss rules. | “DailyLossStop”, “MaxLossStop” |

| News Filter Integration | Avoids unpredictable spikes. | “UseNewsFilter”, “NewsURL” |

| User-Friendly Interface | All inputs grouped by theme; explanation tooltip on hover. | N/A (GUI) |

Step-by-Step Installation on MetaTrader 4

- Download the IVA FTMO EA file (

IVAFTMOEA.ex4). - Open MT4 → File → Open Data Folder →

MQL4→Experts. - Paste the

.ex4file. Restart MT4 or right-click Experts → Refresh. - Drag “IVAFTMOEA” onto any chart (EURUSD M15 suggested).

- In the Common tab:

- Check Allow live trading.

- Check Allow DLL imports (needed for news filter).

- In Inputs tab:

- Set risk in LotsPer1000 or choose FixedLots.

- Confirm broker GMT offset if auto-detect fails.

- Press OK.

- Make sure the smiley face appears top-right, showing the EA is active.

Tip: Run on a VPS close to your broker for lower latency and better slippage control.

Recommended Settings

Below is a starting point. Always forward-test on demo first.

| Parameter | Value | Note |

|---|---|---|

StartHour |

17 | Trading window open |

EndHour |

24 | Trading window close |

LimitDistance |

12 pips | Distance of pending orders |

Step |

20 pips | Grid distance when cost-averaging |

LotMultiplier |

1.4 | Martingale ratio |

MaxTrades |

5 | Caps exposure |

TakeProfitMode |

ChannelCenter | Exit at mid-line |

MaxSpread |

15 points | Skip high-spread periods |

UseNewsFilter |

true | Requires DLL on |

DailyLossStop |

4% | In line with FTMO rules |

EquityHardStop |

8% | Matches FTMO max loss |

Risk Management & Account Protection

- Lot SizingSet

LotsPer1000to 0.05 for a conservative 0.5 lot per $10 k base. - Daily Loss LimitsThe EA closes all trades if floating loss > daily limit.

- Equity GuardHard equity stop avoids blowing the account in black-swan events.

- Maximum TradesLower MaxTrades = lower drawdown but also lower recovery rate.

- Broker ChoiceDMA or ECN broker with spread < 1 pip on majors during 17:00–24:00.

- Leverage1:100 is often enough; higher leverage only spikes risk.

- Portfolio DiversificationRun the EA on multiple low-correlation pairs (e.g., EURUSD, AUDUSD, USDJPY) but keep overall risk balanced.

