Biotech Robot EA MT5 V1.0 + SetFiles For Build 4885+

$9.95

Get exclusive access to Biotech Robot EA that explodes your profits. Advanced automation makes trading easier than ever before. Start now!

Description

Biotech Robot EA: Your Complete Guide to Multi-Asset Trading Automation

Alternative Title: Biotech Robot MT5 – The Advanced Expert Advisor for Forex, Crypto, Gold, and Indices Trading

Table of Contents

- Introduction to Biotech Robot EA

- Understanding Multi-Asset Trading with Expert Advisors

- Key Features of Biotech Robot MT5

- Asset-Specific Trading Capabilities

- Risk Management and Control Systems

- Setup and Configuration Guide

- Performance Optimization Strategies

- Who Should Use Biotech Robot EA

- Comparison with Other Trading Robots

- Frequently Asked Questions

- Conclusion

Introduction to Biotech Robot EA {#introduction}

The world of automated trading has evolved significantly, and the Biotech Robot EA represents the next generation of intelligent trading systems. This sophisticated Expert Advisor brings together advanced algorithmic trading capabilities with the flexibility to handle multiple asset classes seamlessly.

Unlike traditional single-market trading robots, the Biotech Robot MT5 offers adaptive multi-market trading intelligence that can switch between Forex pairs, cryptocurrency markets, precious metals like Gold, and major stock indices. This versatility makes it an ideal choice for traders who want to diversify their automated trading strategies without managing multiple different systems.

Understanding Multi-Asset Trading with Expert Advisors {#understanding}

What Makes Multi-Asset Trading Different

Multi-asset trading involves simultaneously managing positions across different financial markets, each with unique characteristics, volatility patterns, and trading hours. The Biotech Robot EA addresses these complexities by implementing asset-specific trading logic that adapts to each market’s requirements.

Traditional trading approaches often require separate strategies for each asset class. However, modern Expert Advisors like Biotech Robot MT5 use intelligent algorithms that can recognize market conditions and adjust their behavior accordingly. This means the same EA can effectively trade volatile cryptocurrency pairs in the morning and switch to more stable Forex majors in the afternoon.

Benefits of Automated Multi-Asset Trading

Automated trading systems offer several advantages over manual trading:

- Consistent Execution: The EA executes trades based on predefined parameters without emotional interference

- 24/5 Market Coverage: Continuous monitoring of multiple markets during trading hours

- Risk Distribution: Spreading trades across different asset classes reduces overall portfolio risk

- Time Efficiency: Allows traders to focus on strategy development rather than manual execution

Key Features of Biotech Robot MT5 {#features}

Advanced Multi-Asset Support

The Biotech Robot EA stands out with its comprehensive multi-asset trading capabilities. This feature allows traders to:

- Trade Forex Pairs: Major, minor, and exotic currency pairs with optimized spread handling

- Cryptocurrency Markets: Bitcoin, Ethereum, and other digital assets with crypto-specific volatility management

- Precious Metals: Gold (XAU/USD) and Silver trading with metal-specific price action analysis

- Stock Indices: Major indices like NAS100, US30, and others with index-specific trading logic

Each asset class receives tailored treatment through the EA’s intelligent profile-based system, ensuring optimal performance across different market conditions.

