AF SUPPLY AND DEMAND EA 2.0 V5 MT4 For Build 1441+

$9.95

Professional AF Supply And Demand EA makes trading better with advanced algorithms. Discover how this powerful tool transforms your forex trading experience.

Description

AF SUPPLY AND DEMAND EA: Complete Guide to Automated Trading Success

Alternative Title: AF SUPPLY AND DEMAND EA 2.0 V5 MT4 – Your Path to Professional Trading Results

Table of Contents

- Introduction to AF SUPPLY AND DEMAND EA

- Understanding Supply and Demand Trading

- Key Features of AF SUPPLY AND DEMAND EA 2.0 V5 MT4

- Benefits for Different Types of Traders

- Multi-Asset Trading Capabilities

- Fresh Zone Identification System

- Trendline and Channel Analysis

- Risk Management and Reward Optimization

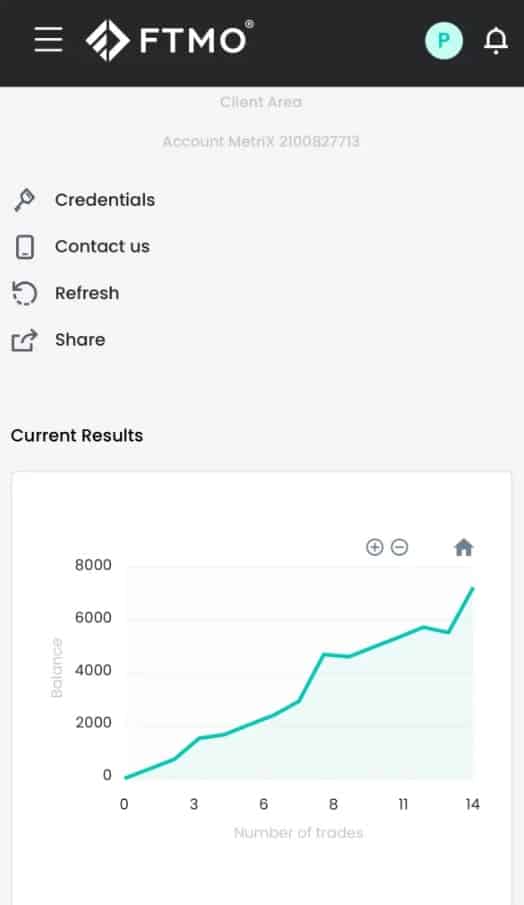

- FTMO and Prop Firm Challenge Success

- Installation and Setup Guide

- Best Practices for Using the EA

- Common Mistakes to Avoid

- Performance Monitoring and Optimization

- Conclusion

Introduction to AF SUPPLY AND DEMAND EA

The AF SUPPLY AND DEMAND EA represents a significant step forward in automated trading technology. This powerful Expert Advisor transforms how traders approach the markets by combining advanced supply and demand analysis with automated execution capabilities.

Trading has become increasingly complex, with markets moving faster than ever before. The AF SUPPLY AND DEMAND EA 2.0 V5 MT4 addresses these challenges by providing traders with a reliable system that can analyze multiple markets simultaneously while maintaining the precision needed for profitable trading.

What makes this EA special is its ability to identify high-probability trading opportunities based on supply and demand principles. These fundamental economic concepts drive all market movements, making them incredibly reliable for trading decisions.

Understanding Supply and Demand Trading

Supply and demand trading focuses on identifying areas where institutional traders have placed large orders. These zones often act as support and resistance levels, creating predictable price reactions when tested.

The AF SUPPLY AND DEMAND EA excels at finding these zones because it analyzes price action patterns that indicate where big players have entered or exited positions. When price returns to these levels, it often reacts strongly, creating trading opportunities.

Why Supply and Demand Works

Market makers and institutional traders move large amounts of money, creating imbalances between buyers and sellers. These imbalances leave footprints in the price charts that skilled traders can identify and exploit.

The AF SUPPLY AND DEMAND EA 2.0 V5 MT4 automates this process, scanning multiple timeframes and assets to find these institutional footprints. This gives retail traders access to the same information that professional traders use.

Key Features of AF SUPPLY AND DEMAND EA 2.0 V5 MT4

Multi-Timeframe Analysis

The EA analyzes price action across multiple timeframes simultaneously. This comprehensive approach ensures that trading decisions align with both short-term and long-term market trends.

Fresh Zone Detection

One of the most powerful features is the ability to identify fresh, untested supply and demand zones. These areas haven’t been retested since their creation, making them more likely to produce strong price reactions.

Automated Trendline Drawing

The AF SUPPLY AND DEMAND EA automatically draws trendlines and channels, helping traders visualize market structure and identify key levels.

