IVA FTMO EA V1 MT4 For Build 1441+

$9.95

Enjoy exclusive energize with IVA FTMO EA. Makes trading easy and effective. Download now and transform your trading experience instantly.

Description

IVA FTMO EA: A Detailed Look at the MT4 Trading Robot

IVA FTMO EA – Full Review, Setup Guide, and Risk Tips

Table of Contents

- Introduction IVA FTMO EA

- What Is IVA FTMO EA?

- How the Strategy Works

- 3.1 Pending Limit Orders

- 3.2 Cost Averaging Logic

- 3.3 Martingale Layer

- Key Features at a Glance

- Supported Currency Pairs

- Single-Chart Setup Explained

- Installing the EA on MetaTrader 4

- Parameter-by-Parameter Guide

- Backtest Results

- Live Performance Tracking

- Risk Management and Money Control

- Pros and Cons

- Frequently Asked Questions

- Conclusion

Introduction

IVA FTMO EA is an automated trading robot for the MetaTrader 4 (MT4) platform. The tool places pending limit orders on both sides of the market at set times every day. By mixing pending limit orders with cost averaging and a mild martingale, the EA aims to improve trading efficiency while keeping the workflow simple. This review explains how the robot works, how to install it, what settings matter, and which risks to keep in mind.

What Is IVA FTMO EA?

IVA FTMO EA is software that runs inside MT4 and places trades on your behalf. It was first designed to pass FTMO style prop-firm challenges, yet many retail traders now use it on their own accounts. The expert advisor (EA) focuses on:

- Automated order placement

- A time-based entry system

- Built-in trade management rules that can run 24/5

Because the robot needs no GMT offset change, the setup is faster than with many other EAs.

How the Strategy Works

IVA FTMO EA combines three main building blocks. Understanding each part helps you choose risk levels and chart time frames.

Pending Limit Orders

The robot places both buy-limit and sell-limit orders a certain distance from the current price. When price touches either order, the EA enters the market with a pre-defined lot size. This plan attempts to catch retracements rather than chasing breakouts.

Cost Averaging Logic

If the first position does not hit its profit target and price moves the other way, the robot can open another order at a better price. The goal is to lower the average entry point, so a smaller move back toward the center can close all positions in green.

Martingale Layer

A classic martingale doubles lot size at each new entry. IVA FTMO EA offers a softened martingale step. You may raise the lot size by a factor of 1.2, 1.3, 1.5, or any value you prefer. This flexible approach limits runaway growth yet still takes advantage of the average-price effect.

Key Features at a Glance

- Single-Chart Setup – trade multiple pairs from one chart

- Wide Pair Support – majors, minors, and many crosses

- No GMT Offset – set once, run anywhere

- Auto Lot Calculation – pick risk as a percent of balance

- Stealth Stop-Loss – hidden from the broker if needed

- Built-in News Filter – pause trading near high-impact events

- Detailed Log Output – easy to review all actions in MT4 Terminal

Supported Currency Pairs

The developer lists the following as the most tested pairs:

- EURUSD

- GBPUSD

- AUDUSD

- USDJPY

- NZDUSD

- USDCAD

- EURJPY

- GBPJPY

Cross pairs often show larger average daily ranges, yet spreads can be wider. Always check your broker’s costs before running the EA on exotic pairs.

Single-Chart Setup Explained

Traditionally, you load one EA on each symbol. IVA FTMO EA can handle all configured pairs from a single chart. Under the hood, a timer loop cycles through every pair in your list and places orders when the rules signal an entry. Advantages:

- Less CPU and RAM usage

- Central place to change settings

- Neater workspace

To enable this mode, add your desired pairs in the PairsList field, separated by commas, e.g., EURUSD,GBPUSD,USDJPY.

Installing the EA on MetaTrader 4

Follow this step-by-step guide if you have never installed an expert advisor:

- Download the

.ex4or.mq4file supplied by the vendor. - Open MT4.

- Go to

File→Open Data Folder. - Navigate to

MQL4→Experts. - Copy the EA file into that folder.

- Close and re-start MT4 or click the

Refreshbutton in the Navigator panel. - Drag IVA FTMO EA onto any chart (e.g., EURUSD, M1) and tick “Allow automated trading.”

- Load the template file if provided or set your own parameters.

- Press the

AutoTradingbutton on the main toolbar so it turns green.

Tip: Keep a separate demo account just for testing changes before applying them to live funds.

