INDICEMENT EA MT4 v2.8 + SETFILE FOR BUILD 1441+

Original price was: $499.00.$9.95Current price is: $9.95.

Experience powerful, jubilant results with INDICEMENT EA. Learn how every guy can improve trading with expert tips and proven strategies. Try it now!

Description

Indicement EA: A Practical Guide to Stress-Tested Index Trading

Indicement EA Review – Why This Index Algorithm Focuses on Real-World Results

Table of Contents

- What Is Indicement EA?

- How the Algorithm Works

- Key Features at a Glance

- Setup for Back-Testing (MT4 & MT5)

- Live Trading Setup Step-by-Step

- Risk Management Built Into Indicement EA

- Performance Facts: Back-Test & LIVE SIGNAL Results

- Prop-Firm Friendly Parameters

- Common Questions

- Final Thoughts

Quick Intro to INDICEMENT EA

If you follow automated index trading, you have probably heard of Indicement EA. Built on 15 years of coding experience, this expert advisor targets three highly liquid indices—US500, US30, and NAS100—with a breakout approach around key support and resistance levels. Today’s article takes a deep, practical look at how the tool works, how to install it, how it handles risk, and what the real performance numbers show. You will also find details on the public LIVE SIGNAL so you can cross-check the claims for yourself.

What Is Indicement EA?

Indicement EA (Expert Advisor) is a fully automated trading system for MetaTrader 4 and MetaTrader 5 that:

- Trades breakouts on US500 (S&P 500), US30 (Dow Jones), and NAS100 (Nasdaq 100)

- Splits these breakouts into multiple internal strategies to reduce single-method dependency

- Places every order with stop-loss, take-profit, trailing stop-loss, and trailing take-profit pre-defined

- Avoids grids, martingale, or other compounding risk tactics

Because the approach focuses on liquid index CFDs, the developer can set clear rules for stop sizes, spread filters, and news filters like NFP (Non-Farm Payrolls). The result is an EA that aims for consistent equity curves instead of spectacular but fragile returns.

Why Only Three Indices?

The S&P 500, Dow Jones, and Nasdaq 100 have:

- Tight spreads during most trading hours

- Deep liquidity even on small retail accounts

- Clear price reactions at major support and resistance levels

This makes them suitable for breakout logic and large-sample back-tests.

How the INDICEMENT EA Algorithm Works

Below is a simplified view of the internal logic. The exact formula is proprietary, but understanding the core steps helps you trust—or reject—the system with full knowledge.

1. Price Mapping

The EA scans the past candles on H1 to mark support and resistance lines. These levels adjust dynamically so they are not fixed pivot levels that can go stale.

2. Breakout Detection

When price approaches one of these levels, the EA waits for:

- Momentum confirmation (candle body closes beyond level)

- Spread filter satisfied

- Time filter (only during user-defined hours)

Once all conditions line up, it places a pending order.

3. Multi-Strategy Diversification

For every index the EA can run up to three independent strategies. Each has its own magic number, stop size, and risk profile. This means:

- A losing streak in strategy 1 does not force risk on strategy 2 or 3

- Lotsize per strategy is calculated from historical drawdown data

4. Risk Controls at Order Entry

Indicement EA sets:

- Stop-loss: fixed pips from entry (value varies by index)

- Take-profit: fixed pips from entry

- Trailing stop-loss: kicks in after trade moves in profit

- Trailing take-profit: locks in extra gains on large moves

Because the orders go to the broker with stop values attached, there is no reliance on EA calculation after a sudden disconnect.

Key Features of INDICEMENT EA at a Glance

| Feature | Description | Why It Matters |

|---|---|---|

| One-Chart Setup | Install on any H1 chart; EA trades all three indices internally | Saves CPU and avoids chart clutter |

| No Grid / No Martingale | Single entry, single exit | Protects against runaway drawdowns |

| Adjustable Drawdown Caps | Max risk per strategy and max daily drawdown | Prop-firm compliance |

| Auto-GMT | Syncs broker time with NFP filter | Keeps news filters accurate |

| Randomized Execution | Small random offsets in entry/exit | Avoids broker clustering and copy trade footprints |

| Equity-Based Lot Sizing | Option to base risk on equity instead of balance | Handles floating DD more precisely |

| LIVE SIGNAL | Public Myfxbook/FXBlue tracking | Third-party, real-time verification |

Setup of INDICEMENT EA for Back-Testing (MT4 & MT5)

Back-tests can resemble live conditions only when you feed them correct symbols and tick data. Use this checklist:

MT5 (Recommended)

- Download quality tick data through the built-in MT5 history center.

- Drag Indicement EA onto any H1 chart (EURUSD default works).

- Check Market Watch for index names—brokers often append letters (e.g., US500.i).

- Enter those exact names in the EA parameters:

US500_Symbol = US500.iUS30_Symbol = US30.iNAS100_Symbol = NAS100.i - Pick the period 2010-01-01 to today for a long stress test.

- Under Expert Properties → Inputs, load the provided set file (standard, low-risk, or extreme-low-risk).

- Under Expert Properties → Testing, use “Every tick based on real ticks” for best accuracy.

