Money Box Robot MT4 with Setfiles

Original price was: $1,300.00.$55.95Current price is: $55.95.

Meet the amazing Money Box Robot! Jubilant kids everywhere are loving this unique way to save money. Start your savings journey today!

Description

Money Box Robot: A Practical Guide to a Fully Automated Swing-Trading EA

Money Box Robot — Intelligent Automation with Dynamic Price Targets

Table of Contents

- What Is Money Box Robot?

- How the Expert Advisor Works

- Key Features at a Glance

- Money Management Logic

- Entry and Exit Strategy

- Installation on MetaTrader 4

- Ideal Market Conditions & Assets

- Back-Testing and Live Results

- Who Should Consider Money Box Robot?

- Tips for Responsible EA Use

- Frequently Asked Questions

- Final Thoughts

Quick Summary

Money Box Robot MT4: Intelligent Automation with Dynamic Price Targets is an Expert Advisor (EA) that focuses on medium- to long-term swing trading. It combines price-target algorithms with a momentum filter, adapts position size to account balance, and synchronizes entry times with your broker’s server.

What Is Money Box Robot?

Money Box Robot is a fully automated trading system for MetaTrader 4. Unlike fast scalping bots, it looks for larger, higher-probability moves in the market. The EA adjusts the lot size for every order so that the percentage of equity at risk stays steady, no matter how the balance changes.

- Primary Platform: MT4

- Strategy Style: Swing trading

- Core Filters: RSI momentum, price levels, broker GMT offset

How the Expert Advisor Works

- Market Scan – The robot checks RSI values and recent price movements.

- Signal Filter – Only signals with clear momentum and matching price targets pass.

- Order Placement – The lot size is calculated from account equity and a risk parameter.

- Dynamic TP & SL – Wide targets aim for favorable reward-to-risk ratios typical of swing setups.

- Monitoring & Management – If price or equity shifts, the system will adapt on the next trade.

Key Features at a Glance

| Feature | Purpose |

|---|---|

| Automatic Lot Sizing | Keeps risk per trade consistent as equity changes. |

| Price Target Engine | Sets fixed TP/SL values so trades are not time-bound. |

| RSI Momentum Filter | Filters out weak moves and focuses on stronger setups. |

| Broker Time Sync | Matches your broker’s GMT offset for accurate candle times. |

| Multi-Asset Ready | Optimized for XAUUSD but can be tested on other pairs. |

| Fully Hands-Off | No manual override is required once parameters are set. |

Money Management Logic

Maintaining a fixed risk percentage is one of the most important parts of any strategy. Money Box Robot’s built-in money management looks like this:

Lot Size = (Account Equity × Risk %) / (Stop-Loss Points × Point Value)This formula means:

- Larger accounts take proportionally larger positions.

- A quick drawdown automatically lowers position size.

- There is no need to recalibrate each week.

Entry and Exit Strategy

Entry Criteria

- RSI crosses a defined threshold (e.g., 30 or 70).

- Momentum confirms direction (price closes beyond a trigger level).

- Spread and slippage filters are checked.

Exit Criteria

- Take-Profit – Pre-defined distance in points or dollars.

- Stop-Loss – Symmetrical or asymmetric distance; wide enough for swing setup.

- Time Exit (optional) – Close after n bars if neither TP nor SL is reached.

External resource: Learn more about the Relative Strength Index (RSI) and how it measures momentum.

Installation on MetaTrader4

- Download the Money Box Robot

.ex4file. - Place it in

MQL4/Experts/inside your MT4 data folder. - Restart MT4 or refresh the Navigator pane.

- Drag the EA onto a chart:

- Timeframe: H1 or H4 recommended.

- Symbol: XAUUSD by default.

- In the Inputs tab:

- Set RiskPercent (e.g.,

1.0). - Confirm GMTOffset matches your broker.

- Fine-tune RSI level and TP/SL points if desired.

- Set RiskPercent (e.g.,

- Allow AutoTrading and keep the platform connected.

