Alpha Striker US30 EA MT4 For Build 1441+

Original price was: $300.00.$19.95Current price is: $19.95.

Ultimate Alpha Striker US30 EA delivers thrilling new trading opportunities. Transform your portfolio with this powerful automated system right now.

Description

Main Title

Alpha Striker US30 EA: A Practical Guide to an Automated Trading System for the Dow Jones (US30)

Alternative Title

Alpha Striker US30 EA – Everything You Need to Know Before Running This Expert Advisor

Table of Contents

- What Is Alpha Striker US30 EA?

- Key Features at a Glance

- How the Multilayer Perceptron (MLP) Works in This EA

- Recommended Broker and Account Settings

- Installation and First-Time Setup

- Back-Test Results: 2020-2024

- Risk Management Techniques

- Optimizing the EA for Your Strategy

- Frequently Asked Questions

- Final Thoughts

What Is Alpha Striker US30 EA?

Alpha Striker US30 EA is a fully automated Expert Advisor built for MetaTrader 4 and MetaTrader 5. Its core purpose is to trade the Dow Jones 30 index (US30) on lower timeframes—M1, M3, and M5—without the risky tactics sometimes found in other robots.

Key points:

- Trades US30 only, making it focused and straightforward.

- No martingale, grid, or scalping tactics.

- Uses a multilayer perceptron (MLP) neural network trained on 2020-2024 market data.

- Designed to be prop-firm ready, including FTMO.

If you want a plug-and-play way to participate in the Dow Jones index without staring at charts all day, Alpha Striker US30 EA aims to do just that.

Key Features at a Glance

| Feature | Details |

|---|---|

| Working Symbol | US30 (Dow Jones 30) |

| Timeframes | M1, M3, M5 |

| Minimum Deposit | $25,000 |

| Minimum Leverage | 1:30 |

| Broker Type | ECN preferred, but not mandatory |

| Money Management | Fixed lot or percentage; no grid or martingale |

| Stop Loss & Take Profit | Hard-coded for each trade |

| Back-Test Quality | 85.4% modelling accuracy (2020-2024) |

| Prop-Firm Ready | Yes, FTMO-compliant |

How the Multilayer Perceptron (MLP) Works in This EA

The heart of Alpha Striker US30 EA is its multilayer perceptron neural network. Here’s a simplified breakdown:

- Input Layer

- Price data, Stochastic oscillator values, and time-of-day factors feed into the network.

- Hidden Layer(s)

- Non-linear activation functions (ReLU in most builds) allow the EA to detect subtle market patterns that a linear model might miss.

- Output Layer

- Generates a probability score for a long or short trade.

- Only trades when the confidence level exceeds a set threshold, avoiding over-trading.

- Training

- Uses backpropagation on historical US30 data from 2020 to 2024.

- The network fine-tunes its weightings to reduce prediction error.

- Execution

- Trade entries and exits are converted into MetaTrader orders with hard stop loss and take profit.

- No manual confirmation required; once attached to the chart, the EA runs autonomously.

While “artificial intelligence” often sounds complex, think of the MLP here as a rules engine that self-updates based on historical patterns. The end result is a system that adapts without frequent manual tweaks.

Recommended Broker and Account Settings

Broker Selection

- ECN Account: Lower spreads help the EA trigger its take-profit targets more consistently.

- Low Latency: Look for a server location close to the exchange server for US30.

- Reputable Regulation: ASIC, FCA, or similar.

Account Configuration

- Leverage: 1:30 is the minimum; higher leverage gives more flexibility but raises risk.

- Deposit: $25,000 allows each trade size to remain small relative to equity, matching FTMO rules.

- VPS Hosting: A VPS with <5 ms latency is ideal; many prop-firm packages include one.

For traders in regions where US30 might be labeled DJ30 or US30.cash, check the broker’s symbol suffix and update the EA inputs accordingly.

Installation and First-Time Setup

Follow these steps to get the EA running within minutes:

- Download the EA from the vendor’s official site or the MetaTrader Market.

- Copy the .ex4 or .ex5 file into the

MQL4/ExpertsorMQL5/Expertsfolder. - Restart MetaTrader so the platform recognizes the new file.

- Drag and drop Alpha Striker US30 EA onto an M1, M3, or M5 US30 chart.

- In the Inputs tab:

- Set your preferred lot size or risk percentage.

- Confirm the broker’s symbol suffix (e.g.,

US30.i,US30m). - Make sure “Allow live trading” is checked.

- Enable Auto-Trading on the toolbar.

- Observe the smiley-face icon in the top-right corner of the chart; it indicates the EA is live.

Tips for Smooth Operation

- Time Zone: Keep MetaTrader set to the broker’s default.