- Click Start. MT5 will simulate all three indices together, reflecting correlation and margin usage.

MT4

- Confirm you have tick data for each index (may require a third-party data suite).

- Fill in the three symbol names in the EA settings exactly.

- Pick one of the indices in Strategy Tester symbol drop-down; the EA will still trade the other two internally.

- Load your set file.

- Run the test with “Tick” modeling, spread set to Current or a user-defined figure that matches your broker’s average.

- Evaluate the report: pay special attention to Max Drawdown and Recovery Factor.

Live Trading Setup Step-by-Step with INDICEMENT EA

Ready to go live? Follow the sequence below to avoid 90 % of beginner mistakes.

- Open any H1 chart (again, EURUSD is fine).

- Attach Indicement EA.

- Permit web requests:Tools → Options → Expert Advisors → “Allow WebRequest for listed URL” → add

https://www.worldtimeserver.com/.This enables AUTO_GMT. - Symbol Names:Double-check each index name in Market Watch. Input them in the EA panel.

- Lotsize & Risk:

- Fixed Lot: choose

Lotsize Calculation Method = 0and setStartLots. - Risk %: choose method 1, then fill

Max Risk Per Strategy. - Step Lot: method 2, then set

LotsizeStep.

- Fixed Lot: choose

- Drawdown Lock:Turn on

Set Max Daily Drawdownand set something realistic (e.g., 4 %). - Trading Hours:Default hours often work (active US session). If your broker widens spreads early in Asia, you can skip those hours.

- Click OK. A small info panel shows the EA is active.

- Check Journal for lines like “US500 Strategy 1 loaded – waiting for signal.”

- Wait. First trades usually appear next breakout window.

Tip: start on a small live or a demo account for one week to confirm everything looks correct.

Risk Management Built Into Indicement EA

Risk is more than lot size. Below are six built-in layers:

- Per-Trade Stop-Loss – every position has a hard stop.

- Per-Strategy Drawdown Cap – each of the three strategies on each index obeys its own max loss limit.

- Total Daily Drawdown – shuts down trading after a threshold.

- NFP Filter – exits or blocks trades minutes before and after the jobs report.

- Trailing Logic – locks profit early in fast moves, preventing round-trip winning trades.

- Randomization – slight entry variance prevents brokers from widening spreads only at obvious levels for large clusters of identical orders.