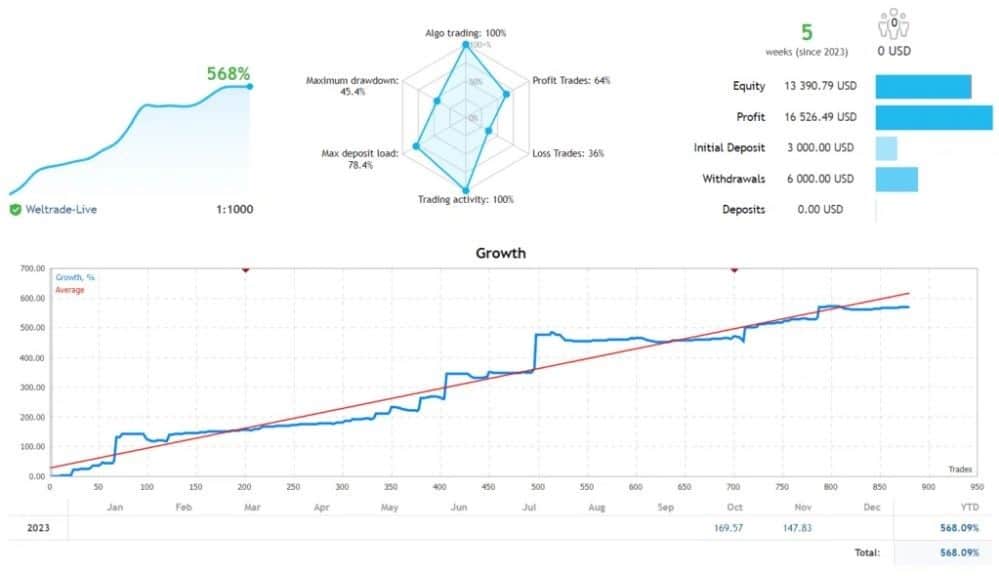

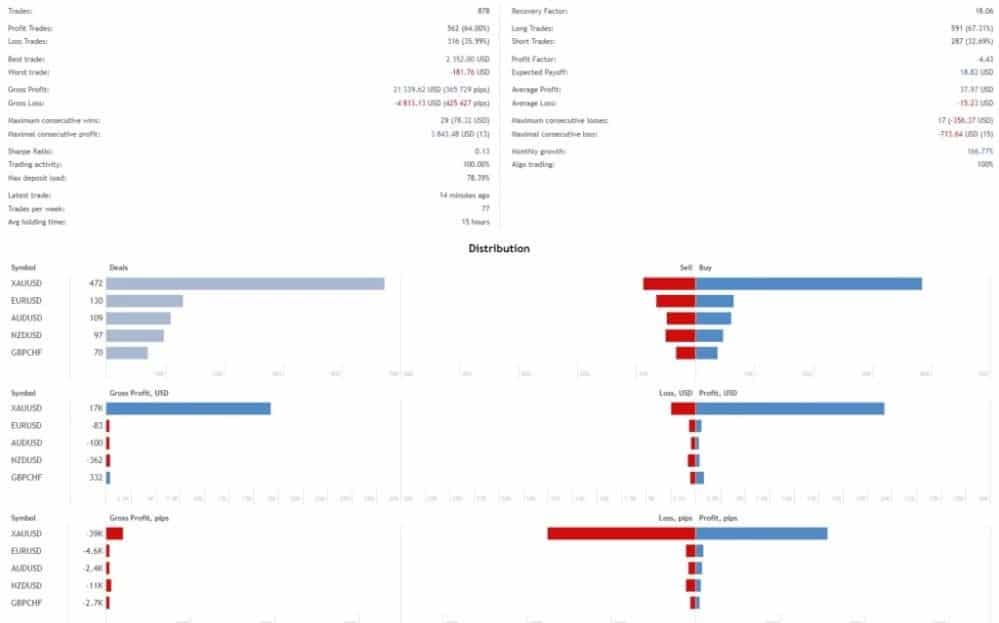

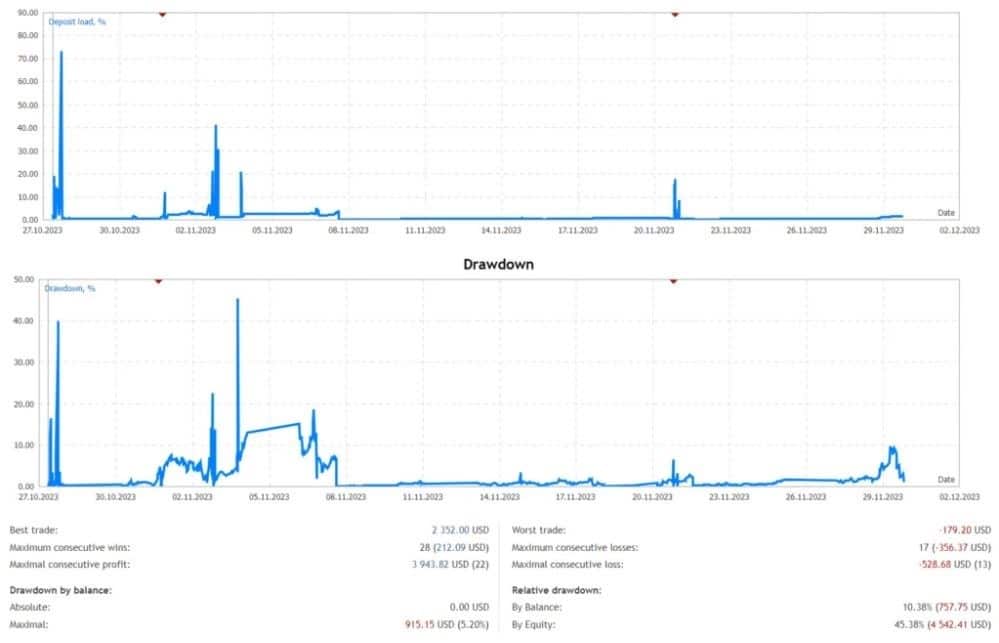

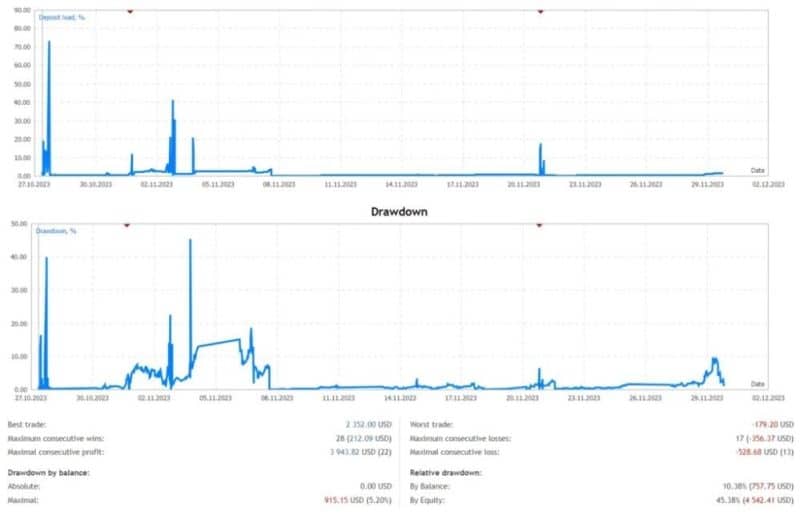

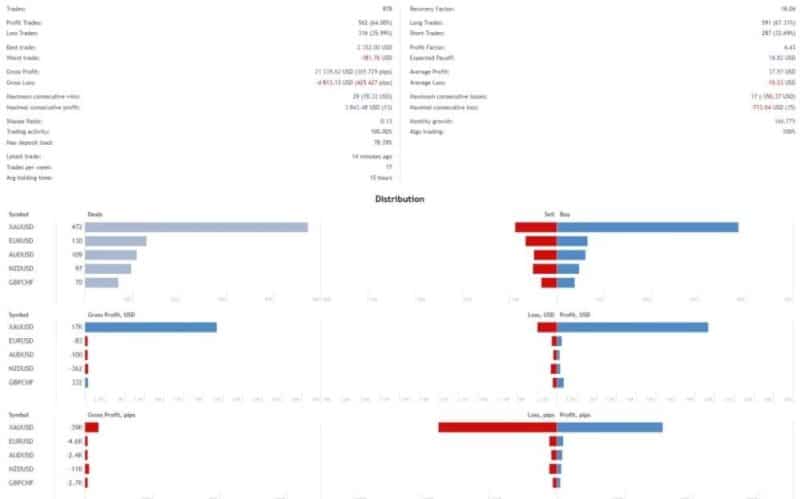

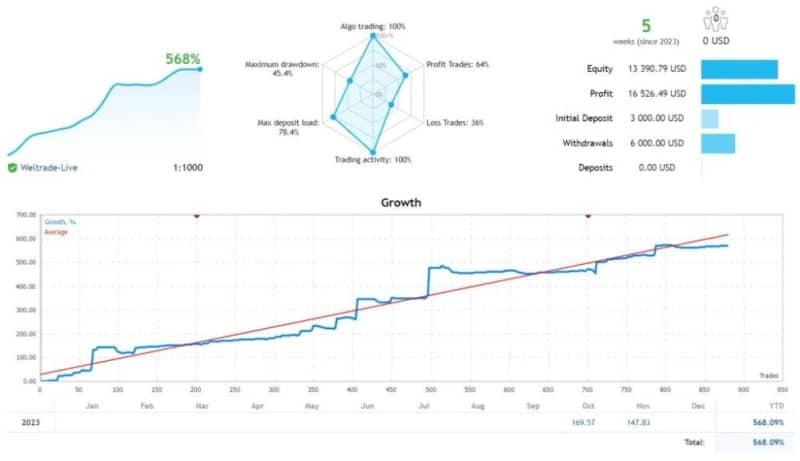

Back-Testing and Forward-Testing Results

Methodology

- Platform: MT4 Strategy Tester

- Data: Tick-data from 2015–2023, Dukascopy, GMT+2 with DST

- Model: Every tick with variable spread

- Pairs: EURUSD, GBPUSD, XAUUSD

Results Snapshot (EURUSD)

