Weis Wave Indicator With Alert MT4 v10.02 For Build 1431

$9.95

Discover the power of Weis Wave Indicator for unparalleled trading success. Learn strategies, boost your profits, and transform your trading journey today.

Description

The Ultimate Guide to Mastering the Weis Wave Indicator

How the Weis Wave Indicator Can Transform Your Trading Strategy

Table of Contents

- Introduction to the Weis Wave Indicator

- Understanding the Weis Wave Indicator

- Key Features of the Weis Wave Indicator

- Setting Up the Weis Wave Indicator

- Trading Strategies Using Weis Wave

- Advanced Techniques: Speed Index and Volume Analysis

- Pros and Cons of the Weis Wave Indicator

- Conclusion: Integrating Weis Wave into Your Trading

Introduction to the Weis Wave Indicator

Weis Wave Indicator is a powerful tool in the arsenal of modern traders, offering unique insights into market dynamics. Based on the theories of Richard D. Wyckoff, this indicator has evolved to become a sophisticated instrument for analyzing price movements and volume patterns across various markets and timeframes.

At its core, the Weis Wave Indicator tracks the ebb and flow of buying and selling pressure, visualizing these forces as waves. This approach allows traders to gain a deeper understanding of market trends, potential reversals, and the strength behind price movements.

Understanding the Weis Wave Indicator

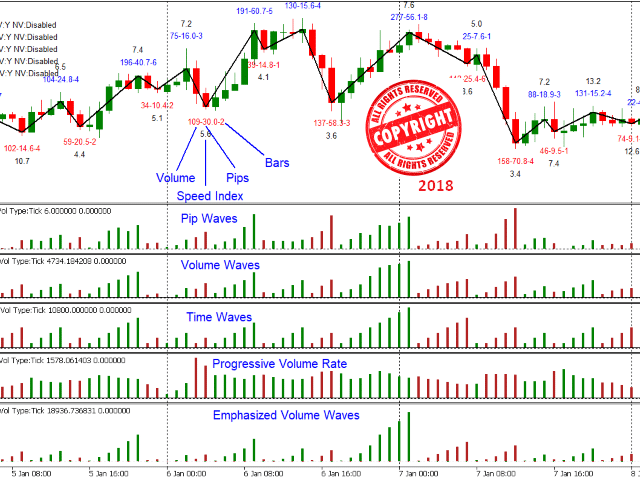

The Weis Wave Indicator operates on a simple yet profound principle: it creates waves based on price movements and volume. Each wave represents a directional move in the market, either up or down. The indicator continues to build a wave in one direction until the price reverses by a specified number of points, at which time a new wave in the opposite direction begins.

What sets the Weis Wave Indicator apart is its ability to incorporate volume data into these waves. This addition provides traders with a more comprehensive view of market activity, highlighting not just price movements but also the conviction behind those moves.

Key Features of the Weis Wave Indicator

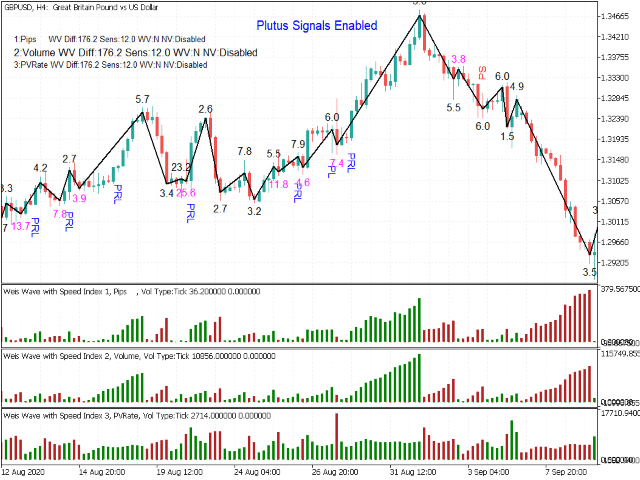

- Autowaves: This feature automatically adjusts the sensitivity of wave creation, ensuring more accurate representation of market movements.

- Multiple Wave Types: The indicator offers five different wave types, including regular volume, pips, progressive volume rate, time, and emphasized volume waves.

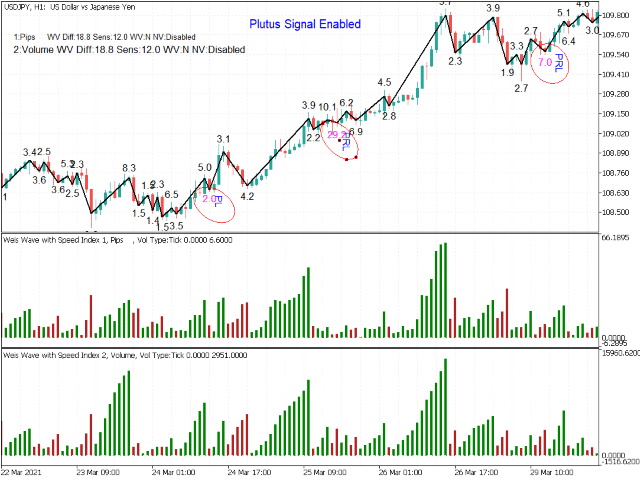

- Speed Index: This powerful tool measures the rate of change in volume, helping traders identify potential trend exhaustion or acceleration.

