US Odyssey US30 EA FTMO MT4 For Build 1441+

$9.95

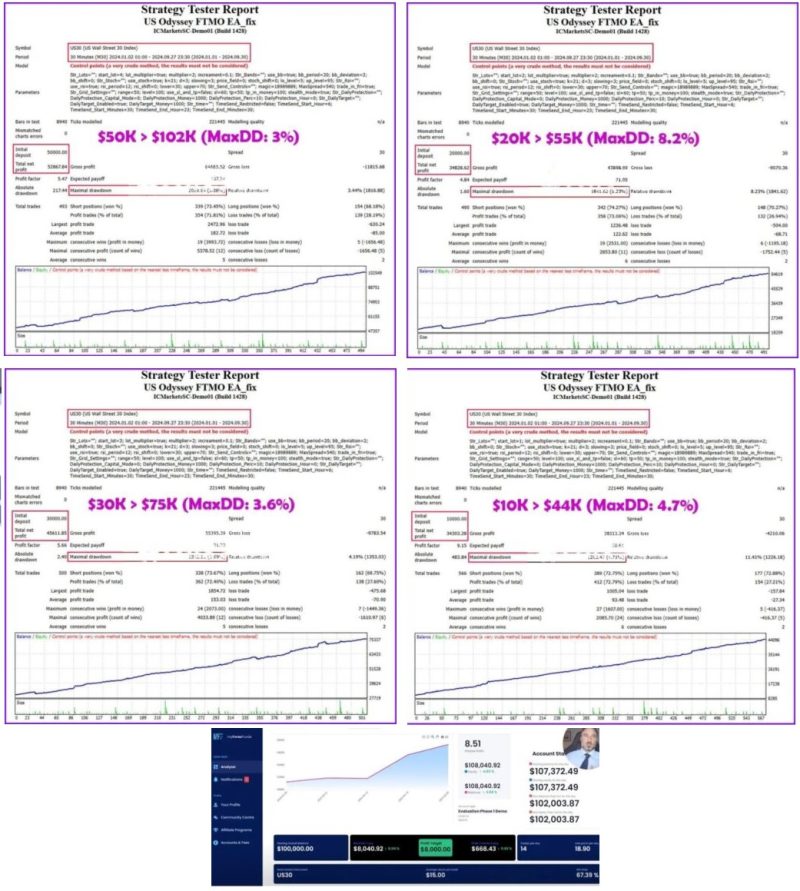

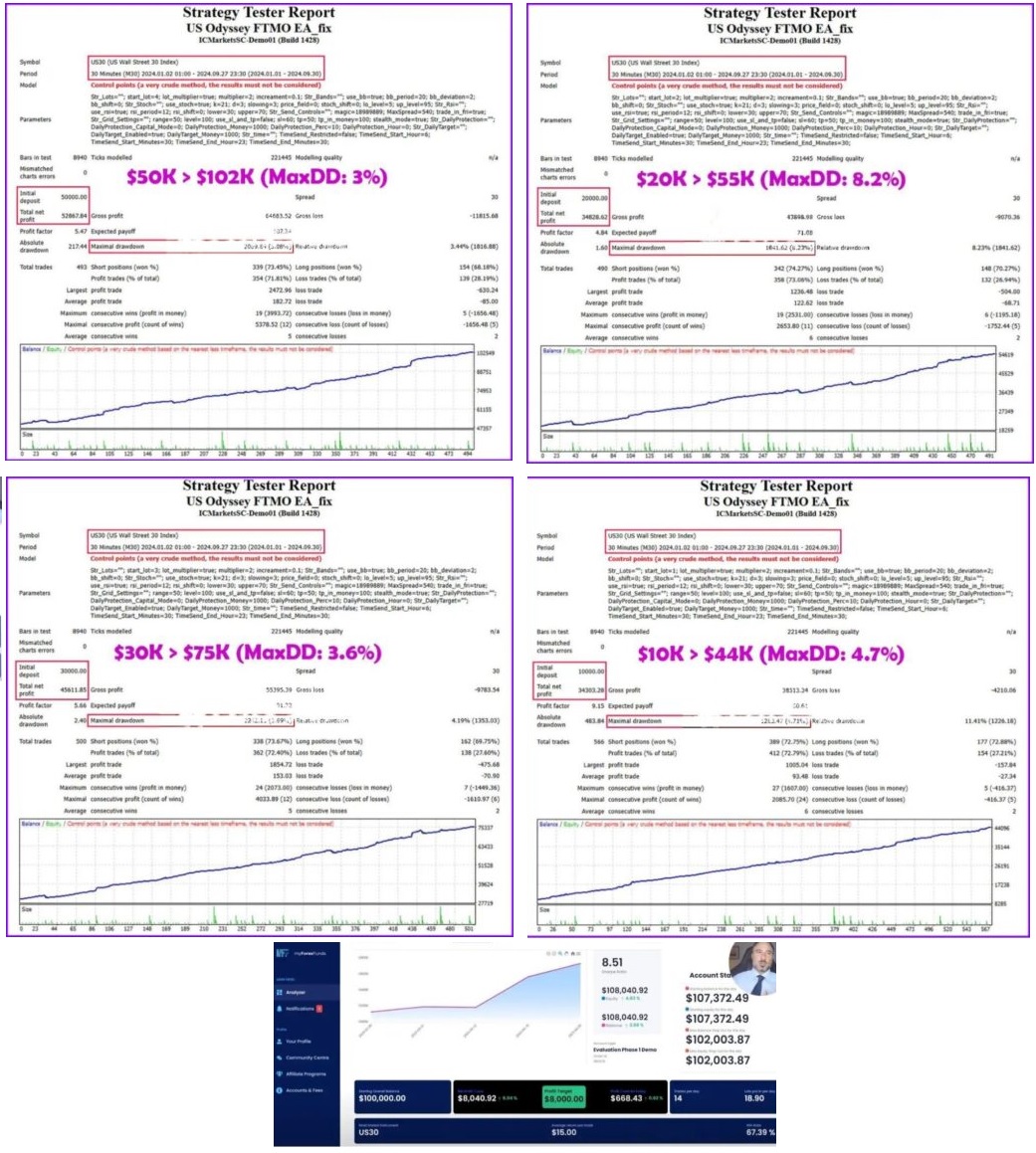

Experience powerful US Odyssey US30 EA results! Jubilant traders reveal how to maximize gains. Get the edge with this innovative and reliable trading tool.

Description

US ODYSSEY US30 EA: The Complete Guide for FTMO and Prop Firm Traders

US ODYSSEY US30 EA – A Smart Way to Trade the US30 Index

Table of Contents

- What Is the US ODYSSEY US30 EA?

- Why the EA Focuses on the US30 Index

- How It Helps You Pass the FTMO Challenge

- Key Features

- Step-by-Step Setup on MetaTrader 4

- Best Practice Settings for Different Prop Houses

- Tips for Ongoing Optimization

- Common Questions and Troubleshooting

- Final Thoughts

What Is the US ODYSSEY US30 EA?

INTRODUCING US ODYSSEY US30 EA, a specialized forex trading robot designed to trade the US30 index on MetaTrader 4. The expert advisor (EA) was built with FTMO-funded accounts in mind, but it also works on other proprietary trading platforms.

The EA tackles three common hurdles:

- Meeting strict profit targets

- Staying within daily and overall loss limits

- Managing trades during high-impact news

Because it was created for prop firms, it comes with default settings that match the risk rules most firms use. For individual retail traders, those settings can be fine-tuned for personal targets.

Why the EA Focuses on the US30 Index

The US30 (often called the Dow Jones 30) is popular among day traders because it:

- Has wide daily ranges, which gives room for quick trade setups

- Reacts clearly to scheduled U.S. economic releases

- Offers high liquidity during the New York session

By specializing in one symbol, the US ODYSSEY US30 EA can:

- Collect a deep data pool for that single market.

- Adapt its strategy to the unique price swings of the index.

- Keep spreads and slippage low, because brokers usually quote tight spreads on the Dow.

For traders facing FTMO or similar challenges, this focus means fewer variables and easier monitoring of drawdown.

How It Helps You Pass the FTMO Challenge

Passing an FTMO Challenge is about meeting two key goals: reach the profit target and stay under the allowed drawdown. The US ODYSSEY US30 EA supports both goals.

- Profit Target Support

- Sophisticated entry logic places trades during optimal volatility windows.

- Partial take-profit levels lock in gains early, leaving a portion to ride larger moves.

- Drawdown Control

- An account-wide risk cap shuts down new trades if daily loss reaches a set percentage.

- Dynamic lot sizing adjusts position size to current equity, reducing the chance of breaching limits.

Because these checks run automatically, the EA reduces emotional trading and human error, which are common reasons people fail a prop-firm assessment.

