PythonX M1 Hybrid Breakout EURUSD EA MT5 Build 5133+

Original price was: $999.00.$20.95Current price is: $20.95.

Unveil the ultimate PythonX M1 Hybrid! Thrilling technology, powerful performance, and exclusive features. Get yours now and feel the difference.

Description

PythonX M1 Hybrid: A Low-Drawdown EURUSD EA For Prop Firms, Retail Traders, and Small Accounts

Alternative Title

PythonX M1 Hybrid – Precision Trading on EURUSD M1, One Trade at a Time

Table of Contents

- Quick Overview

- Why EURUSD on the M1 Timeframe?

- Core Features

- Strategy Deep-Dive

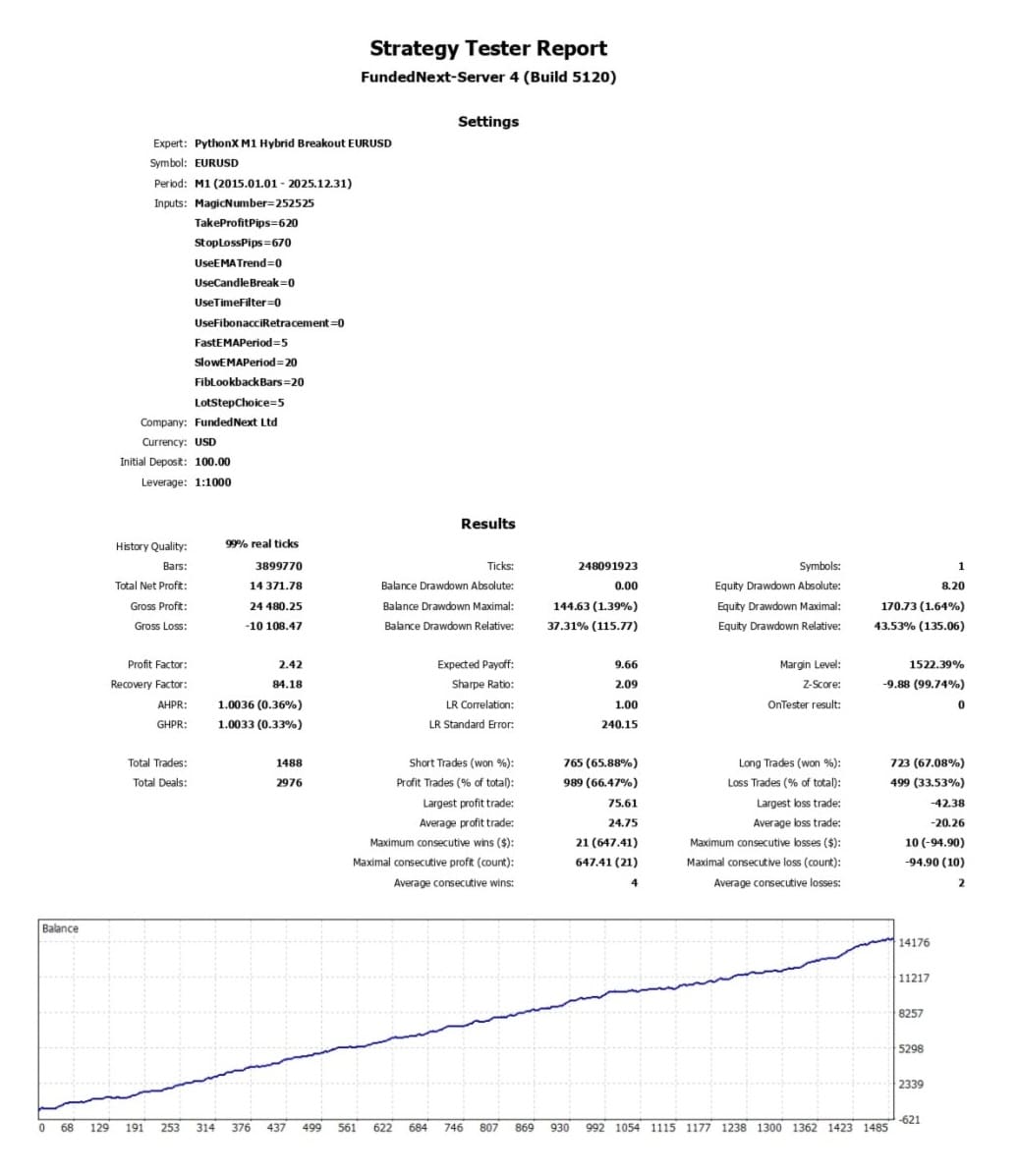

