ATS INDICATOR V4.1 (MQL4 CODE) MT4 For Build 1441+

$14.95

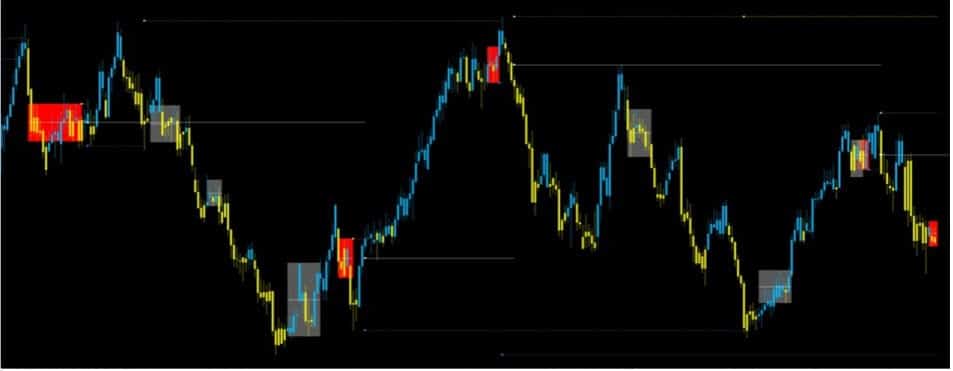

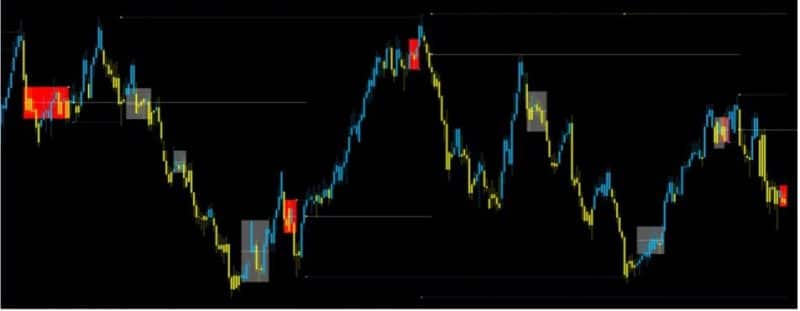

Learn expert ATS indicator strategies that generate amazing profits consistently. Get exclusive access to professional trading secrets and techniques now.

Description

ATS Indicator: A Complete Guide to Understanding and Using an Automated Trading System Indicator

ATS INDICATOR: What It Is, How It Works, and How You Can Apply It in Your Trading Today

Table of Contents

- What Is an ATS Indicator?

- Why Do Traders Use ATS Indicators?

- Key Components of an ATS Indicator

- Hardware, Software, and Data Requirements

- Setting Up Your ATS Indicator: Step-by-Step

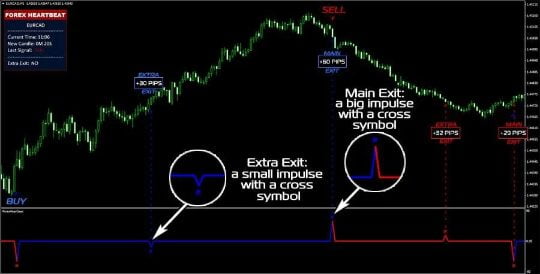

- Reading the Signals: Entry, Exit, and Filter Rules

- Risk Management With an ATS Indicator

- Back-Testing vs. Forward-Testing

- Common Mistakes and How to Avoid Them

- Case Study: Applying an ATS Indicator to EUR/USD Futures

- Frequently Asked Questions

- Final Thoughts on the ATS Indicator

- Important Risk & Performance Disclosures

What Is an ATS Indicator?

An ATS Indicator is a rules-based signal generator built for an Automated Trading System (ATS). In simple terms, it is software code that reads market data and tells you when to buy, sell, or stay flat. The “indicator” part means it is plotted on a chart, just like moving averages or RSI. The “ATS” part means the signals can be sent to a trading engine that places orders without human input.

Key points:

- Primary goal: remove emotional bias by sticking to pre-defined rules.

- Markets: Works on futures, forex, stocks, and even crypto if real-time data is available.

- Platform-agnostic: You can build an ATS Indicator in NinjaTrader, MetaTrader, Sierra Chart, or any platform that supports custom scripting.

Why Do Traders Use ATS Indicators?

- Consistency – The same logic runs every day, no matter how you feel.

- Speed – An algorithm reacts to market changes in milliseconds.

- Multi-market monitoring – One workstation can track dozens of symbols at once.

- Clear reporting – Results can be measured in a database, helping you fine-tune the rules.

- Time savings – You can focus on strategy design while the ATS handles execution.

