Bank Dollar EA MT5 v5.2 + SetFiles For Build 4885+

$9.95

Experience forex trading revolution with Bank Dollar EA. Boost your profits, reduce losses, and automate your trades. Start your journey.

Description

Maximizing Profits with Bank Dollar EA: A Comprehensive Guide

Bank Dollar EA: The Ultimate Robot Trading Solution for Deriv

Table of Contents

- Introduction to Bank Dollar EA

- Understanding Robot Trading on Deriv

- Bank Dollar EA: Key Features

- Hedging Strategy in Bank Dollar EA

- Adapting to All Volatility Levels

- Versatility Across All Time Frames

- Setting Up Bank Dollar EA

- Optimizing Bank Dollar EA Performance

- Pros and Cons of Using Bank Dollar EA

- Conclusion: Is Bank Dollar EA Right for You?

Introduction to Bank Dollar EA

In the world of forex trading, having a reliable and efficient trading system is crucial for success. Enter Bank Dollar EA, a powerful robot trading solution designed specifically for the Deriv platform. This automated trading system has gained popularity among traders for its ability to navigate various market conditions and generate consistent profits.

Bank Dollar EA stands out from other trading robots due to its advanced algorithms and adaptability to different market scenarios. Whether you’re a seasoned trader or just starting, this EA offers a comprehensive solution to help you maximize your trading potential.

Understanding Robot Trading on Deriv

Before diving deeper into Bank Dollar EA, it’s essential to grasp the concept of robot trading on the Deriv platform. Robot trading, also known as automated trading or algorithmic trading, involves using computer programs to execute trades based on pre-defined rules and strategies.

Deriv, a popular online trading platform, supports various trading robots, including Bank Dollar EA. These robots can analyze market data, identify trading opportunities, and execute trades automatically, often at speeds far beyond human capabilities.

Some key advantages of robot trading on Deriv include:

- 24/7 trading without human intervention

- Elimination of emotional decision-making

- Ability to backtest strategies using historical data

- Consistent execution of trading rules

- Potential for higher trading frequency and volume

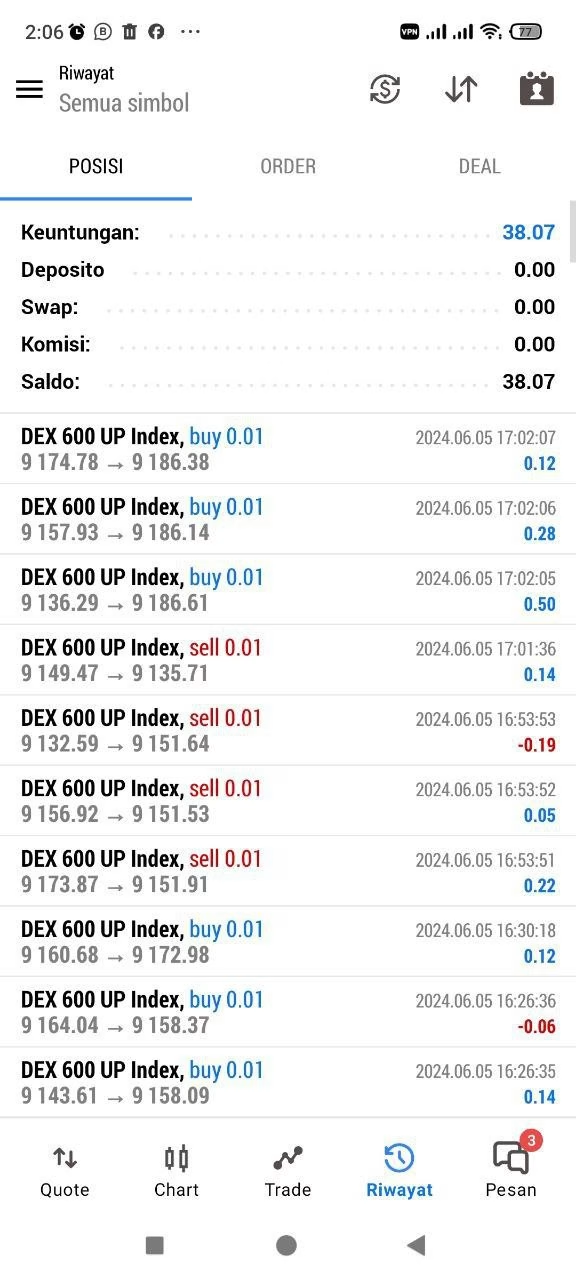

Bank Dollar EA: Key Features

Bank Dollar EA comes packed with several features that make it a popular choice among Deriv traders. Let’s explore some of its key characteristics:

- Hedging Strategy: Bank Dollar EA employs a sophisticated hedging strategy to minimize risks and maximize profits. This approach involves opening opposing positions to offset potential losses.

