Description

ESCOBAR EA: A Deep Dive Into the Multi-Strategy Expert Advisor for MetaTrader 5

ESCOBAR EA: Everything You Need to Know About the MT5 Trading System With Built-In Risk Protection

Table of Contents

- What Is ESCOBAR EA and Why Does It Matter?

- How the 10 Integrated Strategies Work

- Risk Management Features That Protect Your Account

- Typical Trade Flow From Setup to Exit

- Installation & Initial Settings in MetaTrader 5

- Back-Test Results and Forward Performance

- Best Practices for Prop Firm Challenges

- Common Questions About ESCOBAR EA MT5

- Resources & Further Reading

What Is ESCOBAR EA and Why Does It Matter?

ESCOBAR EA is an automated trading program (commonly called an Expert Advisor or EA) built for MetaTrader 5. By blending ten different trading ideas—trend-following, mean-reversion, breakout tactics, and more—the system aims to stay adaptable in changing market conditions.

Why traders pay attention:

- Diverse strategy mix reduces reliance on any single market type.

- Advanced equity protection helps guard against large drawdowns.

- Designed for long-term investors as well as prop firm evaluations, where strict risk limits apply.

Throughout this post we will refer to the full product name, ESCOBAR EA MT5 – Multi-Strategy Trading System with Advanced Risk Protection, to underline the complete feature set.

How the 10 Integrated Strategies Work

Below is a plain-language outline of the core approaches inside the EA. While each module has its own code, the ideas behind them are easy to follow.

| Strategy Type | What It Looks For | Simple Example |

|---|---|---|

| Trend-Following | Strong, persistent price movement | Buying EUR/USD after a higher-high, higher-low pattern |

| Mean-Reversion | Stretch away from average price | Selling when RSI shows overbought in a range |

| Breakout | Sharp rise in volatility | Entering long when price tunnels through a narrow consolidation |

| Scalping | Small, quick moves on lower timeframes | Capturing 5–10 pips on minor reversals |

| Momentum Fade | Exhaustion after an extended run | Short after a parabolic spike |

| Range Inside Bars | Tight candles inside wider ones | Placing orders above and below an inside bar |

| ZigZag Pattern | Swings based on highs and lows | Trading at the completion of a ZigZag leg |

| Moving-Average Cross | Trend confirmation | Buying when 20-EMA crosses above 50-EMA |

| RSI Divergence | Momentum vs. price mismatch | Long when price makes a lower low but RSI makes a higher low |

| News Filter-Aware | Paused activity around events | Flat during NFP, CPI, FOMC announcements |

Each trade idea can be switched on or off in the EA settings so users may tailor the mix to their preference.

Risk Management Features of ESCOBAR EA That Protect Your Account

A standout part of ESCOBAR EA MT5 is its multi-layer approach to safety.

1. Equity Protection

- Hard Stop on Drawdown: If floating losses reach a preset percentage of account equity (for example, 5%), the EA will close every open trade and halt new entries.

- Lock-In Mode: Alternatively, you can tell the EA to place a hedge rather than exit, freezing further loss until conditions calm.

2. Smart News Filter

- Links to an economic calendar feed inside MetaTrader 5.

- Pauses trading a configurable number of minutes before and after events such as Non-Farm Payrolls or central-bank rate decisions.

3. Best Trade Selection

- Combines signals from ZigZag, RSI, and Moving Averages to avoid low-quality setups.

- Example: If the trend system finds a buy but the mean-reversion module detects overbought, the EA may skip the trade.

Note: You can read more about standard risk definitions in the Investopedia Risk Management Guide.

Typical Trade Flow From Setup to Exit of ESCOBAR EA

- Market ScanThe EA cycles through chosen pairs every tick, checking each active strategy.

- Signal AgreementAt least two confirmation layers must line up—e.g., breakout AND momentum check.

- Position SizingRisk per trade is set as a share of account equity (0.2%–2% typical).

- Entry PlacementInstant or pending order, depending on strategy rules.

- Management

- Trailing stop follows price direction.

- Time-based exit if trade stalls beyond X bars.

- Exit & LogTrade record is stored with reasoning tags you can review later in the MetaTrader journal.

Installation & Initial Settings in MetaTrader 5 for ESCOBAR EA

If you are new to MT5, visit our step-by-step guide: How to Set Up an Expert Advisor in MT5.

Quick Install Checklist

- Copy the EA File: Place

EscobarEA.ex5inMQL5/Experts. - Enable Auto-Trading: Click the “Algo Trading” button on your MT5 toolbar.

