OHLC EA MT4 V3 For Build 1441+

$9.95

Unlock proven OHLC EA Forex secrets that can explode your trading profits. Get exclusive strategies and tips from professional traders today.

Description

OHLC EA: The Advanced Expert Advisor for XAUUSD Trading Success

Alternative Title: OHLC EA – Transform Your MetaTrader 4 Gold Trading with Professional Automation

Table of Contents

- What is OHLC EA?

- Key Features and Specifications

- Trading Strategies Used by OHLC EA

- Why XAUUSD is Perfect for OHLC EA

- Optimal Timeframes: M1 and M5 Explained

- How OHLC EA Analyzes Market Data

- Risk Management and Position Sizing

- Setting Up OHLC EA on MetaTrader 4

- Backtesting and Performance Optimization

- Common Mistakes to Avoid

- Frequently Asked Questions

What is OHLC EA?

The OHLC EA represents a significant advancement in automated forex trading technology. This expert advisor is specifically designed for traders who want to automate their XAUUSD trading activities while maintaining professional-grade performance standards.

OHLC EA stands out from other trading robots because it focuses exclusively on the gold market (XAUUSD), allowing for specialized optimization and enhanced performance. The EA combines multiple trading strategies to create a comprehensive approach that can adapt to various market conditions.

Unlike generic expert advisors that try to work across multiple currency pairs, the OHLC EA dedicates all its resources to understanding and trading gold effectively. This specialization allows it to process OHLC data more efficiently and make better trading decisions based on gold’s unique price behavior patterns.

The system operates on MetaTrader 4, making it accessible to traders worldwide regardless of their chosen brokerage. This universal compatibility ensures that you can use the OHLC EA with your preferred broker without technical limitations.

Key Features and Specifications of OHLC EA

Trading Platform Integration

The OHLC EA is built specifically for MetaTrader 4, the world’s most popular trading platform. This integration ensures smooth operation and access to all necessary market data feeds required for optimal performance.

Timeframe Optimization

The EA operates most effectively on M1 and M5 timeframes, which are ideal for capturing short-term price movements in the gold market. These timeframes provide enough data points for accurate analysis while maintaining the speed necessary for timely trade execution.

Universal Broker Compatibility

One of the strongest advantages of the OHLC EA is its ability to work with any brokerage that supports MetaTrader 4. This flexibility means you don’t need to change brokers to use this expert advisor, saving you time and potential transfer costs.

Advanced Algorithm Design

The EA employs sophisticated algorithms that analyze OHLC data in real-time, identifying patterns and opportunities that human traders might miss. These algorithms are continuously refined based on historical performance data.

Trading Strategies Used by OHLC EA

Trend Following Strategy

The OHLC EA excels at identifying and following strong market trends in the XAUUSD pair. When gold enters a trending phase, the EA positions itself to capture maximum profit from the momentum. This strategy works particularly well during news events or economic announcements that create sustained directional movement.

The trend-following component analyzes multiple indicators simultaneously, including moving averages, momentum oscillators, and volume data. By combining these signals, the EA can distinguish between genuine trends and false breakouts, reducing the likelihood of entering trades during market noise.

Mean Reversion Approach

Mean reversion is another core strategy employed by the OHLC EA. This approach capitalizes on gold’s tendency to return to average price levels after extreme movements. The EA identifies when XAUUSD has moved too far from its statistical mean and positions for a potential reversal.

This strategy is particularly effective during range-bound market conditions when gold oscillates between support and resistance levels. The EA can capture profits from these predictable price swings while managing risk through careful position sizing.

Breakout Trading Methodology

The OHLC EA includes sophisticated breakout detection algorithms that identify when gold is about to break through key support or resistance levels. These breakouts often lead to significant price movements, providing excellent profit opportunities.

The EA monitors multiple timeframes simultaneously to confirm breakout signals, ensuring higher probability trades. It also incorporates volume analysis to distinguish between genuine breakouts and false signals.

