News Catcher Pro EA MT4 V4.24 For Build 1441+

$9.95

News Catcher Pro EA is a mean-reversion strategy that uses intraday seasonal volatility patterns caused by high-impact news events.

Description

News Catcher Pro EA: A Practical Guide to This News-Driven Mean-Reversion Robot

Alternative title: News Catcher Pro EA—Hands-On Setup, Back-test, and Risk Tips

Table of Contents

- Quick Overview News Catcher Pro EA

- How News Catcher Pro EA Works

- Supported Pairs, Timeframe, and FIFO Note

- Key Features at a Glance

- Getting Ready: What You Need Before Installing

- Step-by-Step Installation (MT4 / MT5)

- Parameter Walk-Through

- Strategy Detail: Why Mean Reversion Around News?

- Back-Testing With Tick Data Suite (GMT+2, US DST)

- Live Performance Pointers

- Risk Management Checklist

- VPS and Broker Considerations

- Pros and Cons

- Typical Mistakes and How to Avoid Them

- Frequently Asked Questions

- Final Thoughts

Quick Overview

News Catcher Pro EA is an expert advisor that follows a mean-reversion strategy that uses intraday seasonal volatility patterns caused by high-impact news events. In plain words, the robot looks for price spikes that often happen just before major economic news. It then aims to fade, or “catch,” that spike once the market calms down. The EA:

- Enters the market a short time before the scheduled news.

- Uses carefully coded filters so it does not trade frequently—only when conditions fit its template.

- Is designed for GBPUSD, EURUSD, and EURGBP on the M5 chart.

- Meets FIFO rules, so U.S. traders can stay compliant.

How News Catcher Pro EA Works

- News Calendar FeedThe robot listens to a built-in economic calendar (or the MetaTrader calendar, depending on your platform) and flags only high-impact events.

- Intraday Volatility WindowRoughly 5–30 minutes before the event, spreads can widen and the price often overshoots. The EA draws a price channel (PCh) and tracks the ATR to score that overshoot.

- Mean Reversion EntryIf price pokes through the upper or lower band of the channel but spreads and slippage stay inside limits you set, the EA opens a fade trade that targets a small, quick pullback.

- Tight, Volatility-Based Stop & ProfitTake-profit and stop-loss are both defined in %ATR, so they scale with market conditions.

- Time StopPositions that stay open longer than Position Time Stop bars are closed. Holding through the news itself is optional; by default, the EA exits earlier to avoid wild price whips.

Supported Pairs, Timeframe, and FIFO Note

| Pair | Notes |

|---|---|

| GBPUSD | Most active news flow; typical spread 1.0 – 1.5 pips on ECN. |

| EURUSD | Deep liquidity keeps slippage small. |

| EURGBP | Often slower but still offers tradable news spikes. |

- Timeframe: Keep the EA on an M5 chart.

- One-Chart Setup: Attach it to any of the three pairs once. It will trade all pairs internally.

- FIFO Compatibility: The EA has no hedging logic by default, so trades close in order.

Key Features at a Glance

- Advanced News Filter (works even inside Strategy Tester).

- Auto GMT Detection, so you rarely need to set time offsets by hand.

- Self-Diagnostic System warns if data feed or calendar is missing.

- Max Drawdown Actions—close trades, pause trading, or send alerts.

- Hide Stop-Loss option for brokers that hunt visible orders.

- Lot-Sizing Flexibility: Fixed, dynamic, or percent-risk modes.

- Solid Back-test and Live Records publicly shared on the MQL5 Market page.

Getting Ready: What You Need Before Installing

- VPS running 24 / 7Latency under 10 ms to your broker is ideal.

- Good ECN BrokerLook for spreads <1.5 pips on EURUSD during London and New York.

- MetaTrader 4 or 5 updated to the latest build.

- Tick Data Suite (for thorough back-tests).

- Account Size that fits your risk plan. Even micro accounts work; the EA can trade 0.01 lots.

For a primer on selecting a VPS, see our guide: How to Choose a Forex VPS.

Step-by-Step Installation (MT4 / MT5)

1. Download and Copy

- Purchase or download the demo from the official MQL5 page.

- Copy the .ex4 or .ex5 file into MQL4/Experts or MQL5/Experts.

2. Restart MetaTrader

- You will find News Catcher Pro EA under Navigator → Expert Advisors.

