LITTLECRAZY EA MT4 FOR BUILD 1420+

Original price was: $387.00.$9.95Current price is: $9.95.

Explore LITTLECRAZY EA ’s powerful features. Get jubilant results and unique trading strategies. Start your journey to better profits today!

Description

LITTLECRAZY EA: A Practical Guide to an Aggressive Forex Robot

LITTLECRAZY EA: Why This High-Risk Expert Advisor Draws Attention From Small-Account Traders

Table of Contents

- What Is LITTLECRAZY EA?

- How the Algorithm Works

- Key Features at a Glance

- Mean-Reversion and Correlated Pairs Explained

- Account Size, Leverage, and Broker Choice

- Installation and Set-Up Walk-Through

- Risk Management: What You Need to Know

- Back-Test and Forward-Test Results

- Pros, Cons, and Ideal Users

- Frequently Asked Questions

- Final Thoughts

What Is LITTLECRAZY EA?

LITTLECRAZY EA is a fully automated trading system built for the forex market. Once attached to a chart in MetaTrader 4, this Expert Advisor (EA) can place, edit, and close trades on your behalf without any manual input. The robot follows a high-risk, high-return style, focusing on three highly correlated pairs:

- AUDCAD

- AUDNZD

- NZDCAD

Because it is mean-reversion-based and employs an aggressive money-management approach, the EA is suitable mainly for traders who are comfortable with deep drawdowns in exchange for the chance of large gains.

Quick fact: The developer designed LITTLECRAZY EA to work with deposits as low as $200, making it attractive for small accounts.

How the Algorithm Works

Below is a simplified look at the decision process the robot follows each trading day.

| Step | Process | Details |

|---|---|---|

| 1 | Market Scan | The EA checks tick data for the three pairs, reading price deviation from the short-term average. |

| 2 | Overstretch Detection | If price drifts a set distance from the mean (customizable), the algorithm flags a potential entry. |

| 3 | Trade Placement | The EA opens a position in the opposite direction of the move, anticipating a pullback. |

| 4 | Position Scaling | If price keeps drifting, the robot may add one or more positions (a grid) at predefined intervals. |

| 5 | Exit Logic | Once price snaps back toward the mean, the EA closes all open trades, aiming for a net profit. |

| 6 | Parameter Update | The algorithm re-evaluates spread, slippage, and volatility before restarting the loop. |

Thanks to this rule-based method, LITTLECRAZY EA can operate around the clock, even when you are away from the screen.

Key Features at a Glance

- Fully automated — no manual trading skills required.

- Aggressive risk profile — aims for high returns but accepts large drawdowns.

- Small starting capital — optimized for deposits from $200.

- Three correlated currency pairs — AUDCAD, AUDNZD, NZDCAD.

- Mean-reversion strategy — seeks price pullbacks after strong moves.

- Easy installation — supports MetaTrader 4

.ex4file drag-and-drop. - Customizable parameters — spread filter, grid size, stop-out level.

Mean-Reversion and Correlated Pairs Explained

1. Why Mean-Reversion?

In forex, prices often swing above and below a fair value before returning toward the average. Mean-reversion systems, such as LITTLECRAZY EA, try to profit from this back-and-forth movement.

Advantages:

- Works well in range-bound conditions.

- Does not depend on forecasting long trends.

Risks:

- During strong one-way trends, price can blow past the “average,” causing large unrealized losses.

2. Role of Correlated Pairs

AUDCAD, AUDNZD, and NZDCAD share similar economic drivers (Australia and New Zealand vs. Canada). Correlation can help improve the math behind mean-reversion because moves across the three pairs often occur together. When price stretches in all pairs simultaneously, the odds of a snap-back may increase.

However, correlation also means losses can stack up quickly if all three pairs trend against the EA at the same time. Always keep this risk in mind.

