ICT UNO EA MT4 + SetFiles For Build 1441+

Original price was: $899.00.$9.95Current price is: $9.95.

Experience the game-changing ICT UNO EA strategy. Boost your trading performance with our advanced algorithm. Join successful traders worldwide now!

Description

ICT UNO EA: Revolutionizing Smart Money Trading in MT4

Unlock the Power of Institutional Trading with ICT UNO EA

Table of Contents

- Introduction to ICT UNO EA

- Key Features of ICT UNO EA

- How ICT UNO EA Works

- Benefits for Traders

- Setting Up ICT UNO EA

- Best Practices for Using ICT UNO EA

- Conclusion

Introduction to ICT UNO EA

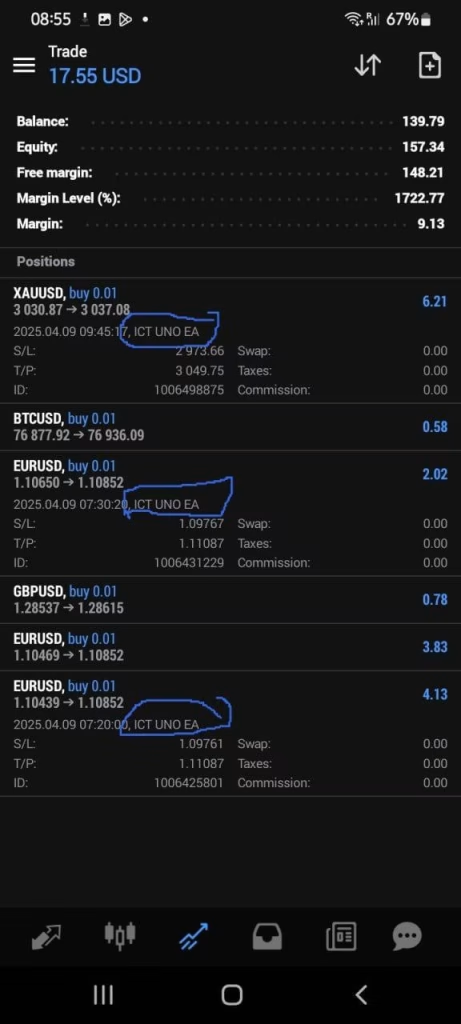

In the world of forex trading, staying ahead of the curve is crucial. Enter ICT UNO EA, a game-changing Expert Advisor for MetaTrader 4 that’s taking the trading community by storm. This powerful tool is designed to help traders capitalize on Smart Money Concepts (SMC) and Inner Circle Trader (ICT) strategies, bringing institutional-level trading to your fingertips.

ICT UNO EA is not just another trading robot. It’s a precision-focused tool built on years of market research and advanced algorithms. Whether you’re a day trader looking to fine-tune your strategy, a prop firm challenge participant aiming for consistent results, or someone interested in low-risk automation, ICT UNO EA offers a solution tailored to your needs.

Key Features of ICT UNO EA

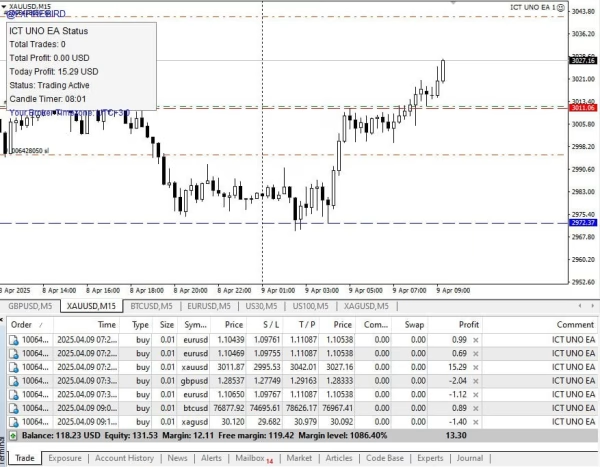

1. Session-Specific Trading

One of the standout features of ICT UNO EA is its session-specific trading capability. The EA focuses on two key market sessions:

- Asian Session (03:00-06:00)

- London Session (06:00-10:30)

By targeting these specific time windows, ICT UNO EA capitalizes on high-probability ICT setups, ensuring that trades are executed when market conditions are most favorable.