Key Features

Consistent Performance

- Uses a blend of trend-following and mean-reversion logic.

- Trades only during specific time blocks to avoid random market noise.

- Stores past market behavior to refine future decisions.

Robust Risk Management

- Stop-loss is hard-coded and can’t be removed by mistake.

- Equity guard stops trading if the account falls below a user-defined level.

- Maximum open trades can be set to one, two, or three positions, which keeps margin usage in check.

User-Friendly Interface

- Clean control panel on the chart shows live stats: current risk, open positions, daily profit/loss.

- Each input field in the settings window has a plain-language note.

- Comes with a PDF manual and short video walkthroughs.

Step-by-Step Setup on MetaTrader 4

- Download the EA file (US_Odyssey_US30_EA.ex4).

- Open MetaTrader 4 → File → Open Data Folder.

- Navigate to MQL4 → Experts and paste the EA file.

- Restart MetaTrader 4.

- Open a US30 chart on the 1-minute or 5-minute timeframe (the EA auto-detects the correct chart interval).

- Drag the EA onto the chart.

- Enable:

- “Allow live trading”

- “Allow DLL imports” (needed for the equity guard)

- Enter your risk settings:

- Risk per trade (as % of equity)

- Daily loss limit

- Maximum total loss limit

- Click “OK.”

- Check that the smiley face in the top right corner is active, showing the EA is running.

Tip: If you run an FTMO account, enter the daily loss limit at 4.5 % and the maximum loss at 9 % to match FTMO rules.

Best Practice Settings for Different Prop Houses

| Prop Firm | Daily Loss | Max Loss | Max Lots* | Suggested Time Window | Default Spread Filter |

|---|---|---|---|---|---|

| FTMO | 4.5 % | 9 % | 5 | 13:30–16:00 UTC | 3.0 |

| MyForexFunds | 5 % | 12 % | 6 | 12:30–18:00 UTC | 3.5 |

| The5ers | 3 % | 6 % | 3 | 14:00–17:00 UTC | 2.5 |

*“Max Lots” is the total open lot exposure across all positions.

These values keep the EA within each firm’s guidelines, but you can adjust them if the rules change.

Tips for Ongoing Optimization

- Update the EA version whenever a new build is released. Each update usually includes improved filters for news events.

- Use the built-in news filter to avoid NFP, FOMC, and CPI releases.

- Review the EA’s trade journal once a week. If the average trade length moves above 60 minutes, tighten the stop-loss to bring it back to the intended range.

- Run a monthly back-test on fresh tick data to make sure spread and slippage have not changed on your broker.

- Keep a written log of any parameter tweaks. This record helps you understand which changes boosted or reduced performance.

For deeper insight, you can read our tutorial on building a simple trading log (external link).

Common Questions and Troubleshooting

Q1: The EA shows “Not Trading – Market Closed.”A: The EA only trades during the chosen session; outside these hours, it stays idle by design.

Q2: Stop-loss was hit three times in one day. Is that normal?A: On high-volatility days, this can happen. Consider lowering risk per trade from 1 % to 0.5 % to spread risk across more days.

Q3: The equity guard closed all trades. What now?A: Wait until the next trading day. The guard resets at midnight server time. If you are in a prop challenge, this protects your account from breaching rules.

Q4: Can I use it on MetaTrader 5?A: A MetaTrader 5 version is in beta. For now, the stable release is MT4 only.

Q5: Does it work on other symbols like NAS100 or SPX500?A: The logic is tuned for US30. Testing on other symbols has not shown the same consistency. Using it elsewhere voids the consistent performance claim.

Final Thoughts

The US ODYSSEY US30 EA gives traders a structured path to trading the Dow Jones 30 on MetaTrader 4. By combining consistent performance, robust risk management, and an easy interface, it addresses the main pain points of prop-firm challenges such as FTMO.

Whether you are starting your first demo or already trading with firm capital, this expert advisor can help you stick to clear rules and focus on results.

Have you tried the EA? Share your experience in the comments below and don’t forget to check out our in-depth review of other prop-trading tools (internal link).

Call to ActionIf you found this guide useful, subscribe to our mailing list for updates on the latest expert advisors and prop-firm strategies. Input your email in the form at the bottom of the page and stay on top of your trading game.

Vendor Site – Click Here

Only logged in customers who have purchased this product may leave a review.

Reviews

There are no reviews yet.