Account Size, Leverage, and Broker Choice

| Aspect | Recommendation | Why It Matters |

|---|---|---|

| Minimum Deposit | $200 | The robot is coded to downscale lot size when margin is low. |

| Recommended Deposit | $500–$1,000 | Offers a larger safety buffer and more room for the grid to breathe. |

| Leverage | 1:200 or higher | Provides margin to open multiple positions during deep pullbacks. |

| Broker Type | ECN or RAW spread | Lower spreads reduce cost for scalping exits. |

| Regulation | Tier-1 or Tier-2 | Protects funds in case of broker failure. |

| VPS | Yes, 24/7 uptime | Keeps the EA running even if your PC is off. |

Tip: Before going live with real money, test LITTLECRAZY EA on a demo account under the same broker conditions.

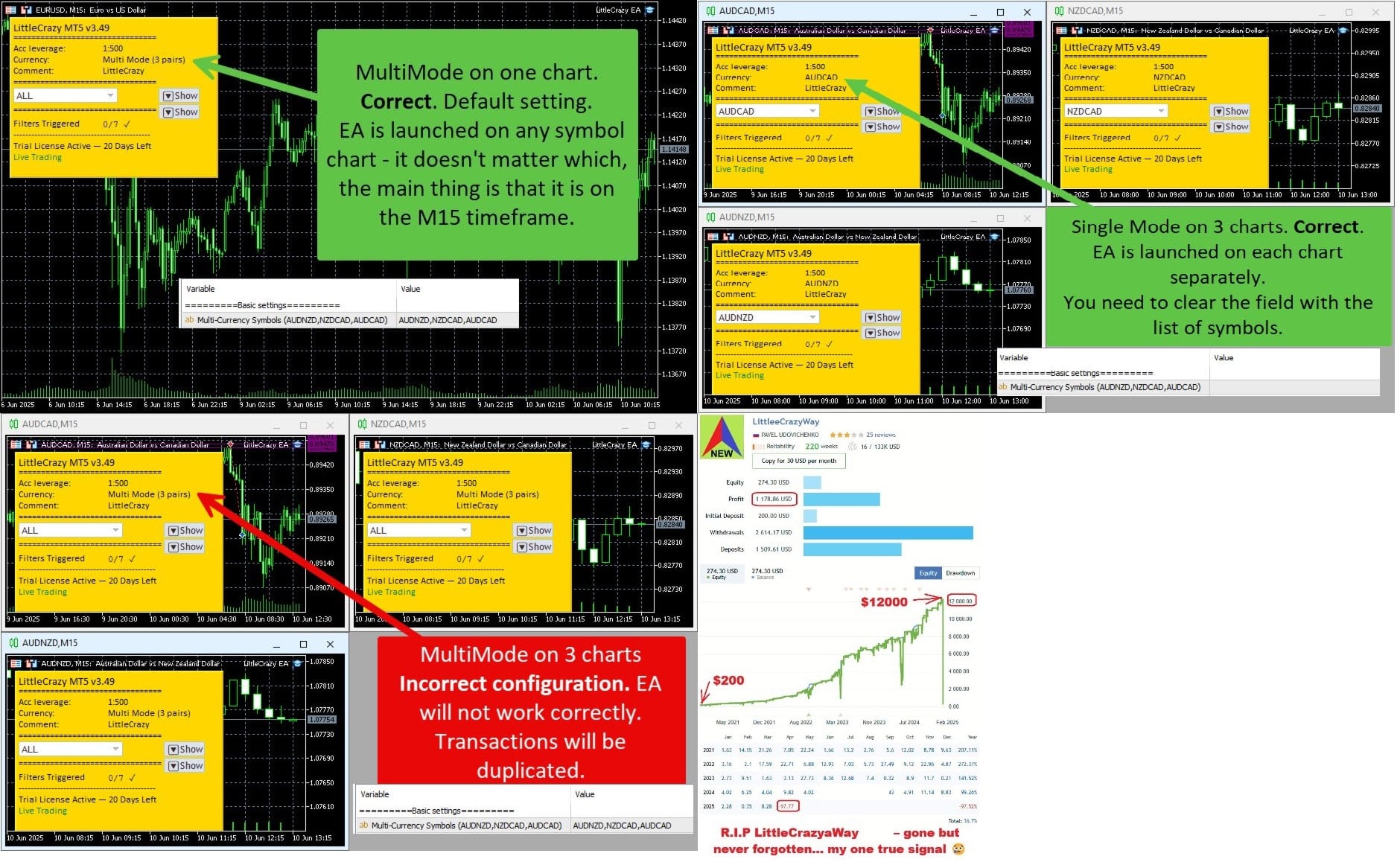

Installation and Set-Up Walk-Through

Follow these steps to install LITTLECRAZY EA on MetaTrader 4.

