StalkeR Arrow Indicator MT4 v7.80 For Build 1441+

Original price was: $160.00.$20.95Current price is: $20.95.

Professional StalkeR Arrow Indicator helps explode new profits. Discover amazing strategies that successful people use to make better trading decisions.

Description

StalkeR Arrow: The Trader’s Guide to Clear Buy-Sell Signals

Alternative Title — StalkeR Arrow: How This Price-Action Indicator Spots Entries, Exits, TP & SL in Real-Time

Table of Contents

- What Is the StalkeR Arrow Indicator?

- How the Arrow Logic Works

- Key Settings Explained

- Reading the TP and SL Lines

- Using the Back-Testing Dashboard

- Step-by-Step Setup in Your Charting Platform

- Practical Tips for Different Market Types

- Frequently Asked Questions

- Final Thoughts

What Is the StalkeR Arrow Indicator?

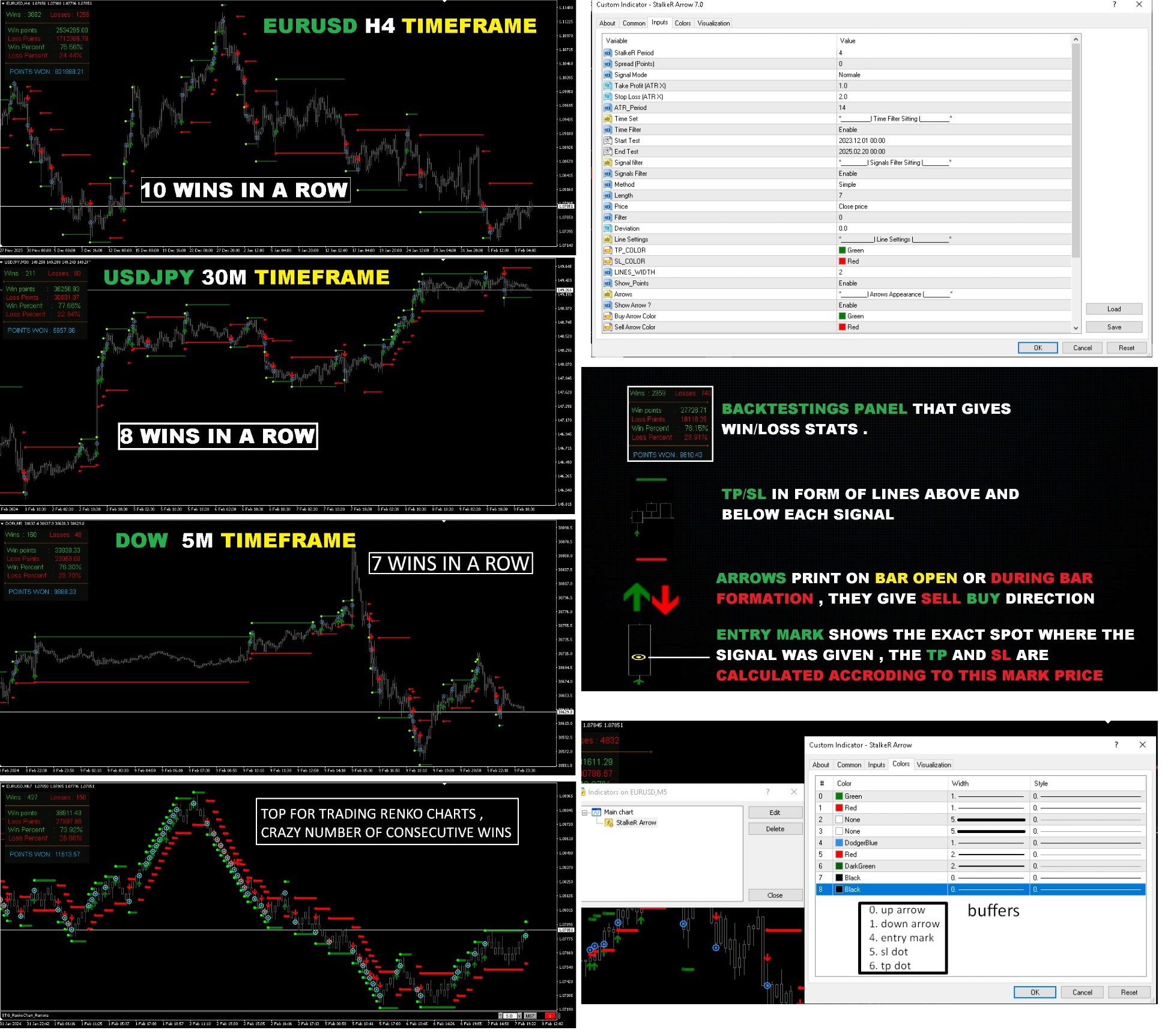

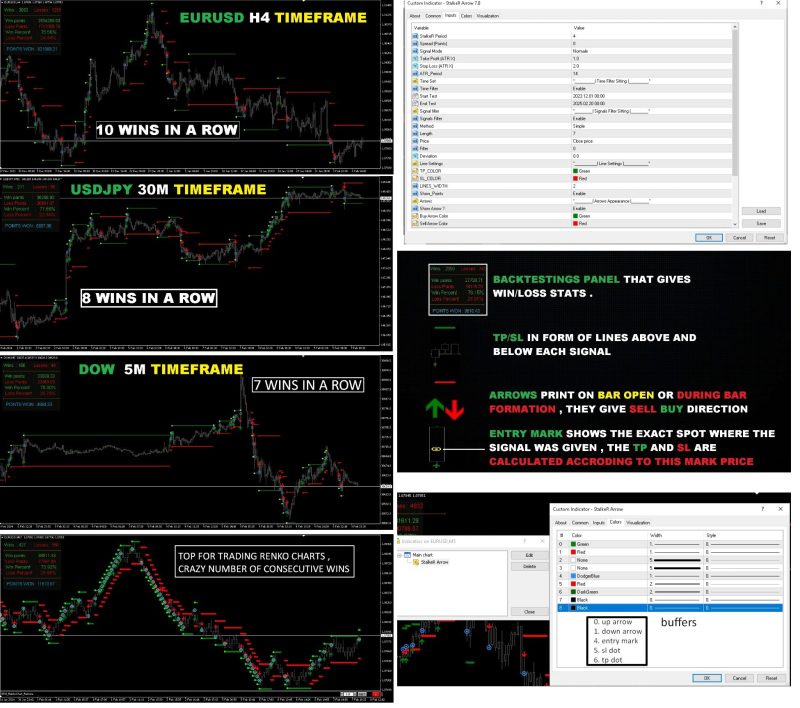

StalkeR Arrow is an arrow indicator that places a clear buy or sell signal right on the open of each bar (or even while the bar is forming). It does not repaint or back-paint, which means that once an arrow appears, it stays—helping traders avoid the common pitfall of “moving targets.”

Key points in plain language:

- Based on price-action patterns and fractals, not lagging oscillators.

- Gives both take-profit (TP) and stop-loss (SL) levels for every signal.

- Displays TP/SL as horizontal lines above or below the arrow.

- Lines remain until a new signal arrives.

- Includes a back-testing dashboard that tracks wins, losses, and overall hit rate.

By blending simple visuals with straightforward stats, StalkeR Arrow aims to cut the clutter, leaving a trader with one glance entries and exits.

How the Arrow Logic Works