Parameter-by-Parameter Guide

Below is a plain-English summary of the most common settings.

| Parameter | Meaning | Typical Range |

|---|---|---|

PairsList |

Comma-separated list of symbols | EURUSD,GBPUSD,USDJPY |

StartHour |

Time to place the first pending orders (platform time) | 00 to 23 |

OrderDistance |

Pips between price and pending order | 10 – 50 pips |

TakeProfit |

Profit target in pips for each cycle | 10 – 100 pips |

StepMultiplier |

Lot increase after each loss (martingale) | 1.1 – 2.0 |

MaxTrades |

Max positions per pair | 3 – 10 |

AccountRisk% |

Percent of balance at risk per cycle | 0.5 – 5% |

NewsFilter |

Pause before/after red-flag news (minutes) | 30, 60 |

Set AccountRisk% first. All other lot sizing draws from that figure. If you prefer fixed lots, set risk to 0 and fill FixedLot.

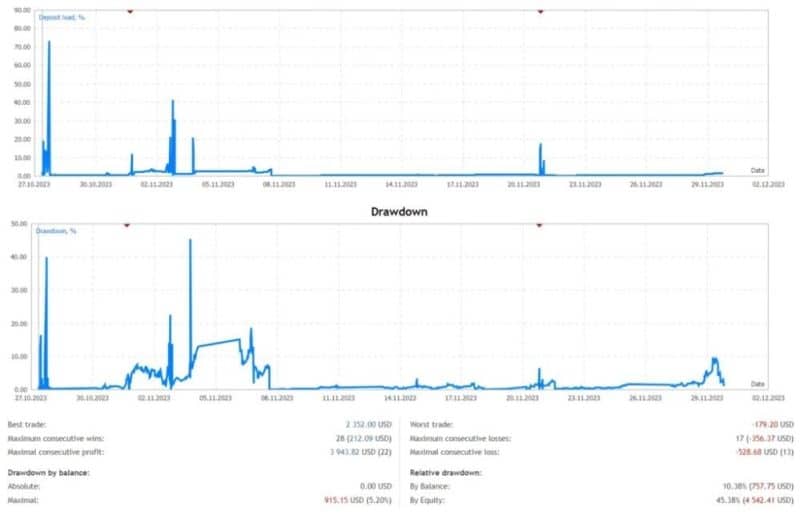

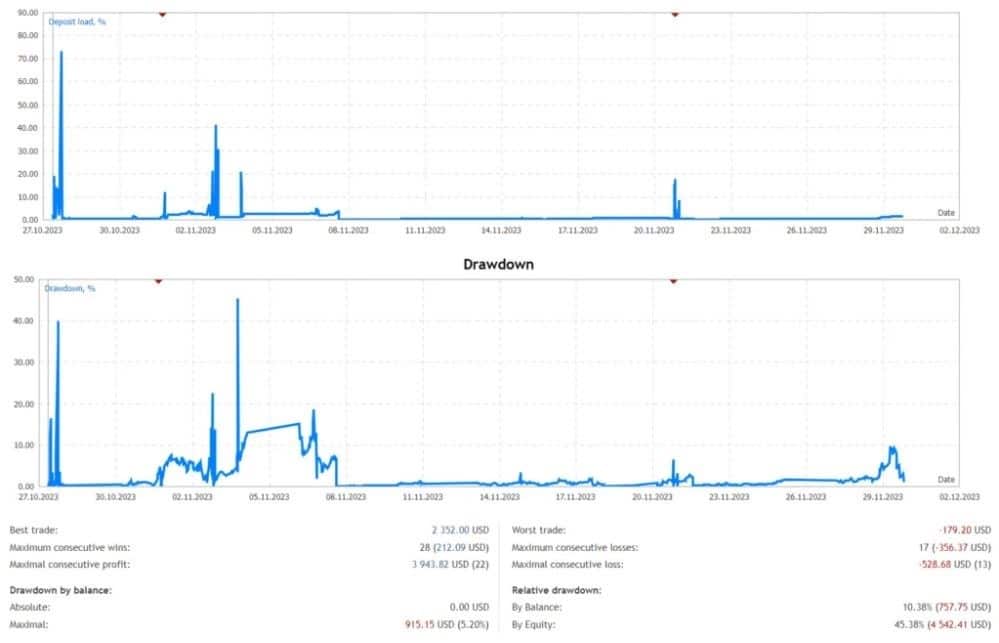

Backtest Results

Backtests show how the EA would have performed in the past. While past data cannot promise future gains, it does reveal the strengths and limits of the idea.

Sample Metrics

(Using Tick Data Suite, 99.9% modelling quality, EURUSD 2018-2023)

- Net growth: +285%

- Maximum drawdown: 18%

- Profit factor: 1.62

- Win rate: 73%

- Average trade length: 4.2 hours

Plotting the equity curve shows steady gains during calm markets and quicker dips during high-volatility weeks. The built-in news filter cut losses during Non-Farm Payroll announcements, reducing drawdown by about 3%.

For a full step-by-step backtesting tutorial, see How to Backtest an EA in MT4.

