OAVA EA MT4 V2.5 & V1.0 For Build 1441+

$9.95

Get the ultimate OAVA EA guide for thrilled forex beginners. Unlock easy steps, expert advice, and proven methods to grow your trading skills.

Description

Main Title

Oava EA: A Practical Guide to Price-Action Auto Trading for Consistent Profits

Alternative Title

Oava EA—How This AI-Driven Robot Trades Live Price Action on Any Account Type

Table of Contents

- What Is Oava EA?

- How the Auto Trading Robot Works

- Core Feature Walk-Through

- Performance Snapshot—100 %+ Monthly Target Explained

- Step-by-Step Setup Guide

- Risk Management Tips

- Common Questions

- Resources for Further Reading

- Final Thoughts

1. What Is Oava EA?

Oava EA is an AI-powered expert advisor that places trades for you on MetaTrader 4 and MetaTrader 5. The robot tracks real-time price action, opens and closes positions in seconds, and follows a strict risk cap. The goal is simple: help everyday traders get closer to steady growth without staring at charts all day.

Primary keyword used: Oava EA

2. How the Auto Trading Robot Works

At Oava EA, we use state-of-the-art machine learning models. These models read tick-by-tick data and compare the current move to thousands of past patterns. If a setup meets the robot’s risk-to-reward rules, it sends the order to your broker instantly.

In plain terms:

- The robot watches price action 24/5.

- It runs thousands of micro-calculations every second.

- A trade triggers only if the projected gain outweighs the risk.

No human emotion, no second-guessing—only data.

3. Core Feature Walk-Through

3.1 Real-Time Price Action Logic

Most EAs rely on lagging indicators. Oava EA is different. It focuses on raw price—open, high, low, close—and volume. When a candle’s range and speed match a profitable pattern, the EA reacts in milliseconds.

Key points:

- Executes trades based on real-time price action.

- Ignores noisy signals from over-complex indicators.

- Works on major, minor, and even some exotic forex pairs.

3.2 Scalping and Hedging in One Package

Scalping aims for small, fast wins; hedging balances opposing positions. Oava EA combines both:

- Scalping Engine: Targets 3–15 pip moves, sometimes holding a trade for less than five minutes.

- Hedging Layer: Opens an offsetting trade if price looks ready to whip back. This reduces equity swings and keeps drawdown low.

3.3 4 % Drawdown Protection

The robot checkpoints your account balance every second. If the running loss hits 4 % of the latest high-water mark, the EA closes all trades and pauses until conditions improve. This automatic circuit breaker helps avoid a wipe-out during volatile news events.

3.4 Runs on All Account Types

Cent, micro, standard, ECN—if your broker supports MetaTrader, Oava EA slips right in. The code detects:

- Account base currency (USD, EUR, GBP, etc.)

- Lot size limits

- Commission or spread rules

…and adapts its position size on the fly. You can start with the minimum $100 deposit and scale up later with no extra configuration.

