DMF AI Ftmo and Prop Firms EA MT4 + Setfiles For Build 1441+

$9.95

Explore the game-changing features of DMF Ai FTMO. Discover how this advanced system can revolutionize your trading approach and maximize your returns.

Description

DMF AI FTMO EA: Revolutionizing Prop Firm Trading with Advanced AI Technology

AI-Powered Trading: How DMF AI FTMO EA is Changing the Game for Prop Firm Traders

Table of Contents

- Introduction to DMF AI FTMO EA

- Key Features of DMF AI FTMO EA

- Optimized for Prop Firm Challenges

- Risk Management and Protection

- Customization and Flexibility

- Compatibility and Support

- Setting Up DMF AI FTMO EA

- Backtesting and Performance

- Conclusion

Introduction to DMF AI FTMO EA

DMF AI FTMO – In the fast-paced world of proprietary trading, having a reliable and intelligent trading tool can make all the difference. Enter DMF AI FTMO EA, an advanced artificial intelligence-powered Expert Advisor designed specifically for prop firm traders. This innovative robot has been carefully crafted to help traders navigate the challenges of prop firm evaluations and funded accounts with precision and efficiency.

DMF AI EA is not just another trading bot flooding the market. It’s a unique version developed to provide traders with a cost-effective solution without compromising on performance. By leveraging cutting-edge AI technology, this EA offers a sophisticated approach to trading that aligns perfectly with the strict requirements of prop firms like FTMO.

Key Features of DMF AI FTMO EA

The DMF AI EA robot comes packed with an array of features that set it apart from conventional trading tools:

- Fully Automated Trading: The EA handles all aspects of trading, from analysis to execution, allowing traders to focus on strategy and risk management.

- News Spike Exploitation: Unlike many other EAs that avoid news events, DMF AI EA is designed to capitalize on the volatility that often accompanies major economic announcements.

- Multiple Strategy Options: Traders can choose from a variety of built-in strategies or customize their own, providing flexibility to adapt to different market conditions.

- Advanced Risk Management: The EA incorporates sophisticated risk control measures to protect your account and comply with prop firm rules.

- No Risky Techniques: DMF AI EA steers clear of potentially dangerous methods like martingale, grid trading, or hedging, focusing instead on sustainable trading practices.

Optimized for Prop Firm Challenges

One of the standout features of DMF AI EA is its optimization for prop firm challenges and evaluations. The developers have fine-tuned the robot to work seamlessly with censored accounts, ensuring that it adheres to the strict guidelines set by prop firms. This makes it an invaluable tool for traders looking to pass challenges and secure funded accounts.

The EA’s ability to manage risk effectively while still generating consistent profits aligns perfectly with the objectives of prop firm evaluations. It’s designed to demonstrate disciplined trading behavior, which is crucial for impressing prop firm risk managers and securing long-term funding.

Risk Management and Protection

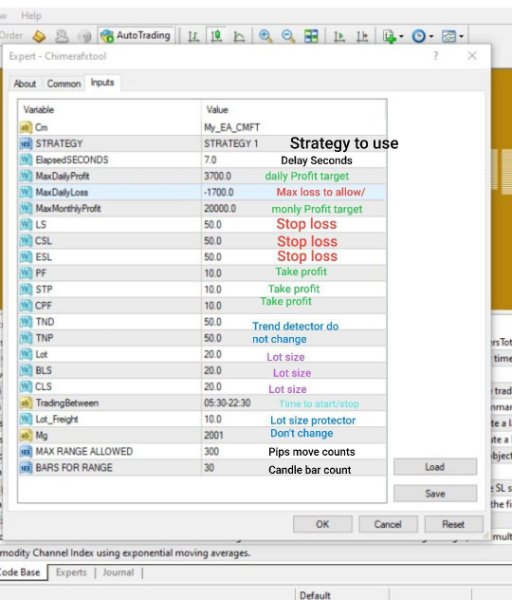

DMF AI EA takes risk management seriously, incorporating several layers of protection:

- Daily Maximum Loss and Profit Limits: The EA respects predefined daily loss and profit thresholds, helping to prevent excessive drawdowns and maintain account stability.

