Us30 EA and Xauusd Hedging Scalper EA MT4 v1.0 + SetFiles

Original price was: $1,499.00.$9.95Current price is: $9.95.

Discover the power of Us30 EA & Xauusd hedging with our revolutionary Scalper EA. Maximize profits, minimize risks, and trade with confidence.

Description

Mastering Forex Trading with Us30 EA and Xauusd Hedging Scalper

Us30 EA and Xauusd Hedging Scalper: The Ultimate Forex Trading Combination

Table of Contents

- Introduction

- Understanding Us30 EA

- Exploring Xauusd Hedging Scalper

- Combining Us30 EA and Xauusd Hedging Scalper

- Benefits of Using These Tools

- Setting Up Your Trading Strategy

- Risk Management Techniques

- Tips for Successful Implementation

- Conclusion

Introduction to Us30 EA and Xauusd Hedging Scalper

In the world of forex trading, staying ahead of the curve is crucial for success. Two powerful tools that have gained significant attention among traders are the Us30 EA and Xauusd Hedging Scalper. These advanced trading instruments offer unique advantages and, when used together, can potentially enhance your trading strategy and improve your overall performance in the forex market.

Understanding Us30 EA and Xauusd Hedging Scalper

The Us30 EA, also known as the Dow Jones Industrial Average Expert Advisor, is an automated trading system designed to trade the US30 index. This powerful tool analyzes market trends, price movements, and various technical indicators to make informed trading decisions.

Key features of Us30 EA include:

- Real-time market analysis

- Customizable trading parameters

- Risk management algorithms

- Automated trade execution

The Us30 EA is particularly useful for traders who want to capitalize on the movements of the US stock market without having to monitor it constantly. By leveraging advanced algorithms, this EA can identify potential trading opportunities and execute trades with precision and speed.

Exploring Us30 EA and Xauusd Hedging Scalper

The Xauusd Hedging Scalper is a specialized forex trading tool focused on gold (XAU) and US dollar (USD) currency pairs. This scalping strategy aims to profit from small price movements in the gold market while minimizing risk through hedging techniques.

Key aspects of Xauusd Hedging Scalper include:

- Quick entry and exit strategies

- Hedging to minimize potential losses

- Focus on short-term price fluctuations

- Utilization of tight stop-loss and take-profit levels

Traders who prefer short-term trading strategies and want to take advantage of gold price volatility often find the Xauusd Hedging Scalper to be a valuable addition to their trading arsenal.

Combining Us30 EA and Xauusd Hedging Scalper

When used together, the Us30 EA and Xauusd Hedging Scalper can create a powerful and diversified trading approach. This combination allows traders to:

- Diversify their portfolio across different markets (stock index and precious metals)

- Implement multiple trading strategies simultaneously

- Balance risk and potential rewards more effectively

- Capitalize on various market conditions and trends

By integrating these two tools, traders can potentially enhance their overall trading performance and reduce their exposure to market-specific risks.

Benefits of Using These Tools

Implementing the Us30 EA and Xauusd Hedging Scalper in your trading strategy can offer several advantages:

- Automated trading: Both tools can execute trades automatically, saving time and reducing emotional decision-making.

- Diversification: Trading across different markets helps spread risk and potentially increase opportunities for profit.

- ** 24/5 market coverage**: These tools can monitor and trade markets around the clock, capturing opportunities even when you’re not actively trading.

- Improved risk management: Advanced algorithms and hedging techniques help minimize potential losses.

- Consistency: Automated systems follow predefined rules, ensuring consistent execution of your trading strategy.

- Scalability: These tools can handle multiple trades simultaneously, allowing you to scale your trading operations efficiently.

Setting Up Your Trading Strategy

To effectively use the Us30 EA and Xauusd Hedging Scalper, consider the following steps:

- Education: Thoroughly understand how each tool works and its specific features.

