ScalpPrime EA MT4 v2.3 + SetFiles For Build 1441+

$9.95

Discover the ultimate ScalpPrime EA with thrilling results that’ll transform your trading. Get exclusive insights and proven strategies for maximum profits.

Description

ScalpPrime EA: The Practical Gold-Scalping Expert Advisor Every MT4 Trader Should Know

Alternative Title

ScalpPrime EA – Your Step-by-Step Guide to Smart Gold Scalping on MetaTrader 4

Table of Contents

- ScalpPrime EA in a Nutshell

- Why Focus on Gold (XAUUSD) Scalping?

- How the Dual Strategy Engine Works

- Key Features at a Glance

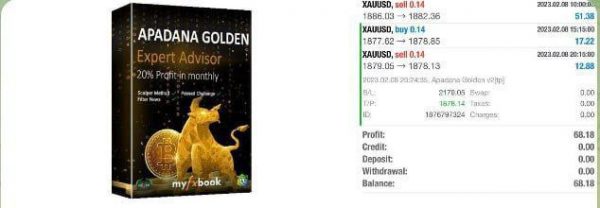

- Built-In Risk Management

- Author Profile: Phathutshedzo Tshivhasa

- Installation and First-Time Setup

- Customising Inputs and Parameters

- Economic News Filter Explained

- Trading Session Filters

- Prop-Firm Compatibility

- Back-Testing and Live Metrics

- Best Practices for Day-to-Day Use

- Frequently Asked Questions

- Final Thoughts

- Get Started with ScalpPrime EA

1. ScalpPrime EA in a Nutshell

ScalpPrime EA is a professional-grade Expert Advisor built for MetaTrader 4 (MT4) with a narrow focus on XAUUSD (gold). It relies on a short-term, rule-based framework that blends Fibonacci retracement zones with volume confirmations to find high-probability entry points. The approach is disciplined and avoids martingale, grid, and arbitrage techniques.

- Primary Platform: MetaTrader 4

- Target Instrument: XAUUSD (gold)

- Core Style: Short-term scalping

- Risk Control: 3-step linear recovery, no aggressive compounding

In short, ScalpPrime EA gives traders an organised way to trade gold in minutes or even seconds rather than hours or days.

2. Why Focus on Gold (XAUUSD) Scalping?

Gold is one of the most liquid markets in the world. During active sessions, spreads stay tight, and price moves often respect technical zones. This makes XAUUSD appealing for quick in-and-out trades.

Key reasons traders pick gold:

- High Liquidity – Orders fill quickly on most brokers.

- Clear Technical Behaviour – Fibonacci levels often act as support and resistance.

- Extended Trading Hours – Unlike stocks, gold trades nearly 24/5.

- Reaction to Global News – Economic events move gold fast, offering multiple trade setups a day.

ScalpPrime MT4 was designed to capture those small yet frequent moves while keeping risk steady.

3. How the Dual Strategy Engine Works

The heart of ScalpPrime EA is its dual strategy engine, which marries two methods:

| Component | What It Does | Why It Matters |

|---|---|---|

| Fibonacci Retracement Logic | Draws retracement levels on recent swings and looks for price tests of the 38.2 %, 50 %, or 61.8 % zones. | These zones often mark temporary reversal points in gold. |

| Volume-Based Confirmation | Checks tick-volume spikes to see if there is genuine market interest near the Fib zone. | Filters out false signals that occur in thin market conditions. |

A trade is placed only when both conditions line up in the same direction. That layered confirmation keeps the strategy selective and helps reduce entries that might otherwise dip into drawdown.

4. Key Features at a Glance

- Bidirectional Trading – Takes both long and short positions, so it can trade whatever direction gold picks.

- No-Martingale and No-Grid – Keeps position sizing linear and predictable.

- 3-Step Recovery Mode – Increases lot size by just 0.01 lot for up to three trades after a loss, then resets.

- Advanced Input Controls – Choose between fixed lots or risk-based lots tied to account balance.

- Economic News Filter – Pauses new trades before high-impact events.

- Trading Session Filter – Restricts trading to times of day you pick, cutting exposure during slow or highly volatile sessions.

- Prop-Firm Friendly – Fits well within common proprietary firm rules that ban martingale and mandate low drawdown.

