Edge Detector EA MT5 + SetFiles For Build 5120+

$9.95

Discover the powerful Edge Detector EA! Actually profitable, easy to use, and designed to excite traders. Start your journey to better trading results today.

Description

Edge Detector EA: A Practical Guide to Smarter, Low-Drawdown Trading

Edge Detector EA – The Everyday Trader’s Roadmap to Precision Entries and Risk Control

Table of Contents

- Introduction: What Makes Edge Detector EA Stand Out?

- How EdgeDetector MT5 Works Under the Hood

- Volatility-Adaptive Money Management

- Putting Edge Detector EA to Work on MetaTrader 5

- Live Trading: What to Expect Day-to-Day

- Frequently Asked Questions

- Closing Thoughts & Next Steps

1. Introduction: What Makes Edge Detector EA Stand Out?

If you are looking for an Expert Advisor that balances accuracy, low drawdown, and clear risk control, Edge Detector EA is worth a closer look. Built on the same core as EdgeDetector MT5, it blends AI-powered prediction, fractal analysis, and entropy filtering to detect high-probability trade setups. In plain words, the EA looks for quiet yet meaningful market moments where price is ready to turn or trend, then manages each position with an adaptive stop loss and lot size.

Unlike many “set-and-forget” robots, Edge Detector EA has a data-driven logic designed to stay out of chaotic price action. That means fewer random trades and a smoother equity curve—two things most traders appreciate.

2. How EdgeDetector MT5 Works Under the Hood

Edge Detector EA combines three main ideas: machine learning, price structure, and market noise filtering. Let’s take each in turn.

2.1 AI-Powered Trade Confirmation

- The EA runs a lightweight neural network to double-check every signal.

- By comparing current price patterns with past data, it rates the quality of each setup.

- Only high-rated signals pass through to execution.

Why it matters: this extra layer often reduces false entries that come from single-indicator systems. For more on neural networks in trading, see Investopedia’s overview.

2.2 Fractal Analysis for Market Structure

- Fractals point out local highs and lows—natural points where orders tend to cluster.

- Edge Detector EA scans these fractals to spot potential reversals or breakouts.

- Combined with the AI module, the fractal data adds context to every trade.

2.3 Entropy Filtering to Cut Market Noise

- “Entropy” measures how random price movement is at any moment.

- A low-entropy reading suggests price is orderly and trends may hold.

- The EA stays on the sidelines when entropy is high to avoid whipsaws.

In short, entropy filtering helps the robot sit out the messy parts of the day—something many manual traders wish they could do more consistently.

3. Volatility-Adaptive Money Management

Risk control is where many EAs fall short. Edge Detector EA counters that with two features: adaptive stops based on ATR and dynamic lot sizing.

3.1 ATR-Based Stop Loss and Take Profit

- Average True Range (ATR) measures current volatility.

- The EA multiplies ATR by a user-defined factor (e.g., 2×) to set stop loss and take profit.

- This keeps the risk/reward ratio steady no matter how “fast” or “slow” the market feels.

Benefit: You don’t have to tweak fixed pip values when volatility spikes or calms down.

3.2 Risk-Based Dynamic Lot Sizing

- The RiskFactor input links each position to a fixed account percentage.

- If you choose 2 % risk per trade, the EA adjusts lot size to match.

- As your balance changes, position sizes scale automatically.

There’s also a FixedLotSize option if you prefer manual control or if your broker has trade-size limits.

4. Putting Edge Detector EA to Work on MetaTrader 5

4.1 Installation Checklist

- Download the EA file (

EdgeDetector.ex5). - Copy it to

MQL5\Expertsin your MetaTrader 5 data folder. - Restart MT5, then drag the EA onto your desired chart (M5 or M15 usually work best).

- Enable Algo Trading (Ctrl+E) and check that the smiley icon is on.

Tip: Consider running MT5 on a VPS for stable 24/7 execution. Our guide on setting up a Forex VPS walks through the basics.

