Quantum Trade EA V4.95 MT4 For Build 1441+

$9.95

Experience powerful, jubilant results with Quantum Trade EA. Uncommon strategies, proven performance, and a happier trading journey are just a click away!

Description

Quantum Trade EA: Complete Guide to a Session-Based Forex Robot

Quantum Trade EA — Automating EURGBP Scalping Between the U.S. Close and the Pacific Open

Table of Contents

- Quantum Trade EA Introduction

- Why Trade the U.S. Close–Pacific Open Gap?

- How Quantum Trade EA Works

- Key Features at a Glance

- Core Parameters Explained

- Step-by-Step Installation on MetaTrader 4

- Best Practice Settings for EURGBP on M5

- Risk Management with Quantum Trade EA

- Back-Testing and Forward-Testing Tips

- Adapting the Expert Advisor to Other Pairs

- Frequently Asked Questions

- Final Thoughts & Next Steps

1. Introduction

Quantum Trade EA is an automated trading robot designed for a very specific window: the short stretch of time after the American trading session wraps up and before the Pacific markets fully wake up. Many intraday traders overlook this gap, yet it often brings sudden changes in volatility and short-lived price moves. By focusing on EURGBP in the M5 timeframe, the Expert Advisor (EA) attempts to capture those moves while keeping risk in check with clear stop loss, take profit, and trailing mechanisms.

This article walks you through everything you need to know—from what makes that session unique to how to fine-tune every setting.

2. Why Trade the U.S. Close–Pacific Open Gap?

While global forex trading runs 24 hours a day, liquidity and volatility shift as major financial centers open and close:

- 21:00–23:00 UTC (rough guide): New York winds down, Tokyo and Wellington prepare to open.

- Order books are thinner, which can translate into sharper, short-term price swings.

- Spreads on the EURGBP pair remain reasonable on low-spread ECN accounts, giving scope for scalping strategies.

Quantum Trade EA is coded to switch on during precisely this transitional phase. Instead of guessing whether price will trend or range, it waits for concrete candle-close signals and indicator confirmation before acting.

3. How Quantum Trade EA Works

- Session Detection• On live accounts the robot auto-detects your broker’s UTC offset, so it knows exactly when the U.S. session closes and the Pacific session starts.• In the MT4 Strategy Tester you can also set the offset manually.

- Market Entry Logic• At the close of every M5 candle, Quantum Trade EA checks moving-average conditions, recent volatility, and distance from key price levels.• If all filters agree, it sends an instant market order with the pre-set lot size.• No martingale or reckless doubling; every trade is isolated and controlled.

- Position Management• Stop Loss and Take Profit are attached the moment the trade is placed.• Trailing Stop can be activated once price moves in your favor.• If maximum daily loss hits your limit, the EA stops trading until the next day.

4. Key Features at a Glance

| Feature | Why It Matters |

|---|---|

| Session-Based Activation | Trades only in the target window, cutting down random exposure. |

| EURGBP Optimization | Strategy logic tuned for stability on one of the most liquid cross pairs. |

| Candle-Close Confirmation | Reduces false signals caused by intra-bar noise. |

| Full Risk Suite | Stop Loss, Take Profit, Trailing Stop, lot control, and a global loss cap. |

| Automatic UTC Offset | Removes guesswork when brokers switch between DST and standard time. |

| User-Friendly Inputs | A short list of parameters lets you adjust risk without touching the code. |

5. Core Parameters Explained

Below is a plain-English guide to every key input you will see in the settings box.

5.1 Time and Session

- Manual_determination_of_UTC_time_shiftChoose

truewhen you want to set the offset yourself—handy for back-tests. - UTC_time_offsetAn integer such as

+2,0, or–5; leave at0if auto-detection is on. - start_time, end_timeThe minute the EA can start and must stop trading. Format:

21:00to23:00in broker time.

5.2 Risk Control

- riskPercent of account balance to risk per trade. A typical figure for scalping is

0.5–1.0. - maximum_lossA daily loss limit, expressed in account currency. Once reached, the EA pauses.

5.3 Technical Filters

- MA_period, ma_periodFast and slow moving-average lengths, e.g.,

8and21. Crossovers help the EA confirm trend direction.

5.4 Exit and Trail

- TakeProfit, StopLossPips or points. On a five-digit broker,

TP=120equals 12 pips if point mode is set to points. - TrailingStopSet to

0to disable, or a small number like30for tight trailing.

5.5 Position Sizing

- KoefA multiplier applied to your base lot size after each trade, often left at

1for fixed size. - DistanceMinimum price distance, in points, between new orders if the EA permits grid entries (off by default).