- Download the EA file (

LittleCrazyEA.ex4) from the official seller page. - Open MetaTrader 4 →

File→Open Data Folder. - Navigate to

MQL4→Expertsand paste the.ex4file. - Close and restart MetaTrader 4.

- In the

Navigatorwindow, expandExpert Advisors, then drag LittleCrazyEA onto the chart of each supported pair (AUDCAD, AUDNZD, NZDCAD). - Enable AutoTrading (button at the top).

- Input your settings in the pop-up panel:

Lots(orRisk %)Grid StepMax TradesTakeProfitEquity Stop

- Press OK. A smiley face in the top-right of your chart shows the EA is active.

Need a visual guide? The developer provides a short video on the official YouTube channel (external link).

Risk Management: What You Need to Know

LITTLECRAZY EA is straightforward to deploy, but its aggressive nature demands prudent oversight. Below are practical steps to help contain risk.

1. Use a Fixed Percentage of Equity

Set the EA to risk a fixed percentage per trade rather than a static lot size. This way, as your account grows or shrinks, position size adjusts automatically.

2. Set an Equity Stop

The Equity Stop parameter tells the EA to close all trades if your account equity drops to a chosen level, protecting you from total loss.

3. Withdraw Profits Regularly

Because gains can come in spikes, withdraw a part of profits after big winning weeks. This locks in returns and leaves only risk capital in the account.

4. Consider Multiple Accounts

Run the EA on separate small accounts instead of a single large account. If one account hits a deep drawdown, the others stay intact.

5. Keep Leverage in Check

While high leverage allows more positions, it also speeds up margin calls. Stick to the minimum leverage that provides enough breathing room.