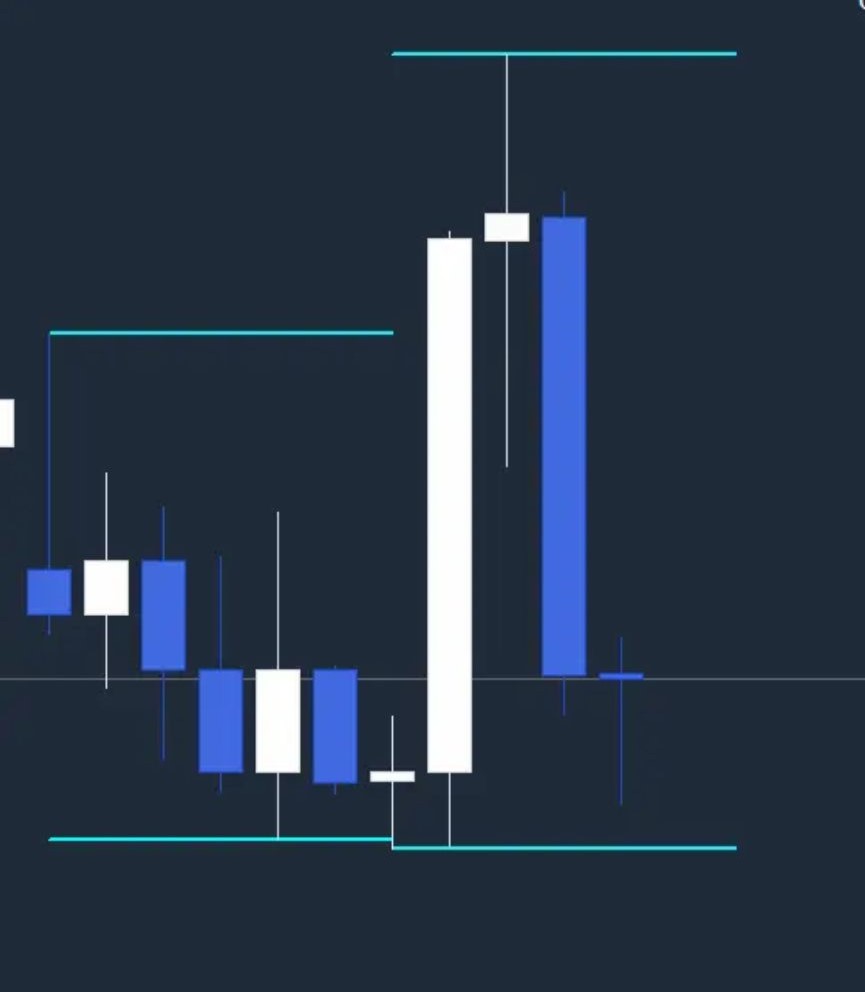

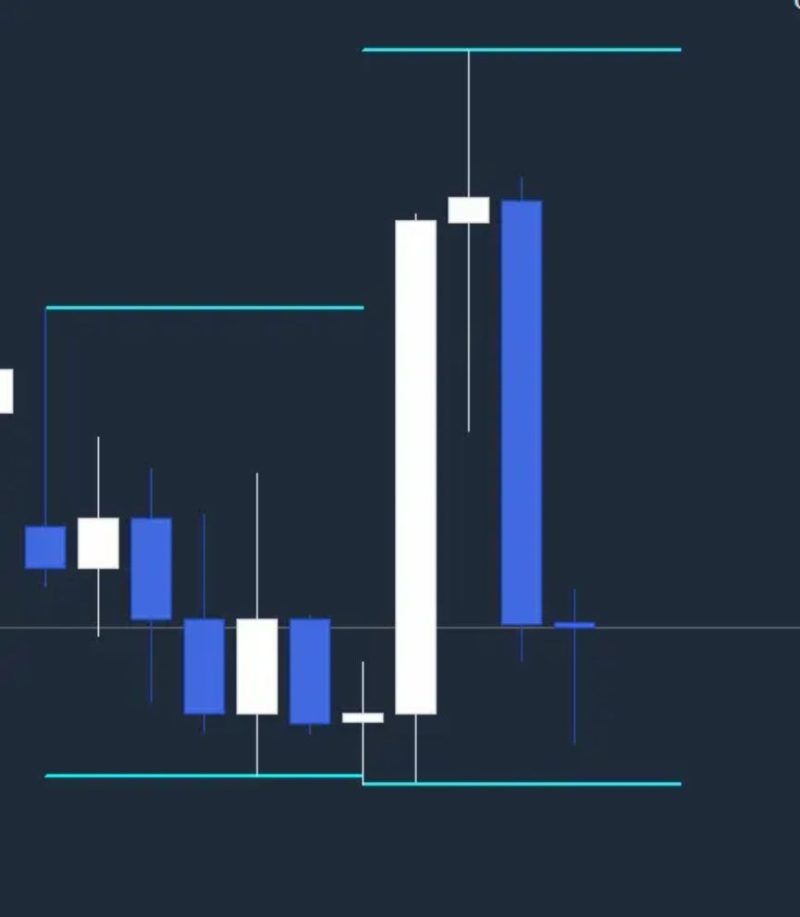

OHLC-Specific Pattern Recognition

The EA’s specialized focus on OHLC data allows it to recognize complex candlestick patterns that are particularly relevant to gold trading. These patterns include doji formations, hammer patterns, and engulfing candles that often signal important market turning points.