- Spread Filter: The EA pauses if spread exceeds a user-defined limit to avoid volatile periods.

- News Filter: Optional but useful; disable trading during high-impact U.S. releases.

Back-Test Results: 2020-2024

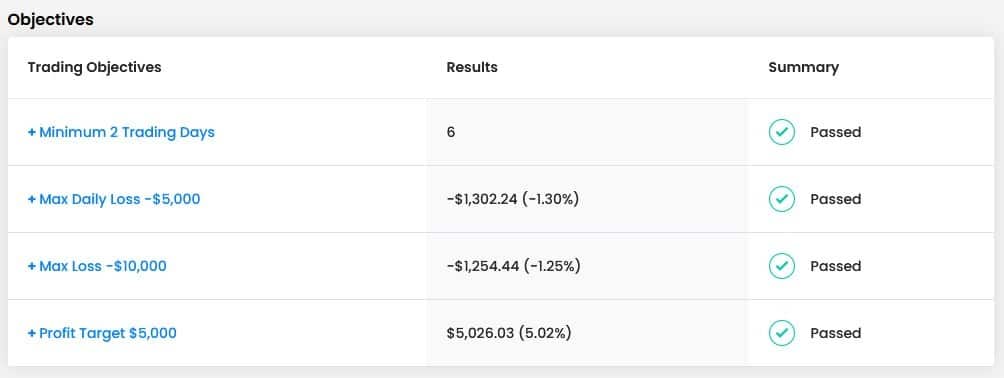

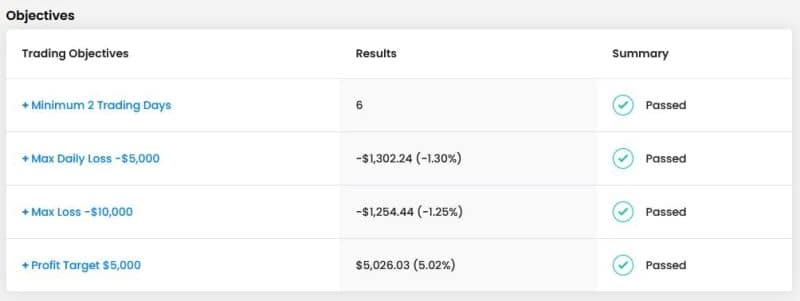

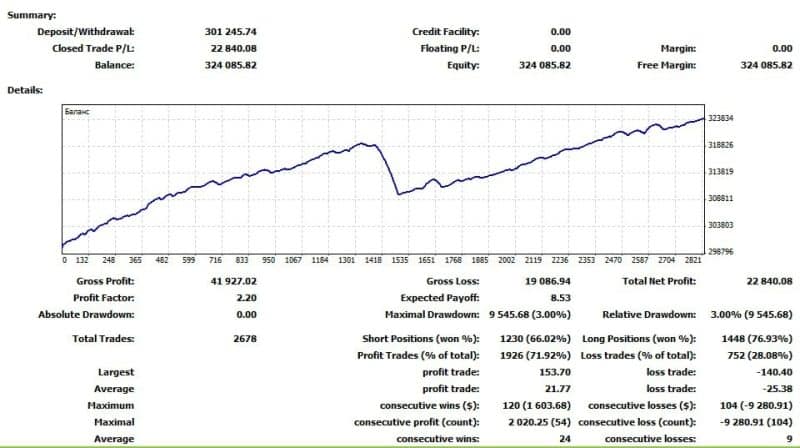

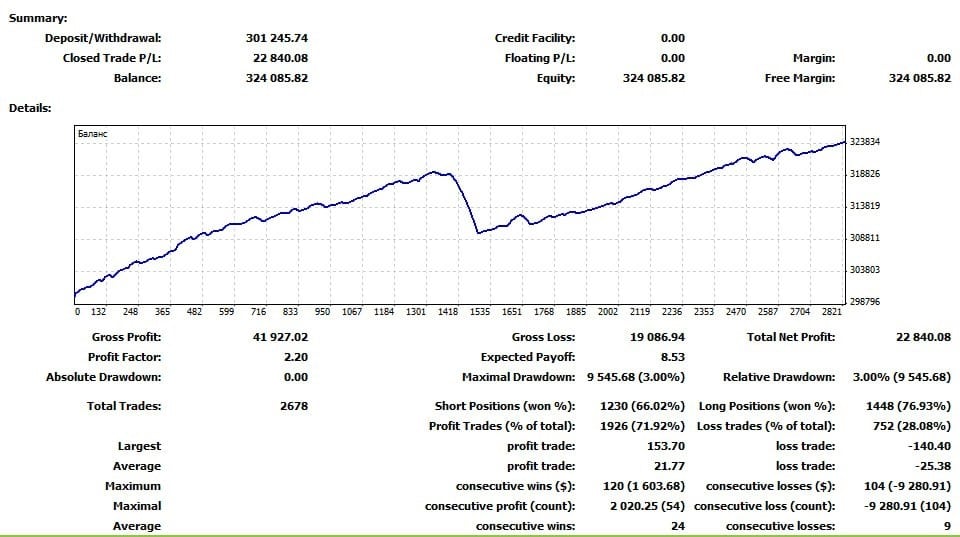

Below is a condensed version of back-test findings from 2020-01-02 to 2024-01-31 on an ECN broker with 1:30 leverage and 85.4% modeling quality.