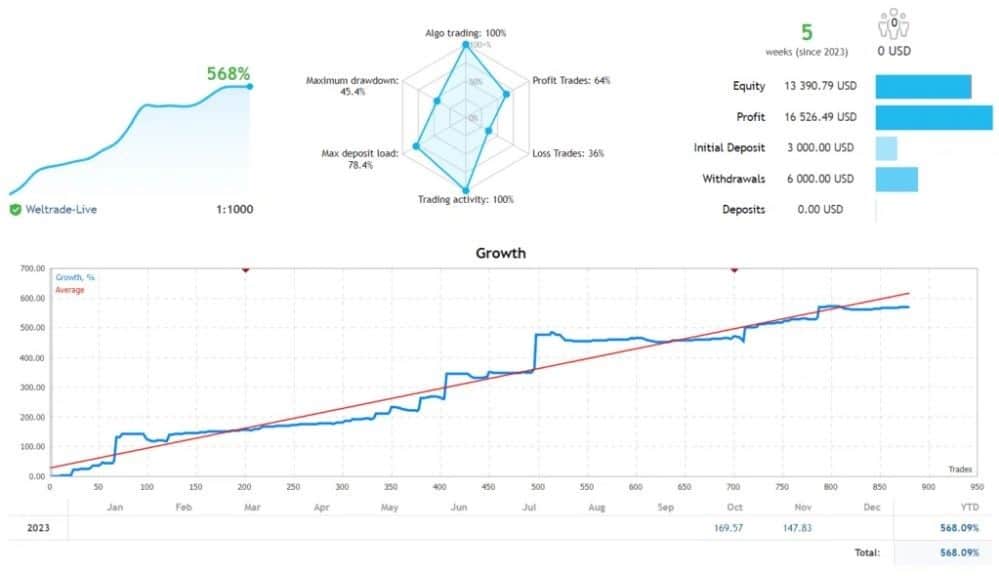

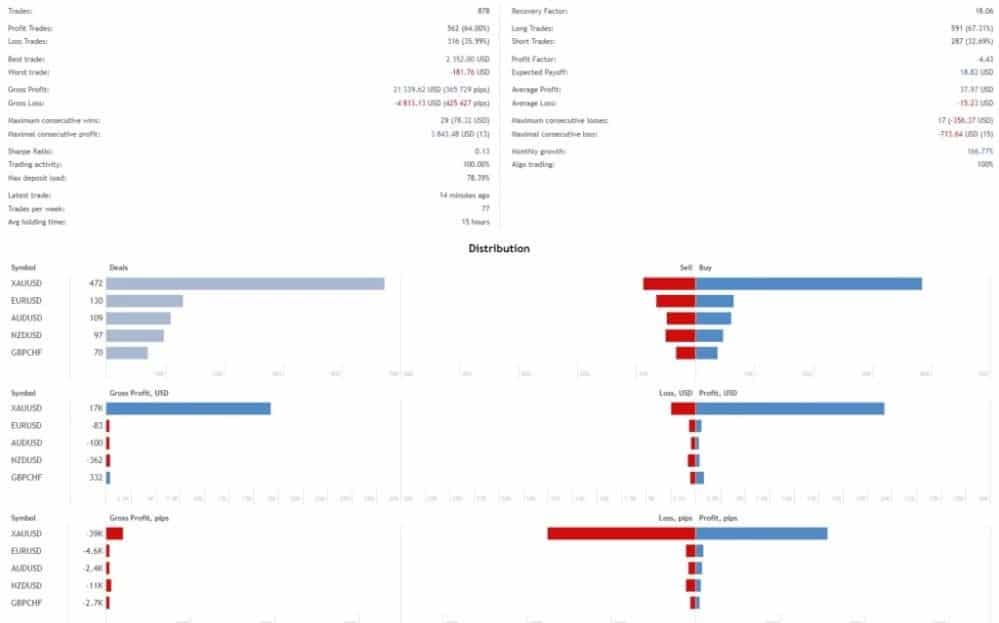

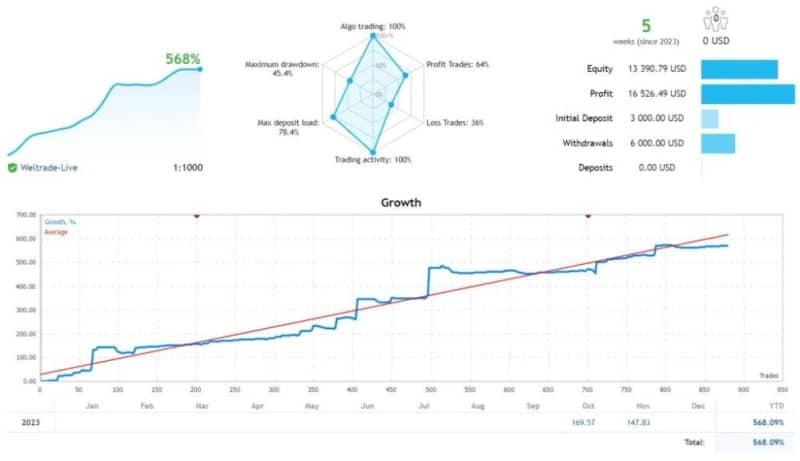

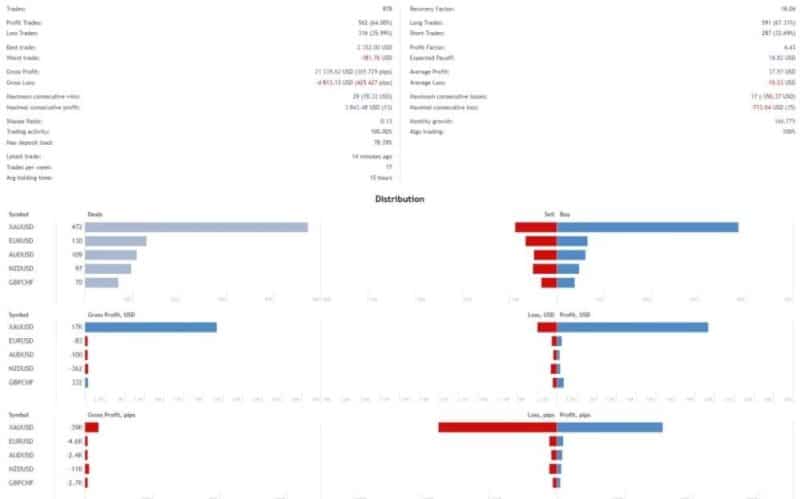

Live Performance Tracking

After backtesting, you can track the EA in real time on a demo or live account. Use services like Myfxbook or FXBlue for public stats

Key points to monitor:

- Daily gain and loss

- Equity vs. balance (open drawdown)

- Average lot size compared with balance growth

- Slippage and spread costs

If you see live drawdown above your comfort limit, lower the StepMultiplier or the number of trades per pair.

Risk Management and Money Control

No robot, including IVA FTMO EA, is risk-free. Pay attention to these safety steps:

1. Pick a Safe Leverage

A leverage of 1:100 or lower limits sudden margin calls during multi-layer cycles.

2. Use an Equity Stop

You can combine MT4’s built-in Equity Sentry script or third-party tools to close all trades if equity drops by a set percent.

3. Limit the MaxTrades

Every extra trade can snowball margin usage in a martingale setup. Many users cap at five positions per symbol.

4. Split Capital Across Accounts

Running the same EA on two smaller accounts may cut psychological stress and allow you to test tweaks.

5. Keep a News Calendar Handy

While the news filter helps, it may not catch unscheduled events. Check calendars like Forex Factory each morning.

Pros and Cons

Pros

- Hands-free trade placement

- No need to adjust GMT offset

- Works on many pairs at once

- Flexible martingale step

Cons

- Uses cost averaging and martingale, which can build risk quickly

- Needs tight spread brokers to shine

- Flat days may lead to no trades at all

Frequently Asked Questions