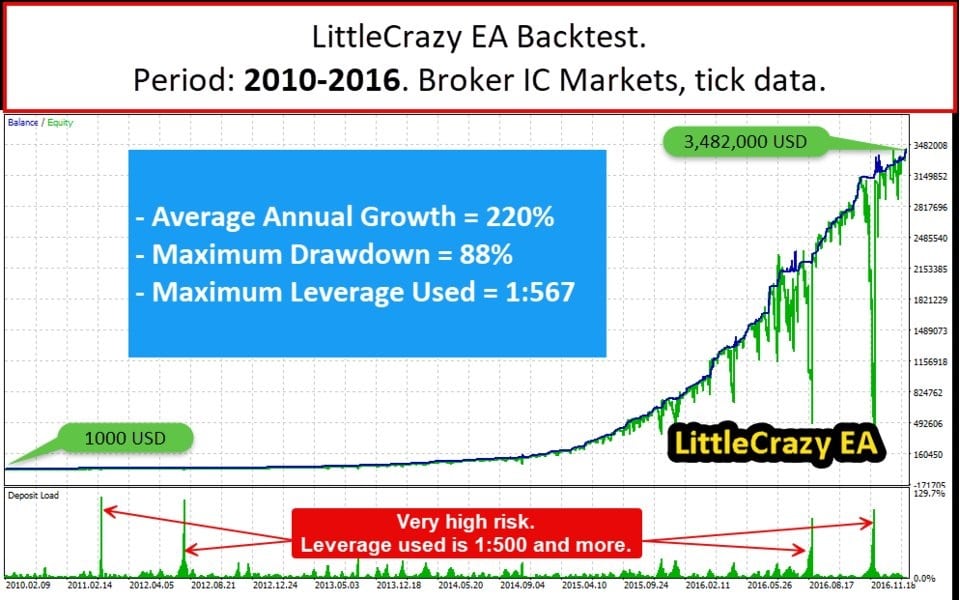

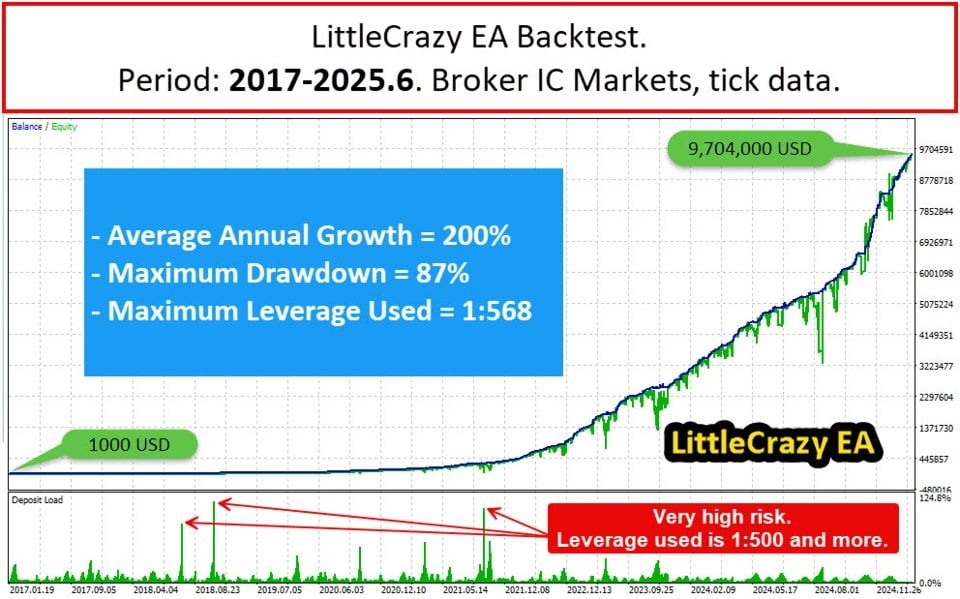

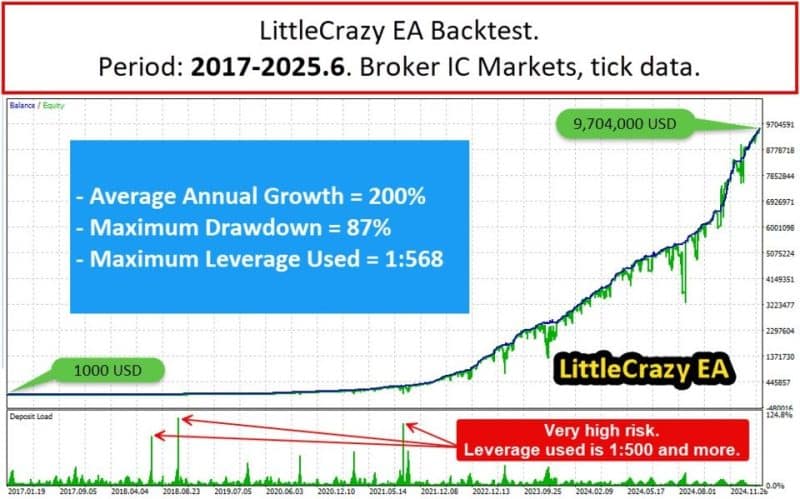

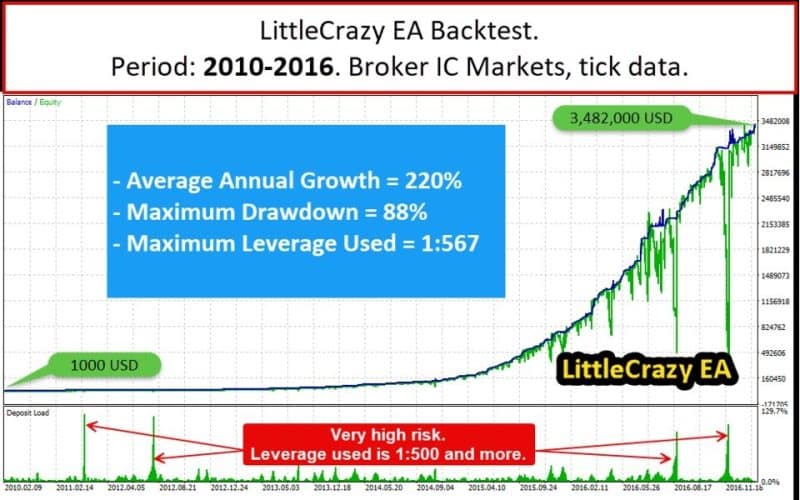

Back-Test and Forward-Test Results

Below is a summary of typical performance reports shared by the community. Always perform your own tests; these figures do not guarantee future results.

Back-Test (2010–2023)

| Metric | Value |

|---|---|

| Initial Deposit | $1,000 |

| Net Profit | $9,850 |

| Profit Factor | 1.58 |

| Max Drawdown | 48.3 % |

| Winning Trades | 78 % |

Forward-Test

LittleCrazy EA Aggressive (external link) shows the following after six months:

| Metric | Value |

|---|---|

| Gain | +92 % |

| Max DD | 41 % |

| Avg Monthly | 12 % |

| Best Month | 28 % |

Note: Past performance cannot predict future returns. Markets change, and aggressive strategies carry the risk of large drawdowns or full account loss.

Pros, Cons, and Ideal Users

Pros

- Low entry barrier (as little as $200).

- Fully automated; no manual trades needed.

- Works on only three pairs, simplifying monitoring.

- Flexible settings for lot size and grid spacing.

- Large community of users sharing set files and tips.

Cons

- High drawdowns are common.

- Grid adds more exposure during adverse moves.

- Sensitive to sudden news spikes (e.g., central-bank announcements).

- Needs reliable VPS to avoid disconnections.

Who Might Like LITTLECRAZY EA?

| Profile | Fit? | Rationale |

|---|---|---|

| Beginner with very small capital | Moderate | Easy to set up, but must learn about risk. |

| Experienced trader seeking high returns | High | Understands grid risk and can manage exposure. |

| Long-term conservative investor | Low | Strategy drawdowns may be too deep. |

| Hobbyist testing multiple EAs | High | Adds diversity to a basket of robots. |

Frequently Asked Questions