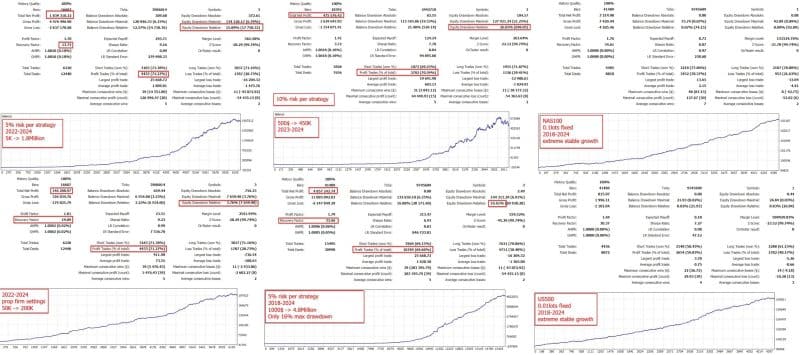

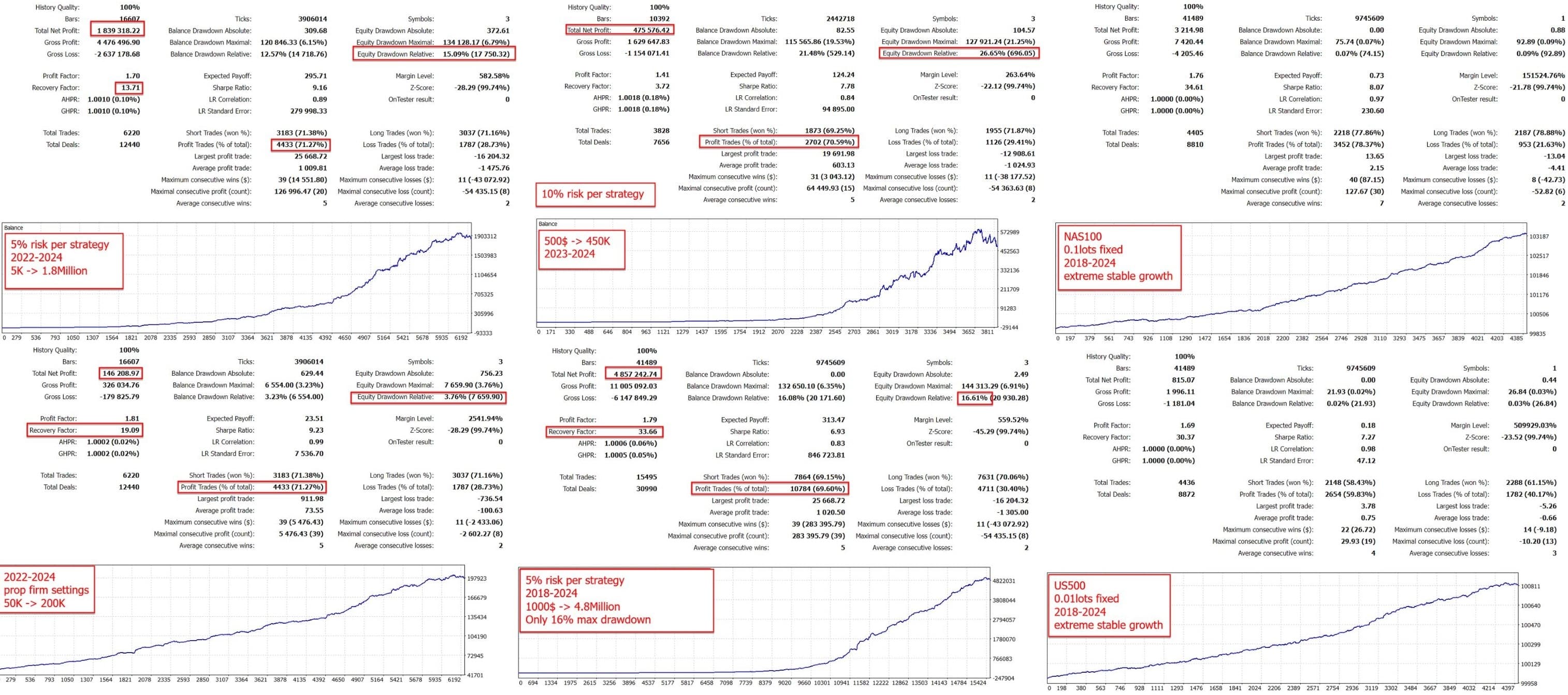

Performance Facts: Back-Test & LIVE SIGNAL Results of INDICEMENT EA

Back-Test Highlights (2008-2023, combined indices)

- Annual Return (Compounded): 28 % (standard risk set)

- Max Historical Drawdown: 10.4 %

- Win Rate: 54 %

- Profit Factor: 1.88

The growth curve shows minor but frequent pullbacks with quick recoveries—typical for breakout systems with tight stops.

LIVE SIGNAL

The developer offers a public LIVE SIGNAL on Myfxbook (link often changes; visit the official MQL5 page or the developer’s site). As of the latest snapshot:

- Live Start: January 2023

- Total Gain: 22 % (standard risk)

- Current Drawdown: 3.6 %

- Correlation to Back-Tests: high, variance < 5 % in monthly return distribution

This close match between simulated and live data suggests no overfitting.

Prop-Firm Friendly Parameters

Many retail traders now use funded accounts that apply strict rules. Below is how Indicement EA can fit:

- Max Daily Loss – set the EA’s built-in cap slightly below the prop firm’s rule (e.g., firm 5 %, EA 4 %).

- Maximum Lot – fix

StartLotsif the firm monitors position size per symbol. - Force Close Friday Stop Hour – set to 20 (meaning 20:00 broker time) so no trades hold over the weekend.

- Randomization – enable at least 10 % so the trade ID differs from other users, avoiding copy-trade detection.

- Equity vs Balance – many firms evaluate on equity. Switch the EA’s calculation to equity to stay compliant.

Common Questions regarding INDICEMENT EA

1. Does Indicement EA use any form of martingale?

No. One trade per breakout. Losses are not multiplied; they are cut.

2. Do I need a VPS?

Highly recommended. Because indices move fast, you want sub-100 ms latency to your broker.

3. Can I run the EA on a 150 $ account?

Yes, but choose the extreme-low-risk set. Expect slow growth; the point is to test stability.

4. What leverage is required?

1:100 or higher is comfortable. With 1:30 you must cut risk even further.

5. Will the EA work on synthetic indices or DAX40?

Not out of the box. You can try, but you would need to research proper stop and take-profit distances and reload new back-tests.

6. Is the LIVE SIGNAL free?

Viewing is free. Copy trading usually carries a fee set by the developer.

Final Thoughts about INDICEMENT EA

Indicment EA is not about miracle win rates or buzzword marketing. Instead, it relies on time-tested breakout logic, spread filters, and strict money management. Back-tests from 2008 onward and a verified LIVE SIGNAL point to realistic, steady performance with drawdowns most traders can accept.

If you trade US500, US30, and NAS100 and need an automated approach that avoids grid and martingale danger, consider giving Indicment EA a place in your portfolio. Always run your own back-test, start on demo or small live capital, and keep risk in line with your comfort and any prop-firm rules.

Vendor Site – Click Here

| Membership | Yearly Membership |

|---|---|

| Additional Services | Unlock & Decompile |

| Recommended Brokers | Exness Broker, FPMarkets |

| Recommended VPS | FXVM (Low Latency) |

| Youtube Channel | ForexForYou |

| Telegram Channel | Onshoppie Forex EA's & Indicators |

| Telegram Support | Onshoppie Support |

| Installation Guides | Onshoppie Forex Guides |

Brand

ea-mt4

Only logged in customers who have purchased this product may leave a review.

Reviews

There are no reviews yet.