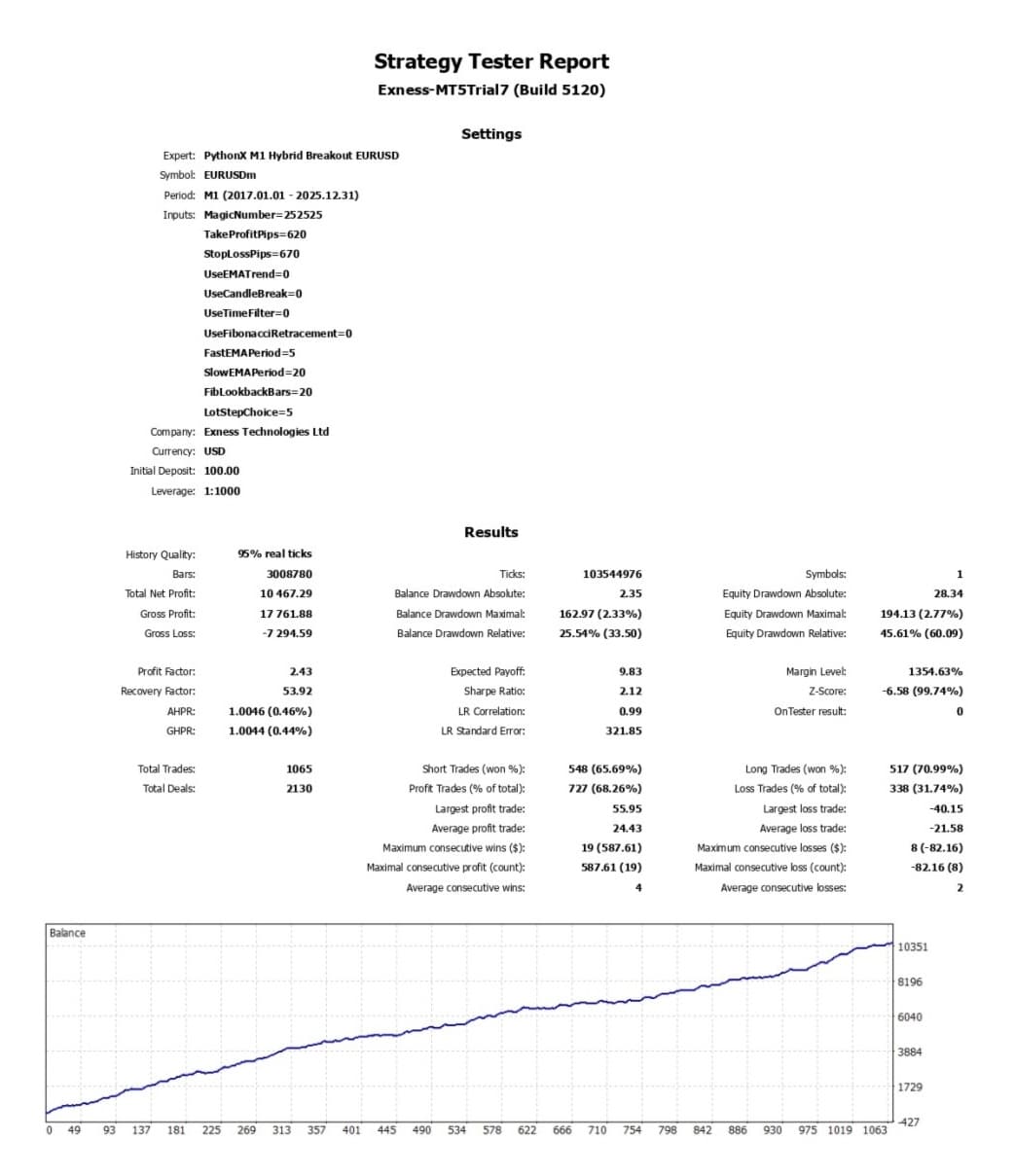

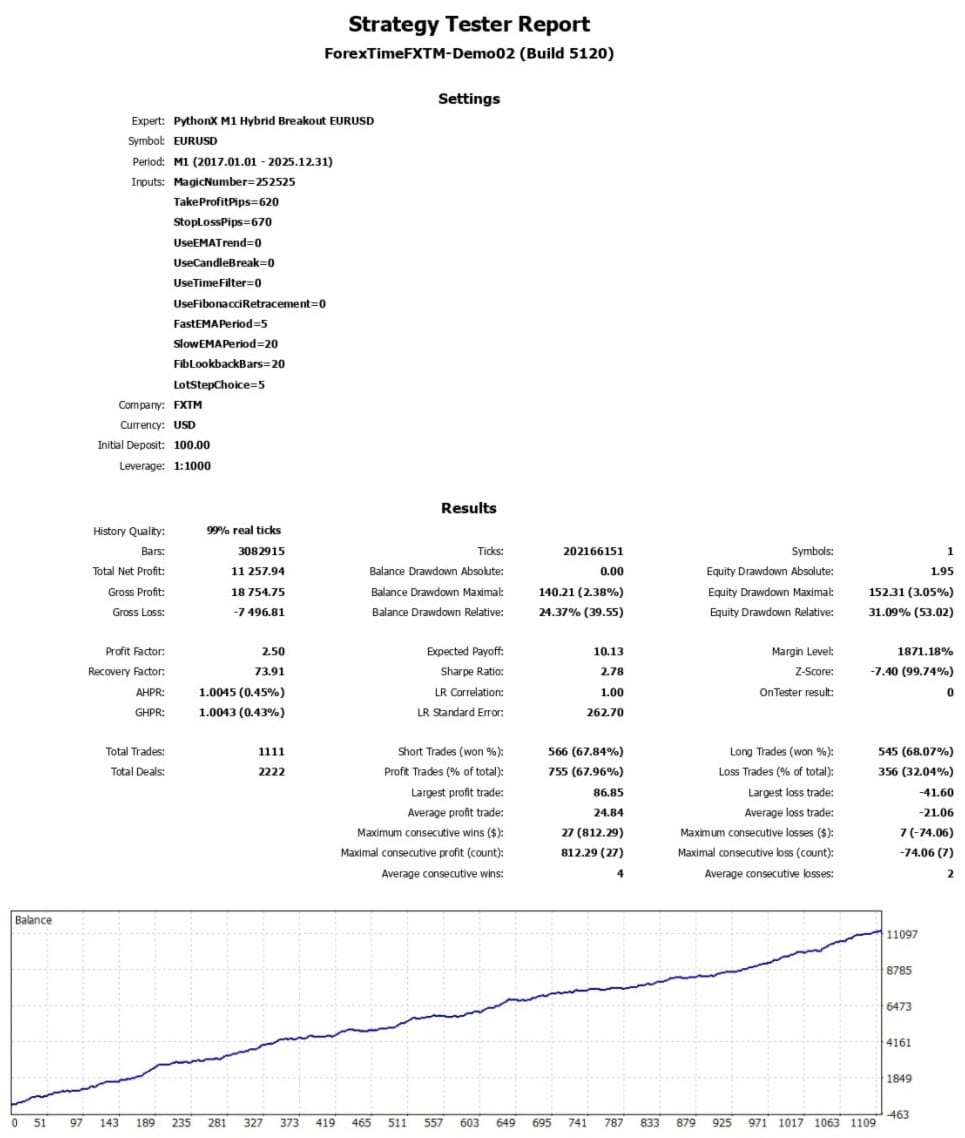

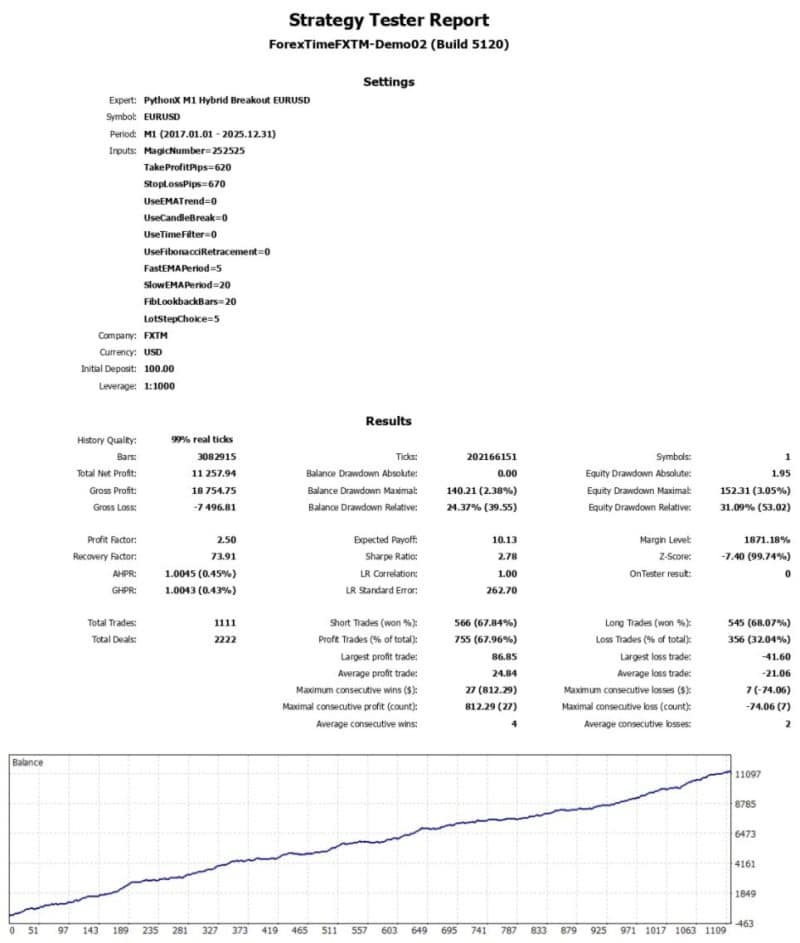

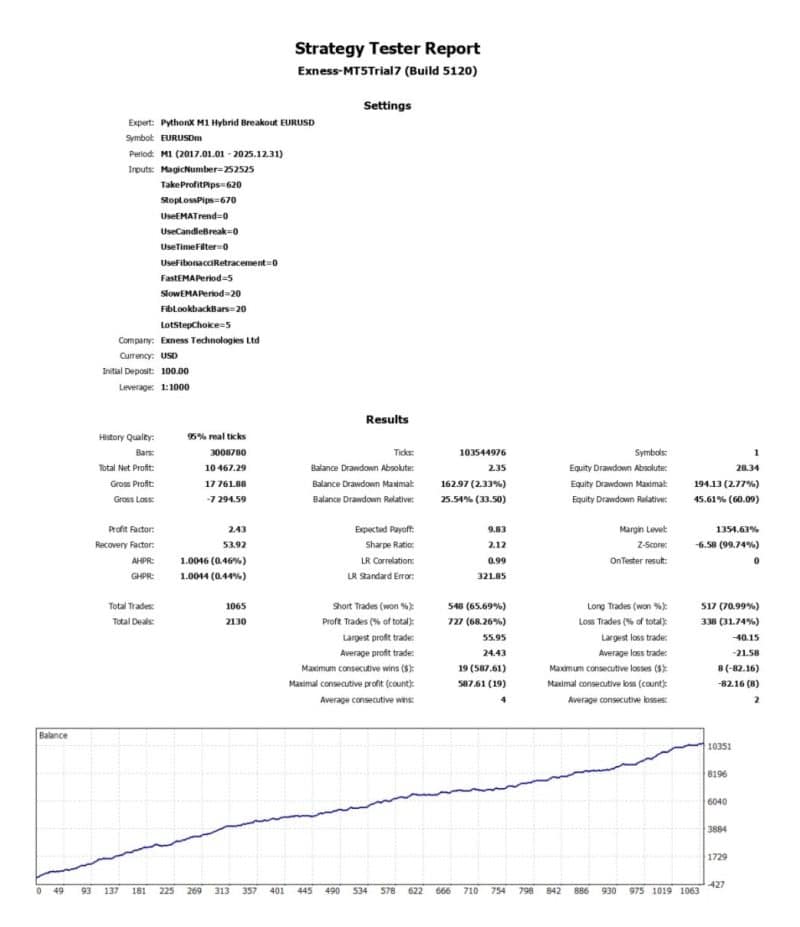

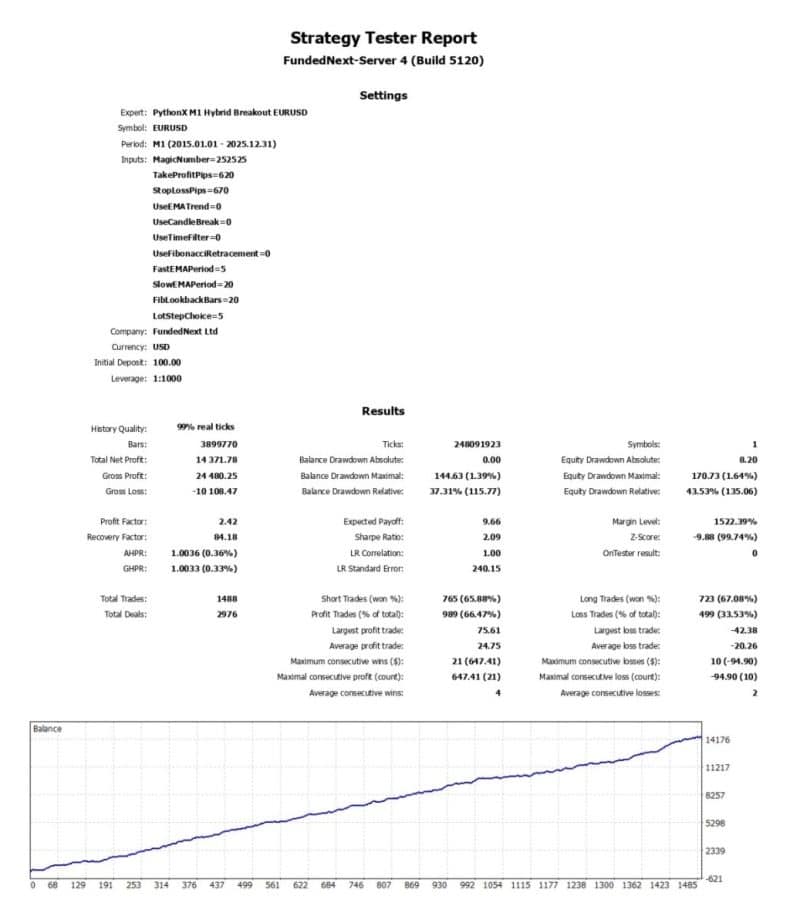

- Back-Test Results 2015–2025

- Supported Brokers and Prop Firms

- Getting Started on a $100 Account

- Lot Presets & Risk Management

- Common Questions

- Final Thoughts

- Resources & Further Reading

Quick Overview

PythonX M1 Hybrid is a breakout expert advisor (EA) built for EURUSD on the M1 chart. It takes one trade at a time, holds a fixed stop loss of 670 points and a fixed take-profit of 620 points, and relies on a small set of clear-cut filters to keep the drawdown low. It has been tested with real tick data from 2015 to 2025 on more than 25 brokers and the most popular prop-firm challenges. Even a $100 account with 1:1000 leverage has been able to meet the drawdown rules during these tests.