5. Built-In Risk Management

Keeping risk small is central to ScalpPrime EA. Here is what the EA does to protect your account:

- Fixed or %-Based Lot Sizes – Decide on a flat 0.01 lot or set the EA to risk, say, 1 % of equity each trade.

- Hard Stop-Loss and Take-Profit – SL and TP levels are pre-defined in pips or based on ATR so you always know your worst-case scenario.

- 3-Step Recovery System – After a losing trade the lot size goes up by only 0.01 lot for three tries. If those fail, the EA resets to the base lot. This prevents steep drawdowns often seen with classic martingale.

- Daily Loss Limit (optional) – Tell the EA to stop new trades after hitting a set loss figure for the day.

- News and Session Filters – Avoids trading when spreads widen or liquidity dries up.

6. Author Profile: Phathutshedzo Tshivhasa

The EA is compiled by Phathutshedzo Tshivhasa, a software developer with more than one year of focused work on the MQL5 language. Despite the relatively short time, he has published several well-known tools:

- ScalpPrime MT4 – The flagship EA we are reviewing here.

- BTC Spiral MT4

- Spiral Ascend MT4

Phathutshedzo’s coding style favours clarity, risk control, and modular design. Each update is tested on multiple brokers before public release. You can view his profile and other products on the official MQL5 Market.

7. Installation and First-Time Setup

Follow these quick steps to get ScalpPrime EA running on your MT4 terminal:

- Download the EA from the MQL5 Market or the author’s website.

- Open MetaTrader 4. If you do not have MT4, download it at MetaQuotes.

- Go to File → Open Data Folder → MQL4 → Experts. Copy the ScalpPrimeEA.ex4 file into the folder.

- Restart MT4.

- Drag the EA onto an XAUUSD M1 or M5 chart. The developer recommends M1 for best granularity, M5 if your broker’s spreads are wider.

- Check Allow Live Trading in the Common tab.

- Press the AutoTrading button in the toolbar so it turns green.

The EA will now begin looking for valid setups.

8. Customising Inputs and Parameters

ScalpPrime EA provides a tidy list of inputs. Here is a plain-language breakdown:

| Input Name | What It Controls | Typical Range |

|---|---|---|

| Base Lot Size | Starting trade size if using fixed lots. | 0.01 – 1.00 lot |

| Risk % per Trade | Risk-based size. EA ignores Base Lot if this is above 0. | 0.5 – 2 % |

| Recovery Steps | Number of 0.01 lot increases after a loss. | 0 – 3 |

| Max Trades | Maximum simultaneous positions. | 1 – 5 |

| Stop-Loss (pips) | Hard distance in pips. | 30 – 150 |

| Take-Profit (pips) | Profit target per trade. | 15 – 100 |

| News Impact Level | Low, Medium, High. | Medium/High usually |

| News Pause Minutes | Minutes before and after news when EA will not trade. | 15 – 60 |

| Session Start/End | hh:mm server time. | 00:00–23:59 |

Experiment with these in a demo account first. Keep notes so you can roll back to earlier settings if needed.

9. Economic News Filter Explained

Gold often jumps on news like U.S. Non-Farm Payrolls or CPI data. ScalpPrime EA downloads a public economic calendar and cross-checks for gold-related events.

Two parts matter:

- Impact Level – Only pause trading for “High” events if you want more trades.

- Delay Window – A 30-minute gap on each side of the event is common.

If you actively follow news, match the filter to your routine. Daytime traders sometimes leave Medium events on and pause only for High.

10. Trading Session Filters

Not all hours are equal for gold. Liquidity changes:

- Asian Session: Quieter but can still move on yen and yuan news.

- London Session: Spreads tighten, volatility climbs.

- New York Session: Gold reacts to U.S. data and equity openings.

ScalpPrime EA allows you to set multiple trading windows. Many users enable London + New York overlap (about 12:00–16:00 UTC) and disable late-Friday trading to avoid weekend gaps.

11. Prop-Firm Compatibility

Most proprietary trading companies (e.g., FTMO, MyForexFunds) have rules such as:

- No martingale or grid.

- Daily loss limit (often 5 %).

- Max overall drawdown (usually 10 %).

ScalpPrime EA respects these by:

- Linear Recovery – Small, fixed increases in lot size.

