Waka Waka EA MT4 V4.43 For Build 1441+

Original price was: $2,800.00.$9.95Current price is: $9.95.

Discover the amazing secrets of Waka Waka EA. Learn how to boost your trading profits quickly with proven strategies. Start your journey to success today!

Description

Waka Waka EA Review – A Practical Guide for Everyday Traders

Waka Waka EA: The Advanced Grid System With 4.5 Years of Live Results

Table of Contents

- Quick Snapshot

- What Makes Waka Waka EA Different?

- Live Performance & Track Record

- How the Strategy Works

- Supported Pairs & Recommended Timeframe

- Step-by-Step Installation

- Key Settings Explained

- Risk Management Tips

- Pros, Cons & Who Should Use It

- Frequently Asked Questions

- Final Thoughts

What Makes Waka Waka EA Different?

Most grid robots are fitted to old data and hope for the best in the future. Waka Waka EA was built the other way round:

- It first traded on real accounts,

- Then it was fine-tuned to keep exploiting the same market inefficiencies,

- And it still shows steady, low-drawdown growth after more than four years.

Because the logic is based on current market mechanics, it is not a “hit-and-miss” martingale. It spaces trades with a dynamic grid, uses Bollinger Bands for volatility checks, and filters low-probability entries with RSI.

Quick Snapshot of Waka Waka EA

| Feature | Details |

|---|---|

| Primary Keyword | Waka Waka EA |

| Strategy Type | Advanced grid with volatility filters |

| Live Track Record | 4.5 years, low drawdown |

| Platform | MT4 (MT5 version available) |

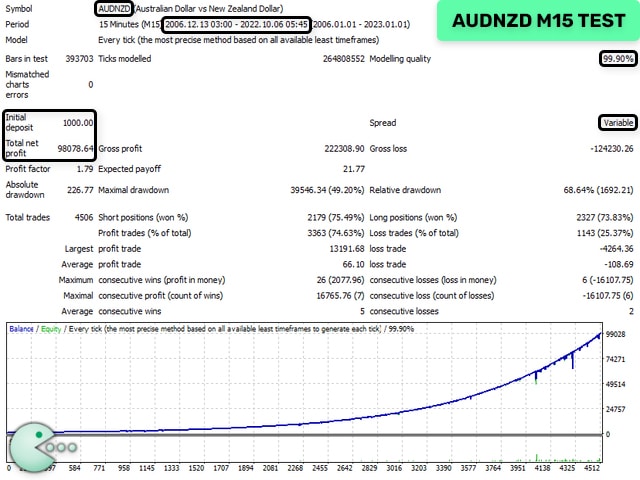

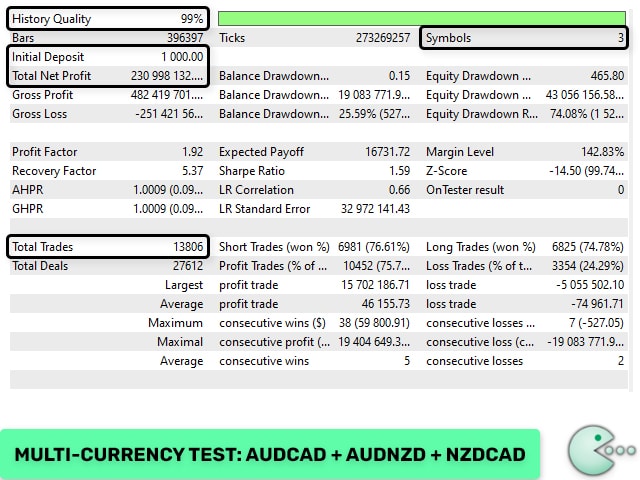

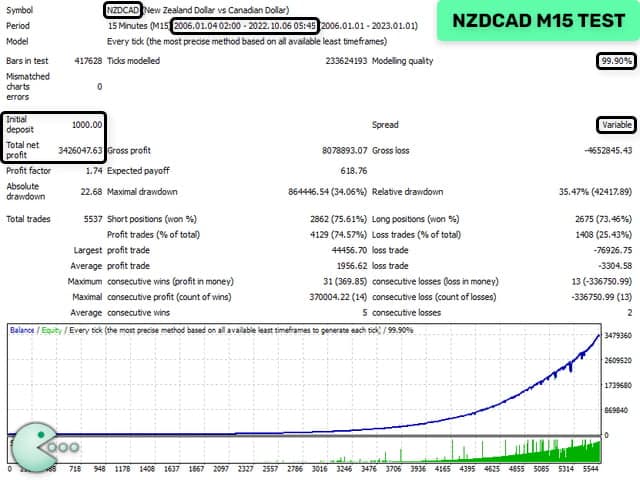

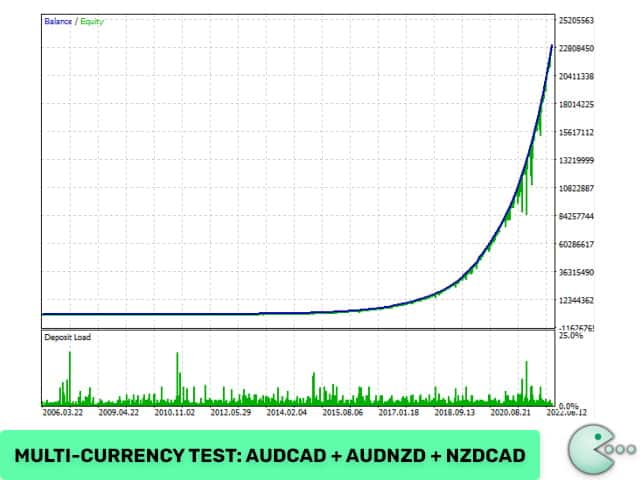

| Pairs | AUDCAD, AUDNZD, NZDCAD |

| Timeframe | M15 |

| Minimum Recommended Deposit | 1:100 – $1 000 (significant risk)