2. Smart Money Concept and ICT Logic

At the heart of ICT UNO EA is its advanced implementation of Smart Money Concept and ICT strategies. The EA is programmed to detect:

- Liquidity grabs

- Market structure shifts

- Institutional entries

This sophisticated logic allows traders to align their positions with the “smart money” in the market, potentially leading to more profitable trades.

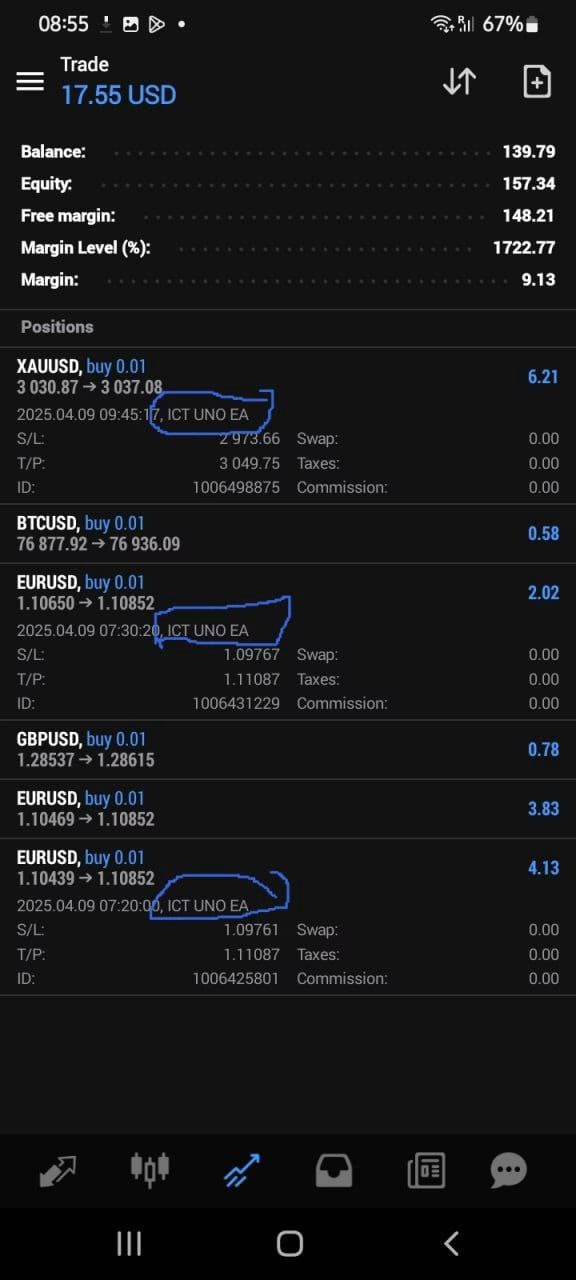

3. Risk Management and Trade Limits

ICT UNO EA comes with built-in risk management features that are particularly beneficial for prop firm challenges and conservative traders:

- Daily profit cap

- Limit of one trade per day

- Dynamic stop loss and take profit system

These features help prevent overtrading and manage risk effectively, crucial aspects of long-term trading success.

4. Dynamic SL/TP System

Unlike EAs that use fixed stop loss and take profit levels, ICT UNO EA employs a smart, fluid exit strategy. This system adapts to market flow, potentially maximizing profits and minimizing losses.

How ICT UNO EA Works

This EA operates on a set of complex algorithms that analyze market conditions in real-time. Here’s a simplified breakdown of its operation:

- Market Analysis: The EA continuously scans the market during the specified session times.

- Setup Detection: It identifies potential trade setups based on SMC and ICT principles.

