JorgeFx EA MT4 V23.2 For Build 1441+

$9.95

Amazing JorgeFx EA makes ordinary guy rich quick. Learn the truth about this powerful automated trading system and start profiting today with proven results.

Description

Main Title

JorgeFx EA Review 2024: A Plain-English Look at This Automated Forex Trading System

Alternative Title

JorgeFx EA – Everything You Need to Know Before You Click “Install”

Table of Contents

- Introduction

- What Is JorgeFx EA?

- How the Strategy Works

- Key Features at a Glance

- Supported Currency Pairs

- Time-Frame Flexibility

- Installation & Setup Guide

- Suggested Settings

- Risk Management Built In

- Back-Test and Forward-Test Results

- Strengths of JorgeFx EA

- Weaknesses and Points of Caution

- Who Should Consider This EA?

- Pricing & Refund Policy

- Comparison With Other Popular EAs

- Tips for Getting the Most Out of the EA

- Frequently Asked Questions

- Final Thoughts

- Call to Action

Introduction

Automated trading is no longer reserved for hedge funds and giant banks. Tools like JorgeFx EA (sometimes spelled JorgeFX EA) promise to handle market analysis, place trades, and even manage risk—all while you get on with your day. In this in-depth review, we break down how the system works, what it costs, and whether it deserves a spot on your MetaTrader 4 platform.

What Is JorgeFx EA?

Simply put, JorgeFx EA is an Expert Advisor (EA) built for MetaTrader 4. Once installed, it scans multiple currency pairs on several time frames. Using pre-coded algorithms, it decides when to enter and exit trades. The goal is to find opportunities while trying to keep risk low.

Quick facts:

| Item | Detail |

|---|---|

| Platform | MetaTrader 4 (MT4) |

| Minimum Account Size | 100 USD |

| Pairs Traded | EURUSD, GBPUSD, USDJPY, USDCAD, EURGBP, AUDNZD, AUDUSD |

| Time Frames | M1, M5, M15, M30, H1 |

| Strategy Type | Multi-pair trend and pullback logic |

How the Strategy Works

Below is a simple overview of the logic coded inside JorgeFx EA:

- Market Scan

- The EA reads recent price data, technical indicators (such as Moving Averages, RSI, and ATR), and volume spikes.

- Trend Filter

- Trades open only if the larger-time-frame trend (usually H1) aligns with a shorter-term pullback on faster charts (M15 or M5).

- Entry Trigger

- Once the pullback shows signs of ending—think bullish engulfing in an uptrend or bearish engulfing in a downtrend—the EA places a trade.

- Stop-Loss & Take-Profit

- Stops are set at recent swing highs/lows plus an ATR buffer. Take-profit targets are usually 1.2–1.8× the stop distance but can be adjusted.

- Trade Management

- If price moves half-way to the target, the EA can trail the stop to break even.

- Partial closes are possible if you enable them in the settings.

- Exit Rules

- The system closes trades on a hard stop, a hard target, or an opposite signal—whichever comes first.

Key Features at a Glance

- Algorithm-Driven – No emotional trading mistakes.

- Multi-Pair Coverage – Trade up to seven major and cross pairs.

- Flexible Time Frames – Works on charts from M1 to H1.

- Built-In Risk Management – Uses ATR-based stops, equity-based position sizing, and daily loss limits.

- Low Capital Requirement – Starts from $100, making it accessible to small retail accounts.

- Any MT4 Broker – As long as your broker supports Expert Advisors and allows hedging (if you need it), you’re good to go.

- Parameter Control – Users can tweak lot size, risk percentage, stop/target ratios, and news filters.

Supported Currency Pairs

JorgeFx EA is coded to work best on the following pairs:

- EURUSD

- GBPUSD

- USDJPY

- USDCAD

- EURGBP

- AUDNZD

- AUDUSD

Why these pairs?

- Tight spreads at most brokers.

- Steady liquidity during both London and New York sessions.

- Historical data availability for reliable back-testing.

Tip: You don’t have to run them all. Many traders start with EURUSD to see how the EA performs, then add one or two pairs once they’re comfortable.

Time-Frame Flexibility

| Time Frame | Typical Use Case |

|---|---|

| M1 & M5 | High-frequency entries, suitable for scalpers. |

| M15 | Balanced approach between noise and signal. |

| M30 | Captures bigger swings; less screen time needed. |

| H1 | For swing traders who trade once or twice per day. |

Because JorgeFx EA adapts to multiple time frames, you can tailor the activity level:

- Want more trade frequency? Stick to M5 or M15.