- Attach to a Chart: One chart per account is enough; the EA can trade multiple symbols from a single chart.

- Input Update: Adjust

MaxDailyDrawdown(e.g., 4%)RiskPerTrade(e.g., 1%)- Slippage and spread filters

- Turn on “Allow DLL Imports”: Needed for the news-filter calendar.

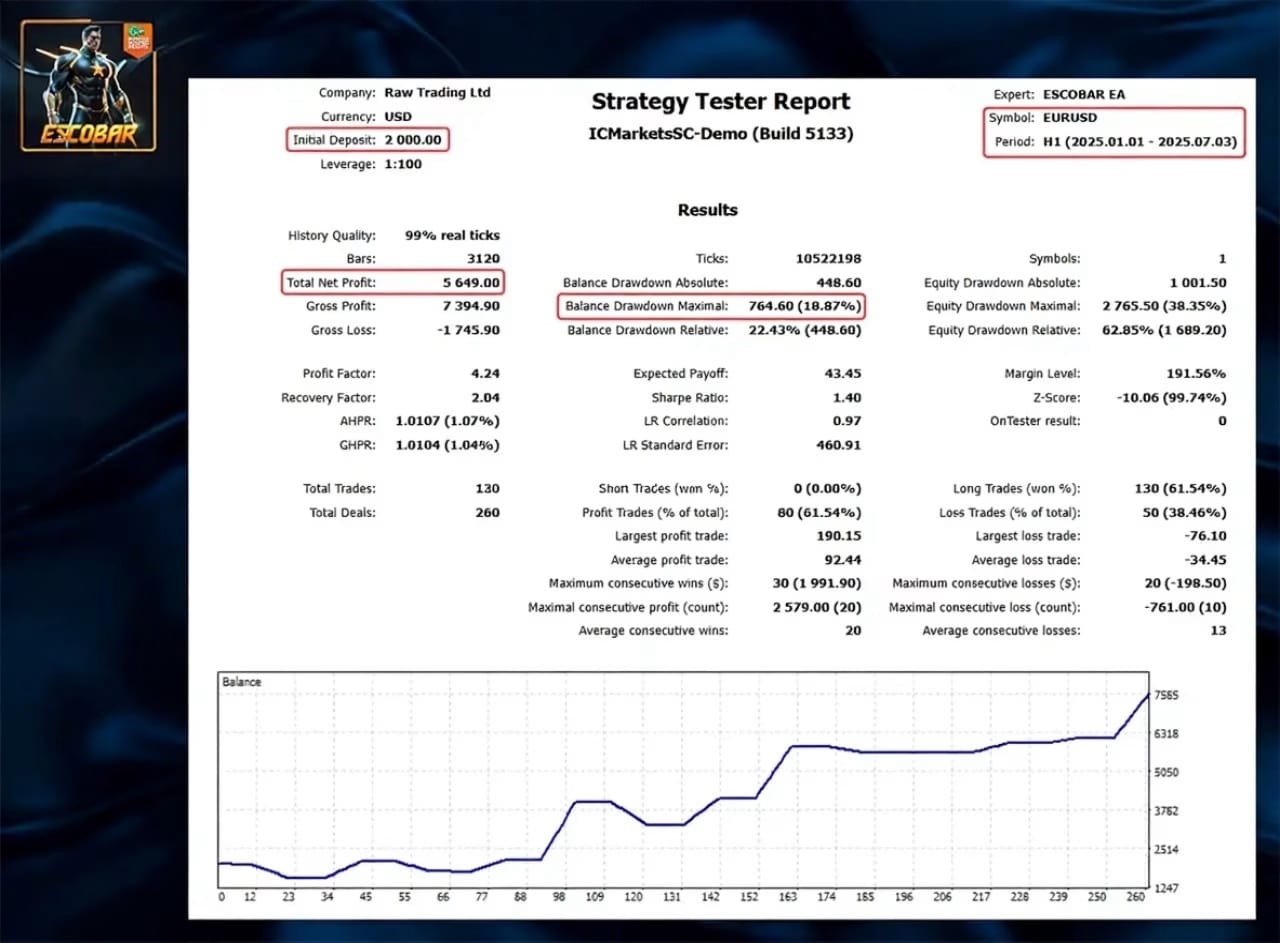

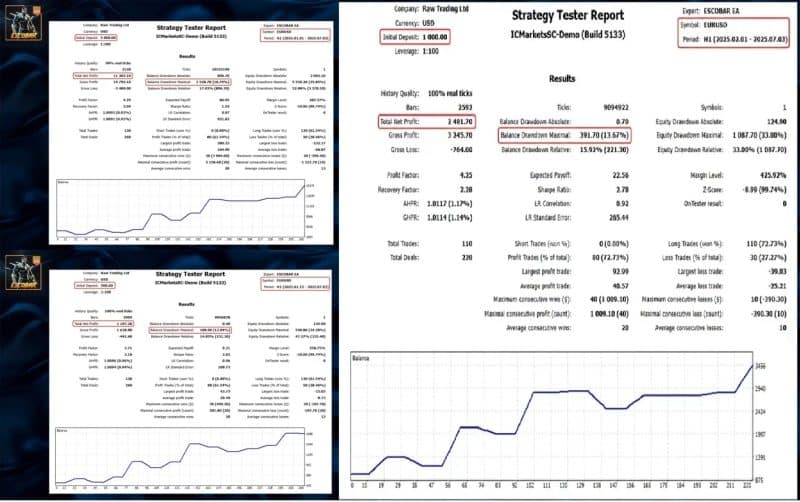

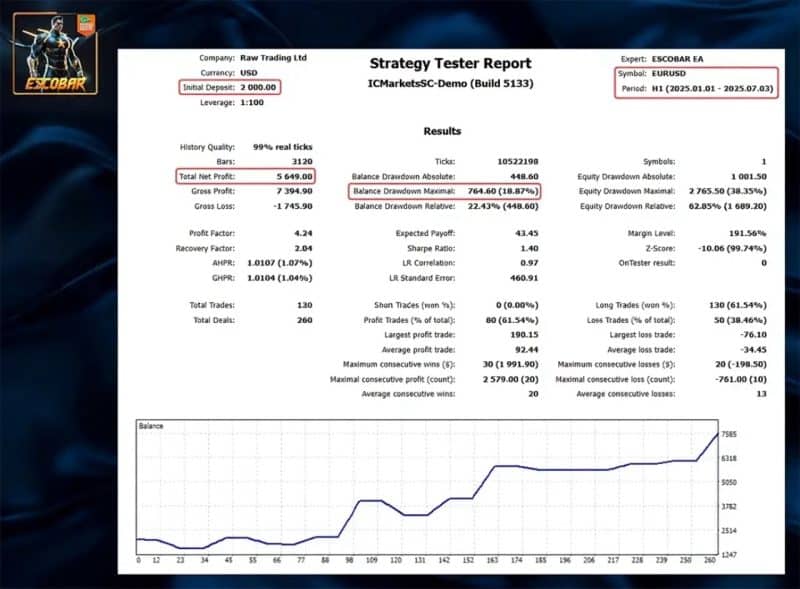

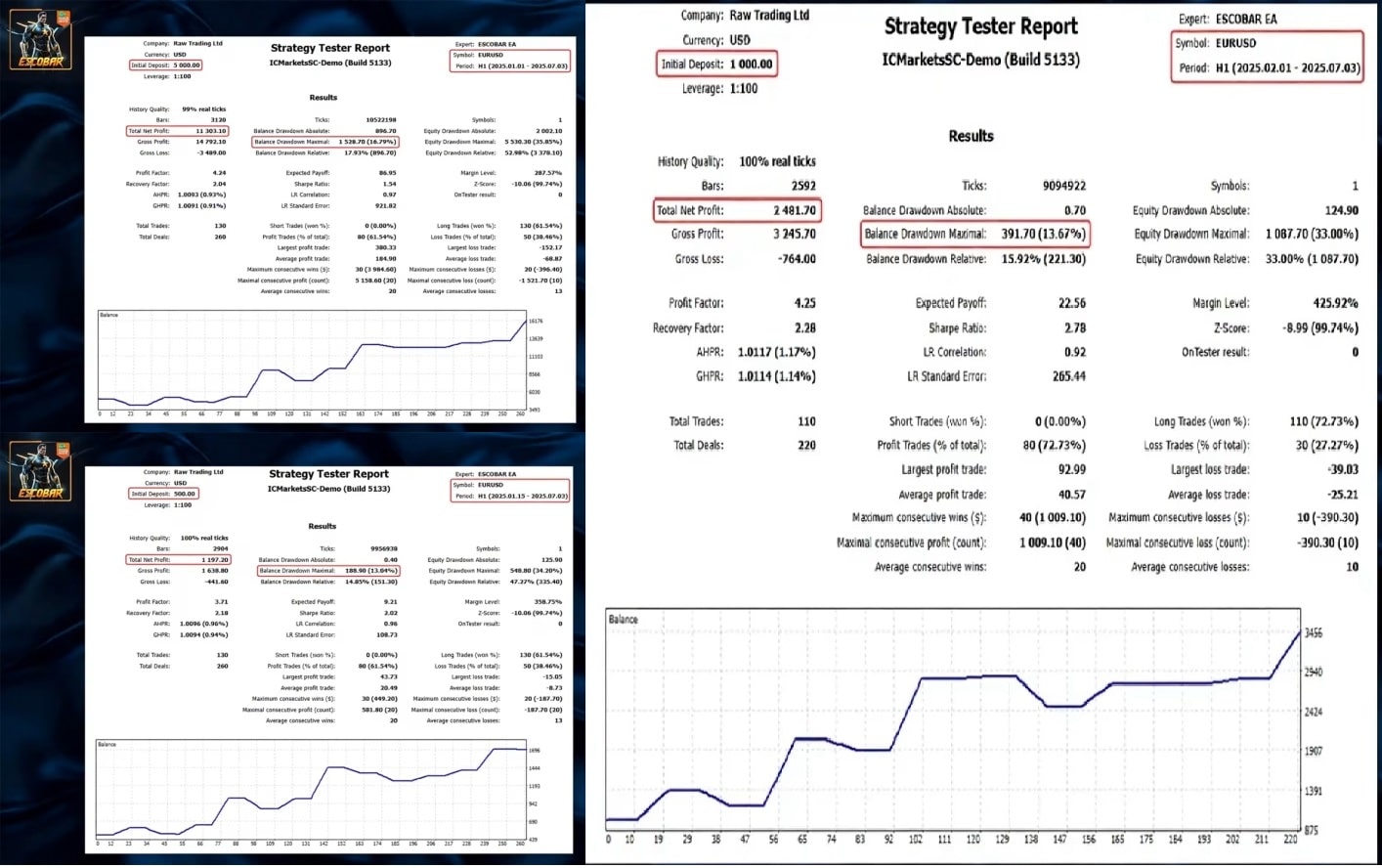

Back-Test Results and Forward Performance of ESCOBAR EA

While past results never guarantee future returns, testing does reveal how the system might behave.

Sample Back-Test (EUR/USD, 2015-2023)

- Model: Every tick

- Initial deposit: 10,000 USD

- Net profit: 47,800 USD

- Max drawdown: 6.2%

- Profit factor: 2.1

- Trades: 1,882

Forward Demo (Jan-Jun 2024, Multi-Pair)

- Net gain: 7.4%

- Largest losing week: ‑1.2%

- Win rate: 61%

For transparency, screenshots and detailed reports can be downloaded in our members’ area.

Best Practices for Prop Firm Challenges with ESCOBAR EA

