Gold Crazy EA MT5 FOR BUILD 4885+

Original price was: $199.00.$9.95Current price is: $9.95.

Discover the power of Gold Crazy EA! This innovative forex tool delivers consistent profits with minimal effort. Unlock your trading potential today.

Description

Gold Crazy EA: The Ultimate Expert Advisor for Gold Trading

Alternative Title: Gold Crazy EA: Mastering Gold Trading with Advanced Automation

Table of Contents

- Introduction to Gold Crazy EA

- Key Features of Gold Crazy EA

- Trading Strategies and Indicators

- Customization Options

- Recommended Brokers

- Setting Up Gold Crazy EA

- Optimizing Your Trading with Gold Crazy EA

- Pros and Cons of Using Gold Crazy EA

- Conclusion

Introduction to Gold Crazy EA

Gold Crazy EA is an innovative Expert Advisor designed specifically for trading gold on the H1 timeframe and EUR/USD on the M15 timeframe. This tool combines advanced indicators and customizable settings to help traders maximize their profits in the volatile gold market. Whether you’re a seasoned trader or just starting out, this EA offers a range of features to suit your trading style and risk appetite.

Key Features of Gold Crazy EA

Gold Crazy EA stands out from other Expert Advisors due to its versatility and advanced features. Here are some of the key highlights:

- Specialized for Gold and EUR/USD: The EA allowing traders to focus on these popular markets.

- Multiple Trading Strategies: Gold Crazy EA can be configured for scalping or grid/martingale trading, depending on your preferences and market conditions.

- Indicator-Based Entry Points: The EA uses a combination of indicators to identify optimal entry points, increasing the likelihood of successful trades.

- Flexible Risk Management: Traders can set stop-loss (SL) levels or opt for a dollar-cost averaging (DCA) approach to manage risk.

- Auto Lot Sizing: The EA can automatically adjust lot sizes based on your account balance, helping to maintain consistent risk levels.

- Customizable Take Profit and Stop Loss: Users can set TP and SL levels for individual trades or for a basket of trades, allowing for fine-tuned risk management.

- RSI Strategy Option: Traders can choose to use the default strategy or switch to an RSI-based strategy by adjusting the RSI_PERIOD parameter.

Trading Strategies and Indicators

Gold Crazy EA employs a sophisticated approach to trading, utilizing various indicators and strategies to identify profitable opportunities. Let’s explore the main components:

Default Strategy

The default strategy of Gold Crazy EA uses a combination of technical indicators to analyze market trends and generate trading signals. While the exact formula is proprietary, it likely incorporates popular indicators such as moving averages, MACD, and Bollinger Bands to identify potential entry and exit points.

RSI Strategy

For traders who prefer a different approach, Gold Crazy EA offers an RSI (Relative Strength Index) strategy. By setting the RSI_PERIOD parameter to a value greater than 0, the EA will switch to this strategy. The RSI is a momentum oscillator that measures the speed and change of price movements, helping to identify overbought and oversold conditions.

Scalping

Gold Crazy EA can be configured for scalping, a strategy that aims to profit from small price changes. This approach involves making numerous trades throughout the day, each with a small profit target. Scalping with Gold Crazy EA can be particularly effective in volatile markets, such as gold trading.

Grid/Martingale Trading

For traders comfortable with higher risk strategies, Gold Crazy EA offers a grid or martingale option. This approach involves opening multiple positions at different price levels, with the aim of averaging out the entry price and potentially increasing profits. However, it’s important to note that this strategy can also increase potential losses if not managed carefully.

Customization Options

One of the strengths of Gold Crazy EA is its high level of customization. Traders can adjust various parameters to tailor the EA to their specific needs and risk tolerance. Some key customization options include:

- MAX_ORDERS: This parameter allows you to limit the number of open orders. Setting it to 1 will restrict the EA to single trading mode.

- STOPLOSS_1 and TAKEPROFIT_1: These settings are used for grid trading, allowing you to define the stop-loss and take-profit levels for the grid strategy.

- STOPLOSS_2 and TAKEPROFIT_2: These parameters are used for single trading mode. Setting them to -1 will disable their use.

- Risk per Trade: Traders can set the risk percentage for each trade, helping to maintain consistent risk management across their account.

- Auto Lot Sizing: The EA can automatically calculate lot sizes based on your account balance, ensuring that position sizes remain proportional to your available capital.

Recommended Brokers

To get the most out of Gold Crazy EA, it’s important to use a reliable broker with low spreads. The developers recommend using ECN brokers for optimal performance. Some suggested brokers include:

These brokers are known for their competitive spreads and reliable execution, which are crucial factors when using an automated trading system like Gold Crazy EA.

Setting Up Gold Crazy EA

To start using Gold Crazy EA, follow these steps:

- Download and Install: Obtain the Gold Crazy EA files from a reputable source and install them in your MetaTrader 4 or 5 platform.