- Weighted Volume: Adjusts volume representation based on different trading sessions, providing a clearer picture of significant volume across various market hours.

- Net Volume: Offers the ability to analyze buying and selling pressure based on closing prices or median prices.

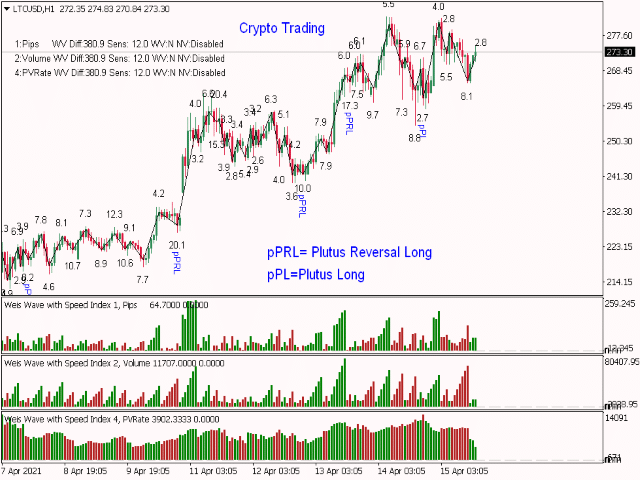

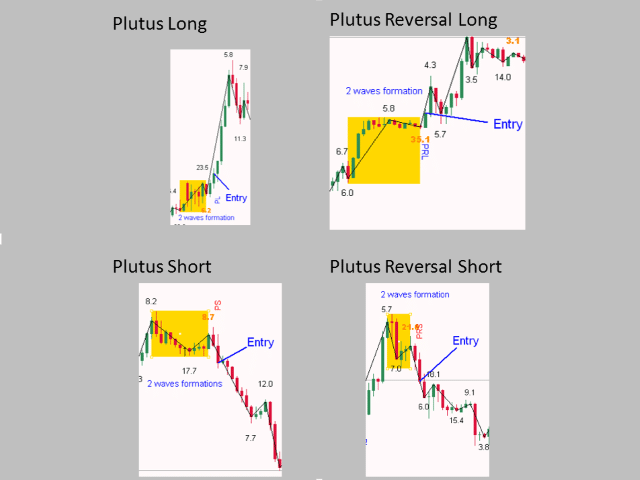

- Plutus Patterns: Identifies specific wave patterns that may indicate potential trading opportunities.

Setting Up the Weis Wave Indicator

To effectively use the Weis Wave Indicator, proper setup is crucial. Here are the key parameters to consider:

- Difference: Set the number of points required for a wave to reverse.

- AutoDifference: Enable this for automatic adjustment of the difference parameter.

- AutoSensitivity: Adjust to control the number of waves formed.

- Wave Type: Choose from the five available types based on your analysis needs.

- Speed Index Display: Select how you want the Speed Index information presented.

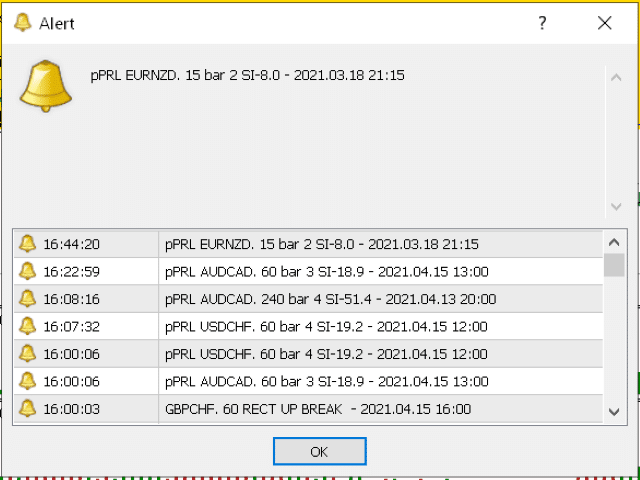

- Volume Alerts: Set thresholds for high volume alerts.

For a complete guide on setup and advanced features, visit Trade the Volume Waves.

Trading Strategies Using Weis Wave

The Weis Wave Indicator can be employed in various trading strategies:

- Trend Identification: Use the direction and size of waves to confirm trend direction and strength.

- Volume Confirmation: Analyze volume associated with each wave to validate price movements.