Q1: Do I need to keep my computer on all the time?A: If you run the EA on your own PC, yes. Using a VPS lets the EA run 24/7 without your PC turned on.

Q2: Can I change the currency pairs?A: The EA is optimized for AUDCAD, AUDNZD, and NZDCAD. Running it on other pairs is possible but carries unknown risk.

Q3: Does the robot use a stop-loss?A: Individual trades may not have a fixed stop-loss; instead, the grid relies on an overall equity or basket exit.

Q4: How often does it trade?A: Trade frequency varies with volatility. On average, the EA opens 1-5 trades per pair per day.

Q5: Can I run it on MetaTrader 5?A: The standard version is coded for MetaTrader 4. Some sellers offer an MT5 version; confirm before purchase.

Final Thoughts

LITTLECRAZY EA offers a straightforward way to automate high-risk, high-return trading on forex pairs that tend to move together. The system’s mean-reversion core can generate strong gains, yet its aggressive money management can lead to sharp drawdowns. Start small, use sensible risk limits, and keep learning from forward results.

Ready to give LITTLECRAZY EA a try? Test it on a demo account today, review the outcomes, and decide if its style aligns with your own risk tolerance.

Call to ActionHave you tested LITTLECRAZY EA or any similar mean-reversion forex robot? Share your experience in the comments below. Your insights help other traders make better choices!

Vendor Site – Click Here

| Membership | Yearly Membership |

|---|---|

| Additional Services | Unlock & Decompile |

| Recommended Brokers | Exness Broker, FPMarkets |

| Recommended VPS | FXVM (Low Latency) |

| Youtube Channel | ForexForYou |

| Telegram Channel | Onshoppie Forex EA's & Indicators |

| Telegram Support | Onshoppie Support |

| Installation Guides | Onshoppie Forex Guides |

Only logged in customers who have purchased this product may leave a review.

Reviews

There are no reviews yet.