Risk/Reward Optimization

Every trade suggestion includes detailed risk/reward analysis, ensuring that profits justify the risks taken.

Multi-Asset Capability

The EA can monitor up to 40 different assets simultaneously, providing diverse trading opportunities across various markets.

Real-Time Alerts

Traders receive instant notifications when high-probability setups develop, allowing for timely trade execution.

Benefits for Different Types of Traders

New Traders

Beginning traders often struggle with market analysis and timing. The AF SUPPLY AND DEMAND EA 2.0 V5 MT4 provides:

- Simplified Analysis: Complex market analysis is automated, allowing new traders to focus on execution and risk management

- Educational Value: By observing the EA’s analysis, new traders learn to identify supply and demand zones themselves

- Reduced Emotional Trading: Automated analysis removes emotional bias from trading decisions

- Consistent Approach: The EA applies the same analysis criteria to every market condition

Experienced Traders

Veteran traders benefit from the EA’s efficiency and comprehensive analysis:

- Time Savings: Automated scanning of multiple markets frees up time for strategy development

- Confirmation Tool: The EA can confirm manual analysis or highlight overlooked opportunities

- Scaling Capabilities: Managing multiple assets becomes feasible with automated assistance

- Backtesting Data: Historical performance data helps refine trading strategies

Professional Traders

Professional traders and those pursuing prop firm funding find specific advantages:

- Consistency: Standardized analysis approach supports consistent trading performance

- Documentation: Detailed trade analysis helps with performance reporting

- Risk Management: Built-in risk/reward calculations support professional risk management practices

Multi-Asset Trading Capabilities

The AF SUPPLY AND DEMAND EA shines in its ability to handle multiple assets simultaneously. This capability opens up numerous advantages for traders willing to diversify their approach.

Portfolio Diversification

Instead of focusing on a single currency pair or asset, traders can spread risk across multiple markets. This diversification helps smooth out performance and reduces the impact of poor performance in any single market.

Correlation Analysis

The EA helps identify relationships between different assets, allowing traders to:

- Avoid overexposure to correlated markets

- Identify hedge opportunities

- Capitalize on divergences between related assets

Opportunity Maximization

With 40 assets under constant analysis, traders rarely miss high-probability setups. The EA ensures that opportunities are identified across all monitored markets.

Implementation Strategy

When using multi-asset capabilities:

- Start Small: Begin with 5-10 assets you understand well

- Group by Market: Focus on forex, commodities, or indices initially

- Monitor Correlation: Ensure selected assets aren’t highly correlated

- Gradual Expansion: Add new assets as you gain experience

Fresh Zone Identification System

Fresh zones represent some of the highest probability trading opportunities available. The AF SUPPLY AND DEMAND EA 2.0 V5 MT4 excels at identifying these untested areas.

What Makes Zones Fresh

A fresh zone forms when price moves aggressively away from a level without retesting it. These zones often contain unfilled institutional orders, making them prime candidates for strong price reactions.

Identifying Fresh Zones

The EA analyzes several factors when identifying fresh zones:

- Volume Analysis: High volume during zone creation indicates institutional involvement

- Price Action: Strong, decisive moves away from the zone suggest trapped orders

- Time Factor: Zones that haven’t been tested for extended periods often remain valid

- Market Context: Zones aligned with overall market structure carry more weight

Trading Fresh Zones

When trading fresh zones identified by the AF SUPPLY AND DEMAND EA:

- Wait for Confirmation: Let price approach the zone before entering

- Monitor Price Action: Look for rejection signals at the zone

- Set Appropriate Stops: Place stops beyond the zone to account for false breaks

- Take Profits Systematically: Use the EA’s target suggestions for profit-taking

Trendline and Channel Analysis

The AF SUPPLY AND DEMAND EA goes beyond zone identification by incorporating trendline and channel analysis. This comprehensive approach provides a complete picture of market structure.

Automatic Trendline Drawing

The EA identifies significant highs and lows, connecting them with trendlines that define market direction. These trendlines help traders:

- Understand overall market bias

- Identify potential reversal points

- Confirm supply and demand zone validity

- Time entries and exits more effectively

Channel Recognition

Channel analysis helps identify:

- Range-bound Markets: Where supply and demand zones at channel boundaries become more significant

- Trend Channels: Where pullbacks to the channel boundary create trading opportunities

- Breakout Situations: Where price moves beyond established channel boundaries

Combining Analysis Methods

The most powerful setups occur when multiple analysis methods align:

- Supply/demand zone at a significant trendline

- Channel boundary coinciding with a fresh zone

- Multiple timeframe alignment of key levels

Risk Management and Reward Optimization

Professional trading requires disciplined risk management, and the AF SUPPLY AND DEMAND EA 2.0 V5 MT4 provides comprehensive tools for managing risk while optimizing rewards.