- All Volatility Adaptation: The EA is designed to perform well in various market conditions, from low to high volatility periods.

- Multi-Timeframe Analysis: Bank Dollar EA can analyze and trade across all time frames, from 1-minute charts to monthly charts, providing versatility in trading opportunities.

- Advanced Risk Management: The EA incorporates built-in risk management features to protect your trading capital and ensure long-term sustainability.

- Customizable Parameters: Users can adjust various settings to tailor the EA’s performance to their specific trading goals and risk tolerance.

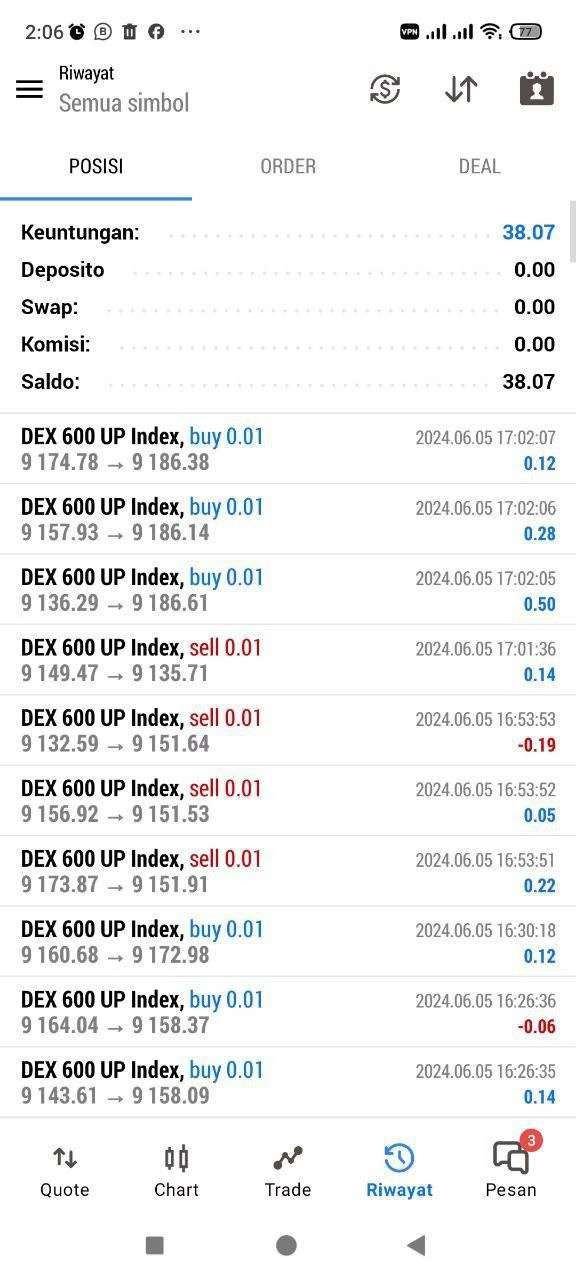

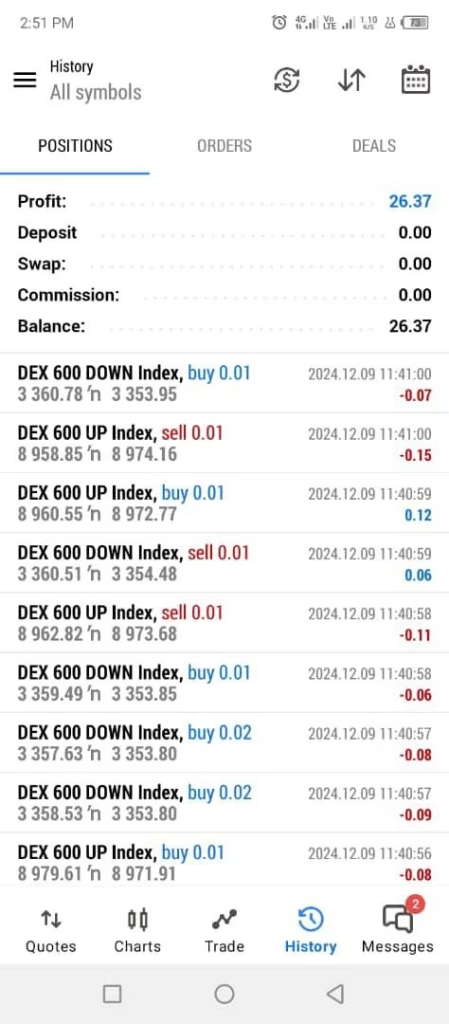

Hedging Strategy in Bank Dollar EA

One of the standout features of Bank Dollar EA is its implementation of a hedging strategy. Hedging is a risk management technique that involves taking an offsetting position in a related asset to reduce the risk of adverse price movements.

In the context of Bank Dollar EA, the hedging strategy works as follows:

- The EA opens a trade in a particular direction based on its analysis.