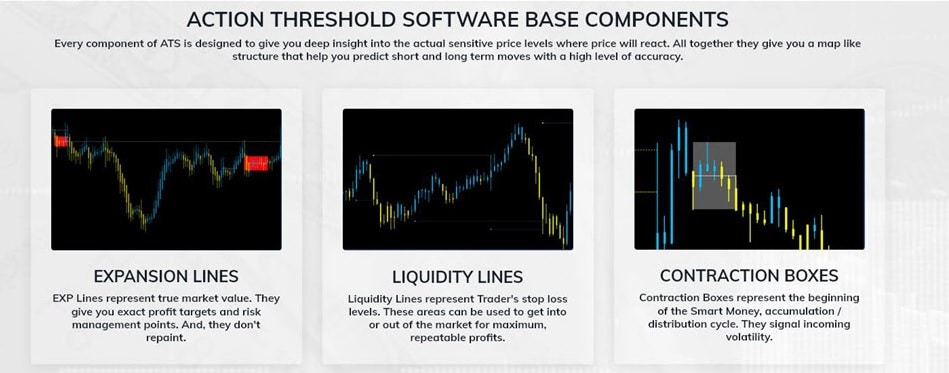

Key Components of an ATS Indicator

| Component | Purpose | Typical Example |

|---|---|---|

| Data Feed | Supplies real-time bids, asks, and trades | CQG, Rithmic, Interactive Brokers |

| Logic Core | Computes conditions for signals | If price > EMA(50) and RSI < 30 → generate Long |

| Visual Output | Draws arrows, dots, or color bars on the chart | Green up-arrow for Buy |

| Alert System | Sends e-mail, SMS, or pushes order to broker | Alert.SendEmail() in NinjaScript |

| Risk Module | Sets stop loss, take profit, and order size | 1% of account value per trade |

Pro Tip: Keep each module separate in your code. This makes debugging easier.

Hardware, Software, and Data Requirements

- PC or VPS – Quad-core CPU, 8 GB RAM minimum.

- Operating System – Windows 10/11 for most retail platforms.

- Broadband – Hard-wired connection is safer than Wi-Fi.

- Charting/Execution Platform – e.g., NinjaTrader 8.

- Historical Data – At least two years of tick or one-minute data to run a solid back-test.

- Broker API – Needed if you want the ATS to place trades automatically.

Setting Up Your ATS Indicator: Step-by-Step

1. Define Your Trading Idea

Write down, in plain words, what you want the indicator to do. Example: “Buy when the 20-period moving average crosses above the 50-period moving average and the ATR is greater than yesterday’s ATR.”

2. Choose Your Platform

Pick a platform that you are comfortable coding in. Popular choices:

- NinjaTrader (C#)

- MetaTrader 5 (MQL5)

- TradeStation (EasyLanguage)

3. Gather Historical Data

Download at least 1000 trades worth of data. The larger the sample, the better.

4. Code the Logic

Inside your OnBarUpdate or equivalent, translate the plain-language rules into code.

if (CrossAbove(EMA(20), EMA(50), 1) && ATR(14)[0] > ATR(14)[1])

{

Draw.ArrowUp(this, "Buy"+CurrentBar, 0, Low[0] - TickSize*2, Brushes.Green);

EnterLong(DefaultQuantity, "Long_Trend");

}5. Back-Test

Run the indicator on historical data. Record key metrics: win rate, average trade, max drawdown, net profit.

6. Optimize

Change parameters (-5-step increments, 10-fold ATR lengths, etc.) and re-test. Avoid curve-fitting by using out-of-sample data.

7. Forward-Test

Apply the optimized settings to live data in simulation mode. At this stage, do NOT connect to your real account.

8. Go Live With Small Size

When forward-test results are satisfactory, trade one micro contract or one mini-lot. Gradually increase only if live performance tracks your test.

Reading the Signals: Entry, Exit, and Filter Rules

Below is a simple layout you can adapt:

| Signal Type | Indicator Reading | Action |

|---|---|---|

| Entry Long | Price closes above upper Bollinger Band AND volume > 20-day average | Buy at market |

| Entry Short | Price closes below lower Bollinger Band AND MACD crosses down | Sell at market |

| Exit Full | Trailing stop of 2 ATR hit | Close position |

| Exit Partial | RSI exceeds 70 for Long, drops below 30 for Short | Close half |

| Filter | Trade only between 08:30 and 15:00 ET | Skip signals outside session |

Tip: Put filter rules in a separate function so you can tweak them without touching core logic.

Risk Management With an ATS Indicator

Even the best ATS Indicator cannot save you from poor money management. Use the following checklist:

- Determine risk capital. Only use funds you can afford to lose.

- Set a daily loss limit. For example, 2% of account equity.

- Use stop orders. Let the platform place stops instantly after entry.

- Apply position sizing. Fixed fractional position sizing is straightforward: risk 1% of balance per trade.