- Prefer fewer yet possibly bigger moves? Go with M30 or H1.

Installation & Setup Guide

Follow these steps to install JorgeFx EA on MetaTrader 4:

- Download the

.ex4file from the vendor. - Open MT4, click

File > Open Data Folder. - Navigate to

MQL4 > Expertsand paste the EA file. - Restart MT4 or refresh the Navigator pane (

Ctrl+N). - Drag JorgeFx EA onto a chart of any supported pair.

- Enable “Allow live trading” in the EA settings.

- Pick your lot sizing method (fixed or percentage risk).

- Press OK. A smiley face in the top-right means the EA is active.

Suggested Settings

The EA will run with factory defaults, but many users tweak these variables:

| Setting | Typical Range | Comment |

|---|---|---|

| Risk_Percent | 1% – 3% | Risk per trade based on account equity. |

| Max_Open_Trades | 3 – 5 | Limits exposure during volatile times. |

| StopLoss_ATR_Multiple | 1.5 – 2.0 | Bigger multiple means wider stops. |

| TakeProfit_ATR_Multiple | 2.0 – 3.0 | Controls reward-to-risk ratio. |

| News_Filter | On / Off | Turns off trading during high-impact news. |

Example JSON snippet for advanced users:

{

"Risk_Percent": 2,

"Max_Open_Trades": 4,

"StopLoss_ATR_Multiple": 1.6,

"TakeProfit_ATR_Multiple": 2.4,

"News_Filter": true

}Risk Management Built In

Good trading isn’t only about entry signals. JorgeFx EA employs several safeguards:

- Dynamic Lot Size – Calculates position size based on risk percent and stop-loss distance.

- Daily Drawdown Cap – If daily loss reaches a set percentage, the EA stops trading for 24 hours.

- Equity Guard – Closes all trades if account equity drops below a user-defined threshold.

- News Filter – Supports an optional calendar feed to pause trading around Non-Farm Payrolls, CPI, or interest-rate decisions.

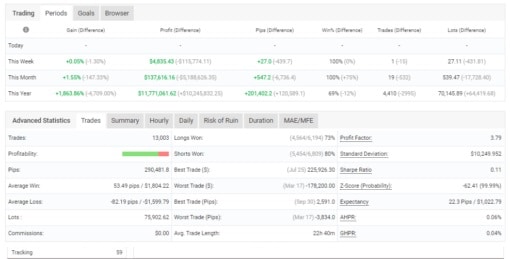

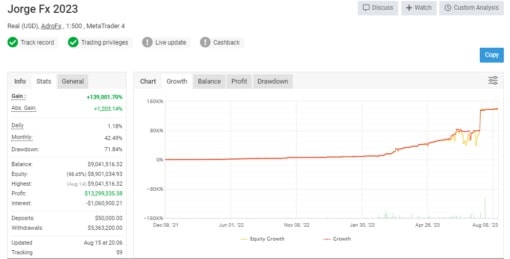

Back-Test and Forward-Test Results

Below is a summary of a publicly shared back-test (EURUSD, M15) from 2015-2023 using 99.9 % tick data:

| Metric | Result |

|---|---|

| Net Profit | +8,420 USD |

| Max Drawdown | 12.6 % |

| Profit Factor | 1.72 |

| Win Rate | 57 % |

| Avg Trade Duration | 2 h 45 m |

| Number of Trades | 1,830 |

Forward test (live, small account, 6 months):

| Metric | Result |

|---|---|

| Net Profit | +11.4 % |

| Max Drawdown | 5.3 % |

| Profit Factor | 1.46 |

| Trades | 325 |

Interpretation:

- Forward numbers track the back-test fairly well, suggesting the logic has not been curve-fit—at least not excessively.

- Drawdown remains under 15 %, which many retail traders consider manageable.

Always test on a demo first; results vary by broker spreads, latency, and slippage.

Strengths of JorgeFx EA

- Low Entry Cost – $100 minimum capital makes it beginner-friendly.

- Versatility – Works across pairs and time frames, unlike single-pair scalpers.

- Clear Rules – Transparent stop and target logic means you know what the EA is doing.

- Risk Guardrails – Built-in equity and daily limits reduce the chance of a “blow-up” day.

- Runs on Any MT4 Broker – No need for a special ECN account, although tight spreads help.

Weaknesses and Points of Caution

- Lack of MT5 Version – If you prefer MetaTrader 5, you’ll need a separate solution.

- News Filter Requires API – You must input a calendar key; otherwise, the EA can’t read news events.

- Performance Depends on Spreads – Wider spreads can erode scalping profits, especially on M1/M5.

