Apex Scalper EA v2.2 MT4 + SetFiles For Build 1441+

$9.95

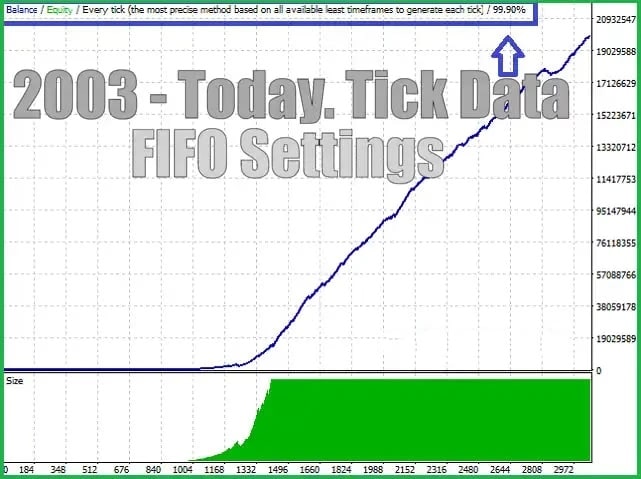

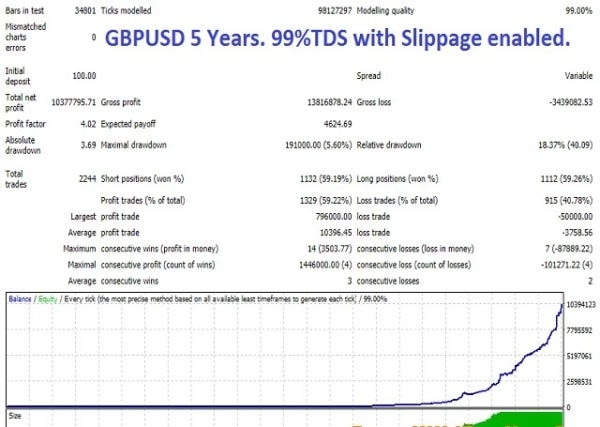

Amazing Apex Scalper EA delivers mind-blowing results for serious traders. Discover the proven way to maximize your forex trading potential now.

Description

Apex Scalper EA Review: A Complete Guide to This Forex Trading Robot

Alternative Title: Apex Scalper EA – Everything You Need to Know About This Automated Trading Tool

Table of Contents

- Introduction of Apex Scalper EA

- What is the Apex Scalper EA?

- Apex Scalper EA Strategy Explained

- Key Features of Apex Scalper EA

- Understanding Apex Scalper EA Settings

- Pros and Cons

- Who Should Use Apex Scalper EA?

- Risk Management Considerations

- Getting Started with Apex Scalper EA

- Final Thoughts

Introduction

This Apex Scalper EA review is an essential read for any trader looking to use this EA. In this review, we delve into the features of the Apex Scalper EA, how it works, as well as its settings. By the end of this review, readers should have a good understanding of the Apex Scalper EA and be able to decide if it is the right tool for their trading needs.

The world of automated trading has grown significantly over the past few years, with more traders turning to Expert Advisors (EAs) to help them trade the forex market. Among these tools, the Apex Scalper EA has gained attention as a potential solution for traders who want to engage in scalping strategies without spending hours monitoring the markets.

What is the Apex Scalper EA?

The Apex Scalper EA is a forex trading robot designed specifically for the MetaTrader 4 platform. This automated trading tool focuses on scalping strategies, which means it aims to make small profits from many trades throughout the day. Unlike many other EAs in the market, this tool claims to use a unique approach to identify trading opportunities.

What makes this EA different from others is its focus on supply and demand zones. The robot is programmed to spot these areas as they develop and enter positions at these key levels. This approach is based on the idea that price movements often respect these zones, creating opportunities for quick profits.

The EA is designed to work primarily on M1 and M5 timeframes, making it suitable for traders who prefer short-term trading strategies. It’s important to note that this is a rapid forex scalper, which means it opens and closes trades quickly to capture small price movements.

Apex Scalper EA Strategy Explained

The Apex Scalper EA strategy revolves around identifying emerging areas of supply and demand as they develop. The algorithm behind this EA is designed to recognize these zones in real-time and enter positions at these levels. The theory is that positions are supported by price fluctuations in these zones, and the EA’s algorithm aims to take advantage of these price movements to generate winning trades.

