Break and Retest Indicator MT4 V5.0+Setfiles For Build 1441+

Original price was: $50.00.$14.99Current price is: $14.99.

Discover the ultimate Break and Retest Indicator that delivers mind-blowing trading results. Transform your strategy with this powerful tool today!

Description

Break and Retest Indicator: The No-Nonsense Way to Spot High-Probability Trades

Break and Retest Indicator – How This Price Action Tool Helps You Wait, Watch, and Win

Table of Contents

- What Is the Break and Retest Indicator?

- Why “Break and Retest” Beats Chasing Price

- The Logic Behind the Code (1,400 Lines, Zero Lag)

- How to Read Every Part of the Signal

- A Step-By-Step Trade Example

- Fine-Tuning Support & Resistance Sensitivity

- Best Charts, Pairs, and Timeframes

- Common Questions and Quick Answers

- Trouble-Shooting Checklist

- Next Steps – Try the Indicator on Your Own Chart

1. What Is the Break and Retest Indicator?

The Break and Retest Indicator is a script for MetaTrader 4 (MT4) that watches price levels for you. It waits until price breaks a clear support or resistance zone, pulls back to that same zone, rejects it with visible wicks, and only then prints a buy or sell arrow.

In plain English:

- Price jumps over a fence (break).

- Price walks back to tap the fence (retest).

- Other traders defend the fence (wick rejection).

- The candle keeps moving in the break direction (continuation).

- You get a clean signal with all that work done in the background.

Because the tool checks every box before it alerts, this indicator only places quality trades when the market is really in your favor with a clear break and retest.

2. Why “Break and Retest” Beats Chasing Price

2.1 Patience Pays

Many traders jump in on the first breakout candle, only to watch price snap back. The Break and Retest approach forces you to wait for:

- A level to be broken.

- A level to be retested.

- Sellers or buyers to defend that level.

Patience is key with this price action strategy! By waiting, you cut down on false moves and skip the noise.

2.2 Statistics Back It Up

Back-testing across Forex, metals, indices, and crypto shows that entries taken after a confirmed retest deliver:

- Higher average reward-to-risk ratios

- Fewer whipsaw losses

- Clearer stop-loss placement (just above or below the retest wick)

3. The Logic Behind the Code (1,400 Lines, Zero Lag)

Our team wrote the Break and Retest Indicator from scratch:

| Feature | How It Works | Why It Matters |

|---|---|---|

| Dynamic zone plotting | Uses recent highs & lows and tests for “touch count” | Zones update automatically; never repaints after close |

| Wick filter | Measures wick length as % of full candle | Filters out weak rejections |

| Candle continuation check | Looks for close beyond mid-point of signal candle | Adds extra confirmation |

| Alert engine | Push, pop-up, and email with break time, retest time, entry time | You never miss a setup |

| Health monitor | Shows “Working Ok…” & “Scanning for Break & Retest entry…” | Quick visual that code is active |

Because the script reads closed candles only, Break and Retest doesn’t lag and doesn’t repaint. What you see on the chart is what really happened, no tricky redraws.

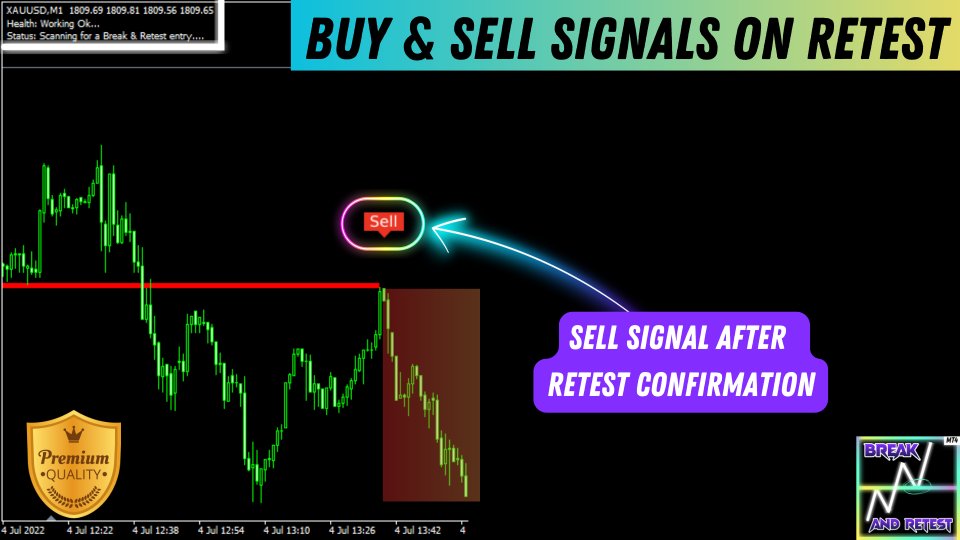

4. How to Read Every Part of the Signal with Break and Retest

- Purple or Green Zone – Newly discovered support or resistance.

