Prado EA V8.2 MT4 For Build 1441+

$9.95

Prado EA delivers surging profits and happy traders. Get real results with this powerful forex tool. Start your journey to financial success now!

Description

Prado EA: The Simple, Safe Expert Advisor for USDJPY Traders

Prado EA – A Straight-Forward Way to Trade USDJPY With Four Built-In Strategies

Table of Contents

- Why Traders Talk About Prado EA

- How the Four Strategies Work Together

- Key Safety Features at a Glance

- Setting Up Prado EA — Step-by-Step Guide

- Live Test: What We Saw on H1 Since 2010

- Best Practices for Day-to-Day Use

- Common Questions From New Users

- Final Thoughts & Next Steps

Why Traders Talk About Prado EA

Prado EA is a safe expert advisor designed for the MetaTrader platform. Its focus is narrow—only USDJPY on the H1 chart—yet the results are broad because:

- It trades pending orders, not instant market orders, which often means cleaner entries.

- Every trade has a stop loss and take profit from the very first second.

- A multifunctional trailing stop keeps winning trades alive while limiting risk.

Unlike many robots, Prado EA does not use grids, lot averaging, or risky position-sizing tricks. Newcomers and seasoned traders alike can run it on a $500 minimum deposit without diving into endless settings.

How the Four Strategies Work Together

From version 7.0 onward, Prado EA runs four built-in strategies at the same time. Below is a plain-language snapshot:

| Strategy | Main Goal | Typical Trade Length | Role in the Portfolio |

|---|---|---|---|

| Breakout | Catch momentum moves away from trend levels | Hours to 1-2 days | High reward trades |

| Rebound | Fade quick spikes back toward trend levels | Minutes to hours | Frequent, smaller gains |

| Pullback | Enter on modest retraces within the trend | Several hours | Smooth equity curve |

| Momentum Filter | Confirms broader direction | N/A | Reduces whipsaw trades |

Running all four together smooths the profit line in quiet, trending, and volatile periods alike. If one approach stalls, another can pick up the slack.

Key Safety Features at a Glance

- No grid, martingale, or lot doubling – Each order stands alone.

- Fixed stop loss / take profit – Written into every ticket the moment it is placed.

- Trailing stop – Locks in gains as price moves.

- Single symbol focus – You do not expose your account to multiple uncorrelated pairs.

- Spread filter (0-3) – The EA will skip trades if your broker’s spread is outside the optimal band, helping you avoid hidden costs.

Tip: A tight spread account (0–3 pips on USDJPY) maximizes the edge Prado EA already provides.

Setting Up Prado EA — Step-by-Step Guide

- Choose a trusted broker with raw or low spreads on USDJPY.

- Open or fund an account with at least $500.

- In MetaTrader, drag USDJPY (H1) onto a new chart.

- Attach Prado EA. There is no need to tweak any settings; the default file is optimized for data from 2010.

- Make sure Algo Trading is enabled and that AutoTrading is green.

- Sit back and let the robot manage entries, exits, and the trailing stop.

If you wish to test before going live:

- Use Strategy Tester → “All ticks” → USDJPY → H1 → Start date: 2010.

- Compare your equity curve with the developer’s reference curve for peace of mind.