6. Step-by-Step Installation on MetaTrader 4

- Download or compile

QuantumTradeEA.ex4in yourMQL4/Expertsfolder. - Restart MT4 so the platform detects the file.

- Open EURGBP, M5 timeframe.

- Drag the EA onto the chart.

- Check “Allow live trading.”

- Verify UTC auto-detection in the Experts tab—look for a green “UTC offset = X” line.

- Adjust risk and session times if needed.

- Press AutoTrading on the toolbar.

- Save template so the setup loads on restart.

Tip: run a short visual back-test with the MT4 Strategy Tester (Ctrl+R) to confirm the EA only trades inside your chosen window.

7. Best Practice Settings for EURGBP on M5

Below is a sample block many users start with. Your broker’s spread, commission, and execution speed will affect results, so tweak carefully.

Manual_determination_of_UTC_time_shift = false

UTC_time_offset = 0

start_time = 21:10

end_time = 22:55

risk = 0.8

maximum_loss = 3.0 (in % of balance)

MA_period = 8

ma_period = 21

TakeProfit = 110

StopLoss = 90

TrailingStop = 35

Koef = 1

Distance = 0Why these numbers?

- 8/21 MA combination is common for short-term trend confirmation.

- TP > SL gives trades room to breathe, yet keeps risk properly contained.

- Trailing kicks in only after ~3.5 pips, locking some gains without squeezing the trade too soon.

8. Risk Management with Quantum Trade EA

Trading a narrow time window does not remove risk; it concentrates it. Follow these guidelines:

- Keep leverage moderate. Even on an ECN account, anything above 1:100 is unnecessary for a scalper.

- Set a daily loss limit (

maximum_loss). Markets can stall or spike without warning. - Monitor broker conditions. If spreads widen unexpectedly after 22:00 UTC, consider widening SL/TP or pausing the EA.

- Use a VPS close to your broker’s servers. Lower latency helps the Expert Advisor execute at intended prices.

- Test each change. Run at least one month of forward demo trading before switching to live.