By analyzing Open, High, Low, and Close data across multiple timeframes, the OHLC EA can identify confluence areas where multiple signals align, increasing the probability of successful trades.

Why XAUUSD is Perfect for OHLC EA

Market Volatility Advantages

Gold (XAUUSD) offers excellent volatility characteristics that make it ideal for automated trading. The precious metal experiences regular price swings that create numerous trading opportunities throughout each trading session.

The OHLC EA is specifically calibrated to take advantage of gold’s volatility patterns. It can quickly identify when volatility is increasing or decreasing and adjust its trading approach accordingly.

Liquidity and Execution Speed

The XAUUSD market provides exceptional liquidity, ensuring that the OHLC EA can execute trades quickly and at favorable prices. This liquidity is crucial for an automated system that needs to enter and exit positions rapidly.

High liquidity also means tighter spreads, which directly improves the EA’s profitability by reducing trading costs. The OHLC EA is optimized to work with various spread conditions, maintaining performance across different market environments.

Predictable Price Behavior

Gold exhibits certain predictable behaviors that the OHLC EA can exploit. These include reactions to economic news, seasonal patterns, and technical level respect. The EA’s algorithms are trained to recognize these patterns and position accordingly.

Optimal Timeframes: M1 and M5 Explained for OHLC EA

M1 Timeframe Benefits

The 1-minute timeframe provides the OHLC EA with maximum granularity in price data. This detailed view allows the EA to identify micro-trends and execute precise entries and exits. The M1 timeframe is particularly useful for scalping strategies and quick profit-taking.

Working on M1 also allows the EA to respond quickly to market changes, potentially capturing more trading opportunities throughout the day. However, this timeframe requires robust risk management to handle the increased frequency of signals.

M5 Timeframe Advantages

The 5-minute timeframe offers a balanced approach between speed and stability. The OHLC EA uses M5 data to filter out some of the noise present in M1 while still maintaining responsiveness to market changes.

M5 timeframe trading typically results in slightly larger average profits per trade compared to M1, as positions are held longer and can capture more significant price movements. This timeframe is ideal for traders who prefer a more conservative approach to automated trading.

Combining Both Timeframes

The OHLC EA often uses both M1 and M5 timeframes simultaneously, creating a multi-timeframe analysis approach. This combination allows the EA to confirm signals across different time horizons, improving trade quality and reducing false signals.

How OHLC EA Analyzes Market Data

Real-Time Data Processing

The OHLC EA continuously processes incoming market data, analyzing each new price tick for potential trading opportunities. This real-time analysis ensures that the EA can respond quickly to changing market conditions.

The system maintains a rolling database of recent price action, allowing it to compare current market behavior with historical patterns. This comparison helps identify when current conditions match previously profitable trading scenarios.

Pattern Recognition Algorithms

Advanced pattern recognition is a core component of the OHLC EA‘s analytical capabilities. The EA can identify complex chart patterns that human traders might miss, including head and shoulders formations, triangles, and flag patterns.

These algorithms are continuously updated based on the EA’s trading performance, ensuring that pattern recognition improves over time. The system learns from both successful and unsuccessful trades to refine its pattern identification skills.

Statistical Analysis Methods

The OHLC EA employs various statistical methods to analyze market data, including standard deviation calculations, correlation analysis, and regression modeling. These statistical tools help the EA understand market behavior on a deeper level.

Statistical analysis also helps the EA identify when market conditions are changing, allowing it to adjust its trading approach accordingly. This adaptability is crucial for maintaining performance across different market cycles.

Risk Management and Position Sizing for OHLC EA

Dynamic Position Sizing

The OHLC EA includes sophisticated position sizing algorithms that adjust trade sizes based on current market conditions and account balance. This dynamic approach helps maximize profits during favorable conditions while protecting capital during difficult periods.

Position sizing calculations consider factors such as recent volatility, account equity, and current drawdown levels. This comprehensive approach ensures that no single trade can cause significant damage to the trading account.

Stop Loss Implementation

Every trade executed by the OHLC EA includes appropriate stop loss levels to limit potential losses. These stop losses are calculated based on technical analysis and volatility measurements, ensuring they provide adequate protection without being too tight.