4.2 Key Input Settings Explained

| Input | Description | Typical Range |

|---|---|---|

| RiskFactor | % of account risked per trade | 0.5 – 3 % |

| ATR_Multiplier | Determines stop-loss distance | 1.5 – 3 |

| EntropyThreshold | Higher = less filtering | 0.3 – 0.5 |

| FractalDepth | Sensitivity of fractal detection | 4 – 6 |

| FixedLotSize | Overrides dynamic lots | 0 (disabled) or any lot value |

| PreEventWindow | Candles checked before entry | 20 – 50 bars |

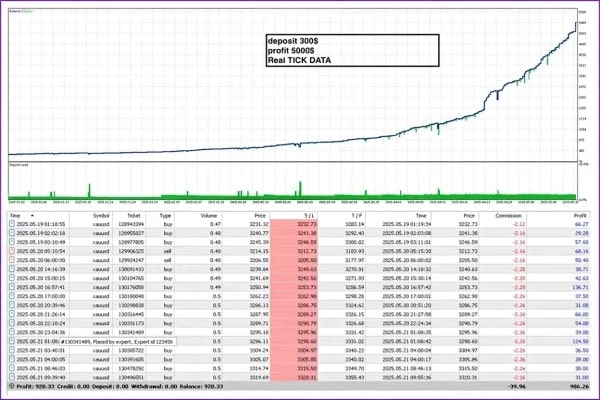

4.3 Back-Testing Tips for Reliable Results

- Use at least five years of tick data to see different market cycles.

- Select “Every tick based on real ticks” in the MT5 strategy tester.

- Test multiple currency pairs—even ones you do not plan to trade. This shows how the EA reacts to varied volatility.

- Note key stats such as Maximum Drawdown and Profit Factor. Aim for drawdown under 20 % and a profit factor above 1.5.

- Once satisfied, run a forward test on a demo account for two weeks before going live.

Need a refresher on back-testing basics? Check out MetaQuotes’ official guide.

5. Live Trading: What to Expect Day-to-Day

5.1 Typical Trade Examples

Below is a simplified EURUSD case on the 15-minute chart:

| Step | Action | Detail |

|---|---|---|

| 1 | Signal | Price forms a bullish fractal two candles back. Entropy < 0.4. |

| 2 | AI Check | Neural net scores pattern at 0.87 (scale 0-1). |

| 3 | Entry | Buy at market, lot size 0.12 (risk 1 %). |

| 4 | Stop Loss | 2 × ATR-14 = 18 pips below entry. |

| 5 | Take Profit | 2 × ATR-14 = 18 pips above entry. |

| 6 | Exit | TP hit in 47 minutes, +1 R (risk unit). |

The EA will log each step in MT5’s Experts tab for later review.

5.2 Managing News & High-Impact Events

Edge Detector EA already skips high-entropy zones, but fund-driven spikes can still surprise the best logic. Consider these steps:

- Check an economic calendar (for example, Forex Factory) each weekend.

- If Non-Farm Payrolls or central-bank meetings are due, lower RiskFactor or disable trading for that hour.

- Re-enable normal settings once spread and volatility settle.

6. Frequently Asked Questions

Q 1: Does Edge Detector EA work on all currency pairs?It was optimized for majors and selected crosses (EURUSD, GBPUSD, USDJPY, AUDUSD, and XAUUSD). Exotic pairs with wide spreads can weaken its edge.

Q 2: Is it scalping, swing, or trend trading?It’s more of an intraday swing system. Average trade length sits between 30 minutes and 4 hours.

Q 3: Does the AI module need external libraries or a GPU?No. The neural network is coded in MQL5 and runs on your CPU with minimal load.

Q 4: Can I run multiple charts at once?Yes, but keep your VPS or PC resources in mind. Each chart needs price data, but the EA itself is light.

Q 5: How often should I update the EA?Check the developer’s page once a month. Updates often improve entry logic or add broker-specific fixes.

7. Closing Thoughts & Next Steps

Edge Detector EA aims to do two things well: pick precise entries and keep risk small. By blending AI confirmation, fractal analysis, and entropy filtering, it reduces the guesswork many systems still face. Pair that with volatility-adaptive stops and dynamic lot sizing, and you get an Expert Advisor focused on steady, low-drawdown growth.

Ready to see it in action?

- Download the latest build.

- Back-test on your preferred pairs.

- Run a small demo to check real-time fills.

If you have questions or want to share your results, drop a comment below or join our trading forum. Good luck, and trade safely with Edge Detector EA!

Vendor Site – Private

| Membership | Yearly Membership |

|---|---|

| Additional Services | Unlock & Decompile |

| Recommended Brokers | Exness Broker, FPMarkets |

| Recommended VPS | FXVM (Low Latency) |

| Youtube Channel | ForexForYou |

| Telegram Channel | Onshoppie Forex EA's & Indicators |

| Telegram Support | Onshoppie Support |

| Installation Guides | Onshoppie Forex Guides |

Only logged in customers who have purchased this product may leave a review.

Reviews

There are no reviews yet.