Dax EA MT4 + SetFiles For Build 1441+

Original price was: $499.00.$25.95Current price is: $25.95.

Amazing Dax EA builds faith in automated trading. Discover how this powerful system delivers consistent, reliable results for modern traders.

Description

DAX EA: A Fresh Take on Index Trading Automation

DAX EA — Why I Built It and How It Helps Index Traders Today

Table of Contents

- A Quick Intro to DAX EA

- Why I Built DAX EA — A Personal Note to Fellow Index Traders

- What Makes DAX EA Different?

- Key Features at a Glance

- How DAX EA Handles Risk

- Why Many Expert Advisors Struggle on the DAX

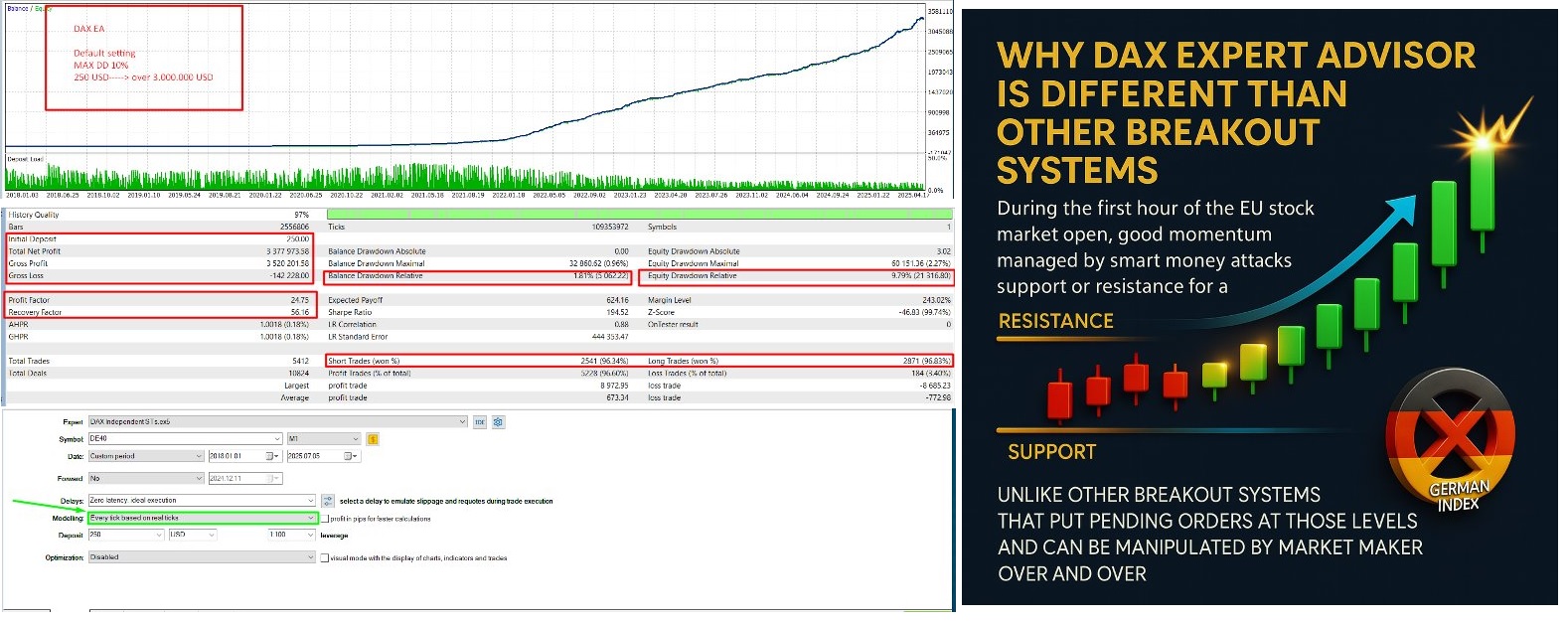

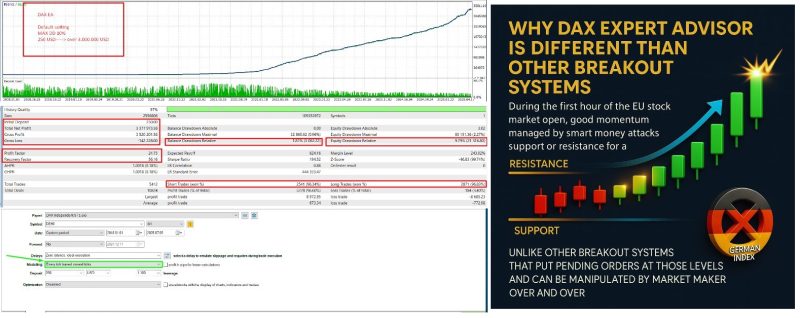

- Real-Tick vs. OHLC Back-Tests: What You Need to Know

- Installation & Setup Guide

- Best Practices for Running DAX EA on Prop Firm Accounts

- Frequently Asked Questions

- Final Thoughts

- Join the Conversation

A Quick Intro to DAX EA

DAX EA is an automated trading system built for Germany’s leading stock index (often shown on platforms as DAX, DE30, GER30, DE40, GER40, DAX40, Germany30, or Germany40). Instead of relying on fixed stop-loss levels and a single trading style, it uses twenty-three mini-strategies. Each mini-strategy follows real market behaviour, adjusts to index value changes, and keeps risk within clear limits.

Primary keyword focus: DAX EARelated keyword used naturally above.

Why I Built DAX EA — A Personal Note to Fellow Index Traders

Years ago, I noticed most Expert Advisors that looked solid on a back-test soon fell apart on live charts. After digging deeper, one problem kept showing up: static settings.

- If the DAX was trading at 9,000 points when the EA was written, the same stop size makes little sense now that the index can swing above 16,000.

- Expiry cycles for futures influence cash moves more than many people think. Some days carry stronger directional bias.

I started noting how those dates line up with price spikes. This “calendar effect” became one of the core filters inside DAX EA. I kept the logic simple but dynamic:

- Each trade checks current volatility before it decides where the stop needs to sit.

- Profit targets shift with the same logic.

- When conditions look choppy, fewer strategies turn on.

The result is a tool that aims to stay in step with today’s index environment—no endless tweaking required.

What Makes DAX EA Different?

| Aspect | Standard EA | DAX EA |

|---|---|---|

| Stop-loss size | Fixed (often outdated) | Dynamic, scaled by current volatility |

| Entry logic | One or two patterns | 23 independent micro-strategies |

| Capital curve | Sharp peaks then flat | Smoother, lower drawdown targets |

| Broker limits | May need low spreads | Works with typical retail & prop brokers |

| Update cycle | Manual patching | Self-adjusting, fewer manual edits |

Key Features at a Glance

1. Broker Flexibility

- Runs on MT4 or MT5 with regular retail conditions.

- FIFO-capable; no hedging loopholes required.

2. Risk-to-Reward Structure

- About $3 max stop per 0.1 lot (≈1–1.5 % on a $25 risk block).

- Up to ten micro-strategies can be active at once (user-adjustable).

3. Simple Setup

- One file to load.

- Attach on any timeframe; logic works on tick data internally.

4. Multi-Strategy Core

- Twenty-three strategies help reduce trade clustering.

- Each carries its own magic number for easy tracking.

5. Prop-Firm Alignment

- You can throttle risk quickly by changing the lot-calc field.

- Strategy cap lets you meet daily loss rules easier.

How DAX EA Handles Risk

| Account Size (USD) | Suggested Lot Rule | Max Active Strategies | Approx. Risk per Strategy |

|---|---|---|---|

| 100 | 0.01 lot per $25 | 5 | 1 % |

| 5,000 | 0.01 lot per $100 | 10 | 0.25 % |

| 50,000 (prop) | 0.01 lot per $150 | 10 | 0.17 % |

Tip: If your prop firm tracks correlation, rotate which of the 23 strategies stay active. That tiny tweak can set your trade feed apart from other users and reduce the chance of copied trade flags.

Why Many Expert Advisors Struggle on the DAX

- Fast GapsDAX futures often jump on open—an EA built on low-timeframe candle data may miss the gap and misplace stops.