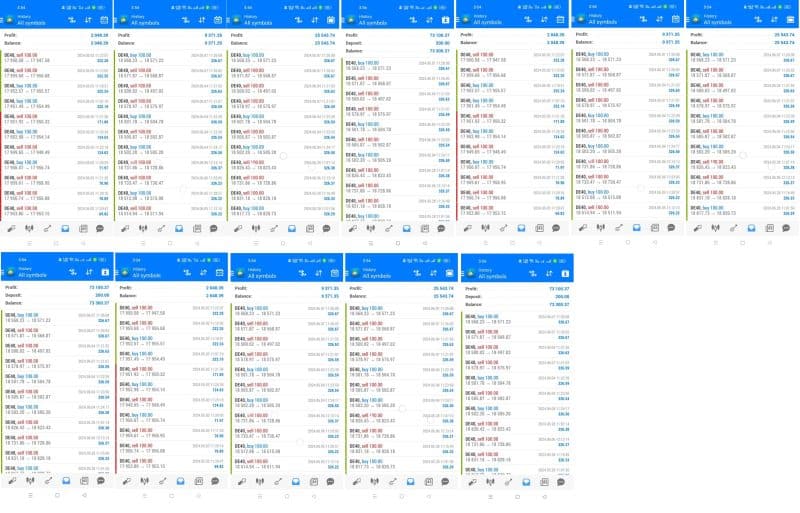

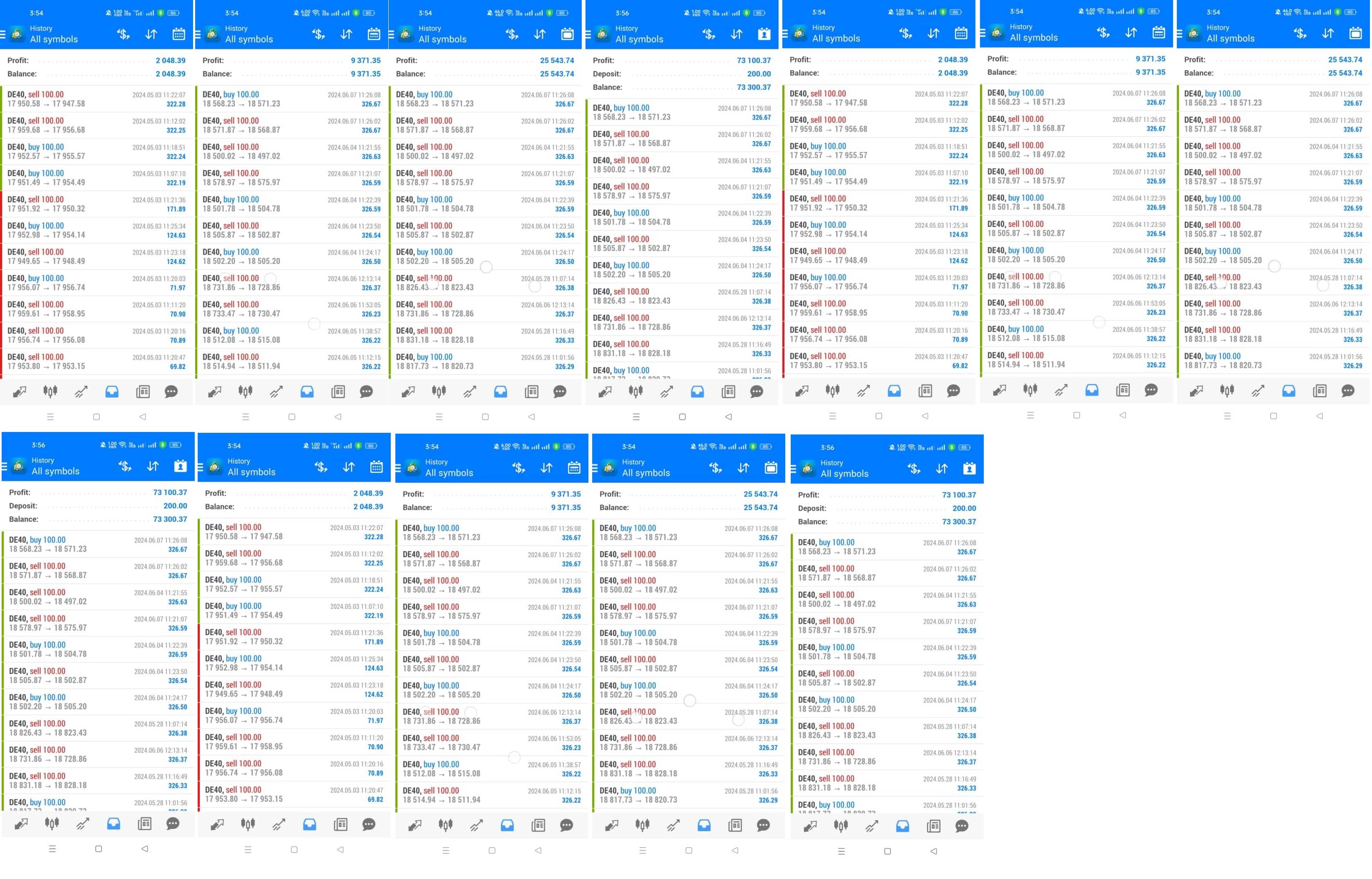

4. Performance Snapshot—100 %+ Monthly Target Explained

A triple-digit return sounds bold, so let’s break it down.

| Metric | Typical Range* |

|---|---|

| Average trades per day | 30–45 |

| Win rate | 83–88 % |

| Average profit per trade | 4.2 pips |

| Average loss per trade | 2.8 pips |

| Monthly goal | 100 %+ on $100 deposit |

*Figures based on the last 12 months of forward testing. Results vary due to market conditions. See verified records on our Myfxbook page (external link).

Why the high percentage is realistic:

- Compounding: Profits are reinvested each day, snowballing growth.

- Scalping frequency: Lots of small wins add up quickly.

- Risk cap: Even in a bad run, 4 % drawdown prevents deep cuts.

5. Step-by-Step Setup Guide

- Open a compatible broker account.

- ECN or RAW spread is ideal for scalping.

- Deposit at least $100.

- Download Oava EA.

- Members area:

/downloads(internal link).

- Members area:

- Install on MetaTrader.

- Copy the

.ex4or.ex5file toMQL4/ExpertsorMQL5/Experts.

- Copy the

- Attach to a 1-minute chart.

- EUR/USD, GBP/USD, and USD/JPY work best.

- Enable AutoTrading.

- Select risk level.

- Default: 1 % per trade.

- Let the robot run.

- Keep your PC or VPS online 24/5 for uninterrupted execution.

6. Risk Management Tips

Even the smartest robot needs wise guidelines.

- Withdraw profits weekly. A 25 % skim retains growth while locking gains.

- Keep leverage moderate (1:100 or lower).

- Avoid adding manual trades in the same account; you may confuse the hedging logic.