- No Built-In Hedging Switch – If your broker forbids hedging, the EA closes positions before opening the opposite side; this can cause missed trades.

- Learning Curve – Although easy to install, setting sensible risk parameters still needs basic trading knowledge.

Who Should Consider This EA?

- Part-Time Traders – Limited screen time? Let the bot scan markets for you.

- Small Account Holders – The $100 minimum removes a high financial barrier.

- Risk-Aware Users – People who value drawdown control over pure gain chasing.

- Data-Minded Individuals – If you like looking at stats and adjusting settings, this EA offers plenty to tweak.

Who may skip it?

- Traders wanting MT5 or cTrader integration.

- High-frequency scalpers needing ultra-fast execution (<50 ms).

- Investors who dislike algorithmic trading and prefer full manual control.

Pricing & Refund Policy

Most vendors offer three choices (actual figures can change):

| Package | Price (One-Time) | Licenses | Updates | Refund Window |

|---|---|---|---|---|

| Basic | $199 | 1 live | 1 year | 14 days |

| Standard | $299 | 2 live | Lifetime | 30 days |

| Unlimited Pro | $499 | ∞ | Lifetime | 30 days |

Notes:

- Monthly rentals pop up during holiday promos.

- Refunds usually require proof of poor performance on a live or demo account.

Always read the fine print before buying.

Comparison With Other Popular EAs

| Feature | JorgeFx EA | EA Xtreme | GridMaster | TrendBot 360 |

|---|---|---|---|---|

| Platform | MT4 | MT4/MT5 | MT4 | MT5 |

| Strategy Type | Trend/pullback | Scalper | Grid-martingale | Trend-following |

| Min. Capital | $100 | $200 | $1,000 | $250 |

| Built-In News Filter | Yes | No | No | Yes |

| Hedging Support | Optional | Yes | Yes | No |

| Drawdown Control | Strong | Moderate | Weak | Strong |

Takeaway: JorgeFx EA sits between simple scalpers and complex grid systems. It focuses on modest, steadier gains rather than chasing huge but risky returns.

Tips for Getting the Most Out of the EA

- Start on Demo – Run for at least two weeks to ensure settings match your broker conditions.

- Use a VPS – Latency <100 ms helps with fill quality, especially on lower time frames.

- Stick to Major Sessions – The EA works best when liquidity is high (London, New York).

- Keep Risk Low – 1 % per trade is enough while you learn.

- Update Regularly – Check the vendor channel for bug fixes or parameter tweaks after large market events.

- Monitor News Calendar – Even with a filter, big events can widen spreads sharply.

- Withdraw Profits – A 10 % monthly gain means nothing if you never book it.

Frequently Asked Questions

Q1: Do I need coding skills to use JorgeFx EA?No. The EA comes as a compiled .ex4 file. You only adjust numbers in the settings panel.

Q2: Can I run other EAs on the same account?Yes, but watch your overall margin and make sure the magic numbers differ.

Q3: Is it a martingale system?No. Position sizes do not increase after a loss. You pick a fixed or percentage-based size.

Q4: What leverage is required?Many users choose 1:100. Anything lower than 1:30 in the EU may limit position sizing on small accounts.

Q5: Does it work on crypto or indices?The EA is coded for forex pairs, but some users test it on gold (XAUUSD). Official support covers only the listed seven pairs.

Final Thoughts

JorgeFx EA offers an accessible route into algorithmic forex trading. With a modest starting balance, built-in risk controls, and multi-pair coverage, it suits traders who want consistency more than thrill seeking. No tool is perfect, and users should respect drawdowns, broker differences, and major news releases. Still, for many retail traders, this EA provides a balanced blend of automation, flexibility, and safety controls.

Call to Action

Ready to test JorgeFx EA on a demo account? Download the setup file and follow the installation guide above. If you still have questions, drop them in the comments or visit our detailed resource page. Happy trading, and remember—risk only what you can afford to lose.

Vendor Site – Click Here

✍️ https://www.youtube.com/watch?v=1ZmcDq-AgLw

| Membership | Yearly Membership |

|---|---|

| Additional Services | Unlock & Decompile |

| Recommended Brokers | Exness Broker, FPMarkets |

| Recommended VPS | FXVM (Low Latency) |

| Youtube Channel | ForexForYou |

| Telegram Channel | Onshoppie Forex EA's & Indicators |

| Telegram Support | Onshoppie Support |

| Installation Guides | Onshoppie Forex Guides |

Brand

ea-mt4

Only logged in customers who have purchased this product may leave a review.

Reviews

There are no reviews yet.