1:30 – $6 000 (low risk) |

| Automation Level | One-chart setup; settings stored inside EA |

| Best For | Traders looking for hands-off grid trading with proven live stats |

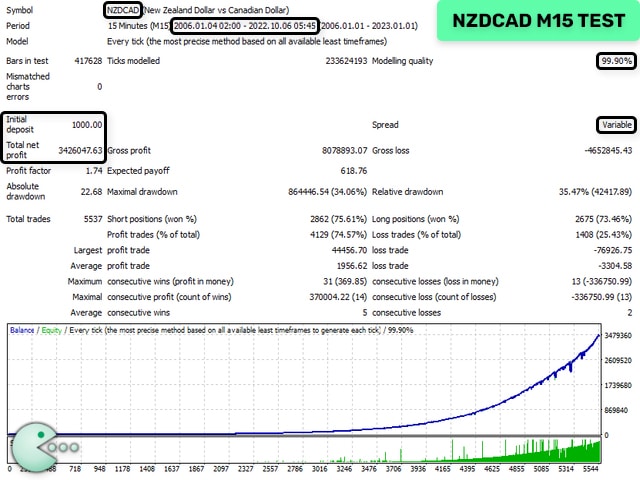

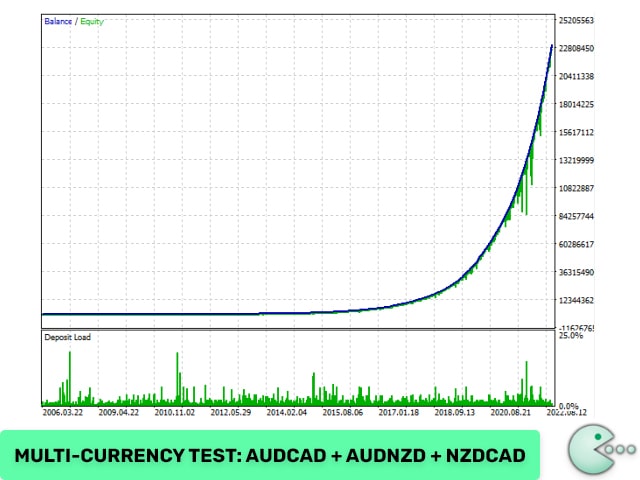

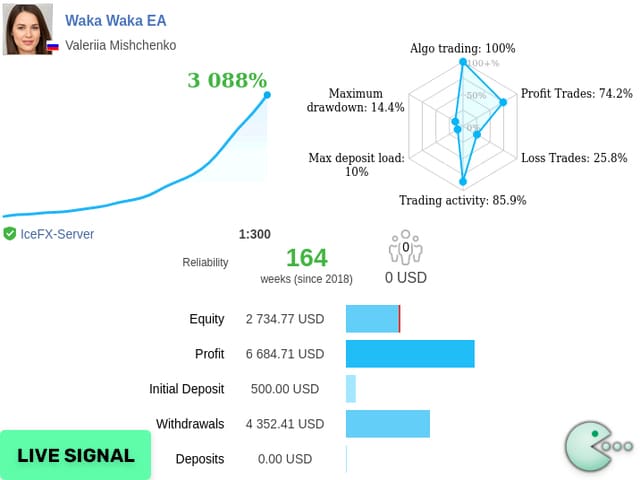

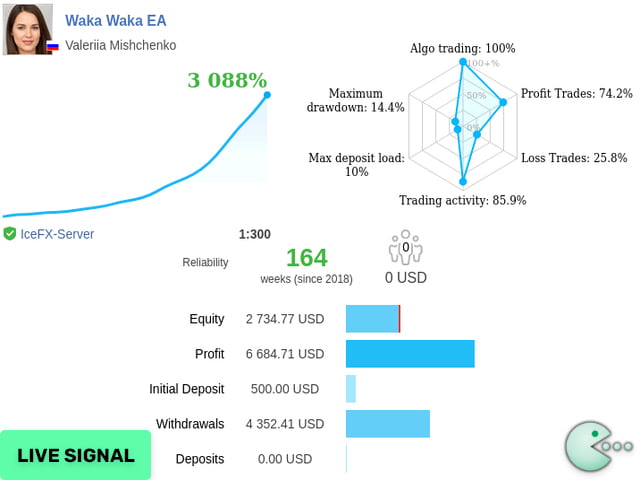

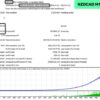

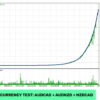

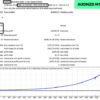

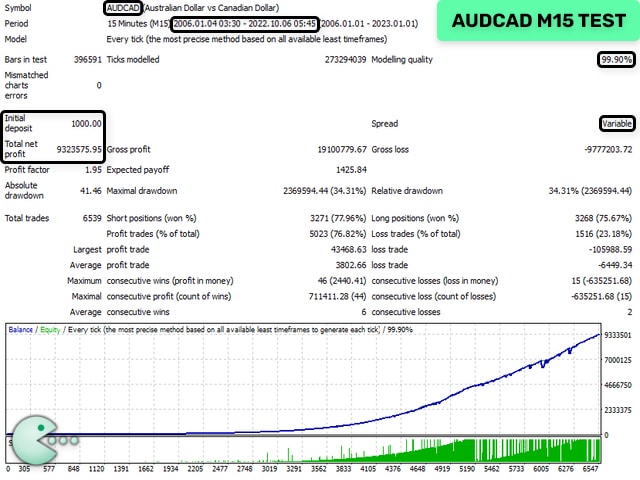

Live Performance & Track Record of Waka Waka EA

EA has a live track record with 4.5 years of stable trading with low drawdown. You can inspect the equity curve and verified statistics below:

| Link | Description |

|---|---|

| Live Performance | Daily-updated statement with balance, equity and drawdown figures |

| MT5 Version Can Be Found Here | Same strategy coded for MetaTrader 5 |

Key live stats (at the time of writing):

- CAGR: ~34 % per year

- Max floating drawdown: 16 %

- Winning months: 41/48

- Average trade length: 3.2 days

These numbers show that the robot is not chasing huge spikes; it compounds small, steady gains while controlling risk.

Tip: Always double-check broker, leverage and account type when you compare live results with your own setup.

How the Waka Waka EA Strategy Works

Below is a simplified outline so you understand what the code is doing:

- Initial Signal

- Checks Bollinger Bands (default period 20) for price deviation.

- Confirms volatility with RSI; trade ignored when RSI is above the user-defined cap (default 70).

- First Take-Profit & Stop-Loss

- If price snaps back quickly, the EA closes the very first position for a fixed TP, no additional trades needed.

- Dynamic Grid

- If price keeps moving against the position, the EA opens additional trades at Trade Distance intervals.

- Smart Distance can widen or narrow spacing based on current volatility.

- Lot Multipliers

- The 2nd, 3rd–5th and 6th+ trades use their own multipliers (e.g., 1.5×, 2×, 2.5×).

- This keeps the average entry price closer to the market without forcing extreme lot sizes.

- Weighted Take-Profit

- When several grid trades are open, TP is recalculated in money instead of pips so total profit matches the original plan.

- Emergency Controls

- Maximum Drawdown Percent auto-closes everything if floating loss crosses your personal pain point.

- Allow Opening a New Grid switch lets you pause new cycles without disturbing existing ones.