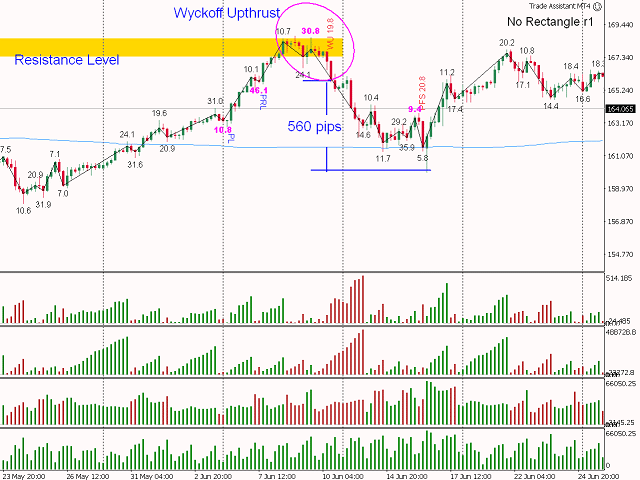

- Divergence Trading: Look for divergences between price action and wave characteristics to spot potential reversals.

- Breakout Confirmation: Use volume waves to confirm the strength of price breakouts.

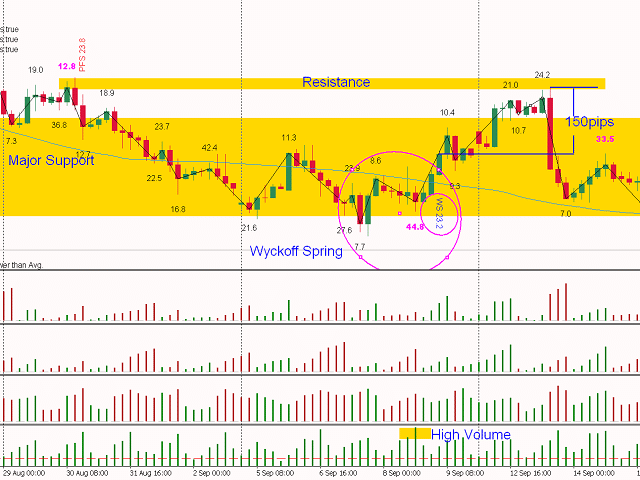

- Support and Resistance: Identify key levels where waves consistently reverse or struggle to continue.

Advanced Techniques: Speed Index and Volume Analysis

The Speed Index is a unique feature of the Weis Wave Indicator that measures the rate of change in volume. This can be particularly useful for:

- Identifying potential trend exhaustion

- Spotting sudden increases in buying or selling pressure

- Confirming the strength of breakouts

Combining the Speed Index with volume analysis can provide deeper insights into market dynamics. For instance, a high Speed Index coupled with increasing volume in the direction of the trend may indicate trend continuation.

Pros and Cons of the Weis Wave Indicator

Pros:

- Provides a visual representation of buying and selling pressure

- Incorporates volume data for more comprehensive analysis

- Offers multiple wave types for versatile analysis

- Includes advanced features like Speed Index and Plutus Patterns

Cons:

- Can be complex for beginners to interpret

- Requires proper setup and understanding for effective use

- Last wave may repaint, which could affect real-time decision making

Conclusion: Integrating Weis Wave into Your Trading

The Weis Wave Indicator is a sophisticated tool that can significantly enhance your trading analysis when used correctly. By providing insights into price movements, volume patterns, and market dynamics, it allows traders to make more informed decisions.

To truly master the Weis Wave Indicator, consider the following steps:

- Study the indicator thoroughly, understanding each component and its significance.

- Practice using the indicator on historical data to familiarize yourself with its patterns and signals.

- Start integrating the indicator into your live trading gradually, using it alongside your existing strategies.

- Continuously refine your approach, noting which aspects of the indicator work best for your trading style and preferred markets.

Remember, while the Weis Wave Indicator is powerful, it should be used as part of a comprehensive trading strategy that includes proper risk management and continuous learning.

For more detailed information on trading strategies and to access training resources, visit Trade the Volume Waves. Consider reaching out for the two-hour webinar, training room access, and complete manual to fully leverage the potential of this indicator in your trading journey.

Vendor Site – Click Here

| Membership | Yearly Membership |

|---|---|

| Additional Services | Unlock & Decompile |

| Recommended Brokers | Exness Broker, FPMarkets |

| Recommended VPS | FXVM (Low Latency) |

| Youtube Channel | ForexForYou |

| Telegram Channel | Onshoppie Forex EA's & Indicators |

| Telegram Support | Onshoppie Support |

| Installation Guides | Onshoppie Forex Guides |

Brand

Indicator-mt4

Only logged in customers who have purchased this product may leave a review.

Reviews

There are no reviews yet.