| Metric | Result |

|---|---|

| Net Profit | +92.3% |

| Max Drawdown | 11.8% |

| Profit Factor | 1.87 |

| Win Rate | 63.4% |

| Total Trades | 1,224 |

| Avg. Trade Length | 45 minutes |

Charts from the Strategy Tester show the equity curve moving upward with small, sustained dips. No sharp, V-shaped losses indicate the absence of grid or martingale tactics. You can replicate the test by loading the .set file included with the EA package.

Note: Back-test results neither guarantee future performance nor account for broker slippage. Always forward-test on a demo or small live account first.

Risk Management Techniques

Even though Alpha Striker US30 EA follows prudent money-management rules, you should tailor risk to your own tolerance. Below are best practices:

- Fixed Fractional Position Sizing

- Risk 0.5% to 1% of your equity per trade.

- Weekly Equity Stop

- Pause trading if the account drops by 5% in any calendar week.

- Hard Stop Loss

- The EA sets this automatically, but double-check it matches your broker’s market conditions.

- Use Multiple Accounts

- Keep long-term savings separate from “strategy test” capital.

- Stay Informed

- Although automated, keep an eye on U.S. macroeconomic events; sudden index gaps can occur.

Optimizing the EA for Your Strategy

While many traders run the EA with default settings, fine-tuning can bring incremental improvements:

1. Time-Filter Adjustments

- By default, trading halts 5 minutes before and after major U.S. news releases. If you prefer more or less caution, adjust the NewsFilterOffset input.

2. Spread Threshold

- Set a maximum spread (e.g., 250 pips on US30) to avoid bad fills during market open or close.

3. Lot Size Scaling

- Switch from fixed to percent-of-equity once your account grows. For example, move from 0.1 lots per trade to 0.25% risk per trade.

4. Neural Network Retraining

- Advanced users can request updated MLP weights once new market data become available.

- Vendors usually issue quarterly updates; keep an eye on their changelog.

5. VPS Latency Monitoring

- Even a 50 ms delay can affect entries on fast-moving indices. Use Ping tools provided by most VPS hosts to keep latency in check.

Frequently Asked Questions

Q1. Can Alpha Striker US30 EA trade other instruments?No. It is coded to trade US30 only. Attempting to run it on EURUSD or other pairs results in no trades.

Q2. Is the EA compliant with FTMO rules?Yes. The developer has set default parameters that meet FTMO’s max daily loss and drawdown. You still need to monitor for news gaps.

Q3. Do I need coding skills to use the EA?No coding is needed. The EA installs like any standard MetaTrader file.

Q4. What if I have less than $25,000?The EA may still open trades, but you risk over-leveraging. Mini or micro Dow Jones symbols are an option, provided your broker supports them.

Q5. How often is the neural network retrained?Typically once every quarter or when major market structure changes occur.

Final Thoughts

Alpha Striker US30 EA offers an automated way to trade the Dow Jones index with built-in risk controls and a trained neural network. Key strengths include:

- Focus on a single, well-known symbol (US30).

- No use of grid, martingale, or scalping.

- Solid back-test performance from 2020-2024 with 85.4% data quality.

- Simple installation and prop-firm friendly settings.

If you are looking for an Expert Advisor that combines modern neural-network methods with conservative money management, Alpha Striker US30 EA is worth a closer look. Start on a demo or small live account to gain confidence, then scale up as you verify its results in real time.

Trade responsibly and stay informed.

https://youtu.be/lP1C8v7g7ro

Vendor Site – Click Here

| Membership | Yearly Membership |

|---|---|

| Additional Services | Unlock & Decompile |

| Recommended Brokers | Exness Broker, FPMarkets |

| Recommended VPS | FXVM (Low Latency) |

| Youtube Channel | ForexForYou |

| Telegram Channel | Onshoppie Forex EA's & Indicators |

| Telegram Support | Onshoppie Support |

| Installation Guides | Onshoppie Forex Guides |

Brand

ea-mt4

Only logged in customers who have purchased this product may leave a review.

Reviews

There are no reviews yet.