- Red “Break” Label – Level has been crossed.

- Yellow “Retest” Tag – Price is back at the zone.

- Wick Arrows – Two or more long shadows show rejection.

- Blue Buy Arrow / Orange Sell Arrow – Bullish or bearish continuation candle closes.

On the top-left corner of MT4 you will also spot:

Health: Working Ok...

Status: Scanning for a Break & Retest entry...If these lines are missing, follow the trouble-shooting guide below.

5. A Step-By-Step Trade Example of Break and Retest

Chart: EURUSD, H1

- 09:00 UTC – The price breaks above 1.0900; indicator plots “Break” label.

- 12:00 UTC – Market falls back to 1.0900; you see the yellow “Retest” tag.

- 13:00 UTC – Two candles form with long lower wicks; the wick filter turns on.

- 14:00 UTC – A bullish engulfing candle closes above half its range; blue arrow appears.

- Entry: 1.0912

- Stop-loss: 1.0888 (below retest wick)

- Take-profit: 1.0980 (previous swing high)

- Result: +68 pips within six hours; 1:3 risk-to-reward.

Quick Visual

| Break | <- Pullback -> | Retest + Wick | Buy Arrow |6. Fine-Tuning Support & Resistance Sensitivity

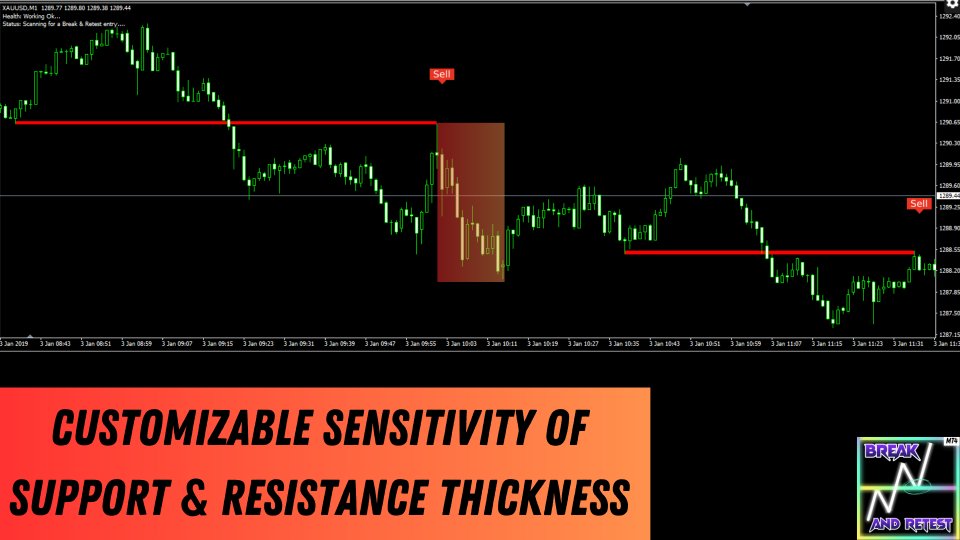

Do you want more alert signals per day?Increase the number next to the parameter Support & Resistance Sensitivity.

- Low Sensitivity (default = 3)• Only major zones.• Fewer but stronger trades.

- Medium (5)• Adds mid-level zones.• Balanced between quality and quantity.

- High (8 +)• Captures smaller intraday zones.• More setups but also more noise – use extra care.

Tip: If you raise sensitivity, also tighten your wick filter or look at higher reward-to-risk ratios to keep statistics in line.