Need a refresher on MT4 basics? Read our step-by-step MT4 setup guide (internal link).

Ideal Market Conditions & Assets

| Asset | Why It Fits | Notes |

|---|---|---|

| XAUUSD | High volatility, frequent swing moves | Default optimization target |

| GBPJPY | Wide daily ranges, momentum friendly | Test lower lot size due to big pip value |

| EURUSD | Lower spread, smoother trends | May require tighter SL/TP |

| US30 | Stock index with large intraday swings | Check broker contract specs first |

Money Box Robot favors markets that:

- Have enough range for a 2:1 or better reward-to-risk.

- Do not widen spreads excessively during news.

- Provide reliable price feeds on MT4.

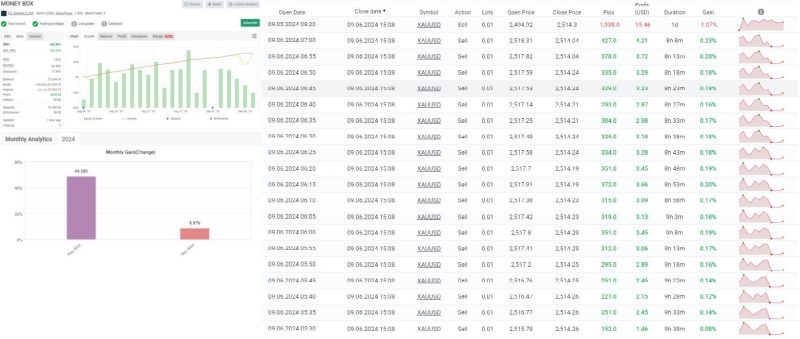

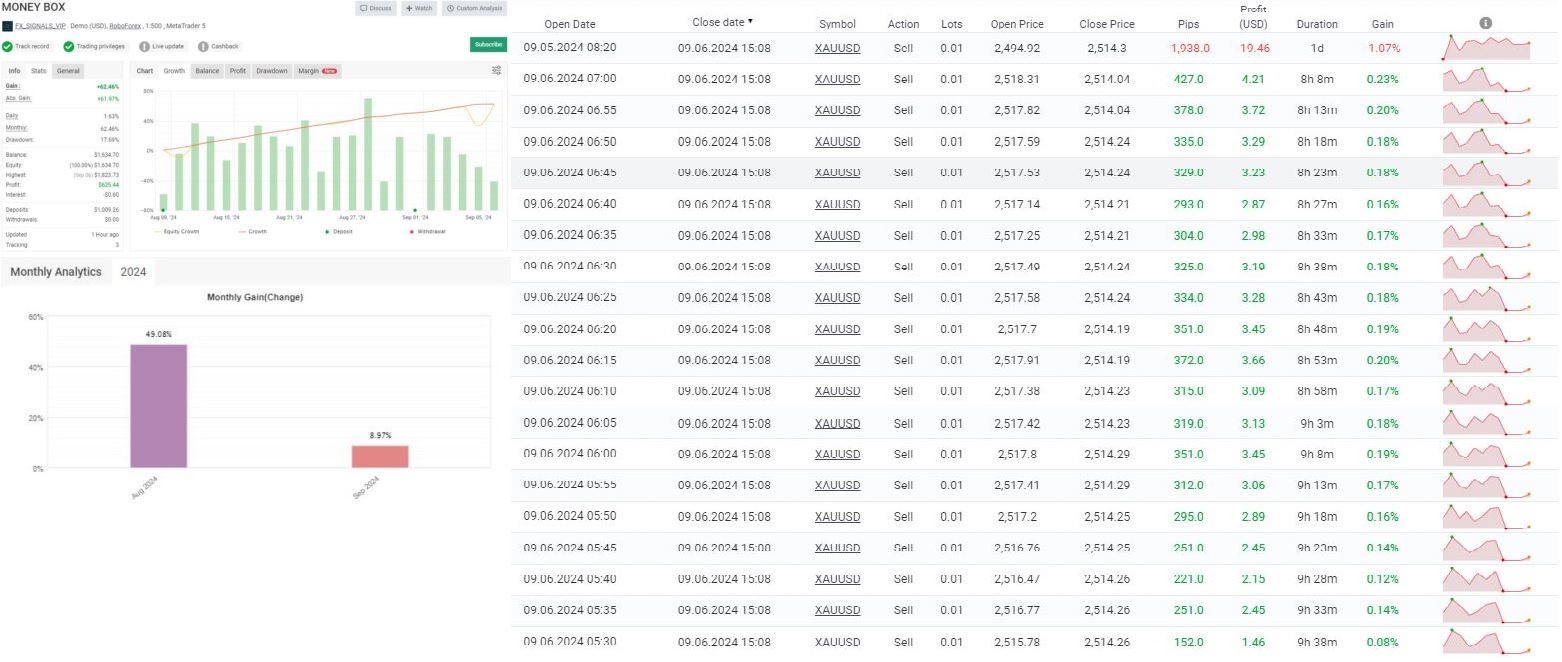

Back-Testing and Live Results

When back-testing:

- Use Every Tick model to see realistic fills.

- Run at least 3–5 years of data.

- Include spread simulation margins.

Key metrics to focus on:

- Win Rate – More meaningful than total trades.

- Profit Factor – Ideally above 1.5 in swing systems.

- Max Drawdown – Keep below 20–25 % to suit prop-firm rules.

Live tracking links (example):

- Myfxbook (external)

- FX Blue (external)

These help verify if live performance is in line with historical tests.

Who Should Consider Money Box Robot?

| Trader Type | Reason Money Box Robot Helps |

|---|---|

| Busy Professionals | Fully automated once installed. |

| Prop-Firm Candidates | Built-in risk control suits firm rules. |

| New EA Users | Simple parameter list to learn from. |

| Swing-Trade Enthusiasts | Strategy aligns with multi-day positions. |

Scalpers who expect several trades each hour may feel the pace is slow.

Tips for Responsible EA Use

- Start on a Demo Account – Observe several weeks first.

- Use a VPS – Keeps MT4 online 24/7.

- Update GMT Offset – Check after daylight-saving changes.