- Monitor slippage. Compare expected fill price vs. actual price to keep tabs on execution quality.

- Pause after a drawdown. A “cool-off” period stops emotional overrides.

Remember: Past performance is not necessarily indicative of future results.

Back-Testing vs. Forward-Testing

| Test Type | What It Does | Strength | Weakness |

|---|---|---|---|

| Back-Test | Runs your logic on old data | Fast, broad sample | Done with hindsight; ignores order queue, slippage |

| Forward-Test | Runs on live or recent data in sim | Shows real-time behavior | Slower, shorter sample |

When results differ, give more weight to forward-testing.

Common Mistakes and How to Avoid Them

- Curve-fitting. Solution: Keep parameter ranges realistic, split data into training and validation groups.

- Ignoring commissions. Always add the broker’s round-turn cost into the test.

- Over-trading. Too many signals can rack up fees. Add a minimum time between trades.

- Skipping maintenance. Update software and check code after platform updates.

- No contingency plan. Prepare for power or internet outages by having a backup VPS.

Case Study: Applying an ATS Indicator to EUR/USD Futures

Objective

Test a simple trend-following ATS Indicator on 6E (EUR/USD) futures.

Rules

- Entry Long: 30-period EMA above 100-period EMA, ADX(14) > 25.

- Entry Short: 30-period EMA below 100-period EMA, ADX(14) > 25.

- Exit: Stop = 1 ATR, Target = 2 ATR, or opposite signal.

- Filter: Trade only between 02:00 and 11:00 ET (highest liquidity).

Data

- Range: Jan 2021 – Dec 2023

- Type: 5-minute bars

- Platform: NinjaTrader 8

Results (Hypothetical)

| Metric | Value |

|---|---|

| Net Profit | $16,450 |

| Win Rate | 46% |

| Avg Trade | $45 |

| Max Drawdown | ‑$1,980 |

| Trades | 364 |

Interpretation

Although the win rate is below 50%, the profit target is twice the stop, leading to positive expectancy. Drawdown stayed under 5% of a $40k account, within acceptable risk.

IMPORTANT: These figures are hypothetical and come with all the limits discussed in the Hypothetical Performance Disclaimer.

Frequently Asked Questions

Q: Can I use an ATS Indicator on a small account?A: Yes, but trade micro futures or small forex lots and keep risk per trade below 1%.

Q: How often should I update my indicator?A: Review performance monthly; update code only when you see a clear edge decay or market change.

Q: Do I need to know how to code?A: Basic coding skills help, but many platforms offer a “strategy builder” with point-and-click interfaces.

Q: What about latency?A: For charts on higher time frames like 5-minute bars, standard broadband is fine. For scalping, consider colocated VPS.

Q: How do I decide between running the ATS Indicator fully automated vs. semi-automated?A: Start semi-automated to build trust in the signals, then switch to full auto once results align with expectations.

Final Thoughts on the ATS Indicator

An ATS Indicator can bring structure and speed to your trading. It turns a well-defined idea into repeatable actions and frees you from minute-by-minute decision stress. Still, no indicator is perfect. Success depends on solid risk management, thorough testing, and discipline. Treat your ATS Indicator as a tool—not a magic solution—and you’ll be in a better position to handle the ups and downs of real-world trading.

Next step: If you want hands-on practice, download our sample ATS Indicator template and try it on historical data today.

Important Risk & Performance Disclosures

RISK DISCLOSURE:Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

HYPOTHETICAL PERFORMANCE DISCLAIMER:Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown; in fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program.

One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all which can adversely affect trading results.

ADDITIONAL DISCLAIMER:Advanced Trading Signals, LLC, assumes no responsibility for your trading results. Past performance does not guarantee future performance and Advanced Trading Signals does not make any performance representations or guarantees. Any chart or trading demonstration produced by Advanced Trading Signals representing trades or in any advertisement, seminar, brochure, magazine or online demonstrations are to be considered hypothetical trades for educational purposes only. No trading system can guarantee profits. Hypothetical trading results can be unreliable.

Have a question about setting up your own ATS Indicator?Leave a comment below or reach out through our contact form.

Vendor Site – Click Here

????YOUTUBE

https://www.youtube.com/@tradeats

| Membership | Yearly Membership |

|---|---|

| Additional Services | Unlock & Decompile |

| Recommended Brokers | Exness Broker, FPMarkets |

| Recommended VPS | FXVM (Low Latency) |

| Youtube Channel | ForexForYou |

| Telegram Channel | Onshoppie Forex EA's & Indicators |

| Telegram Support | Onshoppie Support |

| Installation Guides | Onshoppie Forex Guides |

Brand

Indicator-mt4

Only logged in customers who have purchased this product may leave a review.

Reviews

There are no reviews yet.