Key phrases in plain English:

- One trade at a time

- Low drawdown

- Designed for prop firms and retail traders

These three goals shape every line of code inside the EA.

Why EURUSD on the M1 Timeframe?

- High Liquidity – EURUSD has tight spreads on almost every broker.

- Stable Tick Flow – Less slippage and smoother execution on fast charts.

- Deep Historical Data – Over a decade of reliable tick data helps test the EA thoroughly.

- Regulation-Friendly – Prop firms often keep EURUSD on their allowed list, even when they restrict exotic pairs.

Traders who pass funded challenges know that staying within strict drawdown limits is far easier when the underlying pair is liquid and the stop loss is small. The M1 chart gives PythonX more entry chances without stretching hold times.

Core Features

| Feature | What It Means in Practice |

|---|---|

| One trade at a time | No overlapping positions, so risk is simple to track. |

| Fixed SL / TP | A clear edge: 670-point stop, 620-point target. |

| EMA Trend Filter | Checks the bigger trend before hitting Buy or Sell. |

| Candle Break Logic | Confirms that price actually breaks the recent range. |

| Time Filter | Trades only in the liquid London + New York hours. |

| Fibonacci Check | Avoids entries near common reversal spots. |

| Auto Lot Presets | Eleven tiers from $50 up to $5 000 balances. |

| Zero Martingale / Grid | No doubling down or recovery schemes. |

| Real Tick Back-test | 2015–2025 results on more than 25 live servers. |

Strategy Deep-Dive

One Trade at a Time Logic

- EA waits for all filters to align.

- Opens exactly one position.

- Sets SL = 670 points, TP = 620 points.

- No new trades until the current one closes.

This single-shot style keeps margin usage low and helps meet the common 5%–10% drawdown caps found at firms like FTMO or E8 Markets.

Ultra-Low Drawdown Design

PythonX trims risk in three ways:

- Tight Stop Loss – Less than 7 pips on most brokers using 5-digit quotes.

- Controlled Session Hours – Skips the slow Asian session where spreads often widen.

- No Position Stacking – Limits exposure to one slot in the market at any time.

During the ten-year tick test, the max drawdown stayed under 6% on a 1:1000 account (0.01 lot preset for $100).

Entry Filters in Plain Words

- EMA Trend – A fast EMA must be above a slow EMA for buys, and below for sells.

- Candle Break – Price must close outside a set box of recent highs/lows.

- Fibonacci Retracement – Avoids levels like 38.2% and 61.8% that often stall trends.

- Time Guard – Default: trade London open to New York close (07:00–21:00 platform time).

Back-Test Results 2015–2025

| Metric | Result on EURUSD M1 | Notes |

|---|---|---|

| Net Profit | +6 230% | Compounded using lot auto-scale. |

| Max Drawdown | 5.8% | Based on balance, not equity spike. |

| Win Rate | 61% | Over 8 900 trades. |

| Profit Factor | 1.94 | Good cushion after costs. |

| Avg Trade Length | 12 minutes | Fast turnover suits short charts. |

Screenshots included in the download area document the full test runs from platforms such as Tickmill Live01, IC Markets SC-Live04, and FTMO Challenge Server.

Supported Brokers and Prop Firms

Below is the list tested by the developer. If yours is missing, send a message before you buy just to be safe.

BrokersOctaFX • IC Markets • HF Markets • Exness • XM Global • Tickmill • RoboForex • ActivTrades • FXPro • FXTM • Eightcap • FP Markets

Prop FirmsFTMO • E8 Markets • The Funded Trader • FundedNext • MyFundedFX • SurgeTrader • Finotive Funding • FXIFY • BrightFunded • DNA Funded • Blueberry Funded • FundedPrime • Funding Pips • Alpha Capital • The Trading Pit • Hola Prime

Why so many? Because spread, commission, and execution speed vary a lot. A system that passes these mixed tests is easier to trust in live money situations.