The EA can also implement trailing stops that move in favor of profitable trades, allowing winners to run while still protecting against reversals. This feature helps maximize profits from successful trades.

Risk-Reward Optimization

The OHLC EA carefully calculates risk-reward ratios for each potential trade, ensuring that expected profits justify the risks taken. This analysis helps improve the overall profitability of the trading strategy.

The EA maintains detailed statistics on historical risk-reward performance, using this data to refine future trade selection. This continuous improvement process helps the EA evolve and adapt to changing market conditions.

Setting Up OHLC EA on MetaTrader 4

Installation Process

Installing the OHLC EA on MetaTrader 4 is straightforward. After downloading the EA file, you need to place it in the correct folder within your MT4 installation directory. The EA will then appear in your Navigator window under Expert Advisors.

Before activating the EA, ensure that automated trading is enabled in your MT4 settings. You’ll also need to add the EA to your XAUUSD chart and configure the input parameters according to your trading preferences.

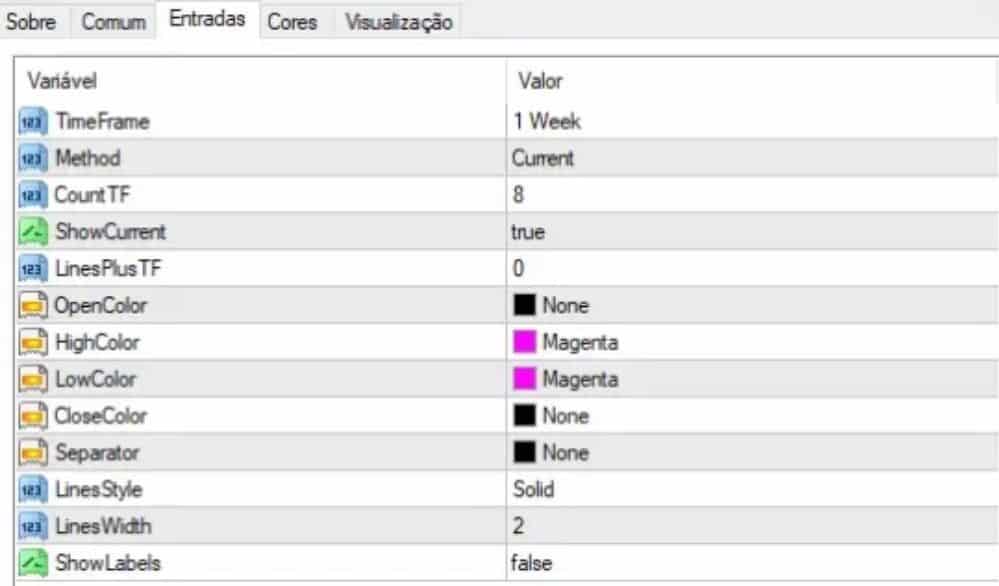

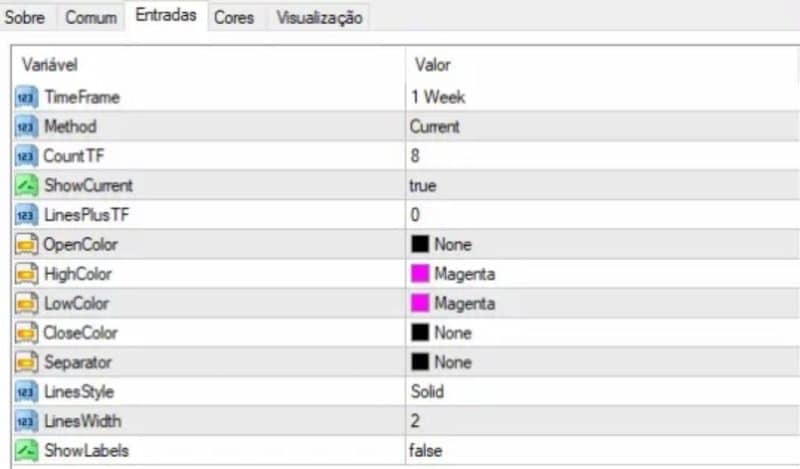

Parameter Configuration

The OHLC EA includes numerous configurable parameters that allow you to customize its behavior. These parameters include lot sizes, risk levels, and strategy preferences. Take time to understand each parameter before making changes.

Many traders find success using the default parameters initially, then gradually adjusting settings based on their risk tolerance and performance preferences. The EA includes detailed documentation explaining each parameter’s function.