Price-Action Patterns Meet Fractals

Price action in StalkeR Arrow is distilled into mini-structures—often referred to as fractals. When a fresh high or low shows signs of rejection, and when the fractal structure aligns with the selected StalkeR Period, the indicator prints an arrow:

- Blue/Green Arrow (Buy): Price pattern hints at upward move.

- Red Arrow (Sell): Price pattern hints at downward move.

The logic runs on every new tick, which allows the arrow to form intra-bar. However, if you prefer confirmation on bar close, you can set alerts to trigger then.

Key Settings Explained

A quick dive into each parameter:

StalkeR Period

- Acts as the sensitivity knob.

- Small number → many signals, suited for scalpers.

- High number → fewer but stronger signals, suited for swing traders.

Spread

- Input your broker’s average spread in points.

- The back-testing panel adjusts win/loss stats by subtracting spread cost, giving realistic results.

Stop-Loss ATR ×

- Multiplies the Average True Range (ATR) value to set the SL distance.

- Example: ATR = 10 pips, SL × = 1.5 → SL = 15 pips.

Take-Profit ATR ×

- Same idea but for TP.

- A TP multiple greater than the SL multiple creates a positive reward-to-risk ratio.

ATR Period

- The ATR look-back.

- 14 is common; longer periods smooth noise.

Line & Arrow Style

- Adjust color, opacity and width.

- Popular combo: lime green arrows for buys, crimson for sells, with thin white TP/SL lines.

Panel or Dashboard Placement

- Choose corners: top-left, top-right, bottom-left, bottom-right.

- You can also drag it if your platform allows.

Alerts, Emails & Push Notifications

- Enable one-time, every-time, or once-per-bar.

- Supports SMS/email if your charting tool forwards web-hooks.