Intelligent Risk Management System

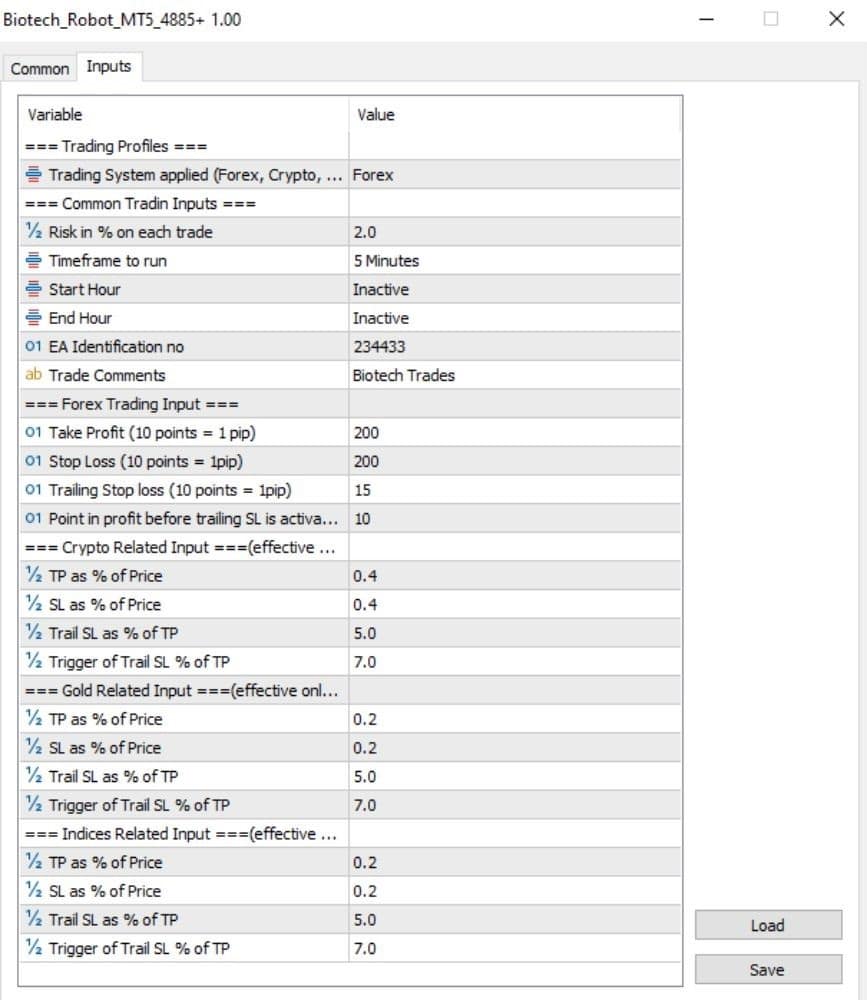

Risk management forms the backbone of the Biotech Robot MT5. The system includes:

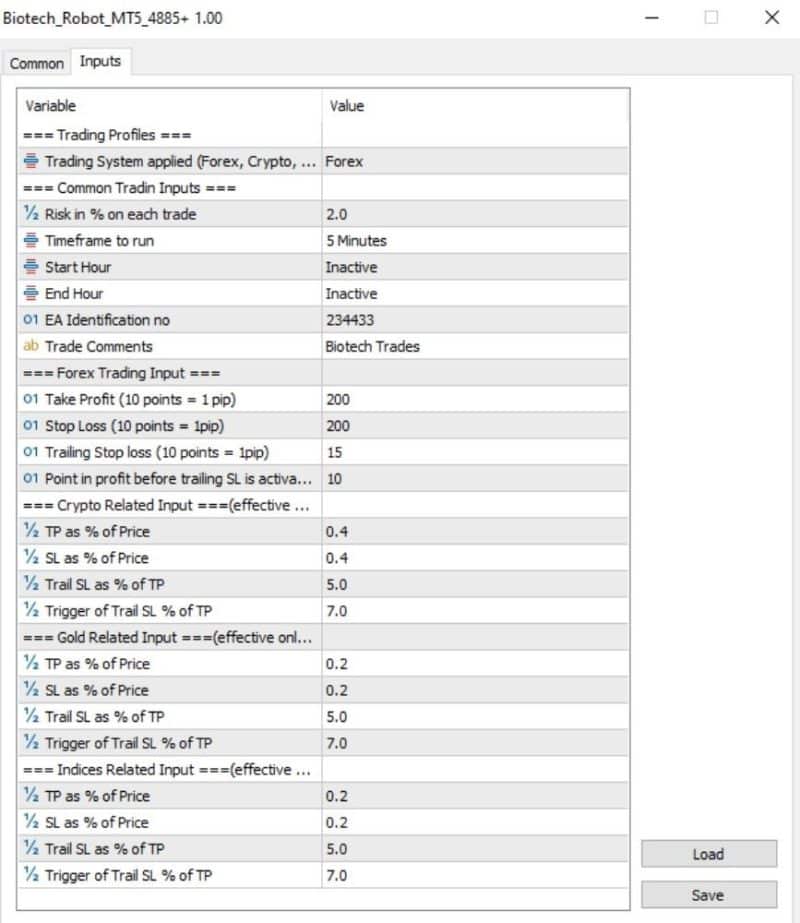

Fixed Percentage Risk Control: Starting from 2% risk per trade, traders can customize their exposure levels based on account size and risk tolerance. This percentage-based approach ensures consistent risk management regardless of account balance fluctuations.

Dynamic Stop Loss and Take Profit: The EA employs different TP/SL strategies for different assets:

- Forex trading uses a balanced 20-pip TP/SL with 1:1 risk-reward ratio

- Crypto, Gold, and Indices use percentage-based TP/SL adapted to each market’s volatility

Trailing Stop Mechanism: The intelligent trailing stop system automatically adjusts stop loss levels as trades move in favor, protecting profits while allowing for continued upside potential.

Optimized Timeframe Performance

The Biotech Robot EA is specifically optimized for M5 (5-minute) timeframe trading, making it ideal for:

- Scalping Strategies: Quick in-and-out trades capturing small price movements

- Intraday Trading: Multiple trades throughout the day across different assets

- High-Frequency Opportunities: Rapid response to market changes and news events

Asset-Specific Trading Capabilities {#assets}

Forex Trading Excellence

In the Forex market, the Biotech Robot MT5 implements sophisticated currency pair analysis. The EA recognizes different types of currency pairs and adjusts its trading parameters accordingly:

Major Pairs: EUR/USD, GBP/USD, USD/JPY receive standard volatility treatment with tight spreads consideration.

Minor Pairs: Cross-currency pairs like EUR/GBP, AUD/CAD get adjusted volatility filters to account for lower liquidity.

Exotic Pairs: Emerging market currencies receive wider stop losses and different position sizing to accommodate higher volatility.

Cryptocurrency Market Adaptation

Cryptocurrency markets present unique challenges due to their 24/7 nature and extreme volatility. The Biotech Robot EA addresses these with:

- Volatility-Adjusted Position Sizing: Automatically reduces position sizes during high volatility periods

- Crypto-Specific Entry Signals: Recognition of crypto market patterns and behaviors

- Weekend Trading: Unlike Forex, crypto markets never close, and the EA can trade continuously

Gold and Precious Metals Trading

Gold trading requires special consideration due to its unique price action characteristics. The Biotech Robot MT5 includes:

- News Event Awareness: Built-in filters for major economic announcements that heavily impact gold prices

- Correlation Analysis: Recognition of gold’s inverse relationship with USD and stocks

- Volatility Clustering: Adaptation to gold’s tendency for volatility to cluster during certain market conditions

Stock Indices Specialization

Stock indices like NAS100 and US30 have their own trading characteristics, and the Biotech Robot EA handles these through:

- Market Hours Optimization: Enhanced performance during regular trading hours with reduced activity during thin markets

- Sector Rotation Awareness: Recognition of sector-specific movements that impact indices

- Economic Data Integration: Automatic adjustment of trading parameters around major economic releases

Risk Management and Control Systems {#risk}

Position Sizing and Capital Protection

The Biotech Robot MT5 employs sophisticated position sizing algorithms that consider:

Account Equity: Position sizes automatically adjust based on current account balance, ensuring consistent risk exposure even as account value fluctuates.