- Hard Stops – Every trade has a visible SL.

- News Filter – Reduces risk on volatile releases that could breach limits.

Tip: Set your daily loss stop in the EA slightly below the prop firm’s limit (e.g., 4.5 %) to build a buffer.

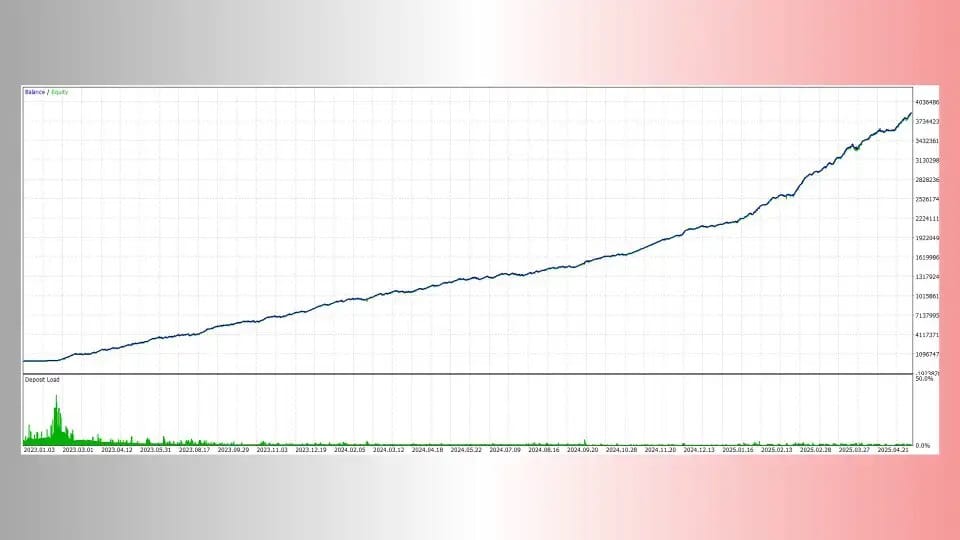

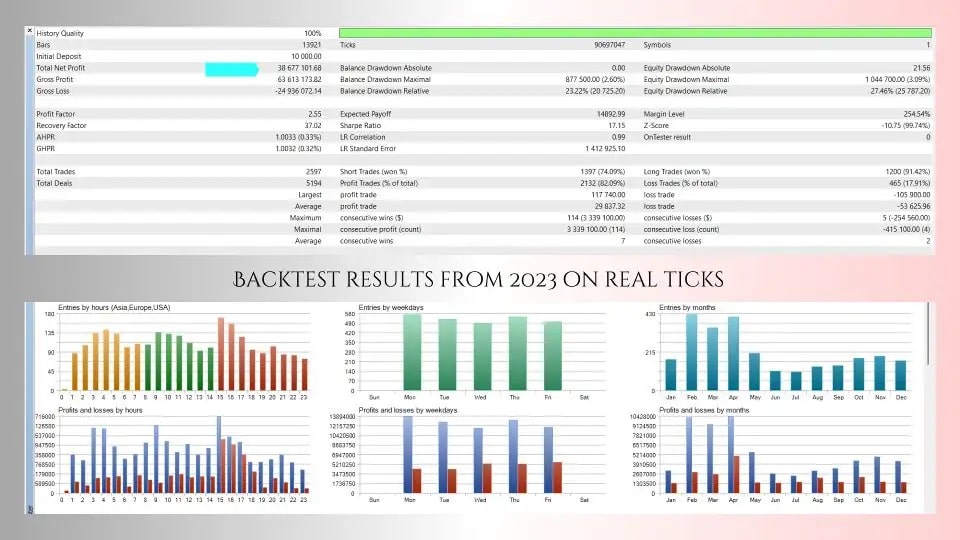

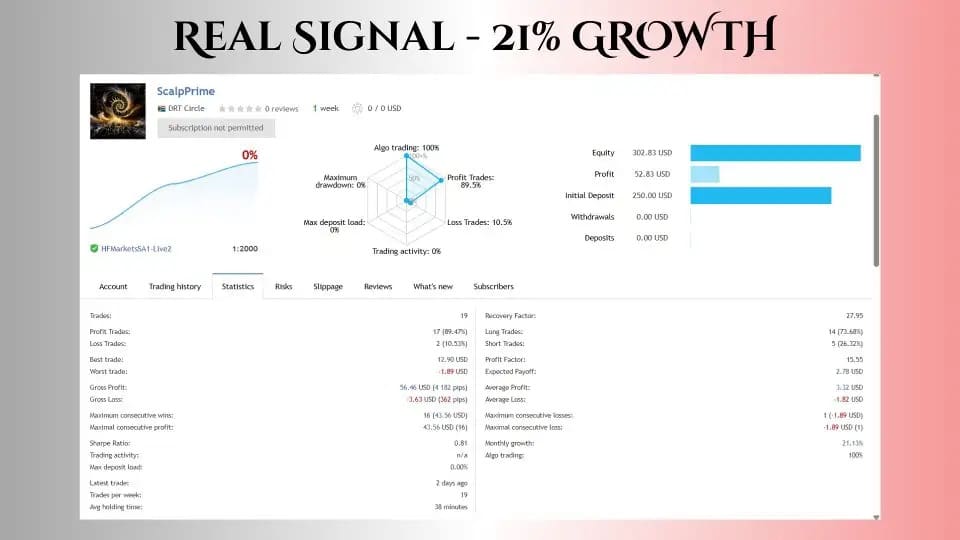

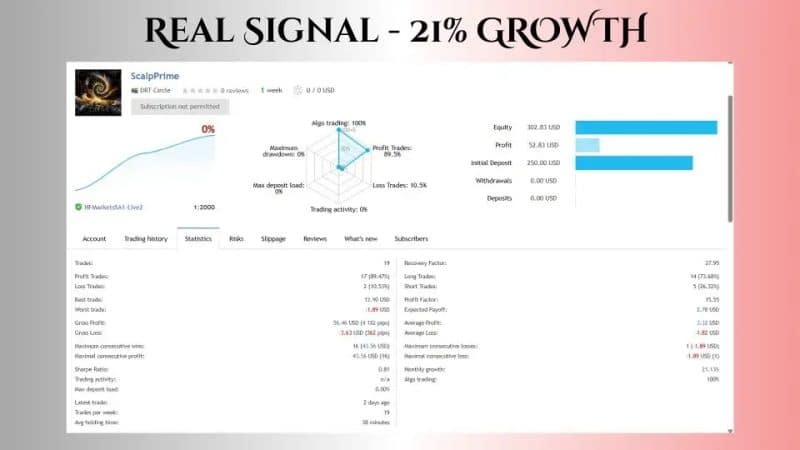

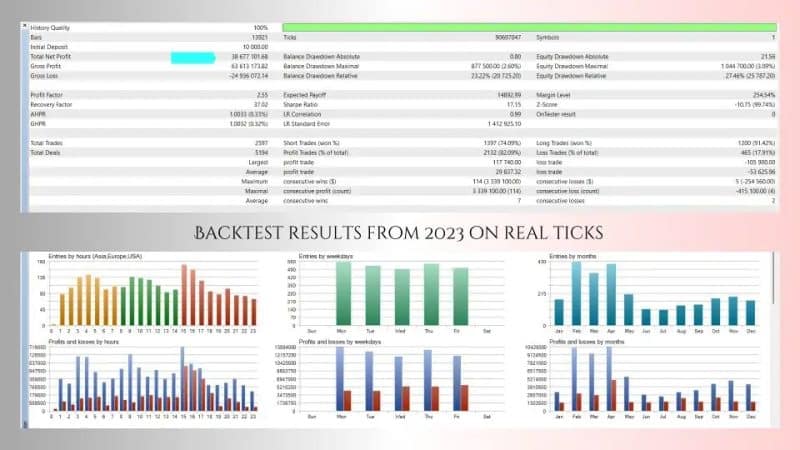

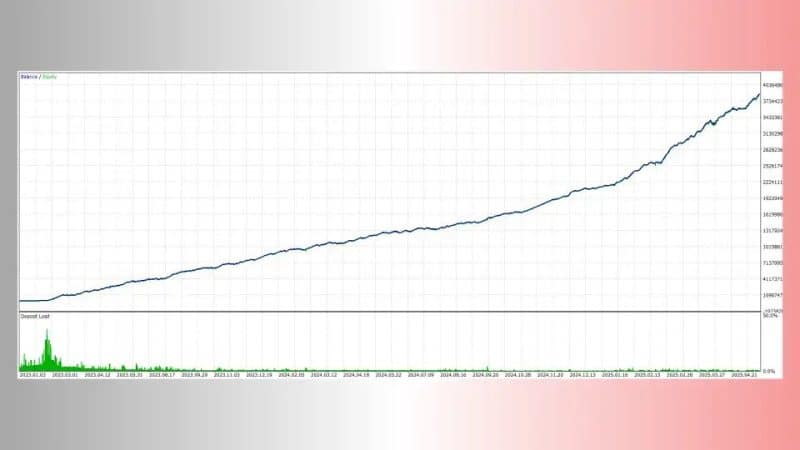

12. Back-Testing and Live Metrics

Before running an EA with real money, a thorough back-test makes sense. Below is an example procedure many ScalpPrime users follow:

- Data Source – Download at least 3 years of 1-minute gold data. Services like Tickstory provide 99 % modelling quality.

- Execution Delay – Add a 100-200 ms delay in MT4’s Strategy Tester to mimic live conditions.

- Spread Variation – Set spread to 50 points in back-test, then run again at 100 points to see the effect.

- Monte Carlo Runs – Tools like EA Analyzer randomise order sequence to stress-test the strategy.

- Equity Curve Check – A smooth upward curve with manageable drawdowns signals a stable strategy.

Once satisfied, trade it on a demo account for at least two weeks before switching to live.

13. Best Practices for Day-to-Day Use