- Monthly Profit Targets: Traders can set monthly profit goals, allowing the EA to adjust its strategy accordingly.

- Customizable Stop Loss and Take Profit: Each trade is protected with adjustable stop loss and take profit levels.

- Risk Trigger Mechanism: The EA includes a risk trigger feature that can modify trading behavior based on account performance.

These risk management features are essential for maintaining compliance with prop firm rules and preserving account capital over the long term.

Customization and Flexibility

While DMF AI EA comes with pre-configured settings optimized for prop firm trading, it also offers extensive customization options. Traders can adjust parameters such as:

- Lot sizes

- Trading hours

- Maximum range allowed

- Profit factors

- Stop loss and take profit levels

This flexibility allows traders to tailor the EA to their specific trading style and risk tolerance while still benefiting from its AI-driven core.

Compatibility and Support

DMF AI EA is designed to work with various trading platforms and prop firms:

- Primary Platform: MetaTrader 4 (MT4)

- Alternative Platforms: For countries with MT4 restrictions, the EA supports trade copying to DXTrader, Matchtrader, TradeLocker, and cTrader.

- Broker Compatibility: While optimized for FTMO, the EA can be adapted for use with other prop firms and brokers.

The developers offer dedicated support through their Telegram channel (DMF_aggressive) to assist users with setup and customization.

Setting Up DMF AI FTMO EA

To get started with DMF AI EA, follow these steps:

- Purchase the EA from the official MQL5 market to ensure authenticity.

- Download and install the EA on your MT4 platform.

- Configure the EA parameters according to your account size and risk preferences.

- Run backtests to familiarize yourself with the EA’s performance characteristics.

- Start with a demo account to test the EA in real-time market conditions.

- Once comfortable, deploy the EA on your prop firm challenge or funded account.

Remember to contact support for assistance with setup, especially if you’re using the EA with a non-FTMO broker or on an alternative platform.

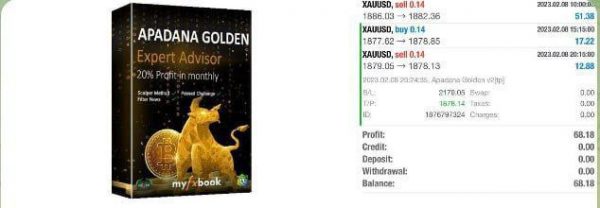

Backtesting and Performance

DMF AI EA comes with recommended backtesting parameters for FTMO accounts:

- Account Size: $100,000

- Instrument: USTECHCASH100

- Timeframe: H1 or H4

- Spread: 100 (if encountering error 130)

These settings provide a starting point for evaluating the EA’s performance. However, it’s crucial to conduct thorough backtesting and forward testing before using the EA on a live account.

Click here to learn more about effective backtesting techniques

Conclusion

DMF AI EA represents a significant advancement in automated trading technology for prop firm traders. By combining AI-driven decision-making with robust risk management and customization options, it offers a powerful tool for navigating the challenges of prop firm evaluations and funded account trading.

While the EA provides impressive capabilities, it’s important to remember that successful trading still requires careful planning, ongoing monitoring, and a solid understanding of market dynamics. DMF AI EA should be viewed as a sophisticated assistant rather than a guaranteed path to trading success.

For traders serious about elevating their prop firm trading game, DMF AI EA offers a compelling solution worth exploring. With its focus on safety, compliance, and performance, it stands out as a valuable asset in the competitive world of proprietary trading.

Learn more about prop firm trading strategies

Remember to always trade responsibly and within your risk tolerance. Happy trading!

Vendor Site – Click Here

| Membership | Yearly Membership |

|---|---|

| Additional Services | Unlock & Decompile |

| Recommended Brokers | Exness Broker, FPMarkets |

| Recommended VPS | FXVM (Low Latency) |

| Youtube Channel | ForexForYou |

| Telegram Channel | Onshoppie Forex EA's & Indicators |

| Telegram Support | Onshoppie Support |

| Installation Guides | Onshoppie Forex Guides |

Brand

ea-mt4

Only logged in customers who have purchased this product may leave a review.

Reviews

There are no reviews yet.