Market Volatility: The EA measures recent volatility for each asset and adjusts position sizes accordingly. High volatility periods receive smaller position sizes to maintain constant risk levels.

Correlation Management: When trading multiple assets simultaneously, the EA considers correlations between different positions to avoid overexposure to similar market movements.

Drawdown Control Mechanisms

Drawdown protection is crucial for long-term trading success. The Biotech Robot EA includes several drawdown control features:

Maximum Daily Loss Limits: Traders can set daily loss limits that pause trading once reached, preventing catastrophic losses during adverse market conditions.

Consecutive Loss Protection: After a series of losing trades, the EA can automatically reduce position sizes or pause trading to prevent emotional revenge trading equivalent behavior.

Equity Curve Monitoring: The system continuously monitors the equity curve and can adjust trading aggressiveness based on recent performance.

Setup and Configuration Guide {#setup}

Initial Installation Process

Setting up the Biotech Robot MT5 requires careful attention to configuration details:

Platform Requirements: Ensure you have MetaTrader 5 platform installed with the latest updates. The EA is specifically designed for MT5 and takes advantage of its enhanced features.

Broker Compatibility: Verify that your broker supports Expert Advisor trading and has reasonable spreads for the assets you plan to trade.

VPS Considerations: For optimal performance, especially with scalping strategies, consider using a Virtual Private Server (VPS) to ensure consistent connection and minimize latency.

Parameter Configuration

The Biotech Robot EA offers extensive customization options:

Risk Parameters: Set your preferred risk percentage per trade, starting from the recommended 2%. Conservative traders might prefer 1%, while more aggressive traders might use 3-5%.

Asset Selection: Choose which asset classes to trade based on your broker’s offerings and your trading preferences. You can enable or disable specific asset types.

Time Filters: While the EA defaults to 24/5 trading, you can set specific trading hours for each asset class to align with your strategy.

