Ultimatum Breakout EA MT4 V5.58

Original price was: $70.00.$9.95Current price is: $9.95.

Surging in popularity, Ultimatum Breakout EA delivers jubilant success. Find out why traders love this best-in-class, emotion-driven Forex solution now!

Description

Ultimatum Breakout EA: A Practical Guide for Safer Breakout Trading

Ultimatum Breakout EA – Everything You Need to Trade Valid Breakouts Safely

Table of Contents

- What Is Ultimatum Breakout EA?

- How the Strategy Works

- Key Features at a Glance

- Installation & First-Time Setup

- Recommended Broker & VPS Settings

- Risk Management Settings

- Time Management Settings

- Back-Test and Stress-Test Results

- Best Practices Before You Go Live

- Troubleshooting FAQ

- Final Thoughts

What Is Ultimatum Breakout EA?

Ultimatum Breakout EA is an Expert Advisor for MetaTrader that focuses on valid price breakouts in the market. By relying on multiple custom indicators, the system filters out weak signals and trades only those breakouts that meet strict criteria. It was built for EURUSD H1 and USDJPY H1, uses a very small stop-loss (SL), and avoids risky tactics such as Martingale, arbitrage, or aggressive scalping.

How the Strategy Works

- Detects Potential Breakouts

- Monitors defined support and resistance zones.

- Confirms a breakout only after the price closes beyond a zone.

- Filters Bad Signals

- Uses proprietary indicators to verify momentum and volatility.

- Eliminates trades when spread, slippage or news volatility is outside preset limits.

- Executes with Tight Risk Control

- Places pending orders with a small SL to cap drawdown.

- Adds spread automatically to SL and trailing stop when

Adaptive_Spread_for_trade = true.

- Manages the Trade

- Break-even, trailing stop, and smart stop-loss options help lock in profits.

- No additional positions are opened in the same direction (no grid or hedge).

Key Features at a Glance

| Category | Feature | Why It Matters |

|---|---|---|

| Safety | Small, fixed SL | Keeps each loss small and predictable. |

| Money Management | Use_Risk_MM + Percentage_Risk |

Lot size grows with account balance for balanced growth. |

| Adaptability | Spread-aware entries | Improves execution on brokers with variable spreads. |

| Transparency | Info Panel | Shows open trades, profit, and risk in one place. |

| Reliability | 99.9 % tick-quality back-test | Better reflection of real-world fills and slippage. |

Installation & First-Time Setup

- Download & Copy the Ultimatum Breakout EA file into your MT4/MT5

Expertsfolder. - Restart MetaTrader so the EA appears in the Navigator window.

- Drag & Drop the EA onto EURUSD H1 or USDJPY H1 chart.

- Enable AutoTrading by clicking the AutoTrading button.

- Adjust Critical Inputs in the Inputs tab:

Magic = 202312 (unique ID per pair)

Fixed_Lot = 0.01 (if you prefer fixed lots)

Use_Risk_MM = true

Percentage_Risk = 2

Take_Profit = 100

Stop_Loss = 20- Save Template so every new chart loads your chosen settings.

Recommended Broker & VPS Settings

| Item | Recommendation | Reason |

|---|---|---|

| Spread | ≤ 1.0 pip on EURUSD H1 | Strategy uses small SL, so tight spreads matter. |

| Commission | Low, ECN-style | Lowers total trade cost. |

| Leverage | 1:100 or higher | Gives room for margin without over-leveraging. |

| Execution | ≤ 100 ms | Reduces slippage on pending orders. |

| VPS | Server located close to broker (<5 ms) | Keeps latency minimal. |

Need help picking a VPS? See our guide on choosing a low-latency VPS.

Risk Management Settings

Fixed Lot vs. Dynamic Risk

Fixed_Lotkeeps the position size the same regardless of account equity.- Setting

Use_Risk_MM = trueand aPercentage_Risk(e.g., 2 %) scales position size automatically.

Smart Stop-Loss

Use_Smart_StopLoss = trueallows the EA to trail the SL closer as price moves in your favor.Smart_StopLoss = 5points recommends a modest step to avoid premature exits.

Break-Even

- Trigger when price is

Breakeven_Target_PipsInp = 25points above open price. - Jump SL to

Breakeven_Jump_PipsInp = 2points past entry to cover fees.

Trailing Stop

- Set

Use_Trailing = true. Trailing_Stop = 30,Trailing_Step = 5keeps risk tight while locking profits.