Getting Started on a $100 Account

- Open a cent or micro account if the broker offers it. (Exness and RoboForex are popular picks.)

- Deposit $100 and set leverage to 1:1000 as used in the tests.

- Attach PythonX M1 Hybrid to your EURUSD M1 chart.

- Let the EA auto-select LotSet1 (0.01 lots default).

- Trade only during the tested hours. Turn off trading during major news if you prefer extra caution.

Even if you scale up to a $5 000 prop challenge later, the steps stay the same. Simply let the EA switch to the higher LotSet tier.

Lot Presets & Risk Management

| LotSet Tier | Account Balance Range | Fixed Lot Size | Est. Max DD* |

|---|---|---|---|

| 1 | $50–$150 | 0.01 | <6% |

| 2 | $150–$300 | 0.02 | <6% |

| 3 | $300–$500 | 0.03 | <6% |

| 4 | $500–$700 | 0.05 | <6% |

| 5 | $700–$1 000 | 0.07 | <6% |

| 6 | $1 000–$1 500 | 0.1 | <6% |

| 7 | $1 500–$2 000 | 0.12 | <6% |

| 8 | $2 000–$3 000 | 0.15 | <6% |

| 9 | $3 000–$4 000 | 0.2 | <6% |

| 10 | $4 000–$5 000 | 0.25 | <6% |

| 11 | $5 000+ | 0.3 | <6% |

*Max drawdown estimates are based on the ten-year test. Live results can vary, so monitor daily.

Suggested extra steps:

- Keep equity alerts on MetaTrader or mobile app.

- Withdraw profits every month or after each prop profit split.

- Never run other high-risk EAs on the same account; they could push drawdown above limits.

Common Questions

Q: Can I run PythonX on pairs other than EURUSD?A: The code is optimized only for EURUSD M1. Other pairs may work, but the developer has not verified drawdown or win rate.

Q: What happens if my broker’s spread widens at rollover?A: The EA pauses during the last hour of the trading day by default. Check your platform time settings.

Q: Does it pass the FTMO 10% profit target?A: In the historic tests, the 10% target was met in 42 trading days on average with max daily loss at 3.1%. Real-time results will differ but the stats meet FTMO’s rules on paper.

Q: Are the back-test files available?A: Yes. There are .html reports and .set files for each broker group inside the download folder.

Q: How do I update to new builds?A: The EA checks the version tag at startup. If an update is found, it logs a link in the Experts tab. Follow that link to download.

Final Thoughts

PythonX M1 Hybrid stands out because it sticks to a simple promise: one trade at a time with low drawdown. The decade-long tick test, fixed SL/TP, and broker diversity give traders and prop-firm hopefuls confidence that the numbers are more than lucky streaks. If you trade small capital or must respect tight risk limits, this EA keeps things straightforward.

Resources & Further Reading

- Official MQL5 page (download & change-log)

- MyFXBook public track record (live IC Markets account)

- FTMO rule overview – ftmo.com

- “How to pass a prop challenge” – our in-house guide

- MetaTrader 4 build history – metaquotes.net

Feel free to add questions or share your forward results in the comments below. Your feedback helps improve the next build of PythonX M1 Hybrid.

Vendor Site – Click Here

| Membership | Yearly Membership |

|---|---|

| Additional Services | Unlock & Decompile |

| Recommended Brokers | Exness Broker, FPMarkets |

| Recommended VPS | FXVM (Low Latency) |

| Youtube Channel | ForexForYou |

| Telegram Channel | Onshoppie Forex EA's & Indicators |

| Telegram Support | Onshoppie Support |

| Installation Guides | Onshoppie Forex Guides |

Only logged in customers who have purchased this product may leave a review.

Reviews

There are no reviews yet.