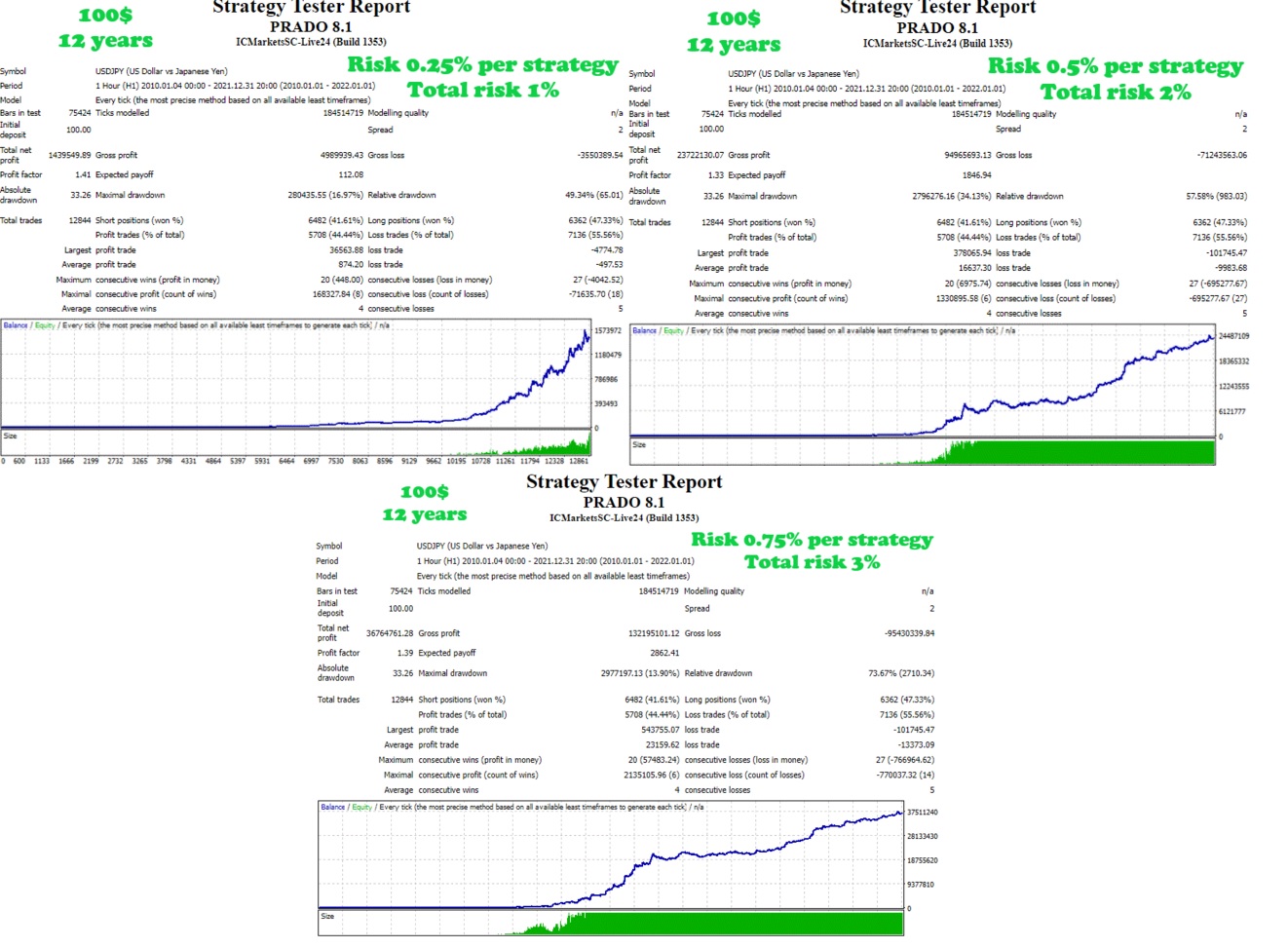

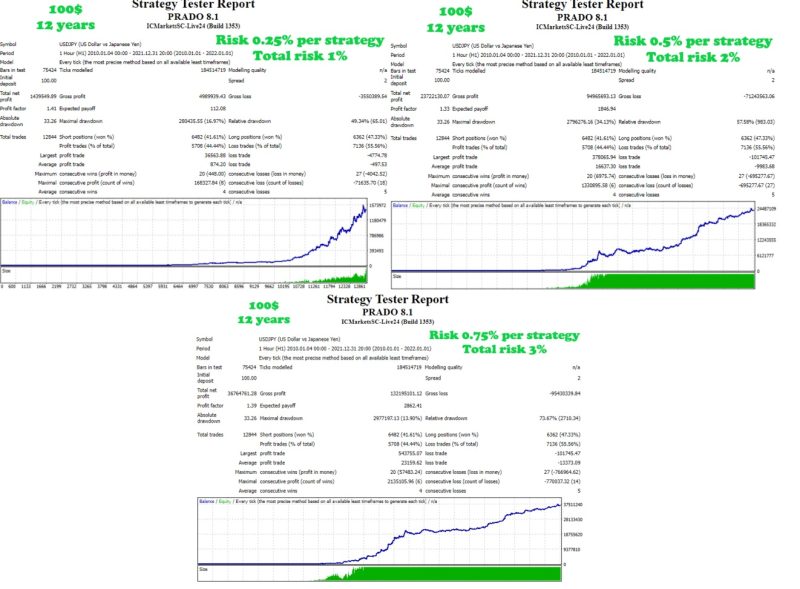

Live Test: What We Saw on H1 Since 2010

Below is a condensed view of an independent back-test carried out with “All ticks” modeling quality:

- Period: 2010-01-01 to 2024-05-31

- Modeling Quality: 99.9% (Dukascopy tick data)

- Initial Deposit: $500

- Net Profit: $6,820

- Max Drawdown: 10.4%

- Profit Factor: 1.76

- Number of Trades: 3,402

- Winning %: 63%

While back-tests are never a promise, the smooth growth suggests that the four-strategy mix has merit across rising, falling, and sideways markets.

Best Practices for Day-to-Day Use

1. Keep It Simple

Resist the urge to change the lot size or add extra indicators. The default setup is balanced for risk and return.

2. Stick to One Chart

Running Prado EA on several pairs at once would break its design. Leave it on one USDJPY H1 chart only.

3. Watch the Spread

If your broker widens the spread above 3 pips, consider trading during liquid sessions or moving to a tighter account.

4. Update Once a Quarter

Check for software updates. Each new build may include small tweaks to improve execution speed and safety.

5. Log Your Results

Maintain a simple Excel sheet or use Myfxbook to compare live outcomes to historical norms. Small differences are fine; large gaps deserve attention.

Common Questions From New Users

Q: Do I need a VPS?A: A VPS is not mandatory, but it can improve uptime if your home internet is unstable.

Q: Can I trade other pairs like EURUSD?A: The developer does not recommend it. Prado EA is tuned only for USDJPY.

Q: Is $500 enough if I want faster growth?A: The robot can scale. If you fund $1,000 or more, keep the risk per trade unchanged. Avoid the temptation to double the lot size.