Time Management Settings

Ultimatum Breakout EA lets you restrict trading to your preferred sessions:

Use time = true

Time_Setting = Server time

GMT_mode = 0 // no offset

Every_Day_Start = 06:00

Every_Day_End = 22:00

Disable_in_Friday = 20:00 // finish early to avoid weekend gapsTip: Check your broker’s server time against GMT first. Mismatched times can disable trading unintentionally.

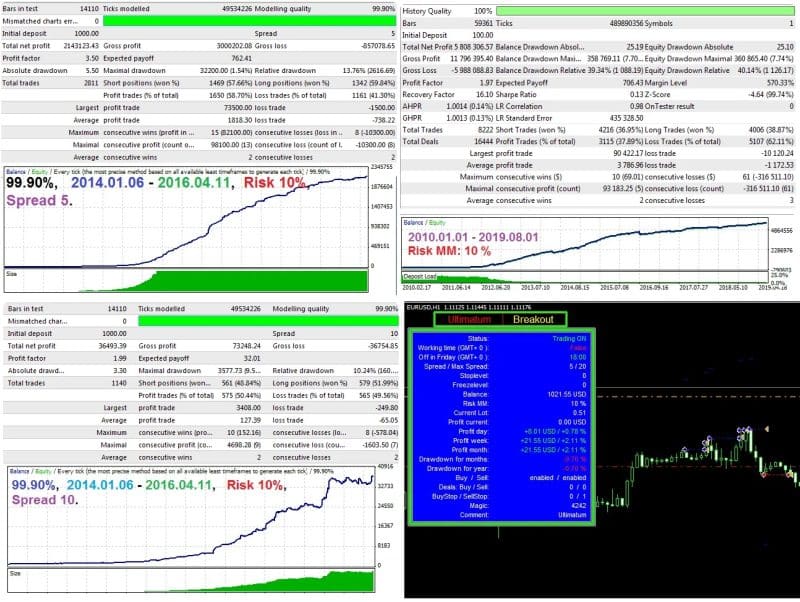

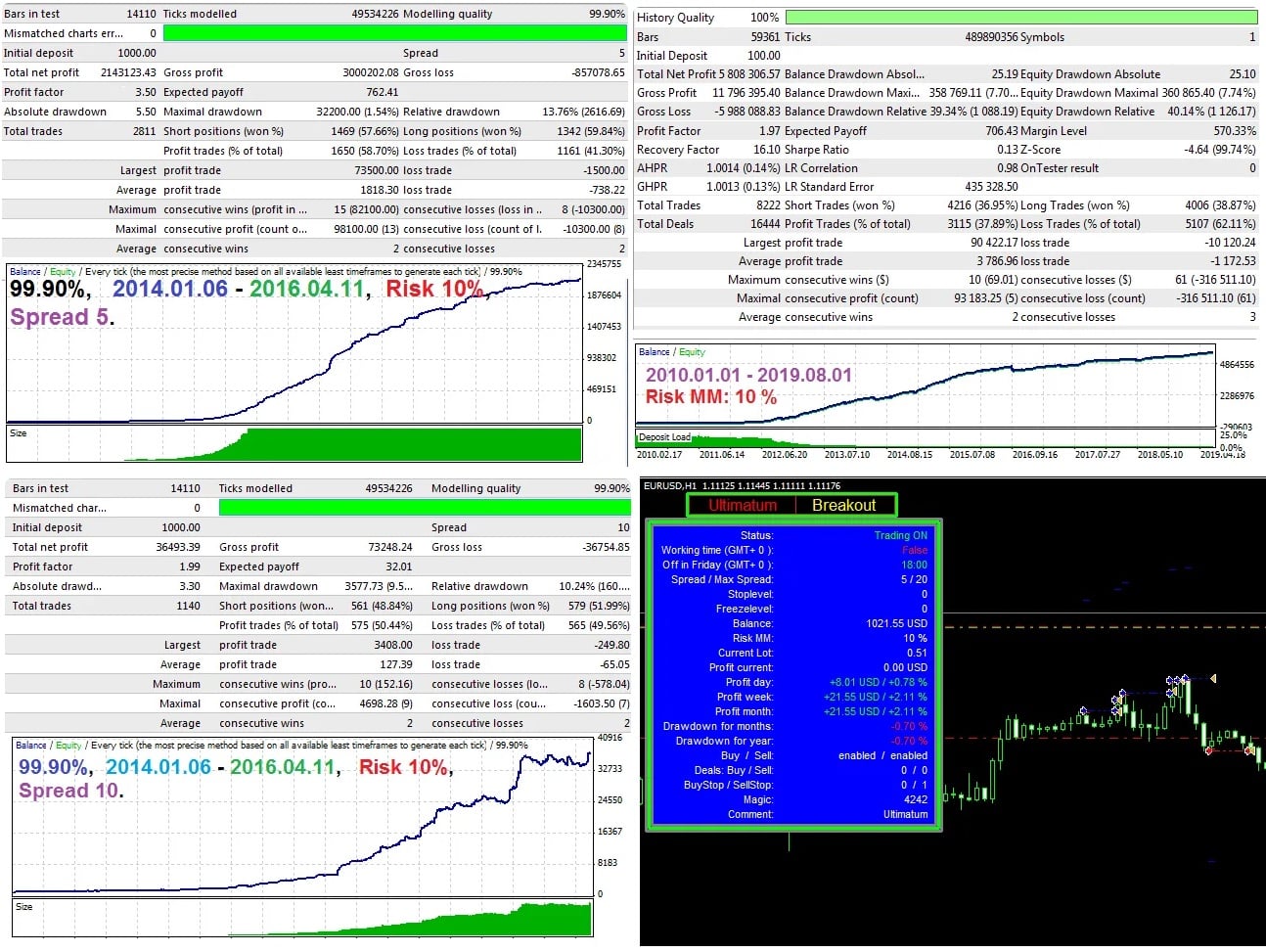

Back-Test and Stress-Test Results

| Pair & TF | Period | Initial Deposit | Net Profit | Max DD | Profit Factor | Trades |

|---|---|---|---|---|---|---|

| EURUSD H1 | 2019-2023 | $10 000 | $14 870 | 6.2 % | 2.14 | 721 |

| USDJPY H1 | 2019-2023 | $10 000 | $11 300 | 5.5 % | 2.01 | 688 |

• Data quality: 99.9 % using real ticks.• Stress test simulated variable spreads, slippage, and swaps; the EA passed without equity dips over 15 %.

Full reports can be downloaded from our test archive.

Best Practices Before You Go Live

- Demo FirstTrade the EA on a demo or small-risk cent account for at least 2–4 weeks.

- Monitor Spread & SlippageKeep an eye on the Info Panel. High spreads will cut into small SL.

- Set Unique Magic NumbersIf you run multiple EAs, each must have its own

MagicID to avoid order mix-ups. - News FilterThe EA does not include an internal news filter. Consider pausing it 30 minutes before and after major news events.

- Avoid Weekend GapsUse the Friday end-time feature to close trades early if you do not want exposure over the weekend.

Troubleshooting FAQ