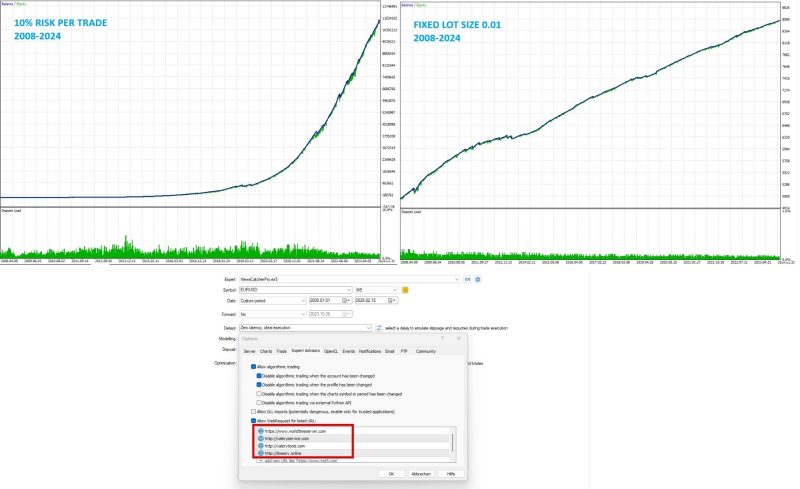

3. Enable Allow DLL & Auto-Trading

- Tools → Options → Expert Advisors → Allow DLL imports and Allow algorithmic trading.

4. Attach to a Chart

- Any of the three recommended pairs, timeframe M5.

- Check that AutoTrading button is green.

5. Load a Preset

- Right-click on the chart → Expert Advisors → Properties → Load.

- Choose “Low Risk,” “Medium Risk,” or “High Risk” preset to match your comfort level.

Parameter Walk-Through

Below is a plain-language guide to the most used settings. (For the full list, consult the EA manual.)

| Section | Parameter | Practical Meaning |

|---|---|---|

| Trading Control | Allow Opening a New Trade | Toggle if you want the EA paused but still managing open trades. |

| Lot Sizing | Fixed Lot / Dynamic Lot / Max Risk per Trade | Pick one method. Dynamic uses balance per 0.01 lots (e.g., 300 means 0.01 lots per $300). |

| Maximum Lot | Safety cap; handy when account grows. | |

| Execution Filters | Maximum Spread / Slippage | Act as a circuit-breaker. Widen slightly during high-volatility hours; start with 2.0 pips spread, 5 pips slippage. |

| Maximum Symbols at a Time | Set to 2 if you want only one pair open at once. | |

| Risk Guard | Minimum Free Margin % | If free margin drops below, EA stops opening new trades. Default 100 %. |

| Max Floating Drawdown % | If loss hits this figure, EA closes trades (e.g., 20 %). | |

| Max Drawdown Action | Choose Close & Halt, Close & Continue, or Alert Only. | |

| Strategy | Symbols separated by comma | Add suffix if broker uses “.pro” etc. (EURUSD.pro,GBPUSD.pro). |

| PCh Period & Offset | Channel look-back in bars, and offset buffer. Test 25/5 as a start. | |

| ATR Period | Daily ATR window, commonly 20 days. | |

| Position Time Stop | How many M5 bars before a forced exit. The default 12 equals 1 hour. | |

| Hour to Stop Trading on Friday | Close positions before weekend risk. Default 20:00 server time. | |

| TakeProfit / StopLoss %ATR | 25/50 are common. Lower TP reduces average holding time. | |

| Hide StopLoss | May bypass broker stop-loss hunting but adds terminal risk. | |

| News Filter | News Filter Enabled | Keep it ON unless you wish to test pure mean-reversion. |

| Minutes Before/After Event | 30/30 common. The EA will not place trades inside this blackout. | |

| Others | UID | If you want two instances on same account, change to 1, 2, etc. |

| Disable Automatic GMT Detection | Set to true only if your broker GMT cannot be detected. |

Strategy Detail: Why Mean Reversion Around News?

When a high-impact event looms (jobs data, rate decision), many traders pull orders, spreads widen, and a few large market orders can push price fast. That move often overshoots fair value because:

- Liquidity is thin.

- Some traders front-run the event.

- Algorithms chase momentum and then quickly exit.

After the spike, liquidity flows back and price snaps toward its prior range. News Catcher Pro EA counts on that snap. Because the strategy does not trade frequently, it tries to pick only the cleanest setups—those with a wide enough spike yet within spread and ATR limits.