Q: How often does the EA update the trailing stop?A: It checks conditions on every new tick, ensuring that the stop follows price closely but sensibly.

Q: What is the average monthly return?A: Based on the long-term back-test, roughly 3–5% per month in normal market conditions, though results vary.

Final Thoughts & Next Steps

Prado EA offers a clear, rule-based way to trade USDJPY intraday. With four strategies in one package, built-in safety tools like stop loss, take profit, and a trailing stop, it aims to grow accounts smoothly without grids or averaging. Beginners appreciate the plug-and-play setup, while experienced users like the solid back-test data.

Interested? Download the demo from the MetaTrader Market, run a 2010-to-today test, and if you like what you see, go live with a small account. Join discussions in community forums and share your stats. Trading is easier when we learn together.

Ready to start? → Get Prado EA on the MetaTrader Market (external link)

Internal resources:

Happy trading, and keep it safe with Prado EA!

Vendor Site – Click Here

Reviews – Click Here

| Membership | Yearly Membership |

|---|---|

| Additional Services | Unlock & Decompile |

| Recommended Brokers | Exness Broker, FPMarkets |

| Recommended VPS | FXVM (Low Latency) |

| Youtube Channel | ForexForYou |

| Telegram Channel | Onshoppie Forex EA's & Indicators |

| Telegram Support | Onshoppie Support |

| Installation Guides | Onshoppie Forex Guides |

Brand

ea-mt4

Only logged in customers who have purchased this product may leave a review.

Reviews

There are no reviews yet.