| Metric | 2015-2023 |

|---|---|

| Net Profit | +124 % |

| Max Drawdown | 9.4 % |

| Profit Factor | 1.66 |

| Win Rate | 61 % |

| Average Trade Length | 2 h 45 m |

Forward-Test (Live Demo, Jan-Jun 2024)

| Metric | EURUSD + USDJPY |

|---|---|

| Net Profit | +6.8 % |

| Max DD | 3.1 % |

| FTMO Compliance | Pass (Daily + Max Loss) |

The live test under real spread and slippage shows slightly lower profitability versus the back-test, yet still within planned risk.

For transparency, screenshots of the back-test equity curve and the Myfxbook forward-test are shared in this Google Drive link (external).

Comparing IVA FTMO EA With Other Limit-Order Robots

| Feature | IVA FTMO EA | EA #2 (Generic Grid) | EA #3 (Fixed Scalper) |

|---|---|---|---|

| Pending Orders | Yes | No | No |

| Adaptive Channel Exit | Yes | No | Yes |

| News Filter | Yes | No | Yes |

| Martingale Control | Light | Heavy | None |

| FTMO Settings | Built-in | Manual | Manual |

| Multi-Pair 1-Chart | Yes | No | No |

| Max Spread Guard | Yes | Optional | Optional |

| Learning Curve | Low | Medium | Low |

Takeaway: IVA FTMO EA blends controlled martingale with strong filters, making it safer than a wide-grid yet more flexible than a tight scalper.

Common Problems and Simple Fixes

| Problem | Likely Cause | Quick Fix |

|---|---|---|

| No trades after setup | Wrong time window | Check StartHour, server time |

| “News Blocked” message | News events during window | Wait until 30 min post-news |

| Spread too high, EA idle | Broker spread at night | Switch broker or adjust MaxSpread |

| Exceeding FTMO daily loss | Lot size too big | Lower LotsPer1000 |

| EA cannot read news | DLL disabled | Tick Allow DLL imports |

Frequently Asked Questions

Q1: Does IVA FTMO EA need a VPS?A: It is highly recommended. Stable connection avoids missed entries in the five-hour window.

Q2: Can I change the trading window?A: Yes. Adjust StartHour and EndHour, but test performance first.

Q3: How many symbols can I trade at once?A: Up to 10 pairs, but lower lot size accordingly.

Q4: Is the robot fully FTMO compliant out of the box?A: Default limits align with FTMO rules; always double-check.

Q5: Does it work on MetaTrader 5?A: The current build is MT4 only. An MT5 port is on the roadmap.

Final Thoughts

IVA FTMO EA brings a balanced mix of pending limit orders, cost averaging, and a measured martingale step inside a controlled five-hour window. When paired with strict risk caps and a good broker, the robot has demonstrated steady returns and compliance with prop-firm rules.

Always start on demo, keep trade sizes small, and respect the daily loss stop built into the IVA FTMO EA. That way the strategy’s strengths—efficient order placement and adaptive exit logic—can play out without exposing your capital to oversized risk.

Further Reading

- Internal: How to Choose the Best VPS for MT4

- Internal: Understanding Grid vs Martingale in Forex

- External: FTMO Challenge Rules

- External: MetaTrader 4 User Guide (MetaQuotes)

Ready to test IVA FTMO EA on a risk-free demo? Download the setup guide and share your experience in the comments below!

Vendor Site – Private

| Membership | Yearly Membership |

|---|---|

| Additional Services | Unlock & Decompile |

| Recommended Brokers | Exness Broker, FPMarkets |

| Recommended VPS | FXVM (Low Latency) |

| Youtube Channel | ForexForYou |

| Telegram Channel | Onshoppie Forex EA's & Indicators |

| Telegram Support | Onshoppie Support |

| Installation Guides | Onshoppie Forex Guides |

Brand

ea-mt4

Only logged in customers who have purchased this product may leave a review.

Reviews

There are no reviews yet.