- If the market moves against the initial position, the EA may open an opposing trade to offset potential losses.

- As the market fluctuates, the EA manages both positions, closing them when profitable or when specific conditions are met.

This approach helps to minimize drawdowns and protect trading capital during periods of market uncertainty or sudden price reversals.

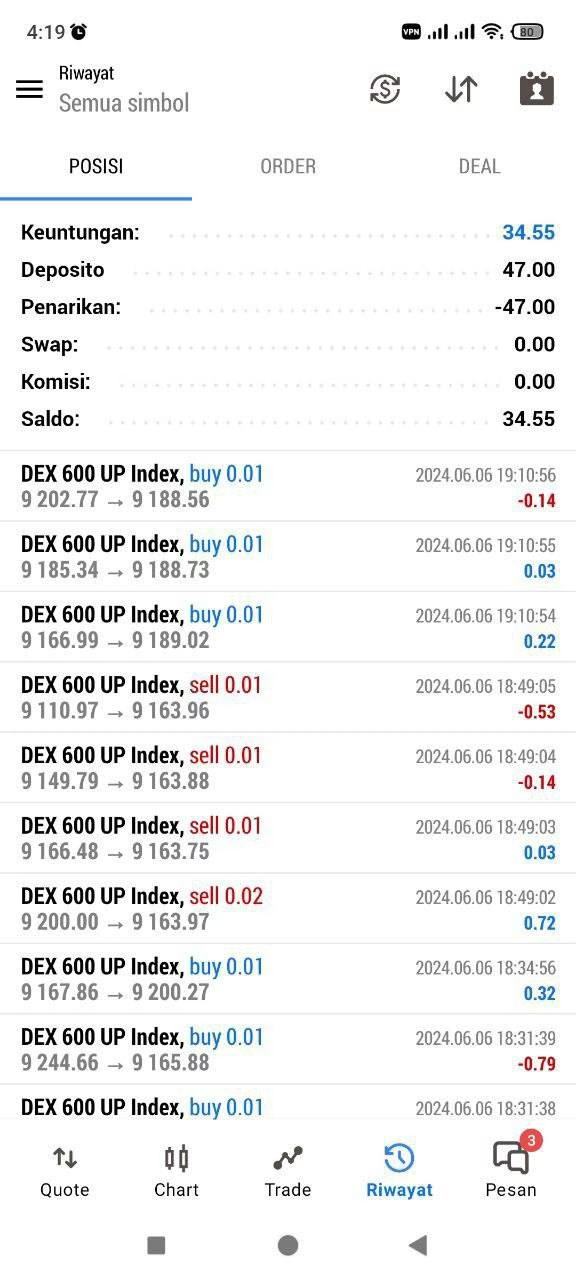

Adapting to All Volatility Levels

Market volatility can have a significant impact on trading performance. Bank Dollar EA is designed to adapt to various volatility levels, making it suitable for different market conditions.

During periods of low volatility:

- The EA may adjust its entry and exit criteria to capture smaller price movements.

- It might increase the frequency of trades to compensate for smaller profit opportunities.

In high volatility environments:

- Bank Dollar EA may widen its stop-loss and take-profit levels to account for larger price swings.

- The EA might become more selective in its trade entries to avoid false breakouts.

This adaptability ensures that Bank Dollar EA can continue to perform effectively regardless of market conditions.