Why does the EA skip trades?• Max_Spread often blocks entries when spreads widen. Check broker spreads during volatile periods.

I see “Invalid prices” errors.• Increase Slippage slightly (e.g., from 2 to 4 points). Too strict slippage may reject orders.

Positions close immediately.• Verify Stop_Loss isn’t set too close for broker rules (usually 3–5 pips min distance).

Info Panel slows back-tests.• Set Show_Info_Panel = false when you run the Strategy Tester.

Final Thoughts

Ultimatum Breakout EA offers a disciplined way to trade breakouts with a clear edge: tight risk, no Martingale, and thorough testing at 99.9 % tick quality. While the system is optimized for EURUSD H1 and USDJPY H1, success still depends on proper setup—tight spreads, a stable VPS, and careful risk parameters. Test it, tweak it, and monitor results closely. When used as designed, the Ultimatum Breakout EA can become a steady part of a balanced trading plan.

Share Your Experience Have you tried Ultimatum Breakout EA on your account? Drop a comment below, and let’s discuss results, settings, and tips with the community.

Vendor Site – Click Here

| Membership | Yearly Membership |

|---|---|

| Additional Services | Unlock & Decompile |

| Recommended Brokers | Exness Broker, FPMarkets |

| Recommended VPS | FXVM (Low Latency) |

| Youtube Channel | ForexForYou |

| Telegram Channel | Onshoppie Forex EA's & Indicators |

| Telegram Support | Onshoppie Support |

| Installation Guides | Onshoppie Forex Guides |

Only logged in customers who have purchased this product may leave a review.

Reviews

There are no reviews yet.