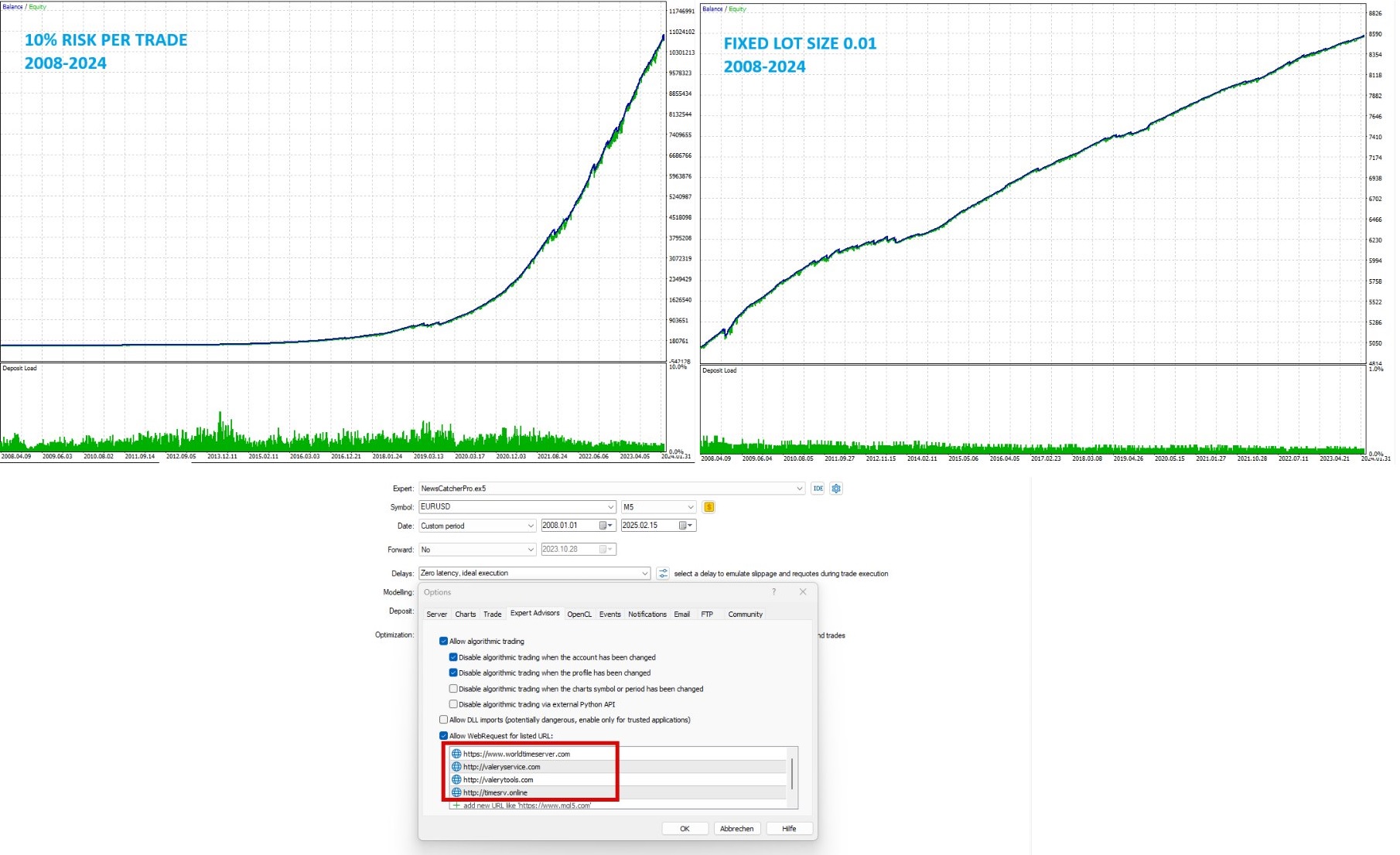

Back-Testing With Tick Data Suite (GMT+2, US DST)

Accurate testing matters. Follow this checklist:

- Use Tick Data Suite (TDS) with GMT+2 plus U.S. DST so that news timestamps line up with broker time.

- Download tick data at least from 2015 to the current year.

- Set the tester to Every tick mode for MT4 or Tick by Tick for MT5.

- Enable News Filter inside Strategy Tester—TDS sends the calendar feed to MT4/5.

- Run one symbol at a time, then combine results in a spreadsheet.

- Evaluate metrics:

- Profit Factor above 1.5

- Drawdown below 25 % (relative)

- Sharpe ratio above 0.7

Tip: Test the default presets first. Only tweak TakeProfit %ATR and PCh Offset once you know the base line.

Live Performance Pointers

Below are habits that seasoned users swear by:

- Leave It Running: Mean reversion around news can happen at odd hours. Turning off the VPS even for one session may skew monthly statistics.

- Split Accounts: Use one low-risk account (≤1 % per trade) and one demo or “play” account for higher risk so you can observe differences.

- Watch Broker Time Changes: Twice a year, server clocks change for DST. Auto GMT handles this, yet verify that trade times remain synced.

