Smart Hub AI EA MT4 Expert Advisor

$19.99

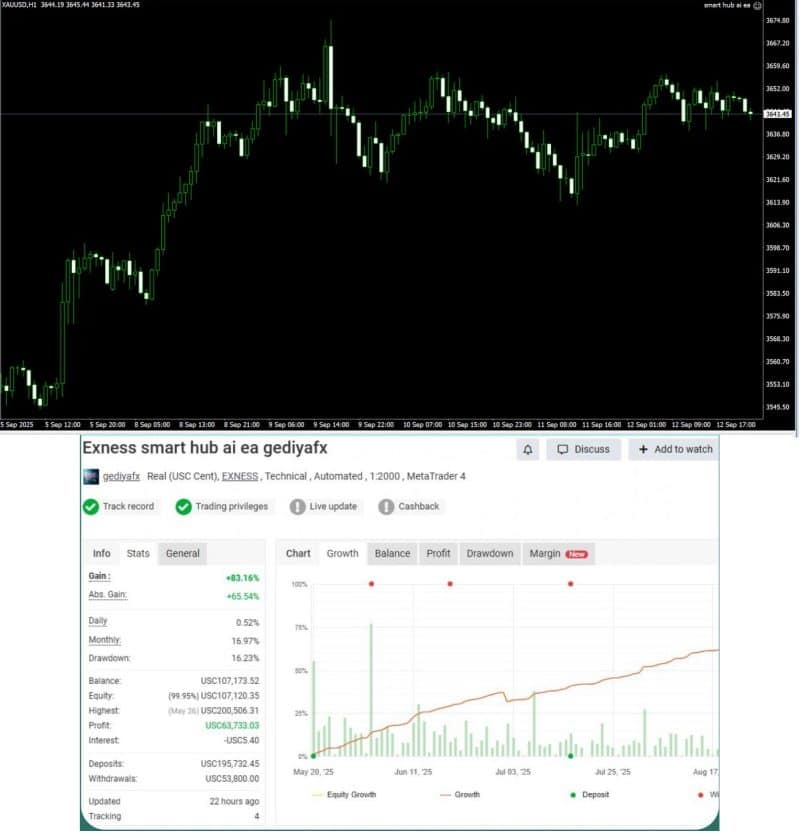

Ultimate guide to Smart Hub AI EA delivers thrilling trading results. Learn proven strategies and expert tips for automated forex success now.

Description

Smart Hub AI EA: The All-In-One Trading Brain for Gold, Forex & Indices

Smart Hub AI EA – Why Centralizing Your Strategy Changes Everything

Alternative title

Smart Hub AI EA: One Hub for Signals, Risk, News, and Prop-Firm Rules

Table of contents

- Introduction: What Makes Smart Hub AI EA Different?

- Core Concept: One Hub, Many Jobs

- AI Signal Hub Explained

- Regime Detection: Reading the Market Mood

- Smart Risk Layer: Numbers First, Emotions Out

- News & Spread Filter: Trade When It Makes Sense

- Prop-Friendly Mode: Pass and Keep Those Funded Accounts

- Portfolio Ready: Attach, Monitor, Repeat

- Step-by-Step Setup Guide

- Real-World Use Cases

- Pros and Cons

- Frequently Asked Questions

- Key Takeaways

- Final Thoughts & Call to Action

1. Introduction: What Makes Smart Hub AI EA Different?

Smart Hub AI EA is a next-generation trading engine that rolls signal generation, risk controls, and market awareness into one neat package. Built for XAUUSD, major forex pairs, and leading indices, it watches volatility in real time and changes its settings on the fly. Think of it as a reliable co-pilot: it checks momentum, structure, and regime before pressing the buy or sell button, and it never drifts into martingale or uncontrolled grid tactics.

Many automated strategies claim to “learn the market.” Most end up doing two things traders fear:

- Chase every candle move, leading to overtrading

- Add to losers in a grid or martingale, hoping for a bounce

Smart Hub AI EA avoids both. It scores every setup, enters only when the odds match your rules, then locks in profit or cuts losses with zero drama. That single idea—centralizing logic, risk, and news filters—is the backbone of this expert advisor.