- Changing Index ValueA 40-point stop was wide at 9,000 points but tight at 16,000. Without scaling, an EA risks frequent stop-outs.

- Session ShiftsFrankfurt, London, and New York overlaps each bring fresh liquidity. Static EAs that trade all day can rack up whipsaw losses.

- Volatility CyclesThe index tends to cool off in the middle of the month and heat up near options expiry. Hard-coded trade windows ignore this edge.

DAX EA addresses these issues by:

- Pulling real-time spread and volatility data before placing orders.

- Knowing which days of the month often deliver a bias and filtering trades accordingly.

- Keeping stops in line with the current tick size and ATR.

Real-Tick vs. OHLC Back-Tests: What You Need to Know

| Test Type | Speed | Detail Level | Best for |

|---|---|---|---|

| OHLC | Fast | 4 prices per bar | Long-term trend systems |

| Real Tick | Slow | Every quote + spread | Scalping & intraday work |

Since DAX EA sometimes works with tight stops, it needs real-tick data to show realistic results. Using OHLC in MetaTrader’s strategy tester can skip mid-bar spikes and paint an “easy” back-test curve that will not repeat live.

External reading: MetaTrader 5 back-testing article on MQL5

Installation & Setup Guide

- Download the fileSave

DAX_EA.ex4orDAX_EA.ex5to your platform’s Experts folder. - Restart or RefreshIn MetaTrader, right-click Navigator → Refresh or restart the terminal.

- Attach to Chart• Choose any DAX symbol offered by your broker.• Timeframe can be M1 to H4—it doesn’t affect logic.

- Input Settings

Field Default Notes LotPerBalance0.01 per $25 Adjust for account size MaxStrategies10 Lower for stricter prop limits RotateGroupstrue Adds strategy variation - Press OKA smiley face or green triangle confirms the EA is running.

- Watch the JournalFirst launch will list strategy IDs and risk blocks for quick review.

Screenshot example below (alt-text: “DAX EA running on MT5 with three open trades”):

[Image Placeholder]Best Practices for Running DAX EA on Prop Firm Accounts

- Keep daily drawdown below 2 % by setting conservative lot rules.

- Use the built-in news filter if your prop rules block trading around high-impact events.

- Rotate strategy groups every few weeks to look less like other accounts.

- Monitor slippage; if it rises above 2 pips on average, consider using a VPS closer to your broker’s data centre.

Quick link: Our low-latency VPS guide (internal)

Frequently Asked Questions

Q1. Does DAX EA grid or martingale?No. Each trade has a single lot size, single stop, single target.

Q2. Minimum balance?About $50 if you run only one group at a time. Realistically, $250+ gives data room for portfolio testing.

Q3. Which platforms are supported?MetaTrader 4 and MetaTrader 5.

Q4. Can I change the magic numbers?Yes, each strategy’s ID can be edited under Advanced Settings.

Q5. Is it legal on prop firms?Generally yes, but always check your firm’s terms on EAs and strategy correlation.

Q6. What if my broker renames the DAX symbol?Enter the custom name in the SymbolAlias field. The EA will then read that chart.

Final Thoughts

DAX EA was built to give index traders a tool that lives in the real market—one that changes its stop, target, and even trade timing as the DAX itself evolves. Twenty-three small strategies spread risk, dynamic scaling keeps stops sensible, and no aggressive tactics such as martingale hide under the hood. Whether you trade a small personal account or a six-figure prop challenge, the same principles apply: manage risk, let the data guide you, and keep your approach flexible.

Join the Conversation

Have questions about DAX EA or index trading automation in general? Drop a comment below, or join our free Telegram group (link in sidebar). Your feedback helps shape future updates.

Vendor Site – Click Here

Review – Click Here

| Membership | Yearly Membership |

|---|---|

| Additional Services | Unlock & Decompile |

| Recommended Brokers | Exness Broker, FPMarkets |

| Recommended VPS | FXVM (Low Latency) |

| Youtube Channel | ForexForYou |

| Telegram Channel | Onshoppie Forex EA's & Indicators |

| Telegram Support | Onshoppie Support |

| Installation Guides | Onshoppie Forex Guides |

Only logged in customers who have purchased this product may leave a review.

Reviews

There are no reviews yet.