Versatility Across All Time Frames

Another key advantage of Bank Dollar EA is its ability to analyze and trade across all time frames. This versatility allows traders to choose the time frame that best suits their trading style and goals.

Some benefits of multi-timeframe analysis include:

- Improved trend identification: By analyzing multiple time frames, the EA can better identify overall market trends and potential reversal points.

- Confirmation of trading signals: Signals generated on lower time frames can be confirmed by analyzing higher time frames, reducing the likelihood of false entries.

- Flexibility in trading strategies: Traders can use different strategies for different time frames, diversifying their approach and potentially increasing overall profitability.

- Adaptation to market conditions: The EA can switch between time frames based on current market conditions, optimizing its performance.

Setting Up Bank Dollar EA

To start using Bank Dollar EA on your Deriv account, follow these steps:

- Purchase and Download: Acquire Bank Dollar EA from a reputable source and download the files to your computer.

- Deriv Account Setup: Ensure you have a funded Deriv account with API access enabled.

- Platform Installation: Install the necessary trading platform (e.g., MetaTrader 4 or 5) and connect it to your Deriv account.

- EA Installation: Copy the Bank Dollar EA files to the appropriate folder in your trading platform directory.

- EA Configuration: Attach the Bank Dollar EA to a chart of your chosen currency pair and time frame.

- Parameter Adjustment: Review and adjust the EA’s parameters according to your trading preferences and risk tolerance.

- Testing: Run the EA in demo mode to familiarize yourself with its operation and performance before using it on a live account.

Optimizing Bank Dollar EA Performance

To get the most out of this EA, consider the following optimization tips:

- Backtesting: Use the platform’s backtesting feature to evaluate the EA’s performance on historical data. This can help you identify optimal parameter settings.

- Start Small: When transitioning to live trading, start with a small account size to minimize risk while you gain confidence in the EA’s performance.

- Monitor and Adjust: Regularly review the EA’s performance and make necessary adjustments to its parameters based on changing market conditions.

- Use Proper Risk Management: Set appropriate lot sizes and risk levels to protect your account from excessive drawdowns.

- Stay Informed: Keep up with market news and economic events that may impact the currency pairs you’re trading.

- Combine with Manual Analysis: While this EA is automated, incorporating your own market analysis can help you make informed decisions about when to enable or disable the EA.

Pros and Cons of Using Bank Dollar EA

As with any trading tool, this EA has its advantages and disadvantages. Let’s explore some of them:

Pros:

- Automated trading 24/7 without constant monitoring

- Elimination of emotional decision-making

- Ability to trade multiple currency pairs simultaneously

- Adaptability to various market conditions and time frames

- Implementation of advanced hedging strategies

Cons:

- Initial cost of purchasing the EA

- Learning curve for proper setup and optimization

- Potential for over-optimization leading to poor live performance

- Dependency on stable internet connection and platform uptime

- May not perform well in unprecedented market conditions

Conclusion: Is Bank Dollar EA Right for You?

This EA offers a powerful and versatile solution for traders looking to automate their forex trading on the Deriv platform. Its ability to adapt to different volatility levels, trade across all time frames, and implement hedging strategies makes it an attractive option for many traders.

However, it’s essential to remember that no trading system is perfect, and success with this EA will depend on proper setup, optimization, and ongoing monitoring. Before committing to using this EA, take the time to thoroughly test it in a demo environment and ensure it aligns with your trading goals and risk tolerance.

Ultimately, this EA can be a valuable tool in your trading arsenal, but it should be used in conjunction with a solid understanding of the forex market and sound risk management practices.

Call-to-Action: Ready to try this EA? Start by opening a demo account on Deriv and test the EA’s performance in various market conditions. Remember to always trade responsibly and never risk more than you can afford to lose.

| Membership | Yearly Membership |

|---|---|

| Additional Services | Unlock & Decompile |

| Recommended Brokers | Exness Broker, FPMarkets |

| Recommended VPS | FXVM (Low Latency) |

| Youtube Channel | ForexForYou |

| Telegram Channel | Onshoppie Forex EA's & Indicators |

| Telegram Support | Onshoppie Support |

| Installation Guides | Onshoppie Forex Guides |

Brand

ea-mt5

Only logged in customers who have purchased this product may leave a review.

Reviews

There are no reviews yet.