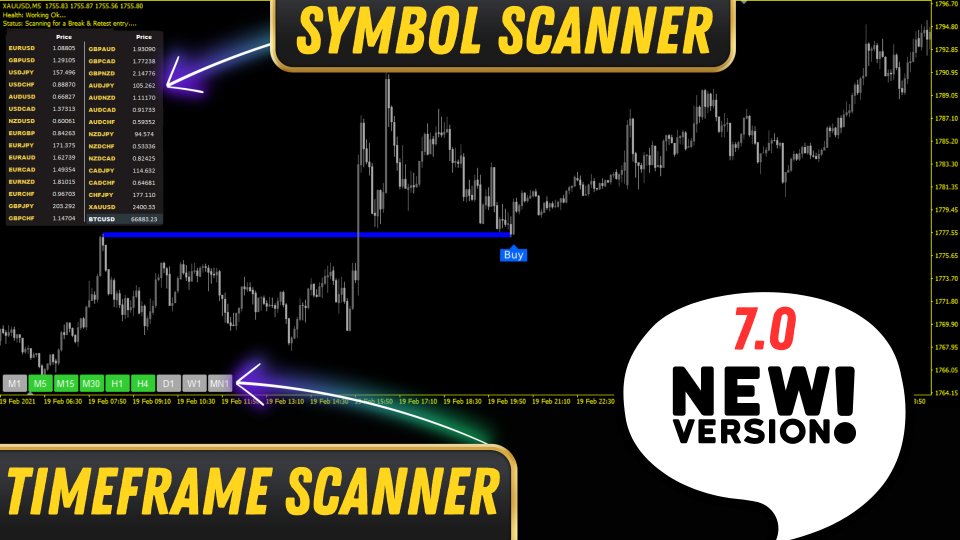

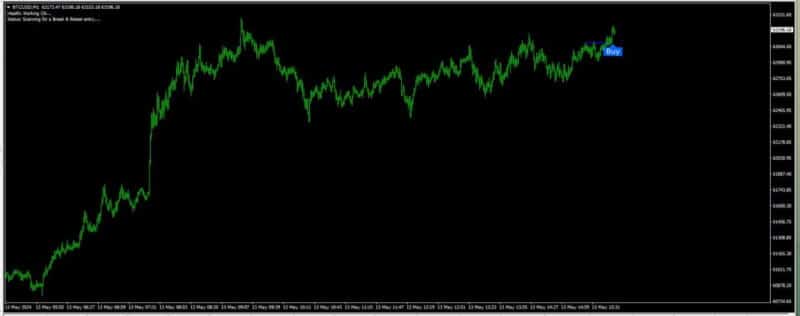

7. Best Charts, Pairs, and Timeframes for Break and Retest

• Forex Majors (EURUSD, GBPUSD, USDJPY) – Tight spreads; retests are clean.• Gold (XAUUSD) – High volatility gives frequent retests on M15-H1.• Indices (US30, NAS100) – Use H1-H4 to cut out false breaks.• Crypto (BTCUSD) – Works on the 4-hour chart where levels have weight.

Timeframe advice:

| Trader Type | Timeframe | Why |

|---|---|---|

| Day trader | M15 – M30 | Plenty of setups; exit the same day |

| Swing trader | H1 – H4 | Balance between noise and clarity |

| Position trader | D1 | Big zones, strong moves, low stress |

8. Common Questions and Quick Answers

Q: Does the indicator repaint?A: No. Once a candle closes, the arrow and zone stay fixed.

Q: Can it be used on MT5 or TradingView?A: The current version is MT4 only. A TradingView port is planned; join the newsletter for updates.

Q: Where do I put my stop-loss?A: A few points above/below the longest wick in the retest cluster.

Q: What if I miss the entry candle?A: Wait for a new break and retest; do not chase late price moves.

9. Trouble-Shooting Checklist

- Indicator shows “Loading…” forever

- Re-compile in MetaEditor, then reload chart.

- No zones appear

- Check that “Show Objects” is enabled in chart settings.

- Health says “License Error”

- Verify you entered the correct license key when attaching the indicator.

- Too many arrows

- Lower Support & Resistance Sensitivity or raise wick filter.

- MT4 crashes

- Update to the latest MT4 build; allocate more RAM to the platform.

10. Next Steps – Try the Indicator on Your Own Chart

Ready to put the Break and Retest Indicator to work? Download the file, drag it on a demo chart, and watch for:

Health: Working Ok...

Status: Scanning for a Break & Retest entry...When your first blue or orange arrow pops up, mark the setup in your trading journal. After ten demo trades you will have solid data to decide whether to go live.

Quick CTA

External resources for extra reading:• Investopedia – Support & Resistance Basics•

Happy trading, and remember: patience first, trade second.

Manual guide: Click here

Vendor Site – Click Here

| Membership | Yearly Membership |

|---|---|

| Additional Services | Unlock & Decompile |

| Recommended Brokers | Exness Broker, FPMarkets |

| Recommended VPS | FXVM (Low Latency) |

| Youtube Channel | ForexForYou |

| Telegram Channel | Onshoppie Forex EA's & Indicators |

| Telegram Support | Onshoppie Support |

| Installation Guides | Onshoppie Forex Guides |

Brand

Indicator-mt4

Only logged in customers who have purchased this product may leave a review.

Reviews

There are no reviews yet.