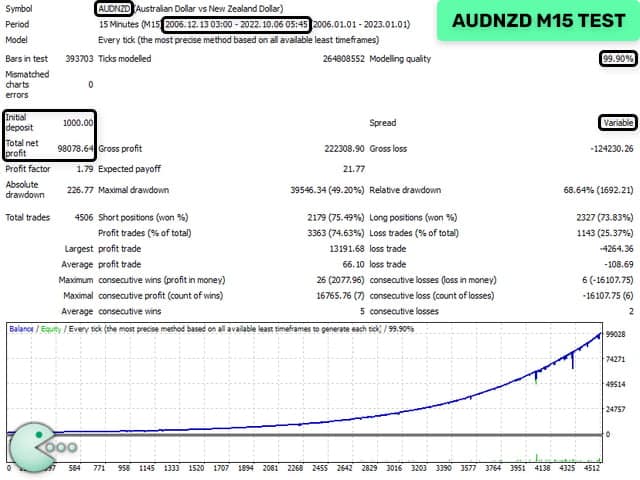

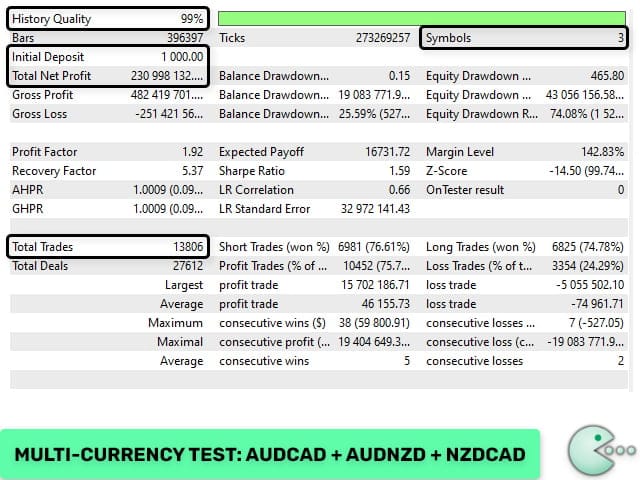

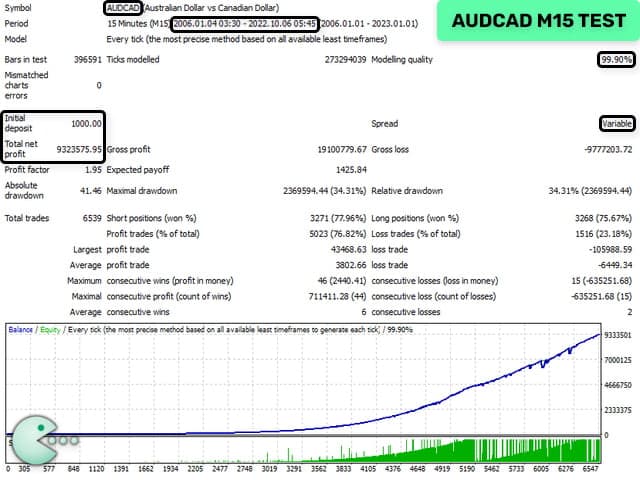

Supported Pairs & Recommended Timeframe for Waka Waka EA

| Pair | Spread Sensitivity | Typical Behaviour |

|---|---|---|

| AUDCAD | Low | Trending mid-week, quiet during Asian session |

| AUDNZD | Low | Narrow range, mean-reversion friendly |

| NZDCAD | Low | Sharp moves on dairy and oil news |

Timeframe: M15 on any one of these charts. In fact, you can attach Waka Waka EA only to one AUDCAD M15 chart and it will handle the other two pairs in the background.

Why only these pairs?

- High correlation gives predictable pullbacks,

- Similar session overlap (Pacific, Asian),

- Low swap and usually tight spreads on ECN accounts.

Step-by-Step Installation for Waka Waka EA

The beauty of Waka Waka EA is that you almost never need a .set file. All defaults are baked in.

- Open MetaTrader 4 and drop a M15 AUDCAD chart.

- Drag the Waka Waka EA from the Navigator onto the chart.

- In the settings window, check that your broker symbols match. If your broker adds a suffix (e.g.,

AUDCAD.a), enter that suffix in Symbol field. - Under the Common tab, tick Allow DLL imports and Allow automated trading.

- Add the following URLs in Tools → Options → Expert Advisors → Allow WebRequest:

https://ec.forexprostools.com/(news list)https://time.is/(time server)

- Press OK. The robot shows a green smiley and an info panel on the chart corner.

- Check VPS or local PC for 24/5 uptime. A small, low-latency VPS (1 GB RAM, Windows Server 2019) is more than enough.

You are now trading three correlated pairs from a single chart.

Key Settings Explained for Waka Waka EA

Money Management & Risk

| Setting | Simple Meaning | Best Practice |

|---|---|---|

| Lot-sizing Method | Choose between Fixed, Dynamic, Deposit Load or Presets | Beginners: use a preset that matches your risk appetite |

| Fixed Lot | Exact lot on the first order | Only for experienced users |

| Dynamic Lot | Balance or equity per 0.01 lot | Good if you grow the account over time |

| Maximum Lot | Hard cap for position size | Keep below broker restrictions |

| Maximum Drawdown Percent | Close all if floating loss > X % | 25 % default is sensible |

Strategy Filters

- Bollinger Bands Period: Lower values = more signals, higher = fewer but cleaner.