How the Strategy Works

The EA uses a unique scalping trading algorithm that operates differently from many other automated trading tools. Here’s how it typically works:

- Market Analysis: The EA continuously analyzes price action to identify potential supply and demand zones

- Zone Recognition: When a zone is identified, the EA prepares to enter a position

- Trade Execution: The EA opens trades when price reaches these predetermined levels

- Quick Exit: Trades are closed quickly to capture small profits

One of the key advantages of this approach is that the Apex Scalper EA does not use martingale, grid, arbitrage, or hedging elements. This is important because these strategies can significantly increase risk. By avoiding these risky trading methods, the EA aims to provide a more stable trading experience.

Trading Timeframes

The EA is optimized for M1 and M5 charts, which means it works best on 1-minute and 5-minute timeframes. This optimization is crucial for scalping strategies because these shorter timeframes provide more trading opportunities throughout the day.

Key Features of Apex Scalper EA

The Apex Scalper EA features are designed to provide traders with a comprehensive scalping solution. Here are the main features that make this EA stand out:

Unique Scalping Algorithm

The EA uses a proprietary algorithm that focuses on supply and demand zones rather than traditional technical indicators. This approach aims to provide more accurate entry and exit points for scalping trades.

No Risky Trading Methods

Unlike many other EAs, the Apex Scalper EA does not use:

- Martingale strategies

- Grid trading

- Arbitrage methods

- Hedging techniques

This approach helps reduce the overall risk associated with automated trading.

Multiple Account Support

The EA can be used on unlimited trading accounts, both demo and live. This flexibility allows traders to test the EA thoroughly before committing real money.

MetaTrader 4 Compatibility

The EA is specifically designed for MetaTrader 4, one of the most popular trading platforms in the forex market. This ensures compatibility and ease of use for most traders.

Customizable Settings

The EA comes with various settings that allow traders to adjust the robot’s behavior according to their preferences and risk tolerance.

Understanding Apex Scalper EA Settings

The Apex Scalper EA settings are crucial for optimizing the EA’s performance. Understanding these settings will help you get the most out of this automated trading tool:

Risk Management Settings

Risk Setting: This adjusts the risk settings for dynamic lot size, allowing you to manage your risk effectively. Higher risk settings will result in larger position sizes, while lower settings will keep position sizes smaller.

Choose Money Management: This setting lets you select between fixed or dynamic lot management. Fixed lot management uses the same position size for all trades, while dynamic lot management adjusts position sizes based on account balance and risk parameters.

Initial Balance: This lets you specify the initial account balance that the EA can use for trading, allowing you to manage your risk and capital more effectively.

Trade Execution Settings

Order Offset: This sets the space in pips to offset the order entry levels from the demand and supply zones. This helps fine-tune the entry levels and can improve trade accuracy.

Target Profit: This determines the take profit level for each trade in pips. You can set profit targets based on your trading strategy and market conditions.

Initial Stop Loss: This sets the initial stop loss level in pips, helping to limit losses in case a trade moves against you.

Advanced Settings

BE Activation Pips: This sets the number of profit pips required to activate the breakeven function. Once a trade reaches this level, the stop loss will move to breakeven.

Trailing Stop: This sets the trailing stop in pips, which automatically adjusts the stop loss level if the trade moves in your favor.

Number of Orders to Open: This determines how many orders with various take profit levels the EA will open simultaneously.

Order Expiration Minutes: This sets how long orders remain active before they expire.

Max Order Retry: This sets the maximum number of attempts to enter or delete orders, which can be useful in volatile market conditions.

Pros and Cons

Advantages of Apex Scalper EA

Easy to Use: The EA is designed to be user-friendly, making it accessible to traders of all experience levels.

No Risky Strategies: By avoiding martingale, grid, and hedging strategies, the EA reduces overall risk.

Customizable: The various settings allow traders to adjust the EA according to their preferences.

Multiple Account Support: Can be used on unlimited demo and live accounts.

Supply and Demand Focus: The strategy based on supply and demand zones can be more reliable than indicator-based approaches.

Disadvantages of Apex Scalper EA

High-Speed Trading: The rapid scalping approach can result in higher transaction costs due to frequent trading.

Market Dependency: Scalping strategies work best in certain market conditions and may struggle in others.

Requires Monitoring: While automated, the EA still requires some monitoring to ensure optimal performance.

Minimum Account Balance: The developers recommend a minimum account balance of $200, which may not be suitable for all traders.

