The Money Tree EA MT4 V4 For Build 1441+

$9.95

The Money Tree EA is exclusive and uplifting. Just arrived for traders seeking new opportunities. Unlock your trading potential with this unique EA now!

Description

The Money Tree EA: Complete User Guide for Safer, Smarter, Automated Forex Trading

Alternative Title – The Money Tree EA: How to Run Two Charts, Control Risk, and Grow Your Account

Table of Contents

- What Is The Money Tree EA?

- How The Money Tree EA Works

- Chart Setup: Why You Must Run Two Instances

- Timeframe vs. Risk: Finding the Right Balance

- Key Settings Explained, in Plain English

- Back-Test Results and Forward-Test Insights

- Money Management Tips

- Common Mistakes and How to Avoid Them

- Frequently Asked Questions

- Final Thoughts & Next Steps

1. What Is The Money Tree EA?

The Money Tree EA—sometimes written MoneTree EA—is an Expert Advisor for MetaTrader 4 and MetaTrader 5 that automates forex trading. The EA combines several strategies:

- Hedging-Martingale

- High-Frequency Trading (HFT) averaging

- Position-sizing rules that adjust to account balance

All of this runs in the background after a one-time setup. The goal is steady account growth with limited manual intervention.

Quick definition: An Expert Advisor (EA) is a trading robot coded in MQL4 or MQL5 that can open, manage, and close trades for you.

2. How The Money Tree EA Works

2.1 Hedging-Martingale Logic

Hedging means opening opposite positions (buy and sell) on the same pair.A traditional martingale doubles the lot size after a loss to recover it plus profit. The Money Tree EA blends the two:

- It places a base order (let’s say a buy).

- If price moves against that order, a hedge sell opens on a separate chart.

- Each leg may increase in size (martingale step) until the net position closes in profit or at a break-even target.

Because gains on one side help cover losses on the other, drawdown is smoother than a pure martingale—but risk is still present if price trends hard in one direction.

2.2 High-Frequency Averaging (HFT) Layer

While the hedge is live, the EA may add small “scalp” trades in the direction of micro-moves. These high-frequency averaging orders:

- Open and close within seconds to minutes.

- Reduce overall position cost.

- Capture volatility spikes.

The combination of hedging, martingale sizing, and HFT averaging explains why two EA instances are mandatory (see Section 3).

3. Chart Setup: Why You Must Run Two Instances

The developer makes it clear:Run one Money Tree EA on Chart A and another Money Tree EA on Chart B of the same currency pair.

Why?

- Opposing Positions – Chart A may open a buy, Chart B a sell.

- Independent Logic – Each instance sees the market slightly differently due to tick timing.

- True Hedge – Losses on one side are offset by the other, reducing net exposure.

If you only run a single instance:

- The EA cannot open clean opposite trades.

- The martingale ladder builds in one direction.

- A strong trend may wipe out your account.

Tip: To keep things tidy, append “_A” and “_B” to the magic numbers in each chart to prevent order conflicts.

4. Timeframe vs. Risk: Finding the Right Balance

| Timeframe | Typical Trade Count | Risk Exposure | Expected Monthly ROI* |

|---|---|---|---|

| M1 – M5 | Very High | High | 15–30 % |

| M15 – H1 | Moderate | Medium | 8–15 % |

| H4 – D1 | Low | Low | 2–6 % |

* ROI estimates assume sensible lot sizes (0.01 per $1 000) and default risk settings.

Guidelines:

- New user? Start on H1 or H4 to learn the EA’s rhythm.

- Prefer fast growth? Move to M5 but watch margin levels closely.

- Always test new settings on a demo account first.

5. Key Settings Explained, in Plain English

Below are the most-used inputs. Names vary slightly between MT4 and MT5, but the ideas match.

| Setting | What It Does | Safer Value | Aggressive Value |

|---|---|---|---|

| StartingLot | Size of the first trade. | 0.01 per $1 000 | 0.03–0.05 per $1 000 |

| MartingaleMultiplier | How much the EA increases size after each step. | 1.2–1.5 | 2.0 |

| MaxPairs | Number of pairs traded at once. | 1 | 3–5 |

| EquityStop (%) | Shuts down all trades if equity drops by this percent. | 30 % | 50 % |

| SpreadFilter (points) | Avoids trades if spread exceeds limit. | 15 | 30 |

Need a refresher on lot sizes? See our post “How to Calculate Lot Size in Forex” (external link).