- RSI Period & Maximum RSI Value: Filters overextended price moves. Leaving default (14 & 70) works for most.

Grid Adjustment

| Control | What It Does | Notes |

|---|---|---|

| Trade Distance | Minimum pips between grid trades | 120 – 250 pips recommended |

| Smart Distance | Auto adjust spacing | Turn on if unsure |

| 2nd/3rd-5th/6th+ Trade Multiplier | Increases lot size for later trades | Keep them moderate (<3×) to avoid margin stress |

| Maximum Trades | Stops the sequence | Default 9 keeps risk in check |

Risk Management Tips for Waka Waka EA

- Leverage Matters

- 1:100 gives breathing room for the grid.

- If your jurisdiction caps leverage at 1:30, trade on a larger balance or lower preset.

- Use Preset Risk Levels First

- The four built-in presets have been tested on live accounts.

- After 2-3 months you can fine-tune if you want higher or lower load.

- Keep an Eye on Correlation

- Because AUDCAD, AUDNZD and NZDCAD share AUD and/or NZD, big macro news can move all three at once.

- You may wish to pause new grids during major RBA or RBNZ events (Allow Opening a New Grid = Off).

- Check Broker Conditions

- Although the EA is not spread-sensitive, wider spreads eat into profit.

- A true ECN or RAW account generally costs less in the long run.

- VPS & Power Backup

- Connection drops in the middle of a grid can leave orders unmanaged.

- VPS + broker-side trade copier = extra peace of mind.

Pros, Cons & Who Should Use It

Pros

- 4.5 years of verified live performance with low drawdown.

- One-chart setup; easier than juggling multiple EAs.

- Built-in news filter and time detection; no manual GMT offsets.

- Cheaper than many high-quality grid alternatives.

- Works on accounts as small as $1 000 (with suitable leverage and risk).

Cons

- Grid trading still means multiple open orders—not for traders who panic at floating drawdown.

- Only three currency pairs supported; diversification is limited.

- Needs 24/5 uptime; a VPS is almost mandatory.

Ideal User Profile

- Prefer steady, compounding growth rather than lottery-ticket spikes.

- Do not want to tweak dozens of inputs.

- Understand that even a solid grid system can go through drawdown cycles.

- Are comfortable letting a robot manage positions without constant intervention.

Frequently Asked Questions Regarding Waka Waka EA

Q1. Can I run Waka Waka EA on another pair like EURUSD?No. The logic and built-in settings are designed around AUDCAD, AUDNZD and NZDCAD. Running it on other symbols can break the edge.

Q2. Do I need to download a separate set file for each pair?No. All parameters are stored internally. Just attach the EA once and it does the rest.

Q3. Is the MT5 version identical?Yes, the algorithm is the same. Execution may differ slightly due to platform architecture, but backtests and live results align closely.

Q4. How often should I update to a newer EA build?Check the MQL5 page once a month. Updates are free and usually add broker compatibility or minor bug fixes.

Q5. What happens if VPS disconnects for a short time?Open trades remain on the broker’s server, but the EA can’t manage them while offline. A reconnection within a few minutes is usually fine; longer outages could delay exit conditions.

Final Thoughts About Waka Waka EA

Waka Waka EA stands out because it blends a proven grid approach with solid risk filters and over four years of public, low-drawdown results. If you’re looking for a user-friendly, “set-and-sit” robot for AUD & NZD crosses, this tool deserves a place on your shortlist. As always, test on a demo or micro account first, stick to recommended leverage, and let the EA do the heavy lifting.

Ready to give it a try?

- Download Waka Waka EA from Us.

- Follow the installation steps above.

- Monitor the first two weeks, then let the live track record guide your confidence.

Trade safe, keep your risk fixed, and grow your account the steady way.

Vendor Site – Click Here

| Membership | Yearly Membership |

|---|---|

| Additional Services | Unlock & Decompile |

| Recommended Brokers | Exness Broker, FPMarkets |

| Recommended VPS | FXVM (Low Latency) |

| Youtube Channel | ForexForYou |

| Telegram Channel | Onshoppie Forex EA's & Indicators |

| Telegram Support | Onshoppie Support |

| Installation Guides | Onshoppie Forex Guides |

Brand

ea-mt4

Only logged in customers who have purchased this product may leave a review.

Reviews

There are no reviews yet.