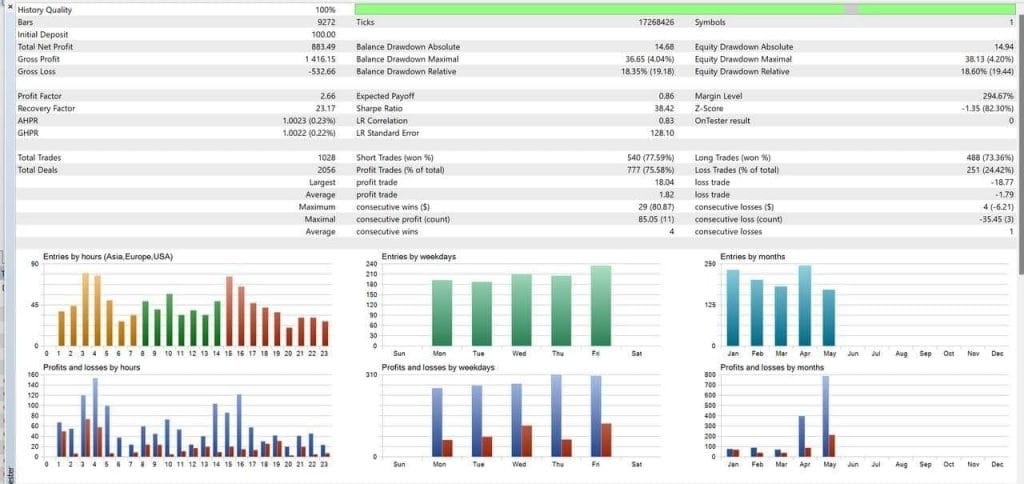

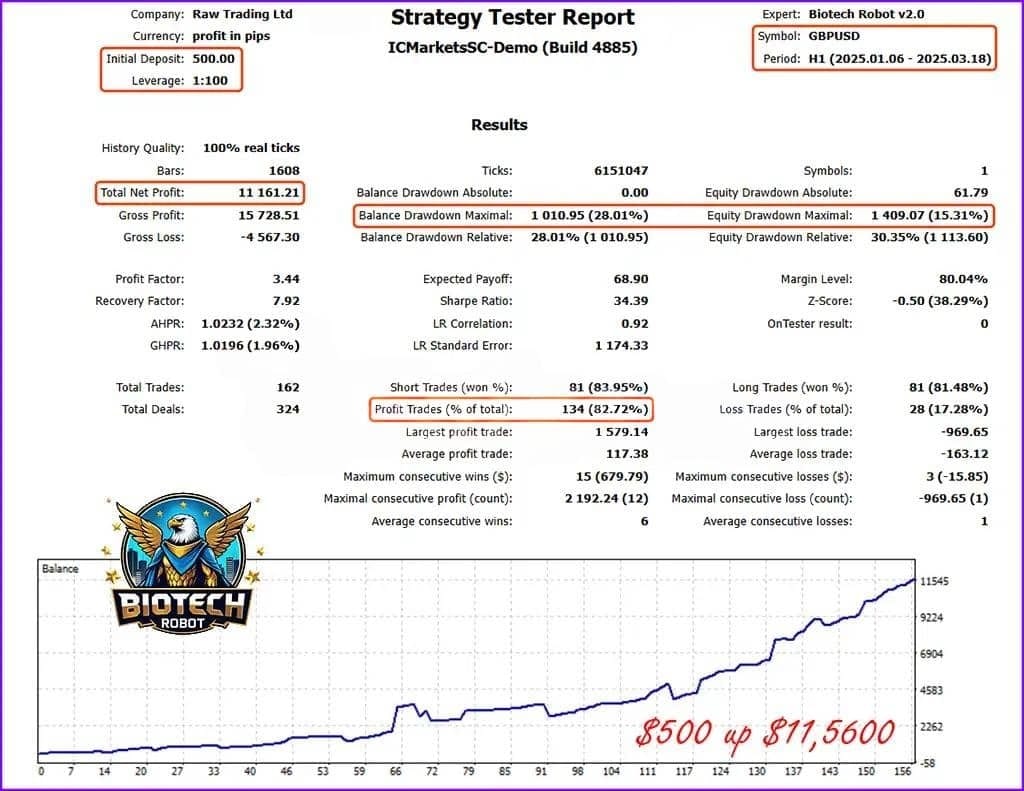

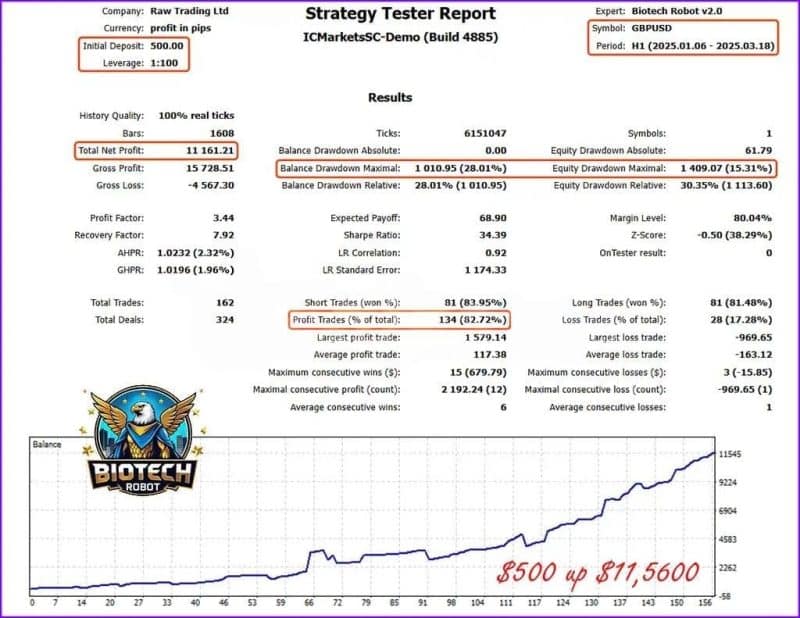

Backtesting and Optimization

Before live trading, thorough backtesting is essential:

Historical Data Quality: Ensure you have high-quality historical data for all assets you plan to trade. Poor data quality can lead to misleading backtest results.