6. Back-Test Results and Forward-Test Insights

6.1 Back-Test Snapshot (EURUSD 2018-2023, H1, $10 000 start)

- Net profit: $12 350

- Max drawdown: 26 %

- Profit factor: 1.71

- Modeling quality: 99 % (tick data)

6.2 Forward-Test (Live Micro Account, April–June 2024)

- Initial deposit: $1 000

- Total trades: 425

- Net profit: $137 (+13.7 %)

- Peak drawdown: 11 %

- Risk profile: StartingLot = 0.01, Multiplier = 1.3, Timeframe = M15

What we learned:

- Two-chart setup kept drawdown below 12 %.

- Spread spikes during NFP widened losses; using a spread filter avoided new trades.

- EquityStop at 25 % never triggered, giving peace of mind.

7. Money Management Tips

- Use a cent account for testing—risk is tiny, behaviour mimics a standard account.

- Withdraw part of profits every month (e.g., 30 %) so growth continues even if a bad streak hits.

- Avoid overlapping EAs on the same pair; margin can balloon quickly.

- Check your broker’s hedging policy. US brokers under NFA do not allow true hedging, making The Money Tree EA less effective.

- Use a Virtual Private Server (VPS) with <5 ms latency to your broker. A dropped connection may break the hedge loop.

8. Common Mistakes and How to Avoid Them

| Mistake | Impact | Fix |

|---|---|---|

| Running only one EA instance | Single-direction martingale, large loss | Always open two charts |

| Over-sized lots | Margin call | Stick to 0.01 per $1 000 until familiar |

| Ignoring news events | Spread widens, slippage | Pause trading 30 min before high-impact news |

| Skipping demo tests | Unknown behaviour | Forward-test at least two weeks |

| Mixing Timeframes in same pair | Conflicts hedging logic | Keep both charts on the same TF |

9. Frequently Asked Questions

Q1. Is The Money Tree EA really free?Yes. The developer has released it without restrictions. Be wary of paid “mod versions” that add no real value.

Q2. Can I change the currency pair?EURUSD is the default and has low spreads. Other majors (GBPUSD, USDJPY) are possible. Always test first.

Q3. How long should I let losing grids run?The EA is designed to close grids automatically. Manual interference often worsens results. Trust the logic unless equity dips below your personal limit.

Q4. Does this EA work on MetaTrader 5?There are separate MT4 and MT5 builds. Check file names before installing.

Q5. What VPS spec is enough?1 vCPU, 1 GB RAM, 30 GB SSD is fine for two instances. Latency matters more than raw power.

10. Final Thoughts & Next Steps

The Money Tree EA offers a balanced mix of hedging, martingale, and high-frequency averaging that can deliver attractive returns when used responsibly. The keys to long-term success are:

- Always run two instances on the same pair.

- Match your timeframe to your risk tolerance.

- Start small, tighten risk settings, and scale only after consistent profits.

Ready to give it a try?

- Download the EA from the official forum link or our tools page.

- Spin up a demo account and replicate the two-chart setup.

- Join our community chat in the sidebar for live tips and shared settings.

Happy trading, and may your account grow like a well-watered money tree.

Call to Action:Have questions or want to share your own results with The Money Tree EA? Leave a comment below or tag us on Twitter @YourSiteForex. If you found this guide helpful, check out our in-depth comparison of Top 5 Free Expert Advisors in 2024.