Risk/Reward Calculation

Every trade suggestion includes detailed risk/reward analysis:

- Entry Price: Optimal entry point based on zone analysis

- Stop Loss: Logical stop placement beyond the zone

- Take Profit: Multiple target levels based on market structure

- Risk Percentage: Suggested position size based on account balance

Position Sizing

The EA helps determine appropriate position sizes by:

- Calculating risk per trade as a percentage of account balance

- Adjusting position size based on stop distance

- Considering overall portfolio exposure

- Maintaining consistent risk across all trades

Multiple Target Strategy

Rather than closing entire positions at single targets, the EA suggests:

- Taking partial profits at initial targets

- Moving stops to breakeven after first target

- Letting remaining positions run to extended targets

- Scaling out of positions as targets are reached

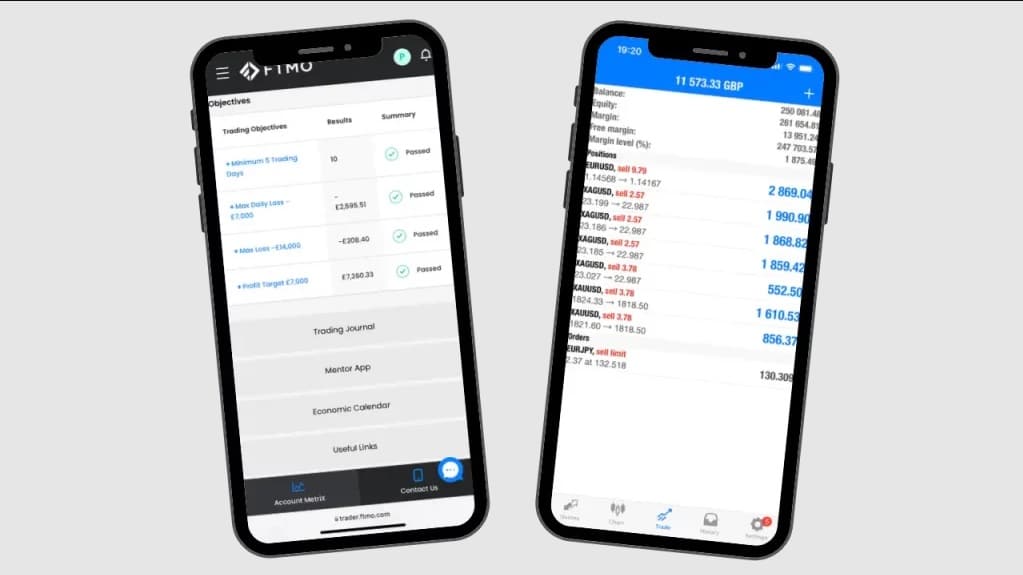

FTMO and Prop Firm Challenge Success

Many traders use the AF SUPPLY AND DEMAND EA to pass prop firm challenges and secure funding. The EA’s consistent approach and risk management features align well with prop firm requirements.

Challenge Requirements

Most prop firms require:

- Consistent profitable trading

- Proper risk management

- Adherence to maximum loss limits

- Demonstration of trading skill

How the EA Helps

The AF SUPPLY AND DEMAND EA 2.0 V5 MT4 supports challenge success by:

- Consistent Strategy: Applying the same analysis approach to all trades

- Risk Control: Built-in position sizing and stop loss recommendations

- Performance Tracking: Detailed records of all trade analysis

- Emotional Control: Reducing emotional decision-making

Challenge Strategy

When using the EA for prop firm challenges:

- Conservative Settings: Use more conservative risk settings during challenges

- Selective Trading: Focus on highest-probability setups only

- Documentation: Keep detailed records of all trading decisions

- Consistency: Maintain the same approach throughout the challenge period

Installation and Setup Guide

Setting up the AF SUPPLY AND DEMAND EA requires careful attention to detail to ensure optimal performance.

System Requirements

- MetaTrader 4 platform (Build 1420 or higher)

- Reliable internet connection

- VPS recommended for 24/7 operation

- Sufficient computer resources for multi-asset analysis

Installation Steps

- Download the EA: Obtain the EA files from your provider

- Copy to MT4: Place the EA file in the MT4 Experts folder

- Restart MT4: Close and reopen the platform

- Enable Expert Advisors: Ensure EA trading is enabled

- Load the EA: Attach the EA to your chosen chart

- Configure Settings: Adjust parameters according to your preferences

Initial Configuration

Key settings to configure:

- Risk Percentage: Set your desired risk per trade

- Asset Selection: Choose which assets to monitor

- Timeframes: Select analysis timeframes

- Alert Settings: Configure notification preferences

Best Practices for Using the EA

Maximizing the AF SUPPLY AND DEMAND EA 2.0 V5 MT4 requires following established best practices.