Who Should Use Apex Scalper EA?

The Apex Scalper EA is most suitable for:

Short-Term Traders

Traders who prefer short-term trading strategies and want to capture small price movements throughout the day will find this EA particularly useful.

Busy Traders

Those who don’t have time to monitor the markets constantly but still want to participate in scalping strategies can benefit from this automated approach.

Intermediate to Advanced Traders

While the EA is user-friendly, having some understanding of forex trading and risk management will help you get better results.

Traders with Adequate Capital

With a recommended minimum account balance of $200, this EA is suitable for traders who have sufficient capital to handle the rapid trading style.

Risk Management Considerations

Traders who are considering using an automated trading tool like the Apex Scalper EA should be aware of the risks associated with using EAs. Automated tools can never replace the importance of human decision-making and experience in trading.

Important Risk Factors

Speed of Trading: The rapid nature of scalping means that losses can accumulate quickly if the EA encounters unfavorable market conditions.

Market Volatility: Highly volatile markets can cause the EA to behave unpredictably, potentially leading to larger losses.

Technical Issues: Network problems, platform issues, or server downtime can affect the EA’s performance.

Over-Optimization: Relying too heavily on automated trading without understanding the underlying strategy can be risky.

Best Practices for Risk Management

Start with Demo Trading: Always test the EA on a demo account before using it with real money.

Use Proper Position Sizing: Don’t risk more than you can afford to lose on any single trade or trading session.

Monitor Performance: Regularly check the EA’s performance and adjust settings if necessary.

Understand the Strategy: Take time to understand how the EA works and what market conditions favor its strategy.

Set Realistic Expectations: Understand that no trading system is perfect, and losses are part of trading.

Getting Started with Apex Scalper EA

If you decide that the Apex Scalper EA is right for your trading needs, here’s how to get started:

Step 1: Platform Setup

Ensure you have MetaTrader 4 installed and properly configured. The EA is specifically designed for this platform.

Step 2: Demo Testing

Before using real money, test the EA on a demo account. This allows you to familiarize yourself with the settings and observe how the EA performs in different market conditions.

Step 3: Settings Configuration

Configure the EA settings according to your risk tolerance and trading preferences. Start with conservative settings and adjust as you gain experience.

Step 4: Live Trading

Once you’re comfortable with the EA’s performance on demo, you can start live trading with a small account balance.

Step 5: Monitoring and Optimization

Regularly monitor the EA’s performance and make adjustments to settings as needed based on market conditions and results.

Final Thoughts

In my opinion, the strength of the Apex Scalper EA is its ability to identify emerging areas of supply and demand in real-time, allowing it to enter positions at these levels. It provides a range of customizable settings that allow traders to manage their risk and fine-tune their trading strategy. Additionally, it works on both demo and live accounts and is developed for MetaTrader 4.

However, it is crucial to understand the EA’s parameters and settings and how they affect its performance. Therefore, it is essential to approach the review of the Apex Scalper EA with an open and critical mind and consider it alongside other available trading tools.

The EA’s focus on avoiding risky strategies like martingale and grid trading is commendable, as these approaches can lead to significant losses. The supply and demand strategy, while not guaranteed to be profitable, offers a logical approach to scalping that many traders find appealing.

Remember that trading always involves risk, and automated trading tools are not magic solutions. Success with the Apex Scalper EA will depend on proper risk management, realistic expectations, and continuous learning about the markets.

Before committing to this or any other EA, take time to thoroughly test it, understand its limitations, and ensure it fits your overall trading strategy. The forex market is complex and ever-changing, so having a solid understanding of both the tool and the market will give you the best chance of success.

Ready to try the Apex Scalper EA? Start with a demo account and take your time to understand how this automated trading tool works. Remember, successful trading is a marathon, not a sprint, so approach it with patience and proper risk management.

Vendor Site – Private

| Membership | Yearly Membership |

|---|---|

| Additional Services | Unlock & Decompile |

| Recommended Brokers | Exness Broker, FPMarkets |

| Recommended VPS | FXVM (Low Latency) |

| Youtube Channel | ForexForYou |

| Telegram Channel | Onshoppie Forex EA's & Indicators |

| Telegram Support | Onshoppie Support |

| Installation Guides | Onshoppie Forex Guides |

Only logged in customers who have purchased this product may leave a review.

Reviews

There are no reviews yet.