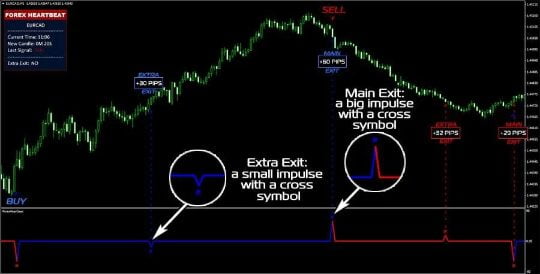

Reading the TP and SL Lines

The StalkeR Arrow shows:

- Solid Line Above a Sell Arrow = target for the short.

- Dashed Line Above the Arrow (optional style) = stop for the short.

- Solid Line Below a Buy Arrow = target for the long.

- Dashed Line Below the Arrow = stop for the long.

Lines extend until a fresh arrow appears, which auto-clears old lines. This keeps the chart from getting cluttered, yet leaves enough history for quick visual back-checking.

Using the Back-Testing Dashboard

The built-in panel sums up every arrow ever drawn on the loaded chart. Data fields often include:

| Field | Description |

|---|---|

| Total Trades | How many arrows so far. |

| Wins | Number hitting TP before SL. |

| Losses | Number hitting SL first. |

| Win % | Wins ÷ Total * 100. |

| Avg R:R | Average reward-to-risk per trade. |

| Net Pips or Points | Combined profit minus losses minus spread. |

Because the arrows don’t repaint, your historical stats match live signals — a big plus for confidence.

Step-by-Step Setup in Your Charting Platform

- Load StalkeR Arrow

- From the indicator library, search “StalkeR Arrow.”

- Set the StalkeR Period

- Start with 5 on lower time-frames (M5-M15); test 20 on H1+.

- Fill in Spread

- Use the average of your broker; e.g., EURUSD = 10 points.

- Adjust ATR-based Stops and Targets

- SL ATR × = 1.2, TP ATR × = 1.8 is a popular ratio.

- Change ATR Period if Needed

- Default 14; test 21 for calmer pairs like USDCHF.

- Customize Visuals

- Softer colors help focus; try pastel arrows, thin grey lines.

- Pick Dashboard Corner

- Keep it off your price axis to avoid overlap.

- Turn On Alerts

- Choose “On arrow creation.” Add email or mobile push if offered.

Pro tip: save all these as a chart template so you can load it onto any pair or asset quickly.

Practical Tips for Different Market Types

Ranging Markets

- Use smaller StalkeR Periods to capture quick swings.

- Consider SL ATR × under 1.0 to stay tight.

Trending Markets

- Increase StalkeR Period to filter chop.

- Boost TP ATR × to ride bigger moves.

High-Spread Exotic Pairs

- Raise the spread field to reflect true cost.

- Check if win-rate holds; if not, focus on majors during peak hours.

Crypto 24-Hour Markets

- ATR can spike during news; monitor the dashboard.

- Set alert filters to “once per bar” to avoid flood of signals.

Frequently Asked Questions

Q: Does StalkeR Arrow repaint?A: No. Once the arrow is on the chart, it stays. The indicator uses confirmed fractal patterns, so you do not get shifting signals.

Q: Can I use it on any timeframe?A: Yes. Scalpers often pick M1–M5; position traders use H4–D1. Adjust StalkeR Period and ATR settings for each timeframe.

Q: Why do TP/SL lines sometimes appear far from price?A: If ATR is elevated (volatile session), the multipliers stretch. You can lower the multipliers or reduce ATR period.

Q: Does the dashboard cover partial closes?A: The default panel assumes full position size until TP or SL. You can track partial exits in your journal or add-on scripts.

Q: How do I receive mobile alerts?A: Enable push notifications in your platform, enter your MetaQuotes ID (MT4/MT5) or broker equivalent, and tick “send notification” in the StalkeR Arrow alert tab.

Final Thoughts

StalkeR Arrow stands out because it puts the three main trading answers—when to buy or sell, where to place the stop, and where to take profit—directly on the chart without repainting. With clear arrows, realistic dashboard stats, and simple parameter tweaks, both new and experienced traders can fold it into their workflow in minutes.

Test different StalkeR Period values, keep an eye on the spread input, and review the win-loss panel regularly. By doing so, you give yourself an objective edge and remove much of the guesswork from day-to-day trading.

Ready to try StalkeR Arrow? Load it on a demo chart today, tweak the ATR settings to your style, and see if the buy-sell arrows improve your decision-making. Happy trading!

Vendor Site – Click Here

| Membership | Yearly Membership |

|---|---|

| Additional Services | Unlock & Decompile |

| Recommended Brokers | Exness Broker, FPMarkets |

| Recommended VPS | FXVM (Low Latency) |

| Youtube Channel | ForexForYou |

| Telegram Channel | Onshoppie Forex EA's & Indicators |

| Telegram Support | Onshoppie Support |

| Installation Guides | Onshoppie Forex Guides |

Only logged in customers who have purchased this product may leave a review.

Reviews

There are no reviews yet.