- Stable VPS: Run the EA on a low-latency VPS near your broker’s server.

- One EA per Chart: Do not stack other EAs on the same XAUUSD chart to avoid trade conflicts.

- Regular Updates: Check the author’s MQL5 page for patches. Install during market closure.

- Review Logs: MT4’s Experts tab will show errors or unhandled events. Investigate any recurring messages.

- Withdraw Profits: A common routine is pulling out 30 % of new gains each month to lock profits.

14. Frequently Asked Questions

Q1. Can I run ScalpPrime EA on other pairs like EURUSD?A1. The EA is coded for gold’s price behaviour. Using it on other pairs is not recommended.

Q2. What is the minimum balance to start?A2. Many traders begin with 300 USD on a cent or micro account. The EA will still calculate lot sizes correctly.

Q3. Does the EA adjust to different broker spreads?A3. Yes. You can tune Stop-Loss, Take-Profit, and trade filters to match your broker’s average spread.

Q4. How often do updates come out?A4. The developer usually releases a minor patch every two to three months or when MT4 updates break something.

Q5. Is manual intervention allowed?A5. Yes. You may close trades early or pause the EA without breaking its logic.

15. Final Thoughts

ScalpPrime EA provides a clear, short-term path to trading gold on MT4. By combining Fibonacci retracement levels with volume confirmations, it keeps entries selective. Built-in risk tools—like the 3-step recovery mode and economic news filter—offer an extra layer of safety. It all adds up to a professional yet easy-to-use package that can meet the strict rules of proprietary firms or the simple needs of independent traders.

16. Get Started with ScalpPrime EA

Ready to give it a test run?

- Download ScalpPrime EA from the MQL5 Market or the author’s website.

- Load it on a Demo Account to learn its rhythm.

- Fine-Tune Inputs to suit your risk profile.

- Move to Live only when you are fully confident.

If you have questions or want to share results, leave a comment below or visit our Expert Advisors discussion hub at /blog/expert-advisors. Your feedback helps the community grow.

Stay disciplined, manage risk, and let ScalpPrime EA do the heavy lifting.

Vendor Site – Private

| Membership | Yearly Membership |

|---|---|

| Additional Services | Unlock & Decompile |

| Recommended Brokers | Exness Broker, FPMarkets |

| Recommended VPS | FXVM (Low Latency) |

| Youtube Channel | ForexForYou |

| Telegram Channel | Onshoppie Forex EA's & Indicators |

| Telegram Support | Onshoppie Support |

| Installation Guides | Onshoppie Forex Guides |

Only logged in customers who have purchased this product may leave a review.

Reviews

There are no reviews yet.