- Avoid Over-Optimization – Keep parameter changes moderate.

- Withdraw Profits Periodically – Secures gains outside the trading account.

Frequently Asked Questions

Q: Can I change the TP and SL values?A: Yes. The Inputs tab lets you set your own targets, though wide levels are recommended for swing trades.

Q: Will Money Box Robot work on MetaTrader 5?A: This version is compiled for MT4. You will need a separate build for MT5.

Q: How often does it trade?A: The system averages a few trades per week, depending on market conditions.

Q: Does it need manual intervention?A: No. Once the settings are in place, the EA runs on its own.

Q: Is it FIFO-compliant?A: Trades open one at a time on most settings, helping meet FIFO rules for U.S. accounts.

Final Thoughts

Money Box Robot offers a steady, rules-based approach to swing trading on MT4. It focuses on high-probability entries, clear price targets, and tight risk control. Traders who prefer measured, consistent exposure—rather than fast scalping—will likely appreciate its structure.

Interested in giving it a try? Download the demo, run a back-test, and see if Money Box Robot’s methodical style fits your trading objectives.

Ready to get started?Download Money Box Robot and test it on a demo account today.

Disclaimer: Trading involves risk. Past performance does not guarantee future results.

Vendor Site – Private

| Membership | Yearly Membership |

|---|---|

| Additional Services | Unlock & Decompile |

| Recommended Brokers | Exness Broker, FPMarkets |

| Recommended VPS | FXVM (Low Latency) |

| Youtube Channel | ForexForYou |

| Telegram Channel | Onshoppie Forex EA's & Indicators |

| Telegram Support | Onshoppie Support |

| Installation Guides | Onshoppie Forex Guides |

Only logged in customers who have purchased this product may leave a review.

Reviews

There are no reviews yet.