AF SUPPLY AND DEMAND EA MT4 2022 For Build 1441+

Original price was: $797.00.$9.95Current price is: $9.95.

Discover the ultimate AF Supply and Demand EA that delivers mind-blowing results. This revolutionary trading bot transforms your forex strategy instantly.

Description

Table of Contents

- Introduction AF SUPPLY AND DEMAND EA

- What Is the AF SUPPLY AND DEMAND EA?

- Why Supply and Demand Zones Matter

- Key Features of the AF SUPPLY AND DEMAND EA

- Installation Guide (MT4 & MT5)

- Initial Settings Explained

- Best Practices for Live Trading

- Risk Management Pointers

- Back-Testing: Step-by-Step Tutorial

- Common Troubleshooting Tips

- Sample Trade Walk-Through

- Frequently Asked Questions

- Glossary of Key Terms

- Final Thoughts

- Call to Action

Introduction

Trading robots are no longer a novelty, yet finding one that truly focuses on simple supply and demand logic can still feel like a chore. The AF SUPPLY AND DEMAND EA brings that idea to life by mapping zones and executing trades with a clear set of rules. In this post we break down how the expert advisor works, how to set it up, and how to decide if it meets your own trading plan.

What Is the AF SUPPLY AND DEMAND EA?

The AF SUPPLY AND DEMAND EA is an automated trading program for MetaTrader 4 and MetaTrader 5. The robot scans the chart, draws supply (probable sell) and demand (probable buy) areas, then places orders when price reaches those levels. Unlike many EAs that use lagging indicators, this tool relies on fresh price structure.

Related ideas used in this guide:

- supply and demand trading

- MetaTrader expert advisor

- forex automation

Why Supply and Demand Zones Matter

Most price movements start from an imbalance between buyers and sellers. These imbalances create pockets—zones—where price often reacts again later. By plotting these zones, a trader gets a visual map of potential entries.

Key points:

- Supply zone: Last bullish candle before a clear bearish move.

- Demand zone: Last bearish candle before a clear bullish move.

- Zones act like magnets when price revisits.

- Combining multiple time frames adds extra context.

For more background, check Investopedia’s overview on supply and demand in markets.

Key Features of the AF SUPPLY AND DEMAND EA

| Feature | What It Does | Why It Matters |

|---|---|---|

| Zone Detection | Marks fresh zones on chosen time frames | Traders avoid chasing old levels |

| Pending Orders | Places buy-limit or sell-limit orders | Better pricing, reduced slippage |

| Risk per Trade | Lets you set risk in % or fixed amount | Consistent position sizing |

| Breakeven & Trailing | Auto move stop to breakeven, trail profits | Locks in gains, cuts outsized loss |

| News Filter | Pauses trading around high-impact events | Helps avoid spikes |

| Multi-Pair Capability | Works on several charts at once | Diversification |

| Email & Push Alerts | Sends updates | Stay informed when away from screen |

Installation Guide (MT4 & MT5)

- Download the AF SUPPLY AND DEMAND EA

.ex4(MT4) or.ex5(MT5) file. - Open MetaTrader.

- Go to

File→Open Data Folder. - Navigate to

MQL4/ExpertsorMQL5/Experts. - Copy the EA file into the folder.

- Restart MetaTrader or right-click on

Expert Advisorsand hitRefresh. - Drag the EA onto your chosen chart.

- Tick

Allow live tradingandAllow DLL imports(if required). - Click

OK. The smiley face indicates the EA is active.

Tip: Enable AutoTrading only after you double-check all settings.

Initial Settings Explained

Below is a rundown of popular parameters:

LotType: Choose between Fixed, Dynamic, or RiskPercent.RiskPercent: If chosen, EA calculates lot size based on account balance.TimeFrameForZones: Pick M15, H1, H4, or Daily.DeleteOldZones: Removes zones after they’re retested.MaxOrders: Caps open positions for that symbol.SpreadFilter: Sets maximum spread allowed to place an order.NewsPauseMinutes: Minutes before and after a news event to halt trades.BreakevenPips: Distance in pips to set stop at entry.TrailingStopPips: Distance for trailing.

Keep settings in a notepad file so you can revert if needed.

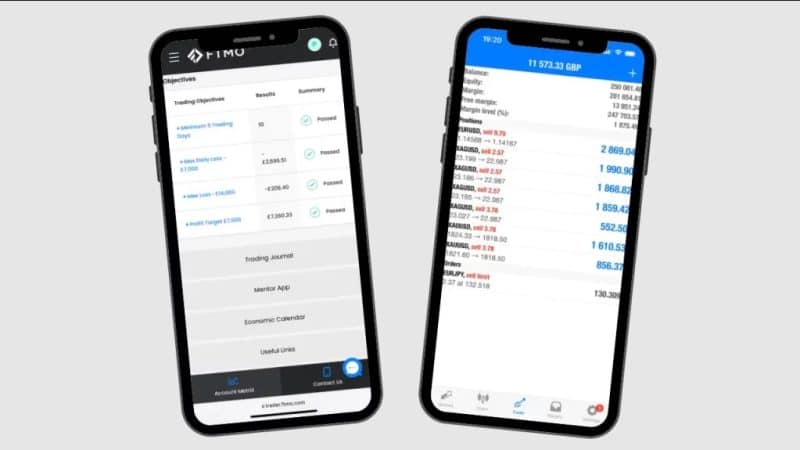

Best Practices for Live Trading

- Start on a demo account for two to four weeks.

- Test one pair first, often EURUSD due to low spread.

- Log every trade outcome in a spreadsheet.

- Pair the EA with higher-time-frame trend direction—e.g., if daily trend is up, keep demand trades only.

- Use a VPS. Downtime can break pending orders.

Risk Management Pointers

- Never risk more than 1–2% per trade on a live account.