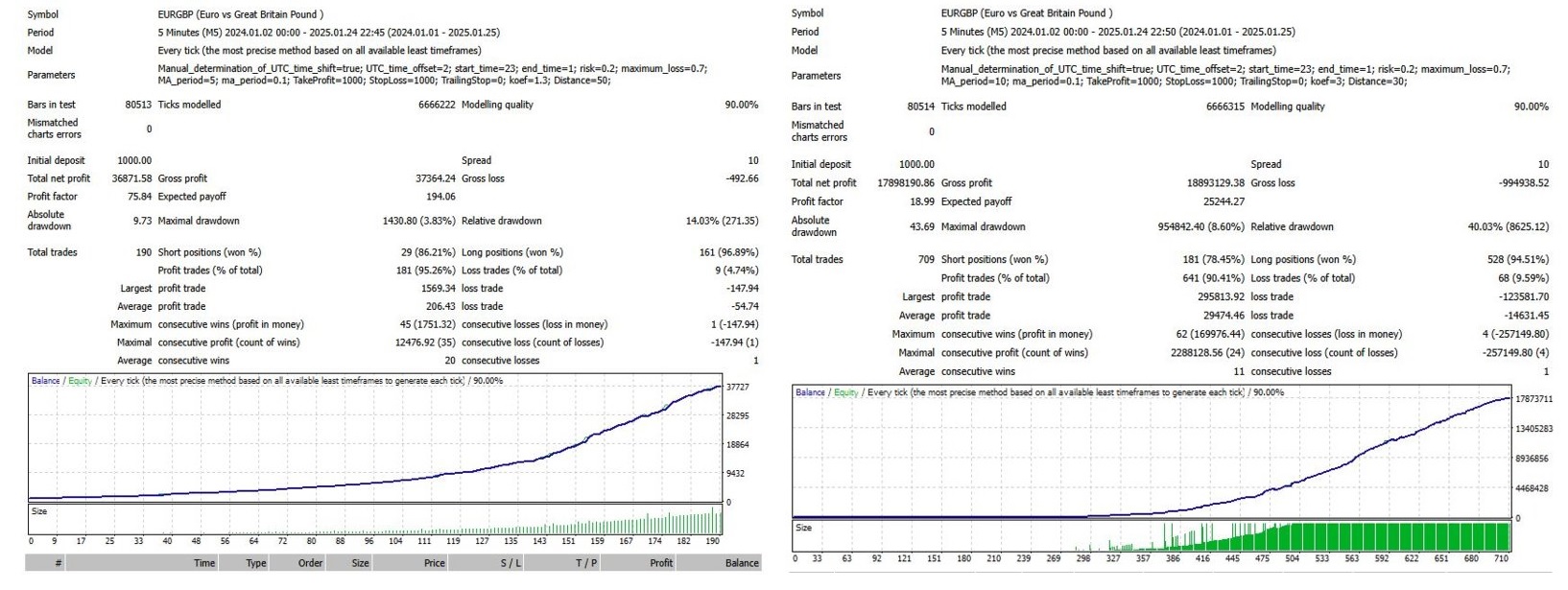

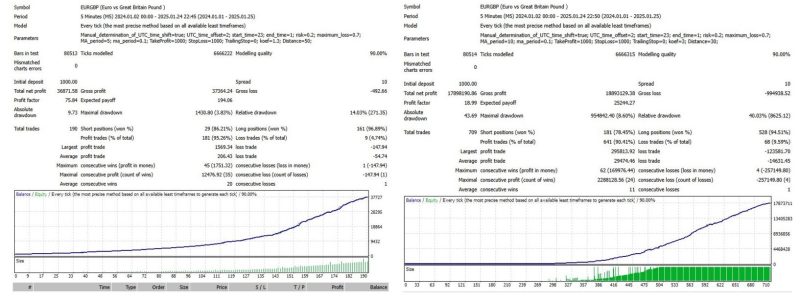

9. Back-Testing and Forward-Testing Tips

9.1 Historical Data Quality

To trust an automated system, start with clean tick data—at least 99 % modeling accuracy. Tools such as Tickstory let you export and convert data into MT4 format.

9.2 Spread Simulation

In MT4 you can set a fixed spread. Match the average you see on your live account for realism.

9.3 Monte Carlo or Multi-Run Tests

Vary the start date, spread, and slippage by small increments. If Quantum Trade EA stays profitable across a range, that’s a sign of robustness.

9.4 Forward Demo Stage

Run the EA on a demo for at least four weeks. Check:

- Does it skip days when volatility is absent?

- Is the average win/loss ratio stable?

- Are there any unexpected gaps in trading?

9.5 Go Live with Reduced Risk

Your first week on live should use half the lot size you intend long term.

10. Adapting the Expert Advisor to Other Pairs

While Quantum Trade EA is optimized for EURGBP, advanced users sometimes explore pairs with similar overnight behavior, such as:

- AUDNZD

- GBPCHF

- EURCHF

Key points when adapting:

- Shift the start/end times to match the pair’s active hours.

- Re-tune MA_period and ma_period. Faster pairs may benefit from smaller values.

- Back-test each new pair individually—never assume one set fits all.

11. Frequently Asked Questions

Q1. Does Quantum Trade EA use a martingale or grid by default?No. Each trade is independent. A grid function exists but stays off unless you deliberately lower the Distance value and raise Koef.

Q2. How many currency pairs can it trade at once?You can attach the robot to multiple charts, but keep an eye on correlated risk if pairs move together.

Q3. What account size is recommended?A micro or nano account works for testing, yet a balance of at least €1 000 allows meaningful risk control at the 0.01 lot level.

Q4. Do I need to keep my computer on all night?Only if you are not using a VPS. A reliable VPS ensures the Expert Advisor runs even if your local PC shuts down.

Q5. Can I run Quantum Trade EA on MetaTrader 5?The current code base is MQL4 only. A port to MQL5 would require recompile and possibly logic adjustment.

12. Final Thoughts & Next Steps

Quantum Trade EA offers a structured way to trade the quiet but opportunity-filled hand-over between the New York close and the Pacific open. By sticking to a clear session, using tried-and-tested moving-average filters, and enforcing strict stop loss and maximum-loss rules, the EA helps traders attempt to capture small, repeatable gains on EURGBP.

Want to see how it performs on your broker?

- Download the EA.

- Run a one-month demo.

- Share your results or questions in the comments below.

For more insight on Expert Advisors and forex sessions, explore our article on “How Time Zones Shape Forex Volatility” (internal link: /blog/forex-time-zones-volatility) and MetaTrader’s official guide on Expert Advisors for extra context.

Happy testing—and trade safely with Quantum Trade EA.

Vendor Site – Click Here

| Membership | Yearly Membership |

|---|---|

| Additional Services | Unlock & Decompile |

| Recommended Brokers | Exness Broker, FPMarkets |

| Recommended VPS | FXVM (Low Latency) |

| Youtube Channel | ForexForYou |

| Telegram Channel | Onshoppie Forex EA's & Indicators |

| Telegram Support | Onshoppie Support |

| Installation Guides | Onshoppie Forex Guides |

Brand

ea-mt4

Only logged in customers who have purchased this product may leave a review.

Reviews

There are no reviews yet.