- Check Calendar Gaps: Very rarely, the news feed can break. The self-diagnostic panel will show a warning. If so, restart MetaTrader.

Risk Management Checklist

✅ Fixed max risk per trade no greater than 1 % of balance on a live account.✅ Maximum Net Number of Currencies set to 4 or less to avoid cluster correlation (e.g., EUR-sided exposure).✅ Max Floating Drawdown % enabled at 25 % or lower.✅ Withdraw profits periodically; remember this is a high-impact, low-frequency robot and tails can be heavy.

VPS and Broker Considerations

- Latency: Aim for <5 ms to your broker. Mean-reversion fills often rely on quick order routing.

- Spread Policy: Some brokers widen spreads to 5–10 pips before news, killing the edge. Run a spread log EA for a week.

- FIFO-Friendly: U.S. traders should confirm that the broker enforces FIFO, then keep Allow Hedging off.

Short list of popular choices:

| Broker | Server Location | Note |

|---|---|---|

| IC Markets | London | Raw spread, small commission. |

| Pepperstone | London / NY | Good for American session news. |

| OANDA | NY | Regulated in U.S., supports FIFO. |

Pros and Cons

Pros

- Simple one-chart setup covers three pairs.

- Auto GMT set-and-forget.

- Built-in news filter reduces black-swan risk.

Cons− Trades are few—some weeks see zero trades, which tests patience.− Strategy is sensitive to spread spikes.− Back-tests require paid tools (Tick Data Suite) for best accuracy.

Typical Mistakes and How to Avoid Them

| Mistake | How to Fix |

|---|---|

| Using a high Dynamic Lot on a small balance, leading to >5 % risk per trade. | Stick to Fixed Lots or lower the dynamic divisor. |

Ignoring broker symbol suffix in Symbols separated by comma. |

Type full symbol names, e.g., EURUSDm,GBPUSDm. |

| Disabling the News Filter “to get more trades.” | Keep it ON. The edge disappears without timing. |

| Letting Friday trades roll over weekend. | Set Hour to Stop Trading on Friday to 17:00 or earlier. |

| Running the EA on a slow home PC that sleeps overnight. | Move it to a VPS; even a $10/month plan works. |

Frequently Asked Questions

1. Does News Catcher Pro EA work on other pairs like USDJPY?Not officially. The logic focuses on GBPUSD, EURUSD, and EURGBP where the back-test edge is verified. You may experiment on demo, but results vary.

2. Can I place manual trades while the EA runs?Yes, but mind your margin and make sure your manual trades do not conflict with FIFO rules.

3. What lot size should I start with?Many users start with 0.01 lot per $1 000 using Dynamic Lot = 1000. Adjust once you see a month of live results.

4. I see “No recent news events found” in the panel. Is something wrong?Possibly the calendar feed is down. Restart terminal and check your internet firewall settings.

5. How often does the EA trade?On average, 5–15 trades per month across all three pairs. Variance is normal.

6. Does it hold trades through the news release?By default, trades close before the impact moment. You can extend Minutes Before/After Event to let them ride, but risk rises sharply.

7. What is the ideal VPS spec?1 vCPU, 1 GB RAM, SSD storage, Windows Server 2019 or 2022. Latency is more important than CPU power.

8. How do I know if Auto GMT is wrong?Cross-check Journal messages. The EA prints detected GMT offset at startup. Compare with broker time vs UTC.

9. Can I use it on a cent account?Yes. Lot sizing will scale; 0.01 cent lot equals 0.0001 standard lot.

10. Is the EA FIFO compliant out of the box?Yes. It does not hedge by default. Set Allow Hedging = false to be safe.

Final Thoughts

News Catcher Pro EA offers a clear, rules-based way to capture the brief mean-reversion that often follows high-impact news. With the right VPS, an ECN broker, and prudent lot sizing, traders can add a low-frequency yet potentially steady edge to their portfolio. If you try it, start small, track metrics for at least one calendar quarter, and adjust only one parameter at a time.

Feel free to leave questions or share your own settings in the comments below—let’s build a fuller picture of how this EA behaves in different market conditions. Happy trading!

Vendor Site – Click Here

| Membership | Yearly Membership |

|---|---|

| Additional Services | Unlock & Decompile |

| Recommended Brokers | Exness Broker, FPMarkets |

| Recommended VPS | FXVM (Low Latency) |

| Youtube Channel | ForexForYou |

| Telegram Channel | Onshoppie Forex EA's & Indicators |

| Telegram Support | Onshoppie Support |

| Installation Guides | Onshoppie Forex Guides |

Brand

ea-mt4

Only logged in customers who have purchased this product may leave a review.

Reviews

There are no reviews yet.