- Choose Your Chart: Open a gold (XAUUSD) H1 chart or a EUR/USD M15 chart, depending on which market you want to trade.

- Attach the EA: Drag and drop the Gold Crazy EA onto your chosen chart.

- Configure Settings: Adjust the EA’s parameters according to your trading preferences and risk tolerance.

- Enable AutoTrading: Make sure that AutoTrading is enabled in your MetaTrader platform.

- Monitor Performance: Regularly check the EA’s performance and make adjustments as necessary.

Optimizing Your Trading with Gold Crazy EA

To get the best results from Gold Crazy EA, consider the following tips:

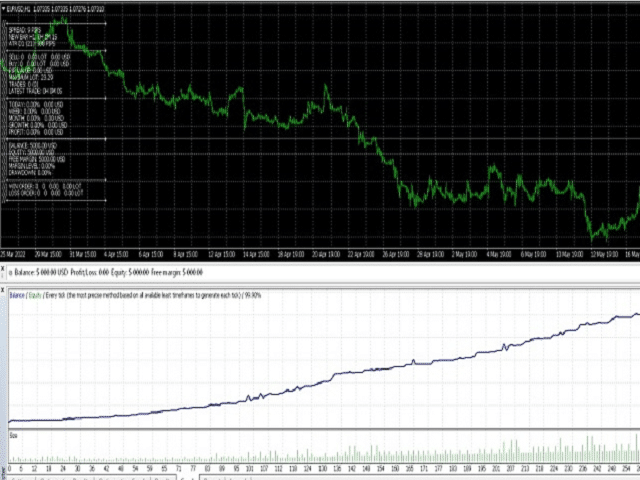

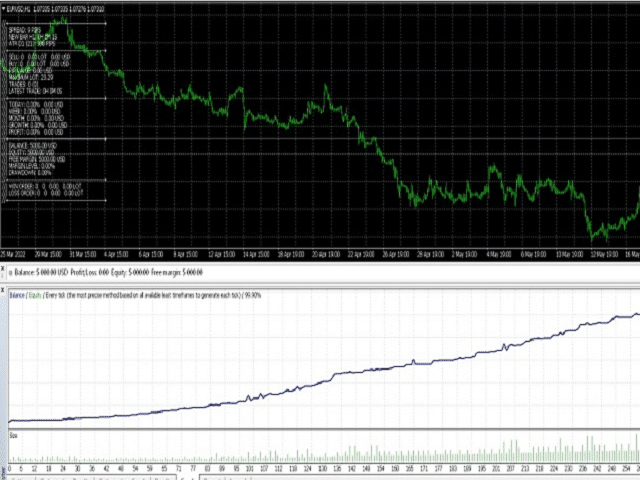

- Backtest Thoroughly: Before using the EA with real money, conduct extensive backtesting using historical data to understand its performance under various market conditions.

- Start with Demo Trading: Use a demo account to familiarize yourself with the EA’s behavior and fine-tune your settings.

- Monitor Market Conditions: While this EA is automated, it’s still important to stay informed about market news and events that could impact gold prices.

- Regularly Review and Adjust: Periodically review the EA’s performance and adjust your settings if necessary to adapt to changing market conditions.

- Use Proper Risk Management: Even with automated trading, it’s crucial to maintain proper risk management. Never risk more than you can afford to lose.

Pros and Cons of Using Gold Crazy EA

Pros:

- Specialized for gold and EUR/USD trading

- Multiple trading strategies available

- Highly customizable settings

- Automated risk management features

- Can be used for scalping or longer-term trading

Cons:

- Requires a reliable broker with low spreads

- May require regular monitoring and adjustment

- Performance can vary depending on market conditions

- Grid/martingale strategies can be high-risk if not managed properly

Conclusion

This EA offers a powerful and flexible solution for traders looking to automate their gold and EUR/USD trading. With its advanced features, customizable settings, and multiple trading strategies, it provides a versatile tool for both novice and experienced traders. However, as with any automated trading system, it’s important to use this EA responsibly, with proper risk management and regular monitoring.

By taking the time to understand the EA’s features, optimizing your settings, and staying informed about market conditions, you can potentially enhance your trading results with this EA. Remember to always start with a demo account, conduct thorough backtesting, and never risk more than you can afford to lose.

Are you ready to take your gold trading to the next level with this EA? Start by researching reputable sources to download the EA, and begin your journey towards more efficient and potentially profitable automated trading.

Vendor Site – Click Here

| Membership | Yearly Membership |

|---|---|

| Additional Services | Unlock & Decompile |

| Recommended Brokers | Exness Broker, FPMarkets |

| Recommended VPS | FXVM (Low Latency) |

| Youtube Channel | ForexForYou |

| Telegram Channel | Onshoppie Forex EA's & Indicators |

| Telegram Support | Onshoppie Support |

| Installation Guides | Onshoppie Forex Guides |

Brand

ea-mt5

Only logged in customers who have purchased this product may leave a review.

Reviews

There are no reviews yet.