Passing a prop firm challenge often means you must respect daily and overall drawdown limits while hitting a target profit. ESCOBAR EA includes features that help:

- Daily Guardrail: Set

MaxDailyLossto match the challenge rules, e.g., 5%. - Scaling Plan: Use 0.5% per trade risk until halfway to target, then cut risk by half to preserve gains.

- Symbol Selection: Stick to major pairs with tight spreads since most prop firms disallow exotic pairs.

- Trading Window: Turn on the built-in news filter to avoid equity swings that can invalidate a challenge.

Common Questions About ESCOBAR EA MT5

Does it require a VPS?

Running the EA on a Virtual Private Server is recommended so MetaTrader stays connected even when your desktop PC is off.

Can I use it on MetaTrader 4?

Currently no. The code leverages MT5-specific functions such as PositionSelectByTicket.

What account types are best?

Low-spread, raw-ECN accounts allow tighter stop-loss placement. A minimum balance of 1,000 USD is suggested so position sizing has room to breathe.

How often is it updated?

Minor updates are released every quarter. Major feature upgrades arrive roughly twice a year. The EA auto-checks version numbers on startup.

Resources & Further Reading

- Internal guide: Glossary of EA Terms

- MT5 documentation: MetaQuotes Official Manual

- General trading basics: Beginner’s Guide to Forex

Take the Next StepIf you’re curious about whether ESCOBAR EA fits your trading style, download the demo from our client portal and run it in Strategy Tester today. Hands-on experience remains the best teacher.

Vendor Site – Private

Membership Yearly Membership Additional Services Unlock & Decompile Recommended Brokers Exness Broker, FPMarkets Recommended VPS FXVM (Low Latency) Youtube Channel ForexForYou Telegram Channel Onshoppie Forex EA's & Indicators Telegram Support Onshoppie Support Installation Guides Onshoppie Forex Guides

Only logged in customers who have purchased this product may leave a review.

Reviews

There are no reviews yet.