Multiple Timeframes: While optimized for M5, test the EA’s performance on different timeframes to understand its behavior fully.

Different Market Conditions: Test the EA across various market conditions including trending, ranging, and high volatility periods.

Performance Optimization Strategies {#performance}

Market Condition Adaptation

The Biotech Robot MT5 includes several features for adapting to different market conditions:

Volatility Filters: The EA can automatically adjust its trading frequency based on current market volatility. During low volatility periods, it may reduce trading activity to avoid false signals.

Trend Recognition: Built-in trend detection algorithms help the EA align its trading direction with prevailing market trends, improving win rates.

Range-Bound Market Handling: Special logic for sideways markets helps prevent the EA from getting caught in false breakouts.

Performance Monitoring

Regular monitoring of the Biotech Robot EA performance includes:

Trade Analysis: Each trade is labeled with “Biotech Trades” for easy identification and analysis on platforms like Myfxbook or in account statements.

Statistical Tracking: Monitor key metrics including win rate, average winner/loser ratio, maximum drawdown, and profit factor.

Asset Performance Comparison: Compare performance across different asset classes to identify which markets are most profitable for your specific setup.

Continuous Improvement

Successful EA trading requires ongoing optimization:

Regular Parameter Updates: Market conditions change over time, and parameter adjustments may be necessary to maintain optimal performance.

New Asset Integration: As new trading instruments become available, the EA can be configured to include them in the trading portfolio.

Strategy Refinement: Based on performance data, refine the trading strategy to improve results and reduce drawdowns.

Who Should Use Biotech Robot EA {#audience}

Beginner Traders

The Biotech Robot MT5 offers several advantages for newcomers to automated trading:

Educational Value: Watching the EA trade provides valuable insights into market behavior and trading strategies across different asset classes.

Risk Management Learning: The built-in risk management features help beginners understand proper position sizing and risk control.

Diversification Benefits: Instead of focusing on a single market, beginners can gain exposure to multiple asset classes simultaneously.

Experienced Traders

Professional traders can benefit from the Biotech Robot EA in several ways:

Strategy Complement: Use the EA alongside manual trading strategies to capture opportunities across multiple markets simultaneously.

Portfolio Diversification: Add automated trading to existing investment portfolios for additional diversification and return potential.

Time Efficiency: Allow the EA to handle routine trading tasks while focusing on higher-level strategy development and market analysis.

Institutional Applications

The Biotech Robot MT5 can also serve institutional needs:

Fund Management: Hedge funds and asset managers can use the EA as part of their systematic trading strategies.

Risk Distribution: Institutions can deploy the EA across multiple accounts and asset classes to spread risk and capture diverse market opportunities.

Compliance Integration: The EA’s detailed logging and trade labeling features support compliance and reporting requirements.

Comparison with Other Trading Robots {#comparison}

Single-Asset vs Multi-Asset EAs

Traditional single-asset Expert Advisors focus on one market, such as Forex-only or crypto-only trading robots. The Biotech Robot EA offers several advantages:

Operational Efficiency: Managing one EA instead of multiple specialized robots reduces complexity and monitoring requirements.

Consistent Risk Management: Unified risk management across all assets ensures coherent portfolio-level risk control.

Correlation Benefits: The EA can consider correlations between different assets when making trading decisions, something impossible with separate systems.

Scalping vs Swing Trading EAs

Many EAs focus either on scalping (very short-term) or swing trading (longer-term positions). The Biotech Robot MT5 bridges this gap:

Adaptive Holding Periods: The EA can hold positions for different lengths depending on market conditions and asset behavior.