- Keep total open risk below 5% at any moment.

- Avoid widening stop losses just to “give the trade room.”

- Scale down lot size during news weeks like NFP or central bank meetings.

- Withdraw profits regularly; it helps with discipline.

For a detailed look at position sizing, visit Babypips Position Size Calculator.

Back-Testing: Step-by-Step Tutorial

- Under MetaTrader, press

Ctrl+Rto open the Strategy Tester. - Pick

AF SUPPLY AND DEMAND EAfrom the list. - Select

Symbol(e.g., GBPUSD) andPeriod(H1 is common). - Choose

Every Tickmodeling for accuracy. - Set the date range (at least two years is ideal).

- Click

Expert Propertiesto match live settings. - Press

Start. - Once complete, examine:

- Profit factor

- Drawdown %

- Average trade length

- Save the report as both

.htmland.xmlfor record keeping.

Regular back-testing helps refine zone sizes or risk levels before going live.

Common Troubleshooting Tips

| Problem | Possible Cause | Quick Fix |

|---|---|---|

| EA not placing orders | AutoTrading off | Press AutoTrading button |

| Zones too small | Wrong time frame | Increase TimeFrameForZones |

| High slippage | Broker with variable spread | Use brokers known for lower spreads |

| Frequent losses | Settings too aggressive | Reduce RiskPercent, use daily trend filter |

| “DLL not allowed” error | DLL imports disabled | Tick Allow DLL imports box |

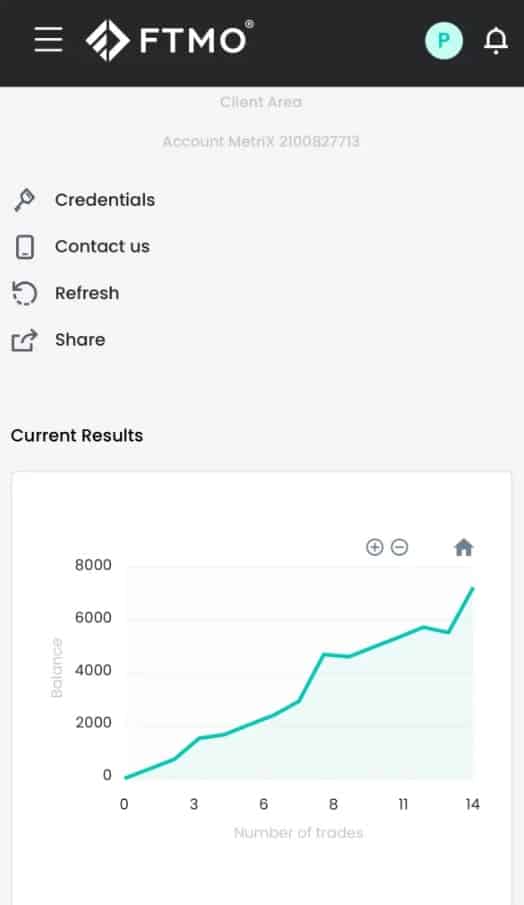

Sample Trade Walk-Through

- EA marks a fresh demand zone on EURUSD H1 at 1.0930–1.0920.

- Price revisits the zone five hours later.

- EA sends a buy-limit order at 1.0930, 0.01 lots, stop loss 1.0910, take profit 1.0970.

- Trade triggers, price stalls but soon climbs.

- At +20 pips the EA moves stop to breakeven.

- Trailing stop follows until final exit at 1.0962 for +32 pips.

- Result: 2.9% gain on a $1,000 demo account when

RiskPercentset to 1%.

Frequently Asked Questions

Does the AF SUPPLY AND DEMAND EA work on crypto pairs?It can, but crypto spreads and weekend gaps may affect performance. Test first.

What time frames are best?Many traders like H1 for balance. Others blend H4 zones for major moves and M15 for scalping.

Can I stop the EA manually?Yes, simply disable AutoTrading or remove the EA from the chart; existing trades remain.

Is hedging allowed?Only if your broker permits it; check regulatory rules in your country.

How often should I optimize?Once a month or after big market shifts, such as rate decisions.

Glossary of Key Terms

EA (Expert Advisor): Script for MetaTrader that automates trades.Supply Zone: Price area where sellers exceed buyers.Demand Zone: Price area where buyers exceed sellers.Stop Loss: Price where the trade is exited to limit loss.Trailing Stop: Stop level that moves with price in your favor.Drawdown: Peak-to-trough decline in account equity.VPS (Virtual Private Server): Remote computer to run trading software 24/7.

Final Thoughts

The AF SUPPLY AND DEMAND EA delivers a clear plan: mark solid zones, manage risk, and let price come to you. Like any tool, it thrives under the right conditions—steady spreads, disciplined settings, and patient traders. By understanding every option in the inputs menu and recording each result, you stay in control of your strategy.

Call to Action

Ready to give the AF SUPPLY AND DEMAND EA a trial run?

- Open a demo account with your broker.

- Download the EA, follow the setup steps above, and see how the zone logic operates without risking real funds.

- Share results or questions in the comments below, or visit our AF Supply and Demand EA community page for tips from fellow users.

Happy trading, and remember: smart risk stays at the heart of every long-term strategy.

| Membership | Yearly Membership |

|---|---|

| Additional Services | Unlock & Decompile |

| Recommended Brokers | Exness Broker, FPMarkets |

| Recommended VPS | FXVM (Low Latency) |

| Youtube Channel | ForexForYou |

| Telegram Channel | Onshoppie Forex EA's & Indicators |

| Telegram Support | Onshoppie Support |

| Installation Guides | Onshoppie Forex Guides |

Brand

ea-mt4

Only logged in customers who have purchased this product may leave a review.

Reviews

There are no reviews yet.