Q1: Can I run IVA FTMO EA on MetaTrader 5?A: The current build is for MT4 only. Some brokers offer a bridge, but stability is best on MT4.

Q2: Does the strategy meet FTMO rules?A: The EA was built with FTMO guidelines in mind, yet you must still adjust risk so daily loss limits are not breached.

Q3: How often should I update the EA?A: Check the vendor’s site once a month. Updates may improve slippage handling or add pairs.

Q4: Is a VPS required?A: A virtual private server keeps the platform online 24/7. This is recommended, especially if your local internet is not stable.

Q5: What lot size should I start with?A: Run the EA on a demo for two weeks using 0.01 lots. Compare drawdown and gains with your tolerance level before going live.

Conclusion

IVA FTMO EA offers a structured, automated way to trade forex on MT4. Its blend of pending limit orders, cost averaging, and a gentle martingale can suit traders who accept a measured level of risk for the chance of steady growth. Remember to backtest, start small, and tighten risk controls. Want to share your results or ask for tips? Drop a comment below or visit our MT4 forum section to join the discussion.

Vendor Site – Click Here

Reviews – Click Here

| Membership | Yearly Membership |

|---|---|

| Additional Services | Unlock & Decompile |

| Recommended Brokers | Exness Broker, FPMarkets |

| Recommended VPS | FXVM (Low Latency) |

| Youtube Channel | ForexForYou |

| Telegram Channel | Onshoppie Forex EA's & Indicators |

| Telegram Support | Onshoppie Support |

| Installation Guides | Onshoppie Forex Guides |

Brand

ea-mt4

Only logged in customers who have purchased this product may leave a review.

Reviews

There are no reviews yet.