- Entry Execution: When a valid setup is detected, the EA enters a trade, adhering to the one-trade-per-day limit.

- Trade Management: Once in a trade, the dynamic SL/TP system takes over, adjusting exit points based on market movements.

- Session Close: The EA closes any open positions at the end of the trading session.

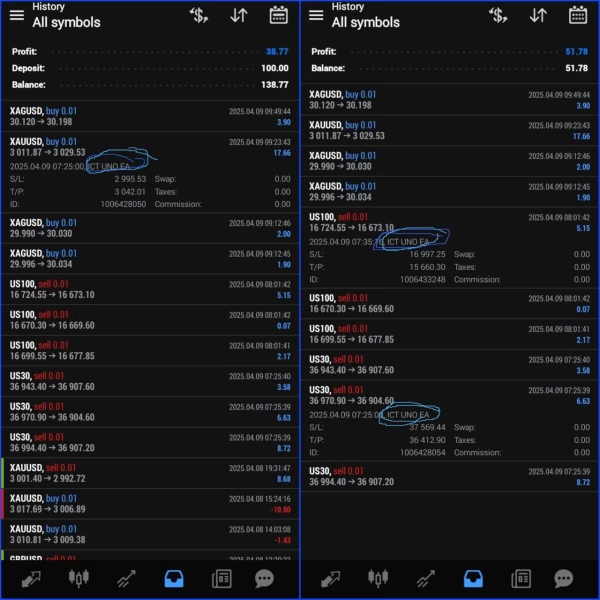

Benefits for Traders

1. Consistency in Trading

By following a rule-based system, this EA helps eliminate emotional decision-making, a common pitfall for many traders.

2. Time Efficiency

With this EA handling the trading, you can focus on other aspects of your trading business or personal life.

3. Low-Risk Approach

The EA’s built-in risk management features make it an excellent choice for traders who prioritize capital preservation.

4. Ideal for Prop Firm Challenges

The daily trade limit and profit cap features align well with many prop firm rules, making it easier to pass challenges.

Setting Up ICT UNO EA

Setting up this EA is straightforward:

- Download the EA from a reputable source.

- Install it on your MetaTrader 4 platform.

- Attach it to your preferred currency pair chart.

- Configure the settings according to your trading preferences.

For detailed installation instructions, refer to the official MetaTrader 4 guide.

Best Practices for Using ICT UNO EA

To get the most out of this EA, consider the following best practices:

- Backtesting: Before live trading, thoroughly backtest the EA on historical data to understand its performance.

- Start Small: Begin with a small account or demo account to get familiar with the EA’s behavior.

- Monitor Performance: Regularly review the EA’s performance and adjust settings if necessary.

- Stay Informed: Keep up with market news and economic events that might impact the EA’s performance.

- Combine with Manual Analysis: Use the EA in conjunction with your own market analysis for best results.

Conclusion

This EA represents a significant advancement in automated trading, particularly for those interested in Smart Money Concepts and ICT strategies. Its precision-focused approach, combined with robust risk management features, makes it a valuable tool for a wide range of traders.

Whether you’re looking to streamline your day trading, tackle prop firm challenges, or simply automate your trading with a low-risk approach, this EA offers a compelling solution. By leveraging institutional-level strategies and advanced algorithms, this EA has the potential to transform your trading experience.

Remember, while this EA is a powerful tool, it’s essential to use it as part of a comprehensive trading strategy. Always practice responsible risk management and continually educate yourself about the markets. Happy trading!

| Membership | Yearly Membership |

|---|---|

| Additional Services | Unlock & Decompile |

| Recommended Brokers | Exness Broker, FPMarkets |

| Recommended VPS | FXVM (Low Latency) |

| Youtube Channel | ForexForYou |

| Telegram Channel | Onshoppie Forex EA's & Indicators |

| Telegram Support | Onshoppie Support |

| Installation Guides | Onshoppie Forex Guides |

Brand

ea-mt4

Only logged in customers who have purchased this product may leave a review.

Reviews

There are no reviews yet.