2. Core Concept: One Hub, Many Jobs

| Hub Feature | Job in Plain English |

|---|---|

| AI Signal Hub | Spots high-probability trades by mixing momentum, pullback, and breakout methods |

| Regime Detection | Learns if price is trending, ranging, or erratic; tweaks buffers and stops |

| Smart Risk Layer | Sets fixed or % risk, partial take profit, trailing, and daily caps |

| News & Spread Filter | Keeps you out of trades around high-impact events or wide spreads |

| Prop-Friendly Mode | Fits common prop-firm daily drawdown and max loss rules |

| Portfolio Dashboard | Shows exposure, open P/L, and risk per symbol in one place |

Why pack all that into one EA?

- Fewer moving parts, less room for error

- Consistent rules across every symbol

- Clear audit trail for funded accounts

3. AI Signal Hub Explained

3.1 How the Scoring Works

Smart Hub AI EA scores each candle using three elements:

- Momentum (speed and direction)

- Structure (support, resistance, trendline touches)

- Regime (ATR/ADR relative to normal conditions)

Each item gets a numeric weight. When the combined score crosses a threshold, the EA arms itself to trade. Only if multiple time frames agree—say H1 momentum plus M15 alignment—does it send a real order.

Example:

Score = (0.4 × Momentum) + (0.4 × Structure) + (0.2 × Regime)

If Score ≥ 75 → trade allowed3.2 Pending vs. Market Orders

Breakouts usually trigger a pending stop order above resistance or below support.Pullbacks often use limit orders to enter near fair value.The EA chooses the order type based on the regime (quiet, normal, or volatile).

3.3 Confidence at a Glance

On chart, a color bar shows:

- Green: High confluence

- Yellow: Medium, stand by

- Red: Low, no trade

4. Regime Detection: Reading the Market Mood

Markets switch from calm to stormy without notice. Using ATR (Average True Range) and ADR (Average Daily Range), Smart Hub AI EA places each session into one of three buckets:

- Trend

- Range

- High-volatility spike

For example, if ATR is 1.5× the 20-day mean, the EA labels it “high-volatility” and widens stops. In a stable range, stops may tighten and take-profit levels shrink. This auto-adjustment keeps risk per trade stable even when gold jumps $40 in an hour.

5. Smart Risk Layer: Numbers First, Emotions Out

Good signals fail if risk is random. Smart Hub AI EA handles risk in layers:

5.1 Entry Risk

- Fixed lot or risk-% of balance/equity

- Hard stop-loss (in pips or ATR multiples)

5.2 Profit Management

- Partial take-profit at level 1 (e.g., 50%)

- Breakeven move when price clears level 1

- ATR trailing stop for the runner

5.3 Account Protection

- Daily loss cap (e.g., –2%)

- Equity guard (e.g., close all if drawdown hits –5%)

- Max trades per day/session

5.4 No Martingale, No Forced Grid

The EA may scale into winners linearly (e.g., +1× original lot) but never doubles down on losers. Default presets leave scaling off for clarity.

6. News & Spread Filter: Trade When It Makes Sense

Economic events move XAUUSD and major FX pairs fast. The built-in calendar blocks entries:

- X minutes before and after red-flag news (NFP, CPI, FOMC, etc.)

- During recorded bad-spread hours (e.g., rollover, holiday liquidity gaps)

If spread widens beyond a user-set cap or slippage goes over X points, pending orders stay paused. The EA re-checks every minute until conditions normalize.

Tip: See ForexFactory Calendar to confirm event impact.

7. Prop-Friendly Mode: Pass and Keep Those Funded Accounts

Rules vary, but most prop firms ask you to:

- Avoid daily loss > X%

- Avoid total drawdown > Y%

- Trade a minimum number of days

- Keep lot size consistent

Smart Hub AI EA ships with templates:

- 100k challenge

- 200k challenge

- Evaluation vs. Funded phases

Each template sets tighter daily stops, equity guards, and max lots to match firm rules. You can’t accidentally blow the account by fat-fingering lot size.

8. Portfolio Ready: Attach, Monitor, Repeat

You can run the EA on gold, EURUSD, GBPUSD, USDJPY, US30, GER40, and NAS100 at the same time. A central dashboard pops up:

- Open trades by symbol

- Risk per trade and total risk

- Daily P/L and drawdown

- Current regime status

Color coding turns red if total risk crosses your limit, giving time to act.

9. Step-by-Step Setup Guide

Below is a quick guide in plain language. For full screenshots, visit our support page.