Testing and Validation

Before using the OHLC EA with real money, conduct thorough testing using MT4’s Strategy Tester. This testing will help you understand how the EA performs under different market conditions and verify that it operates as expected.

Start with demo trading to observe the EA’s behavior in real-time without risking capital. This approach allows you to gain confidence in the system before committing real funds.

Backtesting and Performance Optimization of OHLC EA

Historical Data Analysis

The OHLC EA includes comprehensive backtesting capabilities that analyze historical market data to evaluate strategy performance. This analysis helps identify optimal parameter settings and provides insights into expected performance characteristics.

Backtesting results should be analyzed carefully, paying attention to metrics such as profit factor, maximum drawdown, and win rate. These statistics provide valuable insights into the EA’s risk-return profile.

Parameter Optimization Techniques

The EA supports various optimization techniques that can help improve performance. These include genetic algorithms, grid search methods, and walk-forward analysis. Each technique has its advantages and can be used depending on your optimization goals.

Remember that over-optimization can lead to curve-fitting, where the EA performs well on historical data but fails in live trading. Strike a balance between optimization and robustness to ensure consistent performance.

Performance Monitoring

Continuous performance monitoring is essential when using the OHLC EA. Track key metrics such as monthly returns, drawdown levels, and trade frequency to ensure the EA continues performing as expected.

Regular performance reviews help identify when market conditions may have changed enough to warrant parameter adjustments or strategy modifications. This proactive approach helps maintain consistent profitability.

Common Mistakes to Avoid with OHLC EA

Over-Optimization Pitfalls

One of the most common mistakes when using the OHLC EA is excessive parameter optimization. While it’s tempting to fine-tune every setting for maximum historical performance, over-optimization often leads to poor live trading results.

Focus on robust parameter settings that perform well across different market conditions rather than seeking perfect historical results. This approach increases the likelihood of consistent future performance.

Insufficient Testing

Another frequent mistake is inadequate testing before live deployment. Always conduct thorough backtesting and demo trading before using the OHLC EA with real money. This testing phase is crucial for understanding the EA’s behavior and risk characteristics.

Include stress testing during volatile market periods to ensure the EA can handle challenging conditions. This comprehensive testing approach helps prevent unpleasant surprises during live trading.

Ignoring Market Conditions

The OHLC EA performs differently under various market conditions. Ignoring these differences and expecting consistent performance regardless of market environment is unrealistic and potentially costly.

Learn to recognize different market phases and understand how the EA typically performs in each. This knowledge helps set appropriate expectations and guides decision-making about when to use the EA.

Frequently Asked Questions For OHLC EA

Is OHLC EA suitable for beginners?

The OHLC EA can be used by beginners, but it’s important to understand basic trading concepts and risk management principles. New traders should start with demo accounts and gradually transition to live trading as they gain experience.

What is the minimum account balance required?

While there’s no strict minimum, the OHLC EA typically works best with accounts of at least $1,000. This balance provides sufficient margin for proper position sizing and risk management.

Can I use OHLC EA with other currency pairs?

The OHLC EA is specifically optimized for XAUUSD trading. While it might work with other pairs, performance is not guaranteed, and you would need to conduct extensive testing and optimization.

How often should I update the EA parameters?

Parameter updates should be based on performance analysis rather than arbitrary schedules. Monitor the EA’s performance monthly and consider adjustments if you notice consistent changes in market behavior or declining performance.

The OHLC EA represents a sophisticated solution for automated XAUUSD trading, combining multiple strategies and advanced risk management to deliver consistent results. Success with this expert advisor depends on proper setup, thorough testing, and ongoing performance monitoring. By following the guidelines outlined in this comprehensive guide, you can maximize your chances of achieving profitable automated trading results with the OHLC EA.

Ready to take your gold trading to the next level? Download the OHLC EA today and experience the power of professional automated trading on your MetaTrader 4 platform.

| Membership | Yearly Membership |

|---|---|

| Additional Services | Unlock & Decompile |

| Recommended Brokers | Exness Broker, FPMarkets |

| Recommended VPS | FXVM (Low Latency) |

| Youtube Channel | ForexForYou |

| Telegram Channel | Onshoppie Forex EA's & Indicators |

| Telegram Support | Onshoppie Support |

| Installation Guides | Onshoppie Forex Guides |

Brand

ea-mt4

Only logged in customers who have purchased this product may leave a review.

Reviews

There are no reviews yet.