Timeframe Flexibility: While optimized for M5, the EA’s logic can work across different timeframes as market conditions dictate.

Market-Specific Approaches: Different assets receive different treatment, with some traded more frequently than others based on their characteristics.

Frequently Asked Questions {#faq}

Technical Requirements

Q: What are the minimum system requirements for running Biotech Robot EA?

A: The EA requires MetaTrader 5 platform, at least 4GB RAM, and a stable internet connection. For optimal performance, especially with multiple assets, 8GB RAM and a VPS are recommended.

Q: Can I run multiple instances of Biotech Robot MT5 simultaneously?

A: Yes, you can run multiple instances on different accounts or with different parameter sets. However, ensure your system resources can handle the additional load.

Trading Performance

Q: What is the typical win rate for Biotech Robot EA?

A: Win rates vary by market conditions and parameters, but the EA typically maintains a balanced risk-reward approach rather than focusing solely on high win rates.

Q: How does the EA perform during major news events?

A: The EA includes built-in volatility filters and can reduce trading activity during high-impact news events to protect capital.

Configuration and Setup

Q: Can I customize the assets that Biotech Robot MT5 trades?

A: Yes, the EA allows you to enable or disable specific asset classes and individual instruments based on your preferences and broker offerings.

Q: Is backtesting required before live trading?

A: While not mandatory, backtesting is highly recommended to understand the EA’s behavior and optimize parameters for your specific trading conditions.

Risk Management

Q: What happens if I reach my daily loss limit?

A: The EA will pause trading for the remainder of the day to prevent further losses. Trading resumes the next trading day with fresh risk parameters.

Q: Can I override the EA’s risk management settings?

A: While possible, it’s not recommended. The risk management system is designed to protect your capital and ensure long-term trading viability.

Conclusion {#conclusion}

The Biotech Robot EA represents a significant advancement in automated trading technology, offering traders a comprehensive solution for multi-asset trading automation. Its intelligent design addresses the unique challenges of trading across Forex, cryptocurrency, precious metals, and stock indices markets within a single, cohesive system.

The EA’s strength lies in its adaptive approach to different market conditions and asset classes. Rather than applying a one-size-fits-all strategy, the Biotech Robot MT5 recognizes that each market has unique characteristics and adjusts its behavior accordingly. This flexibility, combined with robust risk management features, makes it suitable for both novice traders looking to automate their trading and experienced professionals seeking to diversify their systematic trading strategies.

Key advantages include the comprehensive multi-asset support, intelligent risk management system, and optimization for high-frequency trading on the M5 timeframe. The trailing stop mechanism and percentage-based risk control ensure that traders can protect their capital while maximizing profit potential across different market conditions.

For traders considering automated trading solutions, the Biotech Robot EA offers a balanced approach that combines sophistication with usability. Its detailed trade labeling, flexible parameter settings, and continuous market adaptation make it a valuable tool for anyone serious about algorithmic trading across multiple asset classes.

Ready to start your automated trading journey? Consider exploring the Biotech Robot MT5 and discover how multi-asset trading intelligence can enhance your trading portfolio. Remember to start with proper backtesting and conservative risk settings as you become familiar with the EA’s behavior across different market conditions.

Vendor Site – Private

| Membership | Yearly Membership |

|---|---|

| Additional Services | Unlock & Decompile |

| Recommended Brokers | Exness Broker, FPMarkets |

| Recommended VPS | FXVM (Low Latency) |

| Youtube Channel | ForexForYou |

| Telegram Channel | Onshoppie Forex EA's & Indicators |

| Telegram Support | Onshoppie Support |

| Installation Guides | Onshoppie Forex Guides |

Brand

ea-mt4

Only logged in customers who have purchased this product may leave a review.

Reviews

There are no reviews yet.