Demo Trading First

Always test the EA thoroughly on a demo account before using real money. This allows you to:

- Understand the EA’s behavior

- Test different settings

- Gain confidence in the system

- Identify optimal parameters

Regular Monitoring

While the EA automates analysis, regular monitoring remains important:

- Review daily trade suggestions

- Check for market news that might affect analysis

- Monitor overall portfolio performance

- Adjust settings as market conditions change

Continuous Learning

Use the EA as a learning tool:

- Study why certain setups are flagged

- Analyze successful and unsuccessful trades

- Understand the reasoning behind trade suggestions

- Develop your own market analysis skills

Performance Tracking

Maintain detailed records of:

- All trades taken based on EA suggestions

- Modifications made to EA recommendations

- Overall portfolio performance

- Lessons learned from each trade

Common Mistakes to Avoid

Even with a powerful tool like the AF SUPPLY AND DEMAND EA, traders can make mistakes that impact performance.

Over-Reliance on Automation

While the EA provides excellent analysis, traders should:

- Maintain awareness of market fundamentals

- Consider news events that might affect trades

- Use personal judgment when evaluating suggestions

- Stay engaged with the trading process

Ignoring Risk Management

The EA provides risk management tools, but traders must:

- Stick to recommended position sizes

- Avoid increasing risk after losses

- Maintain discipline in following stop losses

- Never risk more than they can afford to lose

Inadequate Testing

Rushing into live trading without proper testing can lead to:

- Misunderstanding of EA behavior

- Inappropriate settings for market conditions

- Unrealistic expectations about performance

- Unnecessary losses during the learning phase

Lack of Patience

Successful trading requires patience:

- Wait for high-probability setups

- Don’t force trades when conditions aren’t ideal

- Allow winning trades to develop fully

- Accept that not every day will present opportunities

Performance Monitoring and Optimization

Regular performance monitoring ensures the AF SUPPLY AND DEMAND EA 2.0 V5 MT4 continues to meet your trading objectives.

Key Performance Metrics

Track these important metrics:

- Win Rate: Percentage of profitable trades

- Average Win/Loss: Size of winning vs. losing trades

- Maximum Drawdown: Largest peak-to-trough decline

- Sharpe Ratio: Risk-adjusted return measurement

- Profit Factor: Gross profit divided by gross loss

Performance Analysis

Regular analysis should include:

- Monthly performance reviews

- Comparison to benchmark indices

- Assessment of risk-adjusted returns

- Identification of performance patterns

- Evaluation of market condition impacts

Optimization Strategies

Improve performance through:

- Parameter Adjustment: Fine-tuning EA settings based on results

- Market Adaptation: Adjusting approach for different market conditions

- Asset Selection: Focusing on best-performing assets

- Timeframe Optimization: Emphasizing most effective timeframes

Documentation and Learning

Maintain comprehensive records:

- Trade-by-trade analysis

- Market condition notes

- Performance improvement ideas

- Lessons learned from each period

The AF SUPPLY AND DEMAND EA represents a powerful tool for traders seeking to improve their market analysis and trading results. By combining automated supply and demand analysis with comprehensive risk management features, it provides a solid foundation for trading success.

Success with the EA requires dedication to proper setup, thorough testing, and ongoing performance monitoring. Traders who invest time in understanding the system and following best practices will find it a valuable addition to their trading arsenal.

The key to long-term success lies in treating the AF SUPPLY AND DEMAND EA 2.0 V5 MT4 as a sophisticated tool that enhances rather than replaces sound trading judgment. When used properly, it can significantly improve trading consistency and profitability while reducing the time and effort required for market analysis.

Remember that no trading system guarantees profits, and the EA works best when combined with proper risk management, realistic expectations, and continuous learning. Start with demo trading, progress gradually to live trading, and always maintain the discipline that separates successful traders from the rest.

Vendor Site – Private

| Membership | Yearly Membership |

|---|---|

| Additional Services | Unlock & Decompile |

| Recommended Brokers | Exness Broker, FPMarkets |

| Recommended VPS | FXVM (Low Latency) |

| Youtube Channel | ForexForYou |

| Telegram Channel | Onshoppie Forex EA's & Indicators |

| Telegram Support | Onshoppie Support |

| Installation Guides | Onshoppie Forex Guides |

Brand

ea-mt4

Only logged in customers who have purchased this product may leave a review.

Reviews

There are no reviews yet.