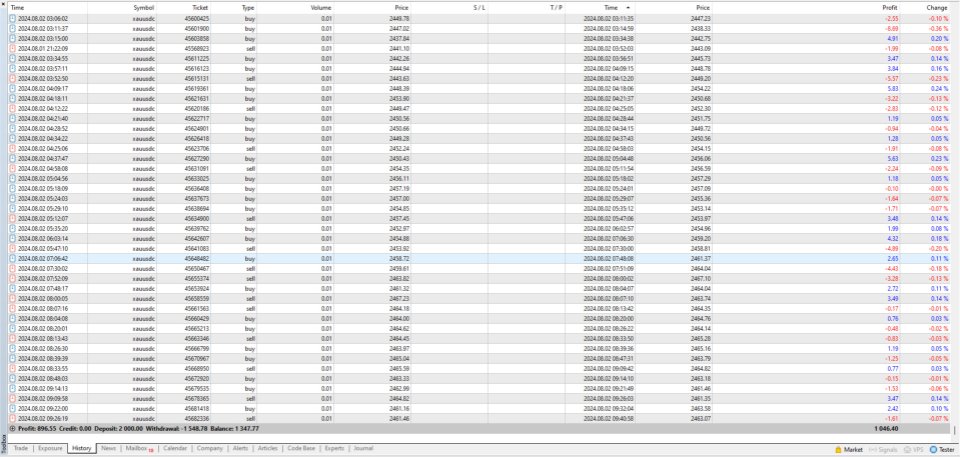

- Backtesting: Use historical data to test the performance of both tools individually and in combination.

- Parameter optimization: Adjust the settings of each tool to align with your risk tolerance and trading goals.

- Demo trading: Practice using the tools in a demo account to familiarize yourself with their operation without risking real capital.

- Gradual implementation: When transitioning to live trading, start with small position sizes and gradually increase as you gain confidence.

- Regular monitoring: Continuously evaluate the performance of your combined strategy and make adjustments as needed.

Risk Management Techniques

While the Us30 EA and Xauusd Hedging Scalper offer built-in risk management features, it’s essential to implement additional risk control measures:

- Set appropriate position sizes: Determine the maximum amount you’re willing to risk per trade and adjust your position sizes accordingly.

- Use stop-loss orders: Always set stop-loss orders to limit potential losses on each trade.

- Implement take-profit levels: Define clear profit targets to ensure you lock in gains when they occur.

- Monitor correlation: Be aware of the correlation between the US30 index and gold prices to avoid overexposure to related market movements.

- Diversify trading pairs: Consider adding other currency pairs or assets to further diversify your trading portfolio.

- Regular performance review: Analyze your trading results regularly to identify areas for improvement and adjust your strategy as needed.

Tips for Successful Implementation

To maximize the potential of the Us30 EA and Xauusd Hedging Scalper combination, consider these tips:

- Stay informed: Keep up-to-date with economic news and events that may impact the US stock market and gold prices.

- Maintain a trading journal: Record your trades, including reasons for entry and exit, to help refine your strategy over time.

- Continuously educate yourself: Attend webinars, read trading books, and participate in forex communities to enhance your knowledge and skills.

- Be patient: Allow time for your combined strategy to prove its effectiveness before making significant changes.

- Use quality data feeds: Ensure you have reliable and low-latency data feeds to support accurate decision-making by your automated tools.

- Regularly update your tools: Keep your Us30 EA and Xauusd Hedging Scalper software up-to-date to benefit from the latest improvements and features.

- Monitor system performance: Regularly check that your trading computer and internet connection can handle the demands of running both tools simultaneously.

Conclusion

The combination of Us30 EA and Xauusd Hedging Scalper offers forex traders a powerful approach to navigate the complexities of the financial markets. By leveraging the strengths of both tools, traders can potentially enhance their trading performance, manage risks more effectively, and capitalize on diverse market opportunities.

Remember that successful trading requires ongoing education, practice, and adaptation. While these tools can significantly aid your trading efforts, they should be part of a comprehensive trading plan that aligns with your personal goals and risk tolerance.

Are you ready to take your forex trading to the next level with Us30 EA and Xauusd Hedging Scalper? Start by thoroughly researching these tools, testing them in a demo environment, and gradually incorporating them into your live trading strategy. With patience, discipline, and continuous learning, you can harness the power of these advanced trading instruments to potentially improve your forex trading results.

Vendor Site – Click Here

| Membership | Yearly Membership |

|---|---|

| Additional Services | Unlock & Decompile |

| Recommended Brokers | Exness Broker, FPMarkets |

| Recommended VPS | FXVM (Low Latency) |

| Youtube Channel | ForexForYou |

| Telegram Channel | Onshoppie Forex EA's & Indicators |

| Telegram Support | Onshoppie Support |

| Installation Guides | Onshoppie Forex Guides |

Brand

ea-mt4

Only logged in customers who have purchased this product may leave a review.

Reviews

There are no reviews yet.