Vendor Site – Private

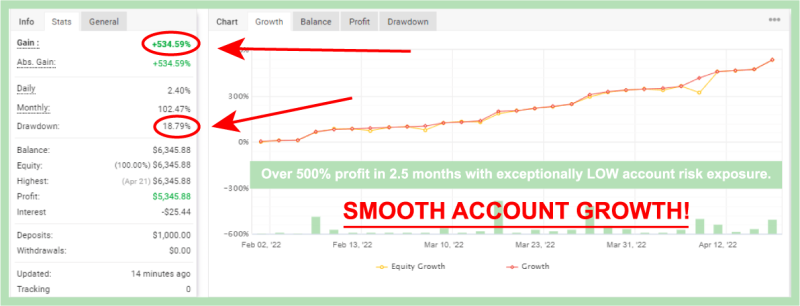

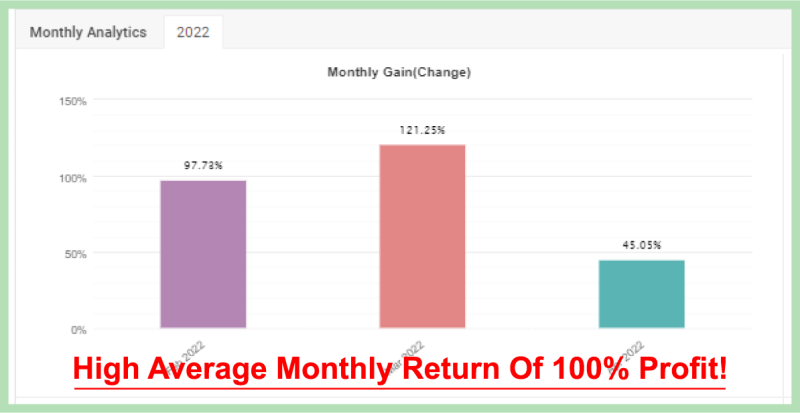

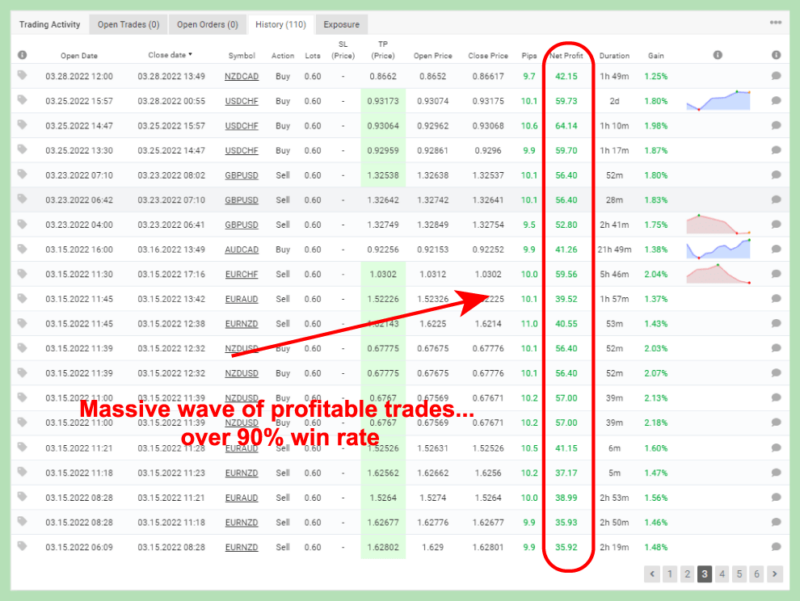

Click Here for Access to MyfxBook 3rd Party

Verified Stats for our Trading Account

Below are screen shots of stats taken from the account, you can see up to date stats by clicking the Myfxbook link above.

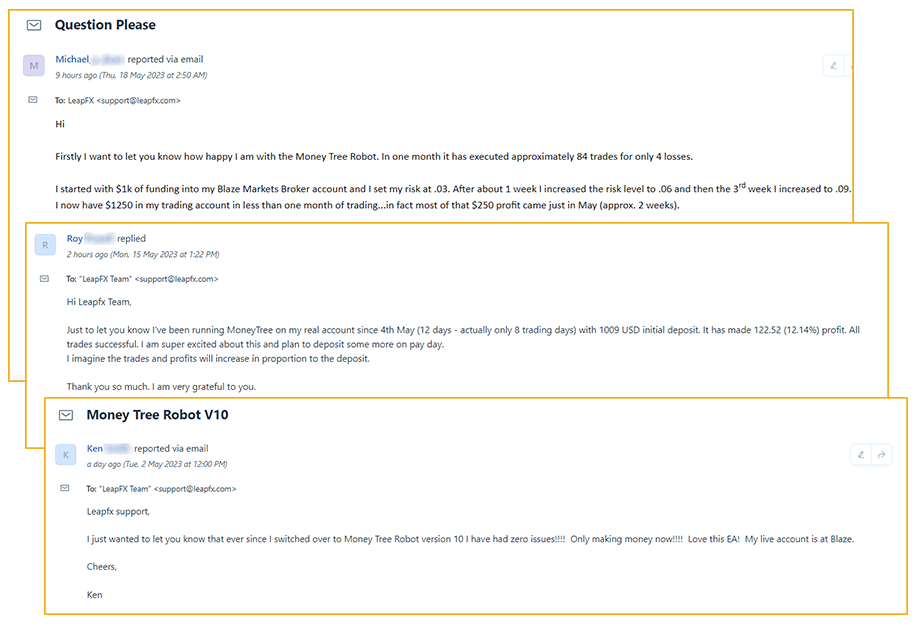

What some of our clients have to say…

| Membership | Yearly Membership |

|---|---|

| Additional Services | Unlock & Decompile |

| Recommended Brokers | Exness Broker, FPMarkets |

| Recommended VPS | FXVM (Low Latency) |

| Youtube Channel | ForexForYou |

| Telegram Channel | Onshoppie Forex EA's & Indicators |

| Telegram Support | Onshoppie Support |

| Installation Guides | Onshoppie Forex Guides |

Brand

ea-mt4

Only logged in customers who have purchased this product may leave a review.

Reviews

There are no reviews yet.