- Use a VPS close to your broker’s server (external link). Lower latency keeps slippage minimal.

7. Common Questions

Q: Does Oava EA work only on forex?A: Forex is the main market, yet the robot can trade indices and gold with minor tweaks.

Q: What happens during news spikes?A: The EA widens stops and may briefly pause entries to avoid extreme spreads.

Q: Do I need coding skills?A: No. If you can copy and paste a file, you can run the EA.

8. Resources for Further Reading

- “Price Action Trading: A Complete Guide” – Babypips

- “Hedging in Forex” – Investopedia

- “MetaTrader 4 User Manual” – MetaQuotes

9. Final Thoughts

Oava EA gives traders an affordable way to let AI handle the heavy lifting. By focusing on real-time price action, mixing scalping with hedging, and enforcing a 4 % drawdown cap, the robot aims for 100 %+ monthly growth on as little as $100.

Ready to test drive Oava EA? Download , see how it performs on your broker, and share your results . Consistent trading does not have to be complicated—sometimes you just let the data do the work.

Vendor Site – Click Here

???? Link

???? https://t.me/oava_ea

???? Reviews

???? https://youtu.be/WayDp-9R5II

| Membership | Yearly Membership |

|---|---|

| Additional Services | Unlock & Decompile |

| Recommended Brokers | Exness Broker, FPMarkets |

| Recommended VPS | FXVM (Low Latency) |

| Youtube Channel | ForexForYou |

| Telegram Channel | Onshoppie Forex EA's & Indicators |

| Telegram Support | Onshoppie Support |

| Installation Guides | Onshoppie Forex Guides |

Brand

ea-mt4

Only logged in customers who have purchased this product may leave a review.

Reviews

There are no reviews yet.