9.1 Files & Platform

- Copy

SmartHubAI.ex4or.ex5intoMQL4/ExpertsorMQL5/Experts. - Restart MetaTrader 4/5.

- Enable auto-trading.

9.2 First Launch

- Load gold chart, set to M15 or H1.

- Drag EA onto chart.

- Pick a preset:

Gold_DefaultorProp_100k.

9.3 Key Inputs to Check

RiskPercent= 1.0 (or your number)DailyLossCap= 2.0ATRMultiplierSL= 1.5NewsBufferMinutes= 30

9.4 Attach to More Symbols

- Repeat steps on EURUSD, US30, etc.

- Watch dashboard for exposure.

9.5 Testing Tips

- Use 99% tick data if possible.

- Walk-forward optimize only signal weights; leave risk identical.

10. Real-World Use Cases

10.1 Swing Trading Gold

- Chart: XAUUSD H1

- Regime: Trend

- Outcome: 2R winner on breakout, trail caught $18 move

10.2 Passing a Prop Challenge

- Account: 100k evaluation

- Daily max loss: 5k

- Settings: Prop_100k template

- Result: 8% target hit in 14 trading days, zero rule violations

10.3 Index Scalping During London Open

- Symbol: GER40 M15

- Regime: High-volatility spike

- Strategy: Pullback to VWAP, partial TP at +1R, trail runner

- Notes: Three scalps per session, risk 0.5% each

11. Pros and Cons

| Pros | Cons |

|---|---|

| Centralized logic & risk, less to track | Needs stable VPS for real-time news filter |

| Built-in prop rules save headaches | Too many symbols may dilute focus if underfunded |

| No martingale or forced grid | Still relies on MT4/MT5 environment constraints |

| Multi-timeframe scoring reduces false entries | Learning curve: many parameters to adjust |

| Dashboard gives quick exposure overview | Out-of-hours spreads can still bite if server slow |

12. Frequently Asked Questions

Q1. Does Smart Hub AI EA “learn” like machine learning?A1. It uses a fixed scoring model that feels like AI but doesn’t retrain in real time. The logic is transparent and adjustable.

Q2. Can I run it on crypto?A2. The EA was designed for gold, FX, and indices. Crypto pairs may show promise if spread is tight, but no default presets exist.

Q3. What is the minimum balance?A3. We suggest at least $1,000 on a 0.01 minimum-lot broker to let percent-risk sizing work.

Q4. Do I need a news API key?A4. No. The EA pulls data from built-in sources. Make sure Allow WebRequest for the listed URLs in MT options.

Q5. How often do I update?A5. Minor updates roll out every quarter. You’ll get an alert inside MT with a link to download.

13. Key Takeaways

- Smart Hub AI EA puts signal, risk, and news filters in one place.

- The AI Signal Hub scores momentum, structure, and regime across time frames.

- Regime detection auto-switches parameters for trend, range, or volatile markets.

- Smart Risk Layer covers SL/TP, partial exits, trailing, and account-wide guards.

- News & Spread Filter blocks bad entries around high-impact events and thin liquidity.

- Prop-Friendly Mode matches common drawdown rules, helping you keep funded accounts.

- Attach the EA to multiple symbols and watch exposure on a single dashboard.

14. Final Thoughts & Call to Action

Automated trading should simplify life, not add stress. Smart Hub AI EA aims to do exactly that by keeping every moving part—signals, risk, news, and portfolio view—inside one hub. Whether you trade gold breakouts, forex swings, or index scalps, consistent rules and clear risk limits are what matter.

Ready to see it in action?

- Download

- Backtest on your favorite pairs, or run it live on a small account.

- Join the community chat for tips, presets, and weekly performance reports.

Have a question or want to share a setup idea? Drop a comment below or send us a note. Happy trading with Smart Hub AI EA!

Vendor Site – Private

| Membership | Yearly Membership |

|---|---|

| Additional Services | Unlock & Decompile |

| Recommended Brokers | Exness Broker, FPMarkets |

| Recommended VPS | FXVM (Low Latency) |

| Youtube Channel | ForexForYou |

| Telegram Channel | Onshoppie Forex EA's & Indicators |

| Telegram Support | Onshoppie Support |

| Installation Guides | Onshoppie Forex Guides |

Only logged in customers who have purchased this product may leave a review.

Reviews

There are no reviews yet.